Performance of Straits Times Index (STI) Constituents in August 2018

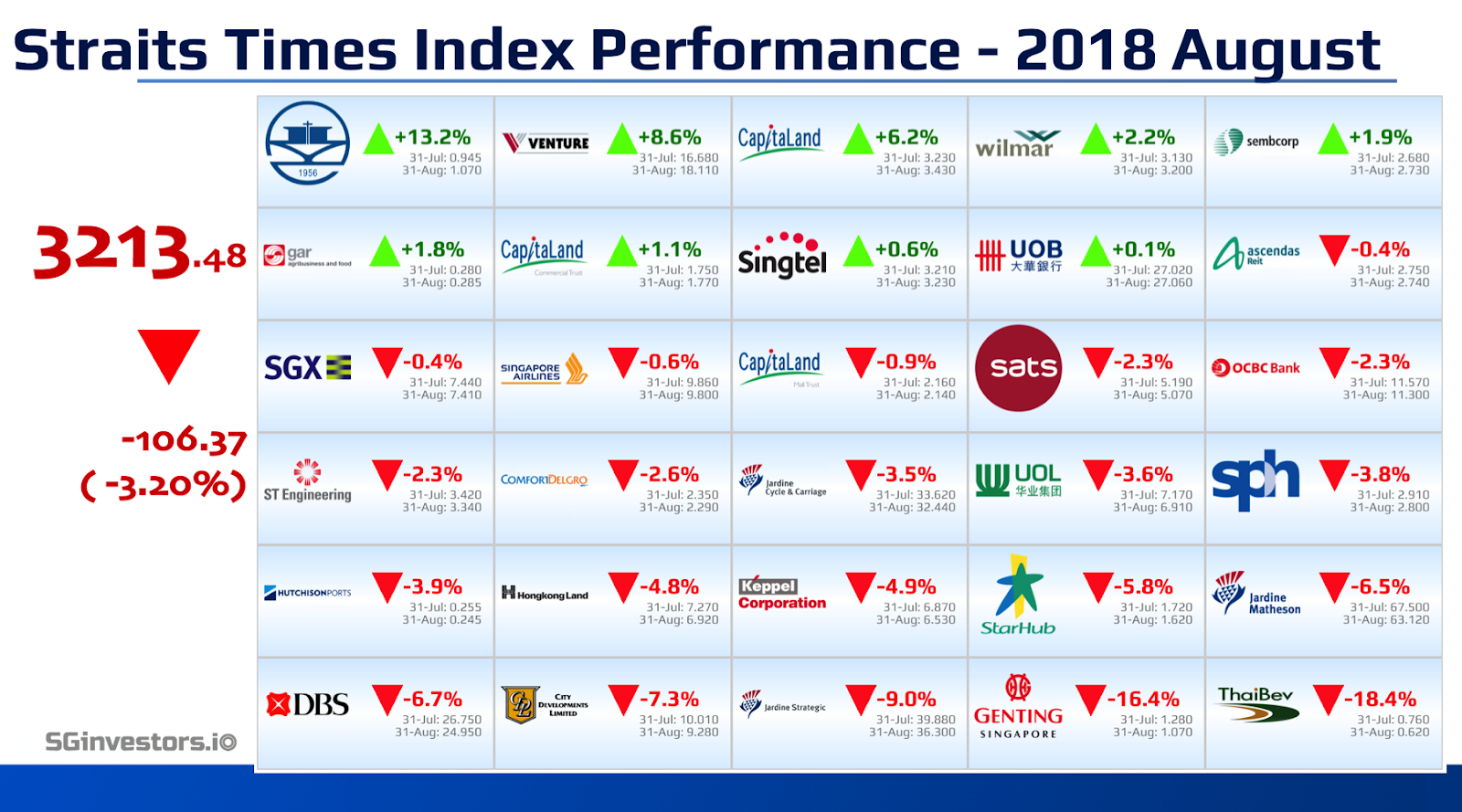

The Straits Times Index (STI) ended 106.37 points or 3.20% lower to 3213.48 in August 2018.

(compared to 3319.85 on 31-Jul-2018)Top Performers: Yangzijiang Shipbuilding, Venture Corporation, CapitaLand, Wilmar International, Sembcorp Industries.

Least Performers: Thai Beverage, Genting Singapore, Jardine Strategic, City Developments, DBS Group.

Most Volatile: Yangzijiang Shipbuilding, Thai Beverage, Genting Singapore, Venture Corporation, CapitaLand.

Straits Times Index (STI) Constituents Performance (August 2018)

(Click to view the share price movement of respective stocks)

Top Active (by Volume Traded)

Top Active (by Value Traded)

Most Volatile

STI Constituents Performance Monthly Summary:

- Performance of Straits Times Index (STI) Constituents in July 2018

- Performance of Straits Times Index (STI) Constituents in June 2018

- Performance of Straits Times Index (STI) Constituents in May 2018

- Performance of Straits Times Index (STI) Constituents in April 2018

- Performance of Straits Times Index (STI) Constituents in March 2018

- Performance of Straits Times Index (STI) Constituents in February 2018

- Performance of Straits Times Index (STI) Constituents in January 2018

- Performance of Straits Times Index (STI) Constituents in December 2017

- Performance of Straits Times Index (STI) Constituents in November 2017

- Performance of Straits Times Index (STI) Constituents in October 2017

- Performance of Straits Times Index (STI) Constituents in September 2017

- Performance of Straits Times Index (STI) Constituents in August 2017

- Performance of Straits Times Index (STI) Constituents in July 2017

DBS's share price closed at its year-to-date low of S$24.95 and Thai Beverage share price closed at S$0.62, the lowest since 2014 today.

The 3.2% decline for the month has made August a negative month to STI for 11 years continuously (see report: Don't bet against the "Perfect 10" by DBS Group Research dated 1-Aug-2018). Year to date, the Straits Times Index was down 5.6%. See Straits Times Index Constituents Share Price Performance.

According to the respective most recent market strategy reports, the 2018 year-end target of the Straits Times Index -

According our tracker of STI constituents target price and analyst ratings, as of 31-Aug-2018, by referencing the average target price and index weightage of the respective of STI constituents, the bottom-up potential upside of 19.7% implies a 12-month target of 3,846 for the Straits Times Index.

The 3.2% decline for the month has made August a negative month to STI for 11 years continuously (see report: Don't bet against the "Perfect 10" by DBS Group Research dated 1-Aug-2018). Year to date, the Straits Times Index was down 5.6%. See Straits Times Index Constituents Share Price Performance.

According to the respective most recent market strategy reports, the 2018 year-end target of the Straits Times Index -

- DBS Group Research: 3,550

- UOB Kay Hian: 3,450 (see report: 2Q18 Results Wrap-Up: More Beats But Outlook Moderated)

- Phillip Securities: 3,700 (see report: Phillip Singapore Monthly (August 2018) - Global Growth Has Peaked)

- CGSCIMB Research: 3,380 (see report: Market Trend From 2Q18 ~ Buckle Up)

- RHB Invest: 3,650 (see report: Switching To Late Cycle Plays; Refreshing of 2H18 Top Picks)

According our tracker of STI constituents target price and analyst ratings, as of 31-Aug-2018, by referencing the average target price and index weightage of the respective of STI constituents, the bottom-up potential upside of 19.7% implies a 12-month target of 3,846 for the Straits Times Index.

If you like what we've been sharing, do show your support by giving our facebook page SGinvestors a 'like' and 'share'. Comments, feedback and suggestions are always welcomed.

Disclaimer: While we've spent our best effort to keep our data up-to-date, we do not guarantee the accuracy of information shared here. Kindly feedback to us for any discrepancies in data.