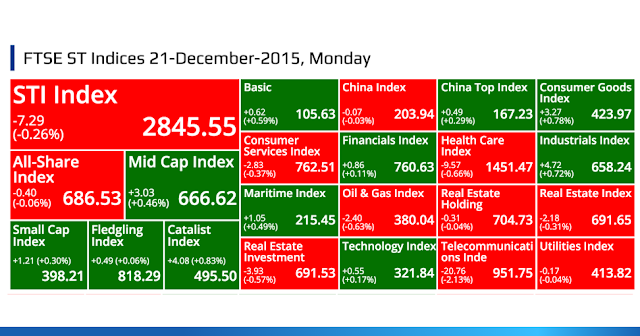

FTSE ST Indices 21-December-2015, Monday

STI Index

-7.29

(-0.26%)

(-0.26%)

2845.55

All-Share Index

-0.40

(-0.06%)

(-0.06%)

686.53

Mid Cap Index

+3.03

(+0.46%)

(+0.46%)

666.62

Small Cap Index

+1.21 (+0.30%)

398.21

Fledgling Index

+0.49 (+0.06%)

818.29

Catalist Index

+4.08 (+0.83%)

495.50

Basic

+0.62

(+0.59%)

(+0.59%)

105.63

China Index

-0.07

(-0.03%)

(-0.03%)

203.94

China Top Index

+0.49

(+0.29%)

(+0.29%)

167.23

Consumer Goods Index

+3.27

(+0.78%)

(+0.78%)

423.97

Consumer Services Index

-2.83

(-0.37%)

(-0.37%)

762.51

Financials Index

+0.86

(+0.11%)

(+0.11%)

760.63

Health Care Index

-9.57

(-0.66%)

(-0.66%)

1451.47

Industrials Index

+4.72

(+0.72%)

(+0.72%)

658.24

Maritime Index

+1.05

(+0.49%)

(+0.49%)

215.45

Oil & Gas Index

-2.40

(-0.63%)

(-0.63%)

380.04

Real Estate Holding

-0.31

(-0.04%)

(-0.04%)

704.73

Real Estate Index

-2.18

(-0.31%)

(-0.31%)

691.65

Real Estate Investment

-3.93

(-0.57%)

(-0.57%)

691.53

Technology Index

+0.55

(+0.17%)

(+0.17%)

321.84

Telecommunications Inde

-20.76

(-2.13%)

(-2.13%)

951.75

Utilities Index

-0.17

(-0.04%)

(-0.04%)

413.82

Top 20 Volume

TERRATECH GROUP LIMITED

(40I.SI)

(40I.SI)

0.058

Vol: 70836800

Value: 3728868

EZRA HOLDINGS LIMITED

(5DN.SI)

(5DN.SI)

0.099

Vol: 39933300

Value: 3886202

REX INTERNATIONAL HOLDING LTD

(5WH.SI)

(5WH.SI)

0.088

Vol: 39452300

Value: 3437744

QT VASCULAR LTD.

(5I0.SI)

(5I0.SI)

0.113

Vol: 37298900

Value: 3941465

GOLDEN AGRI-RESOURCES LTD

(E5H.SI)

(E5H.SI)

0.345

Vol: 35113000

Value: 11756882

ACE ACHIEVE INFOCOM LIMITED

(A75.SI)

(A75.SI)

0.027

Vol: 24397100

Value: 651490

GLOBAL TECH (HLDGS) LIMITED

(G11.SI)

(G11.SI)

0.032

Vol: 21756800

Value: 637406

NOBLE GROUP LIMITED

(N21.SI)

(N21.SI)

0.430

Vol: 20776000

Value: 8884347

COSCO CORPORATION (S) LTD

(F83.SI)

(F83.SI)

0.400

Vol: 20534100

Value: 7657015

PNE MICRON HOLDINGS LTD

(5BS.SI)

(5BS.SI)

0.031

Vol: 15809000

Value: 482440

HUTCHISON PORT HOLDINGS TRUST

(NS8U.SI)

(NS8U.SI)

USD 0.520

Vol: 15775300

Value: 8241604

GLOBAL LOGISTIC PROP LIMITED

(MC0.SI)

(MC0.SI)

2.090

Vol: 15295300

Value: 31883885

LOYZ ENERGY LIMITED

(594.SI)

(594.SI)

0.057

Vol: 15256600

Value: 833871

GEO ENERGY RESOURCES LIMITED

(RE4.SI)

(RE4.SI)

0.148

Vol: 14198700

Value: 2116781

ALLIANCE MINERAL ASSETSLIMITED

(40F.SI)

(40F.SI)

0.134

Vol: 14089700

Value: 1916434

SINGTEL

(Z74.SI)

XD

(Z74.SI)

XD

3.670

Vol: 13756300

Value: 50587565

JUMBO GROUP LIMITED

(42R.SI)

(42R.SI)

0.405

Vol: 13233100

Value: 5232850

GCCP RESOURCES LIMITED

(41T.SI)

(41T.SI)

0.124

Vol: 11461000

Value: 1441546

EZION HOLDINGS LIMITED

(5ME.SI)

(5ME.SI)

0.630

Vol: 11424400

Value: 7039112

SPACKMAN ENTERTAINMENT GRP LTD

(40E.SI)

(40E.SI)

0.145

Vol: 10835900

Value: 1564561

Top 20 Value

SINGTEL

(Z74.SI)

XD

(Z74.SI)

XD

3.670

Vol: 13756300

Value: 50587565

DBS GROUP HOLDINGS LTD

(D05.SI)

(D05.SI)

16.330

Vol: 2913400

Value: 47449479

UNITED OVERSEAS BANK LTD

(U11.SI)

(U11.SI)

19.240

Vol: 1697300

Value: 32639831

GLOBAL LOGISTIC PROP LIMITED

(MC0.SI)

(MC0.SI)

2.090

Vol: 15295300

Value: 31883885

OVERSEA-CHINESE BANKING CORP

(O39.SI)

(O39.SI)

8.750

Vol: 3199800

Value: 27905221

ASCENDAS REAL ESTATE INV TRUST

(A17U.SI)

CO

(A17U.SI)

CO

2.270

Vol: 7632600

Value: 17310564

KEPPEL CORPORATION LIMITED

(BN4.SI)

(BN4.SI)

6.420

Vol: 2504300

Value: 16109354

WILMAR INTERNATIONAL LIMITED

(F34.SI)

(F34.SI)

2.880

Vol: 4534700

Value: 13042062

NEPTUNE ORIENT LINES LIMITED

(N03.SI)

(N03.SI)

1.235

Vol: 10070600

Value: 12450038

GOLDEN AGRI-RESOURCES LTD

(E5H.SI)

(E5H.SI)

0.345

Vol: 35113000

Value: 11756882

CAPITALAND LIMITED

(C31.SI)

(C31.SI)

3.240

Vol: 3362600

Value: 10917124

YANGZIJIANG SHIPBLDG HLDGS LTD

(BS6.SI)

(BS6.SI)

1.055

Vol: 10004100

Value: 10630883

JARDINE CYCLE & CARRIAGE LTD

(C07.SI)

(C07.SI)

34.000

Vol: 306700

Value: 10388837

SINGAPORE PRESS HLDGS LTD

(T39.SI)

(T39.SI)

3.910

Vol: 2499000

Value: 9796059

CAPITALAND MALL TRUST

(C38U.SI)

(C38U.SI)

1.940

Vol: 5045400

Value: 9792277

SINGAPORE EXCHANGE LIMITED

(S68.SI)

(S68.SI)

7.690

Vol: 1207300

Value: 9238914

NOBLE GROUP LIMITED

(N21.SI)

(N21.SI)

0.430

Vol: 20776000

Value: 8884347

HONGKONG LAND HOLDINGS LIMITED

(H78.SI)

(H78.SI)

USD 6.870

Vol: 1291000

Value: 8866777

SINGAPORE AIRLINES LTD

(C6L.SI)

(C6L.SI)

11.010

Vol: 774600

Value: 8543920

HUTCHISON PORT HOLDINGS TRUST

(NS8U.SI)

(NS8U.SI)

USD 0.520

Vol: 15775300

Value: 8241604

Top 20 Gainers ($)

JARDINE STRATEGIC HLDGS LTD

(J37.SI)

(J37.SI)

USD 27.010

Vol: 111800

Value: 2989603

JARDINE MATHESON HLDGS LTD

(J36.SI)

(J36.SI)

USD 47.680

Vol: 95900

Value: 4567671

UNITED OVERSEAS BANK LTD

(U11.SI)

(U11.SI)

19.240

Vol: 1697300

Value: 32639831

VENTURE CORPORATION LIMITED

(V03.SI)

(V03.SI)

8.300

Vol: 415800

Value: 3448943

PSL HOLDINGS LTD

(BLL.SI)

(BLL.SI)

0.600

Vol: 8000

Value: 4609

GLOBAL TESTING CORPORATION LTD

(AYN.SI)

(AYN.SI)

1.130

Vol: 100

Value: 113

SHANGHAI TURBO ENTERPRISES LTD

(AWM.SI)

(AWM.SI)

0.985

Vol: 27100

Value: 24973

GREAT EASTERN HLDGS LTD

(G07.SI)

(G07.SI)

20.030

Vol: 1200

Value: 24049

OVERSEA-CHINESE BANKING CORP

(O39.SI)

(O39.SI)

8.750

Vol: 3199800

Value: 27905221

PNE INDUSTRIES LTD

(BDA.SI)

(BDA.SI)

0.605

Vol: 4200

Value: 2526

FAR EAST ORCHARD LIMITED

(O10.SI)

(O10.SI)

1.515

Vol: 10400

Value: 15059

SIN HENG HEAVY MACHINERY LTD

(BKA.SI)

(BKA.SI)

0.615

Vol: 11100

Value: 6095

SINGAPORE TECH ENGINEERING LTD

(S63.SI)

(S63.SI)

2.990

Vol: 1878500

Value: 5561210

COSCO CORPORATION (S) LTD

(F83.SI)

(F83.SI)

0.400

Vol: 20534100

Value: 7657015

IFS CAPITAL LIMITED

(I49.SI)

(I49.SI)

0.380

Vol: 4300

Value: 1436

COURAGE MARINE GROUP LIMITED

(ATL.SI)

(ATL.SI)

1.110

Vol: 20000

Value: 22100

FIRST RESOURCES LIMITED

(EB5.SI)

(EB5.SI)

1.910

Vol: 1901400

Value: 3581428

RIVERSTONE HOLDINGS LIMITED

(AP4.SI)

(AP4.SI)

2.340

Vol: 240900

Value: 556904

M1 LIMITED

(B2F.SI)

(B2F.SI)

2.680

Vol: 674700

Value: 1796627

SINGAPORE INDEX FUND

(S45U.SI)

(S45U.SI)

1.880

Vol: 5000

Value: 9400

Top 20 Losers ($)

JARDINE CYCLE & CARRIAGE LTD

(C07.SI)

(C07.SI)

34.000

Vol: 306700

Value: 10388837

FORTUNE REAL ESTATE INV TRUST

(F25U.SI)

(F25U.SI)

HKD 7.650

Vol: 27500

Value: 210881

SINGTEL

(Z74.SI)

XD

(Z74.SI)

XD

3.670

Vol: 13756300

Value: 50587565

SINGAPORE AIRLINES LTD

(C6L.SI)

(C6L.SI)

11.010

Vol: 774600

Value: 8543920

HOTEL PROPERTIES LTD

(H15.SI)

(H15.SI)

3.610

Vol: 100

Value: 361

KEPPEL CORPORATION LIMITED

(BN4.SI)

(BN4.SI)

6.420

Vol: 2504300

Value: 16109354

SHANGRI-LA ASIA LIMITED

(S07.SI)

(S07.SI)

HKD 7.140

Vol: 3000

Value: 21420

SINGTEL 10

(Z77.SI)

XD

(Z77.SI)

XD

3.680

Vol: 32040

Value: 117815

SIA ENGINEERING CO LTD

(S59.SI)

(S59.SI)

3.640

Vol: 249600

Value: 909195

AZTECH GROUP LTD.

(AVZ.SI)

(AVZ.SI)

0.505

Vol: 37500

Value: 20192

RAFFLES MEDICAL GROUP LTD

(R01.SI)

(R01.SI)

4.070

Vol: 509600

Value: 2090237

CAPITALAND RETAIL CHINA TRUST

(AU8U.SI)

(AU8U.SI)

1.465

Vol: 909700

Value: 1346130

HONG LEONG FINANCE LIMITED

(S41.SI)

(S41.SI)

2.340

Vol: 14000

Value: 32850

BUKIT SEMBAWANG ESTATES LTD

(B61.SI)

(B61.SI)

4.550

Vol: 2100

Value: 9655

HONGKONG LAND HOLDINGS LIMITED

(H78.SI)

(H78.SI)

USD 6.870

Vol: 1291000

Value: 8866777

SATS LTD.

(S58.SI)

(S58.SI)

3.880

Vol: 887600

Value: 3444001

MYP LTD.

(F86.SI)

(F86.SI)

0.200

Vol: 27800

Value: 6016

ASCENDAS REAL ESTATE INV TRUST

(A17U.SI)

CO

(A17U.SI)

CO

2.270

Vol: 7632600

Value: 17310564

IFAST CORPORATION LTD.

(AIY.SI)

(AIY.SI)

1.315

Vol: 15000

Value: 19725

FOOD EMPIRE HOLDINGS LIMITED

(F03.SI)

(F03.SI)

0.205

Vol: 1500

Value: 307

Top 20 Gainers (%)

ELEKTROMOTIVE GROUP LIMITED

(5VU.SI)

(5VU.SI)

0.003

Vol: 2200200

Value: 6600

TERRATECH GROUP LIMITED

(40I.SI)

(40I.SI)

0.058

Vol: 70836800

Value: 3728868

GLOBAL TECH (HLDGS) LIMITED

(G11.SI)

(G11.SI)

0.032

Vol: 21756800

Value: 637406

CACOLA FURNITURE INTL LIMITED

(D2U.SI)

(D2U.SI)

0.008

Vol: 782700

Value: 5958

MAGNUS ENERGY GROUP LTD.

(41S.SI)

(41S.SI)

0.005

Vol: 7856600

Value: 31426

ADV INTEGRATED MFG CORP LTD

(AXH.SI)

(AXH.SI)

0.235

Vol: 5200

Value: 1222

ACE ACHIEVE INFOCOM LIMITED

(A75.SI)

(A75.SI)

0.027

Vol: 24397100

Value: 651490

ASIA-PACIFIC STRATEGIC INV LTD

(5RA.SI)

(5RA.SI)

0.006

Vol: 6350000

Value: 38100

IFS CAPITAL LIMITED

(I49.SI)

(I49.SI)

0.380

Vol: 4300

Value: 1436

COSCO CORPORATION (S) LTD

(F83.SI)

(F83.SI)

0.400

Vol: 20534100

Value: 7657015

THAKRAL CORPORATION LTD

(AWI.SI)

(AWI.SI)

0.245

Vol: 31600

Value: 7726

PSL HOLDINGS LTD

(BLL.SI)

(BLL.SI)

0.600

Vol: 8000

Value: 4609

QT VASCULAR LTD.

(5I0.SI)

(5I0.SI)

0.113

Vol: 37298900

Value: 3941465

SEROJA INVESTMENTS LIMITED

(IW5.SI)

(IW5.SI)

0.064

Vol: 5000

Value: 323

PNE INDUSTRIES LTD

(BDA.SI)

(BDA.SI)

0.605

Vol: 4200

Value: 2526

SIN HENG HEAVY MACHINERY LTD

(BKA.SI)

(BKA.SI)

0.615

Vol: 11100

Value: 6095

LOYZ ENERGY LIMITED

(594.SI)

(594.SI)

0.057

Vol: 15256600

Value: 833871

COLEX HOLDINGS LIMITED

(567.SI)

(567.SI)

0.340

Vol: 10100

Value: 3034

RH PETROGAS LIMITED

(T13.SI)

(T13.SI)

0.178

Vol: 215300

Value: 35634

KIMHENG OFFSHORE&MARINE HLDLTD

(5G2.SI)

(5G2.SI)

0.110

Vol: 100

Value: 11

Top 20 Losers (%)

IPCO INT'L LIMITED

(I11.SI)

(I11.SI)

0.003

Vol: 1422100

Value: 5730

INFINIO GROUP LIMITED

(5G4.SI)

(5G4.SI)

0.002

Vol: 299900

Value: 599

NEXT-GEN SATELLITE COMM LTD

(B07.SI)

(B07.SI)

0.002

Vol: 482400

Value: 1447

MDR LIMITED

(A27.SI)

(A27.SI)

0.003

Vol: 3535100

Value: 14105

ANNAIK LIMITED

(A52.SI)

(A52.SI)

0.081

Vol: 100

Value: 8

MERCURIUS CAP INVESTMENT LTD

(5RF.SI)

(5RF.SI)

0.010

Vol: 494000

Value: 4940

JADASON ENTERPRISES LTD

(J03.SI)

(J03.SI)

0.010

Vol: 490100

Value: 4901

POLARIS LTD.

(5BI.SI)

(5BI.SI)

0.005

Vol: 200

Value: 1

MYP LTD.

(F86.SI)

(F86.SI)

0.200

Vol: 27800

Value: 6016

FOOD EMPIRE HOLDINGS LIMITED

(F03.SI)

(F03.SI)

0.205

Vol: 1500

Value: 307

KLW HOLDINGS LTD

(504.SI)

(504.SI)

0.006

Vol: 4000200

Value: 22001

ICP LTD

(5I4.SI)

(5I4.SI)

0.007

Vol: 1500100

Value: 12000

USP GROUP LIMITED

(A6F.SI)

(A6F.SI)

0.053

Vol: 185000

Value: 10275

EUROPTRONIC GROUP LTD

(E23.SI)

(E23.SI)

0.008

Vol: 300100

Value: 2400

AZTECH GROUP LTD.

(AVZ.SI)

(AVZ.SI)

0.505

Vol: 37500

Value: 20192

LCD GLOBAL INVESTMENTS LTD.

(L38.SI)

(L38.SI)

0.225

Vol: 29800

Value: 6911

JASON HOLDINGS LIMITED

(5I3.SI)

(5I3.SI)

0.076

Vol: 54400

Value: 4170

LHN LIMITED

(41O.SI)

(41O.SI)

0.130

Vol: 200100

Value: 26014

GRAND BANKS YACHTS LIMITED

(G50.SI)

(G50.SI)

0.250

Vol: 23500

Value: 5945

ATLANTIC NAVIGATION HLDG(S)LTD

(5UL.SI)

(5UL.SI)

0.320

Vol: 11100

Value: 3882

Data Source:

http://www.sgx.com/

http://sg.finance.yahoo.com/

Archive: