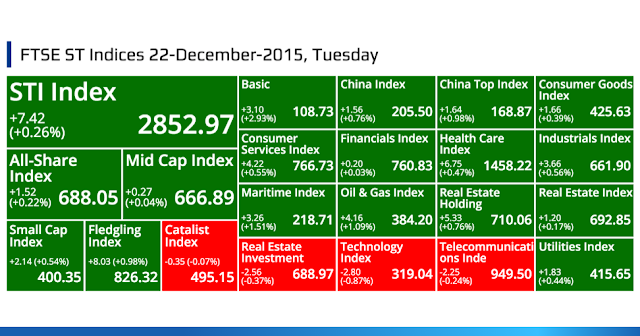

FTSE ST Indices 22-December-2015, Tuesday

STI Index

+7.42

(+0.26%)

(+0.26%)

2852.97

All-Share Index

+1.52

(+0.22%)

(+0.22%)

688.05

Mid Cap Index

+0.27

(+0.04%)

(+0.04%)

666.89

Small Cap Index

+2.14 (+0.54%)

400.35

Fledgling Index

+8.03 (+0.98%)

826.32

Catalist Index

-0.35 (-0.07%)

495.15

Basic

+3.10

(+2.93%)

(+2.93%)

108.73

China Index

+1.56

(+0.76%)

(+0.76%)

205.50

China Top Index

+1.64

(+0.98%)

(+0.98%)

168.87

Consumer Goods Index

+1.66

(+0.39%)

(+0.39%)

425.63

Consumer Services Index

+4.22

(+0.55%)

(+0.55%)

766.73

Financials Index

+0.20

(+0.03%)

(+0.03%)

760.83

Health Care Index

+6.75

(+0.47%)

(+0.47%)

1458.22

Industrials Index

+3.66

(+0.56%)

(+0.56%)

661.90

Maritime Index

+3.26

(+1.51%)

(+1.51%)

218.71

Oil & Gas Index

+4.16

(+1.09%)

(+1.09%)

384.20

Real Estate Holding

+5.33

(+0.76%)

(+0.76%)

710.06

Real Estate Index

+1.20

(+0.17%)

(+0.17%)

692.85

Real Estate Investment

-2.56

(-0.37%)

(-0.37%)

688.97

Technology Index

-2.80

(-0.87%)

(-0.87%)

319.04

Telecommunications Inde

-2.25

(-0.24%)

(-0.24%)

949.50

Utilities Index

+1.83

(+0.44%)

(+0.44%)

415.65

Top 20 Volume

VASHION GROUP LTD.

(5BA.SI)

(5BA.SI)

0.001

Vol: 121560000

Value: 121560

TERRATECH GROUP LIMITED

(40I.SI)

(40I.SI)

0.057

Vol: 52877000

Value: 3168763

LIONGOLD CORP LTD

(A78.SI)

(A78.SI)

0.006

Vol: 51779100

Value: 327046

GLOBAL TECH (HLDGS) LIMITED

(G11.SI)

(G11.SI)

0.040

Vol: 50412100

Value: 1906704

EZRA HOLDINGS LIMITED

(5DN.SI)

(5DN.SI)

0.101

Vol: 38461900

Value: 3842524

SINCAP GROUP LIMITED

(5UN.SI)

(5UN.SI)

0.060

Vol: 34942400

Value: 2109069

COSCO CORPORATION (S) LTD

(F83.SI)

(F83.SI)

0.435

Vol: 31397500

Value: 13317642

REX INTERNATIONAL HOLDING LTD

(5WH.SI)

(5WH.SI)

0.092

Vol: 30399000

Value: 2739909

NOBLE GROUP LIMITED

(N21.SI)

(N21.SI)

0.440

Vol: 29820200

Value: 12984575

ADDVALUE TECHNOLOGIES LTD

(A31.SI)

(A31.SI)

0.047

Vol: 24810600

Value: 1191632

ARTIVISION TECHNOLOGIES LTD.

(5NK.SI)

(5NK.SI)

0.060

Vol: 24119200

Value: 1442742

MMP RESOURCES LIMITED

(F3V.SI)

(F3V.SI)

0.012

Vol: 23876900

Value: 297902

GOLDEN AGRI-RESOURCES LTD

(E5H.SI)

(E5H.SI)

0.340

Vol: 23197000

Value: 8037384

QT VASCULAR LTD.

(5I0.SI)

(5I0.SI)

0.109

Vol: 22714800

Value: 2537432

CHINA ENVIRONMENT LTD.

(5OU.SI)

(5OU.SI)

0.079

Vol: 22191900

Value: 1795899

LINC ENERGY LTD

(TI6.SI)

(TI6.SI)

0.128

Vol: 20798700

Value: 2770541

GEO ENERGY RESOURCES LIMITED

(RE4.SI)

(RE4.SI)

0.148

Vol: 20595200

Value: 3067595

GLOBAL LOGISTIC PROP LIMITED

(MC0.SI)

(MC0.SI)

2.070

Vol: 18612500

Value: 39205361

SINGTEL

(Z74.SI)

XD

(Z74.SI)

XD

3.660

Vol: 18072300

Value: 66387477

JASPER INVESTMENTS LIMITED

(FQ7.SI)

(FQ7.SI)

0.007

Vol: 17408600

Value: 140369

Top 20 Value

SINGTEL

(Z74.SI)

XD

(Z74.SI)

XD

3.660

Vol: 18072300

Value: 66387477

GLOBAL LOGISTIC PROP LIMITED

(MC0.SI)

(MC0.SI)

2.070

Vol: 18612500

Value: 39205361

DBS GROUP HOLDINGS LTD

(D05.SI)

(D05.SI)

16.350

Vol: 1914100

Value: 31287786

UNITED OVERSEAS BANK LTD

(U11.SI)

(U11.SI)

19.240

Vol: 1385400

Value: 26720485

OVERSEA-CHINESE BANKING CORP

(O39.SI)

(O39.SI)

8.720

Vol: 2999200

Value: 26173758

SINGAPORE AIRLINES LTD

(C6L.SI)

(C6L.SI)

11.180

Vol: 2000600

Value: 22295711

HONGKONG LAND HOLDINGS LIMITED

(H78.SI)

(H78.SI)

USD 7.020

Vol: 2904000

Value: 20228069

SINGAPORE PRESS HLDGS LTD

(T39.SI)

(T39.SI)

3.960

Vol: 4709900

Value: 18547676

KEPPEL CORPORATION LIMITED

(BN4.SI)

(BN4.SI)

6.460

Vol: 2879100

Value: 18483640

CAPITALAND LIMITED

(C31.SI)

(C31.SI)

3.270

Vol: 5202300

Value: 16989451

SINGAPORE TECH ENGINEERING LTD

(S63.SI)

(S63.SI)

3.020

Vol: 4797100

Value: 14464556

COSCO CORPORATION (S) LTD

(F83.SI)

(F83.SI)

0.435

Vol: 31397500

Value: 13317642

NOBLE GROUP LIMITED

(N21.SI)

(N21.SI)

0.440

Vol: 29820200

Value: 12984575

WILMAR INTERNATIONAL LIMITED

(F34.SI)

(F34.SI)

2.880

Vol: 3460400

Value: 10010800

SINGAPORE EXCHANGE LIMITED

(S68.SI)

(S68.SI)

7.640

Vol: 1253300

Value: 9593361

COMFORTDELGRO CORPORATION LTD

(C52.SI)

(C52.SI)

2.980

Vol: 3151700

Value: 9401982

SEMBCORP INDUSTRIES LTD

(U96.SI)

(U96.SI)

3.090

Vol: 2937400

Value: 9020912

CITY DEVELOPMENTS LIMITED

(C09.SI)

(C09.SI)

7.650

Vol: 1172200

Value: 8961660

EZION HOLDINGS LIMITED

(5ME.SI)

(5ME.SI)

0.625

Vol: 14078300

Value: 8844283

ASCENDAS REAL ESTATE INV TRUST

(A17U.SI)

CO

(A17U.SI)

CO

2.250

Vol: 3837800

Value: 8658715

Top 20 Gainers ($)

JARDINE MATHESON HLDGS LTD

(J36.SI)

(J36.SI)

USD 48.000

Vol: 157800

Value: 7488314

JARDINE STRATEGIC HLDGS LTD

(J37.SI)

(J37.SI)

USD 27.250

Vol: 111500

Value: 3005125

SINGAPORE AIRLINES LTD

(C6L.SI)

(C6L.SI)

11.180

Vol: 2000600

Value: 22295711

HONGKONG LAND HOLDINGS LIMITED

(H78.SI)

(H78.SI)

USD 7.020

Vol: 2904000

Value: 20228069

HOTEL PROPERTIES LTD

(H15.SI)

(H15.SI)

3.750

Vol: 400

Value: 1468

UNITED OVERSEAS INSURANCE LTD

(U13.SI)

(U13.SI)

4.670

Vol: 5700

Value: 26548

SEMBCORP MARINE LTD

(S51.SI)

(S51.SI)

1.840

Vol: 3570800

Value: 6477709

SEMBCORP INDUSTRIES LTD

(U96.SI)

(U96.SI)

3.090

Vol: 2937400

Value: 9020912

CITY DEVELOPMENTS LIMITED

(C09.SI)

(C09.SI)

7.650

Vol: 1172200

Value: 8961660

SATS LTD.

(S58.SI)

(S58.SI)

3.930

Vol: 1347200

Value: 5293981

SINGAPORE PRESS HLDGS LTD

(T39.SI)

(T39.SI)

3.960

Vol: 4709900

Value: 18547676

HONG LEONG ASIA LTD.

(H22.SI)

(H22.SI)

0.790

Vol: 195000

Value: 152254

RAFFLES MEDICAL GROUP LTD

(R01.SI)

(R01.SI)

4.110

Vol: 364000

Value: 1491468

KEPPEL CORPORATION LIMITED

(BN4.SI)

(BN4.SI)

6.460

Vol: 2879100

Value: 18483640

MANDARIN ORIENTAL INTL LTD

(M04.SI)

(M04.SI)

USD 1.490

Vol: 35500

Value: 51065

LCD GLOBAL INVESTMENTS LTD.

(L38.SI)

(L38.SI)

0.265

Vol: 61800

Value: 15768

CREATIVE TECHNOLOGY LTD

(C76.SI)

(C76.SI)

1.110

Vol: 25450

Value: 27692

AXCELASIA INC.

(42U.SI)

(42U.SI)

0.199

Vol: 21000

Value: 4180

COSCO CORPORATION (S) LTD

(F83.SI)

(F83.SI)

0.435

Vol: 31397500

Value: 13317642

ENGRO CORPORATION LIMITED

(S44.SI)

(S44.SI)

1.045

Vol: 34700

Value: 35104

Top 20 Losers ($)

JARDINE CYCLE & CARRIAGE LTD

(C07.SI)

(C07.SI)

33.690

Vol: 147000

Value: 4957352

STRAITS TRADING CO. LTD

(S20.SI)

(S20.SI)

2.090

Vol: 10000

Value: 21033

CITIC ENVIROTECH LTD.

(U19.SI)

(U19.SI)

1.420

Vol: 8900

Value: 12462

DAIRY FARM INT'L HOLDINGS LTD

(D01.SI)

(D01.SI)

USD 5.970

Vol: 182500

Value: 1094288

HAW PAR CORP LTD

(H02.SI)

(H02.SI)

8.230

Vol: 160200

Value: 1326489

SINGAPORE EXCHANGE LIMITED

(S68.SI)

(S68.SI)

7.640

Vol: 1253300

Value: 9593361

IFS CAPITAL LIMITED

(I49.SI)

(I49.SI)

0.340

Vol: 50000

Value: 17000

STRACO CORPORATION LIMITED

(S85.SI)

(S85.SI)

0.845

Vol: 65100

Value: 55257

BUKIT SEMBAWANG ESTATES LTD

(B61.SI)

(B61.SI)

4.510

Vol: 45200

Value: 203852

SUNTEC REAL ESTATE INV TRUST

(T82U.SI)

(T82U.SI)

1.540

Vol: 5231900

Value: 8080063

WEIYE HOLDINGS LIMITED

(BMA.SI)

(BMA.SI)

0.400

Vol: 1400

Value: 560

OVERSEA-CHINESE BANKING CORP

(O39.SI)

(O39.SI)

8.720

Vol: 2999200

Value: 26173758

FRASER AND NEAVE, LIMITED

(F99.SI)

CD

(F99.SI)

CD

2.170

Vol: 16300

Value: 35527

LANTROVISION (S) LTD

(BJK.SI)

(BJK.SI)

2.260

Vol: 27000

Value: 61956

OVERSEAS EDUCATION LIMITED

(RQ1.SI)

(RQ1.SI)

0.550

Vol: 18000

Value: 9900

YEO HIAP SENG LTD

(Y03.SI)

(Y03.SI)

1.300

Vol: 1000

Value: 1300

CHINA YUANBANG PROP HLDGS LTD

(BCD.SI)

(BCD.SI)

0.275

Vol: 4000

Value: 1100

NSL LTD.

(N02.SI)

(N02.SI)

1.445

Vol: 3300

Value: 4775

FORTUNE REAL ESTATE INV TRUST

(F25U.SI)

(F25U.SI)

HKD 7.630

Vol: 2200

Value: 16757

ASCENDAS REAL ESTATE INV TRUST

(A17U.SI)

CO

(A17U.SI)

CO

2.250

Vol: 3837800

Value: 8658715

Top 20 Gainers (%)

LIFEBRANDZ LTD.

(L20.SI)

(L20.SI)

0.006

Vol: 5783100

Value: 29093

IPCO INT'L LIMITED

(I11.SI)

(I11.SI)

0.005

Vol: 5160000

Value: 20700

ZHONGXIN FRUIT AND JUICE LTD

(5EG.SI)

(5EG.SI)

0.012

Vol: 100000

Value: 1200

ATTILAN GROUP LIMITED

(5ET.SI)

(5ET.SI)

0.004

Vol: 300000

Value: 1200

GLOBAL TECH (HLDGS) LIMITED

(G11.SI)

(G11.SI)

0.040

Vol: 50412100

Value: 1906704

AXCELASIA INC.

(42U.SI)

(42U.SI)

0.199

Vol: 21000

Value: 4180

POLARIS LTD.

(5BI.SI)

(5BI.SI)

0.006

Vol: 400

Value: 2

LCD GLOBAL INVESTMENTS LTD.

(L38.SI)

(L38.SI)

0.265

Vol: 61800

Value: 15768

JACKSPEED CORPORATION LIMITED

(J17.SI)

(J17.SI)

0.100

Vol: 60000

Value: 5650

MYP LTD.

(F86.SI)

(F86.SI)

0.235

Vol: 35500

Value: 8224

RYOBI KISO HOLDINGS LTD.

(BDN.SI)

(BDN.SI)

0.240

Vol: 2000

Value: 480

COMPACT METAL INDUSTRIES LTD

(T4E.SI)

(T4E.SI)

0.032

Vol: 135900

Value: 4348

ICP LTD

(5I4.SI)

(5I4.SI)

0.008

Vol: 887400

Value: 7099

EUROPTRONIC GROUP LTD

(E23.SI)

(E23.SI)

0.009

Vol: 912700

Value: 8202

SAPPHIRE CORPORATION LIMITED

(NF1.SI)

(NF1.SI)

0.117

Vol: 4972500

Value: 548110

FORISE INTERNATIONAL LIMITED

(I5H.SI)

(I5H.SI)

0.019

Vol: 6674400

Value: 122754

NAM CHEONG LIMITED

(N4E.SI)

(N4E.SI)

0.138

Vol: 9376900

Value: 1222500

SINGAPORE EDEVELOPMENT LTD

(40V.SI)

(40V.SI)

0.042

Vol: 800000

Value: 32469

OSSIA INTERNATIONAL LTD

(O08.SI)

(O08.SI)

0.190

Vol: 100

Value: 19

SUNMOON FOOD COMPANY LIMITED

(AAJ.SI)

(AAJ.SI)

0.065

Vol: 16472400

Value: 1096659

Top 20 Losers (%)

INFINIO GROUP LIMITED

(5G4.SI)

(5G4.SI)

0.001

Vol: 100

Value: 0

MAGNUS ENERGY GROUP LTD.

(41S.SI)

(41S.SI)

0.003

Vol: 1455100

Value: 5820

JASPER INVESTMENTS LIMITED

(FQ7.SI)

(FQ7.SI)

0.007

Vol: 17408600

Value: 140369

ISR CAPITAL LIMITED

(5EC.SI)

(5EC.SI)

0.005

Vol: 220000

Value: 1100

KLW HOLDINGS LTD

(504.SI)

(504.SI)

0.005

Vol: 111300

Value: 556

EUCON HOLDING LIMITED

(E27.SI)

(E27.SI)

0.027

Vol: 712400

Value: 20024

IFS CAPITAL LIMITED

(I49.SI)

(I49.SI)

0.340

Vol: 50000

Value: 17000

ALBEDO LIMITED

(5IB.SI)

(5IB.SI)

0.009

Vol: 510000

Value: 4990

IEV HOLDINGS LIMITED

(5TN.SI)

(5TN.SI)

0.057

Vol: 239000

Value: 13671

KIMHENG OFFSHORE&MARINE HLDLTD

(5G2.SI)

(5G2.SI)

0.100

Vol: 100

Value: 10

NIPPECRAFT LIMITED

(N32.SI)

(N32.SI)

0.033

Vol: 20000

Value: 660

ASIAN MICRO HOLDINGS LTD

(585.SI)

(585.SI)

0.011

Vol: 100000

Value: 1100

CHINA YUANBANG PROP HLDGS LTD

(BCD.SI)

(BCD.SI)

0.275

Vol: 4000

Value: 1100

ENVIRO-HUB HOLDINGS LTD

(L23.SI)

(L23.SI)

0.070

Vol: 1059100

Value: 76854

NTEGRATOR INTERNATIONAL LTD

(5HC.SI)

(5HC.SI)

0.012

Vol: 830000

Value: 9960

MMP RESOURCES LIMITED

(F3V.SI)

(F3V.SI)

0.012

Vol: 23876900

Value: 297902

LEY CHOON GROUP HLDG LIMITED

(Q0X.SI)

(Q0X.SI)

0.037

Vol: 100000

Value: 3750

PROGEN HOLDINGS LTD

(583.SI)

(583.SI)

0.120

Vol: 9200

Value: 1014

WEIYE HOLDINGS LIMITED

(BMA.SI)

(BMA.SI)

0.400

Vol: 1400

Value: 560

ADVANCED HOLDINGS LTD.

(BLZ.SI)

(BLZ.SI)

0.270

Vol: 7200

Value: 1913

Data Source:

http://www.sgx.com/

http://sg.finance.yahoo.com/

Archive: