FTSE ST Indices 01-April-2016, Friday

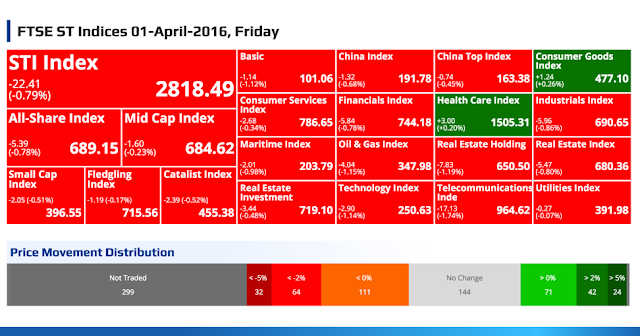

STI Index

-22.41

(-0.79%)

(-0.79%)

2818.49

All-Share Index

-5.39

(-0.78%)

(-0.78%)

689.15

Mid Cap Index

-1.60

(-0.23%)

(-0.23%)

684.62

Small Cap Index

-2.05 (-0.51%)

396.55

Fledgling Index

-1.19 (-0.17%)

715.56

Catalist Index

-2.39 (-0.52%)

455.38

Basic

-1.14

(-1.12%)

(-1.12%)

101.06

China Index

-1.32

(-0.68%)

(-0.68%)

191.78

China Top Index

-0.74

(-0.45%)

(-0.45%)

163.38

Consumer Goods Index

+1.24

(+0.26%)

(+0.26%)

477.10

Consumer Services Index

-2.68

(-0.34%)

(-0.34%)

786.65

Financials Index

-5.84

(-0.78%)

(-0.78%)

744.18

Health Care Index

+3.00

(+0.20%)

(+0.20%)

1505.31

Industrials Index

-5.96

(-0.86%)

(-0.86%)

690.65

Maritime Index

-2.01

(-0.98%)

(-0.98%)

203.79

Oil & Gas Index

-4.04

(-1.15%)

(-1.15%)

347.98

Real Estate Holding

-7.83

(-1.19%)

(-1.19%)

650.50

Real Estate Index

-5.47

(-0.80%)

(-0.80%)

680.36

Real Estate Investment

-3.44

(-0.48%)

(-0.48%)

719.10

Technology Index

-2.90

(-1.14%)

(-1.14%)

250.63

Telecommunications Inde

-17.13

(-1.74%)

(-1.74%)

964.62

Utilities Index

-0.27

(-0.07%)

(-0.07%)

391.98

Price Movement Distribution

Top 20 Volume

ANNICA HOLDINGS LIMITED

(5AL.SI)

(5AL.SI)

0.001

- / -

Vol: 293350900

Value: 293350

EZRA HOLDINGS LIMITED

(5DN.SI)

(5DN.SI)

0.104

-0.007 /

-6.31%

Vol: 106220000

Value: 11332686

SPACKMAN ENTERTAINMENT GRP LTD

(40E.SI)

(40E.SI)

0.140

-0.007 /

-4.76%

Vol: 81663600

Value: 11867744

NOBLE GROUP LIMITED

(N21.SI)

(N21.SI)

0.430

-0.010 /

-2.27%

Vol: 75816100

Value: 32882148

IPCO INT'L LIMITED

(I11.SI)

(I11.SI)

0.005

-0.001 /

-16.67%

Vol: 39966800

Value: 199834

GOLDEN AGRI-RESOURCES LTD

(E5H.SI)

CD

(E5H.SI)

CD

0.420

+0.010 /

+2.44%

Vol: 34221700

Value: 14374163

MFS TECHNOLOGY LTD

(5BM.SI)

XE

(5BM.SI)

XE

0.028

+0.003 /

+12.00%

Vol: 28202000

Value: 778877

OKH GLOBAL LTD.

(S3N.SI)

(S3N.SI)

0.123

- / -

Vol: 27771200

Value: 3444800

YUUZOO CORPORATION LIMITED

(AFC.SI)

(AFC.SI)

0.230

- / -

Vol: 26368900

Value: 6070856

REX INTERNATIONAL HOLDING LTD

(5WH.SI)

(5WH.SI)

0.120

- / -

Vol: 25329000

Value: 3058837

MM2 ASIA LTD.

(43D.SI)

(43D.SI)

0.520

-0.015 /

-2.80%

Vol: 20607300

Value: 10228877

GENTING SINGAPORE PLC

(G13.SI)

(G13.SI)

0.815

-0.020 /

-2.40%

Vol: 17857700

Value: 14599468

SINGTEL

(Z74.SI)

(Z74.SI)

3.750

-0.070 /

-1.83%

Vol: 17470500

Value: 65801595

THE STRATECH GROUP LIMITED

(ATN.SI)

CE

(ATN.SI)

CE

0.027

-0.002 /

-6.90%

Vol: 17067800

Value: 464065

CEDAR STRATEGIC HOLDINGS LTD

(530.SI)

(530.SI)

0.003

+0.001 /

+50.00%

Vol: 14924100

Value: 37869

YANGZIJIANG SHIPBLDG HLDGS LTD

(BS6.SI)

(BS6.SI)

0.970

-0.010 /

-1.02%

Vol: 14055800

Value: 13568303

COMFORTDELGRO CORPORATION LTD

(C52.SI)

CD

(C52.SI)

CD

2.900

-0.020 /

-0.68%

Vol: 13396000

Value: 38922873

THAI BEVERAGE PUBLIC CO LTD

(Y92.SI)

CD

(Y92.SI)

CD

0.715

- / -

Vol: 13114400

Value: 9440910

GLOBAL LOGISTIC PROP LIMITED

(MC0.SI)

(MC0.SI)

1.935

+0.010 /

+0.52%

Vol: 12044600

Value: 23307788

CSC HOLDINGS LTD

(C06.SI)

(C06.SI)

0.023

+0.003 /

+15.00%

Vol: 11581100

Value: 254595

Top 20 Value

DBS GROUP HOLDINGS LTD

(D05.SI)

CD

(D05.SI)

CD

15.210

-0.170 /

-1.11%

Vol: 4683300

Value: 71079552

SINGTEL

(Z74.SI)

(Z74.SI)

3.750

-0.070 /

-1.83%

Vol: 17470500

Value: 65801595

OVERSEA-CHINESE BANKING CORP

(O39.SI)

CD

(O39.SI)

CD

8.820

-0.020 /

-0.23%

Vol: 5242400

Value: 46021357

UNITED OVERSEAS BANK LTD

(U11.SI)

CD

(U11.SI)

CD

18.760

-0.110 /

-0.58%

Vol: 2146500

Value: 40085015

COMFORTDELGRO CORPORATION LTD

(C52.SI)

CD

(C52.SI)

CD

2.900

-0.020 /

-0.68%

Vol: 13396000

Value: 38922873

JARDINE MATHESON HLDGS LTD

(J36.SI)

(J36.SI)

USD 56.280

-0.800 /

-1.40%

Vol: 601300

Value: 33923196

NOBLE GROUP LIMITED

(N21.SI)

(N21.SI)

0.430

-0.010 /

-2.27%

Vol: 75816100

Value: 32882148

CAPITALAND LIMITED

(C31.SI)

CD

(C31.SI)

CD

3.020

-0.050 /

-1.63%

Vol: 10615300

Value: 32153372

CITY DEVELOPMENTS LIMITED

(C09.SI)

CD

(C09.SI)

CD

8.150

-0.020 /

-0.24%

Vol: 3335500

Value: 27360950

HONGKONG LAND HOLDINGS LIMITED

(H78.SI)

(H78.SI)

USD 5.860

-0.130 /

-2.17%

Vol: 4481000

Value: 26333390

KEPPEL CORPORATION LIMITED

(BN4.SI)

CD

(BN4.SI)

CD

5.780

-0.050 /

-0.86%

Vol: 4416300

Value: 25588766

WILMAR INTERNATIONAL LIMITED

(F34.SI)

CD

(F34.SI)

CD

3.360

- / -

Vol: 7438000

Value: 24946842

GLOBAL LOGISTIC PROP LIMITED

(MC0.SI)

(MC0.SI)

1.935

+0.010 /

+0.52%

Vol: 12044600

Value: 23307788

CAPITALAND MALL TRUST

(C38U.SI)

(C38U.SI)

2.080

-0.010 /

-0.48%

Vol: 9300800

Value: 19359076

SINGAPORE EXCHANGE LIMITED

(S68.SI)

(S68.SI)

7.770

-0.180 /

-2.26%

Vol: 2337000

Value: 18239690

SINGAPORE AIRLINES LTD

(C6L.SI)

(C6L.SI)

11.440

+0.020 /

+0.18%

Vol: 1558700

Value: 17805276

SINGAPORE PRESS HLDGS LTD

(T39.SI)

(T39.SI)

4.030

+0.030 /

+0.75%

Vol: 3734000

Value: 15006255

ASCENDAS REAL ESTATE INV TRUST

(A17U.SI)

(A17U.SI)

2.380

-0.010 /

-0.42%

Vol: 6293500

Value: 14927989

GENTING SINGAPORE PLC

(G13.SI)

(G13.SI)

0.815

-0.020 /

-2.40%

Vol: 17857700

Value: 14599468

GOLDEN AGRI-RESOURCES LTD

(E5H.SI)

CD

(E5H.SI)

CD

0.420

+0.010 /

+2.44%

Vol: 34221700

Value: 14374163

Top 20 Gainers ($)

SHANGRI-LA ASIA LIMITED

(S07.SI)

CD

(S07.SI)

CD

HKD 9.030

+0.410 /

+4.76%

Vol: 60600

Value: 539537

SOUTHERN PACKAGING GROUP LTD

(BQP.SI)

(BQP.SI)

0.600

+0.120 /

+25.00%

Vol: 100

Value: 60

VENTURE CORPORATION LIMITED

(V03.SI)

CD

(V03.SI)

CD

8.420

+0.060 /

+0.72%

Vol: 317400

Value: 2668491

SATS LTD.

(S58.SI)

(S58.SI)

4.010

+0.060 /

+1.52%

Vol: 3163800

Value: 12619755

SIA ENGINEERING CO LTD

(S59.SI)

(S59.SI)

3.660

+0.060 /

+1.67%

Vol: 305000

Value: 1104409

SRI TRANG AGRO-INDUSTRY PCL

(NC2.SI)

CD

(NC2.SI)

CD

0.500

+0.050 /

+11.11%

Vol: 30000

Value: 14517

FAR EAST ORCHARD LIMITED

(O10.SI)

(O10.SI)

1.550

+0.050 /

+3.33%

Vol: 1000

Value: 1550

DARCO WATER TECHNOLOGIES LTD

(BLR.SI)

(BLR.SI)

0.380

+0.050 /

+15.15%

Vol: 41000

Value: 15832

PLASTOFORM HOLDINGS LIMITED

(AYD.SI)

CD

(AYD.SI)

CD

0.255

+0.050 /

+24.39%

Vol: 20000

Value: 5096

CORDLIFE GROUP LIMITED

(P8A.SI)

(P8A.SI)

1.360

+0.035 /

+2.64%

Vol: 1150000

Value: 1554925

ASL MARINE HOLDINGS LTD

(A04.SI)

(A04.SI)

0.325

+0.030 /

+10.17%

Vol: 5300

Value: 1670

SINGAPORE PRESS HLDGS LTD

(T39.SI)

(T39.SI)

4.030

+0.030 /

+0.75%

Vol: 3734000

Value: 15006255

HAW PAR CORP LTD

(H02.SI)

CD

(H02.SI)

CD

8.420

+0.030 /

+0.36%

Vol: 92900

Value: 779770

FIRST RESOURCES LIMITED

(EB5.SI)

CD

(EB5.SI)

CD

2.050

+0.030 /

+1.49%

Vol: 3010000

Value: 6135729

RAFFLES MEDICAL GROUP LTD

(R01.SI)

(R01.SI)

4.540

+0.030 /

+0.67%

Vol: 531900

Value: 2419774

QAF LTD

(Q01.SI)

(Q01.SI)

1.055

+0.025 /

+2.43%

Vol: 286100

Value: 298212

FRASERS HOSPITALITY TRUST

(ACV.SI)

(ACV.SI)

0.800

+0.025 /

+3.23%

Vol: 226600

Value: 179106

CHEMICAL INDUSTRIES (F.E.) LTD

(C05.SI)

(C05.SI)

0.560

+0.020 /

+3.70%

Vol: 7100

Value: 3955

BOUSTEAD PROJECTS LIMITED

(AVM.SI)

(AVM.SI)

0.670

+0.020 /

+3.08%

Vol: 76400

Value: 51199

IHH HEALTHCARE BERHAD

(Q0F.SI)

CD

(Q0F.SI)

CD

2.210

+0.020 /

+0.91%

Vol: 227500

Value: 502326

Top 20 Losers ($)

JARDINE MATHESON HLDGS LTD

(J36.SI)

(J36.SI)

USD 56.280

-0.800 /

-1.40%

Vol: 601300

Value: 33923196

PRUDENTIAL PLC

(K6S.SI)

(K6S.SI)

USD 18.700

-0.800 /

-4.10%

Vol: 300

Value: 5610

JARDINE STRATEGIC HLDGS LTD

(J37.SI)

(J37.SI)

USD 29.340

-0.510 /

-1.71%

Vol: 76500

Value: 2244574

GREAT EASTERN HLDGS LTD

(G07.SI)

CD

(G07.SI)

CD

22.300

-0.190 /

-0.84%

Vol: 6500

Value: 145181

UOL GROUP LIMITED

(U14.SI)

(U14.SI)

5.810

-0.190 /

-3.17%

Vol: 2013500

Value: 11756225

SINGAPORE EXCHANGE LIMITED

(S68.SI)

(S68.SI)

7.770

-0.180 /

-2.26%

Vol: 2337000

Value: 18239690

DBS GROUP HOLDINGS LTD

(D05.SI)

CD

(D05.SI)

CD

15.210

-0.170 /

-1.11%

Vol: 4683300

Value: 71079552

TAN CHONG INT'L LTD

(T15.SI)

(T15.SI)

HKD 2.410

-0.160 /

-6.23%

Vol: 12000

Value: 28985

HONGKONG LAND HOLDINGS LIMITED

(H78.SI)

(H78.SI)

USD 5.860

-0.130 /

-2.17%

Vol: 4481000

Value: 26333390

UNITED OVERSEAS BANK LTD

(U11.SI)

CD

(U11.SI)

CD

18.760

-0.110 /

-0.58%

Vol: 2146500

Value: 40085015

JARDINE CYCLE & CARRIAGE LTD

(C07.SI)

CD

(C07.SI)

CD

39.940

-0.090 /

-0.22%

Vol: 275100

Value: 11034534

SINGTEL

(Z74.SI)

(Z74.SI)

3.750

-0.070 /

-1.83%

Vol: 17470500

Value: 65801595

LOGISTICS HOLDINGS LIMITED

(5VI.SI)

(5VI.SI)

0.225

-0.070 /

-23.73%

Vol: 2100

Value: 442

CAPITALAND LIMITED

(C31.SI)

CD

(C31.SI)

CD

3.020

-0.050 /

-1.63%

Vol: 10615300

Value: 32153372

KEPPEL CORPORATION LIMITED

(BN4.SI)

CD

(BN4.SI)

CD

5.780

-0.050 /

-0.86%

Vol: 4416300

Value: 25588766

SINGTEL 10

(Z77.SI)

(Z77.SI)

3.750

-0.050 /

-1.32%

Vol: 38690

Value: 145595

SEMBCORP INDUSTRIES LTD

(U96.SI)

CD

(U96.SI)

CD

2.980

-0.040 /

-1.32%

Vol: 4518500

Value: 13515967

STARHUB LTD

(CC3.SI)

CD

(CC3.SI)

CD

3.310

-0.040 /

-1.19%

Vol: 1796000

Value: 5959183

AUSNET SERVICES LTD

(AZI.SI)

(AZI.SI)

1.510

-0.035 /

-2.27%

Vol: 32300

Value: 48637

OLAM INTERNATIONAL LIMITED

(O32.SI)

CD

(O32.SI)

CD

1.690

-0.030 /

-1.74%

Vol: 297200

Value: 502250

Top 20 Gainers (%)

INFINIO GROUP LIMITED

(5G4.SI)

(5G4.SI)

0.002

+0.001 /

+100.00%

Vol: 300

Value: 1

ALLIED TECHNOLOGIES LIMITED

(A13.SI)

(A13.SI)

0.028

+0.011 /

+64.71%

Vol: 1250200

Value: 35178

CEDAR STRATEGIC HOLDINGS LTD

(530.SI)

(530.SI)

0.003

+0.001 /

+50.00%

Vol: 14924100

Value: 37869

EQUATION SUMMIT LIMITED

(532.SI)

(532.SI)

0.004

+0.001 /

+33.33%

Vol: 3030200

Value: 12120

CHINASING INVESTMENT HLDG LTD

(O2R.SI)

(O2R.SI)

0.014

+0.003 /

+27.27%

Vol: 379900

Value: 5228

SOUTHERN PACKAGING GROUP LTD

(BQP.SI)

(BQP.SI)

0.600

+0.120 /

+25.00%

Vol: 100

Value: 60

PLASTOFORM HOLDINGS LIMITED

(AYD.SI)

CD

(AYD.SI)

CD

0.255

+0.050 /

+24.39%

Vol: 20000

Value: 5096

TSH CORPORATION LIMITED

(574.SI)

(574.SI)

0.098

+0.019 /

+24.05%

Vol: 5316100

Value: 512040

DARCO WATER TECHNOLOGIES LTD

(BLR.SI)

(BLR.SI)

0.380

+0.050 /

+15.15%

Vol: 41000

Value: 15832

CSC HOLDINGS LTD

(C06.SI)

(C06.SI)

0.023

+0.003 /

+15.00%

Vol: 11581100

Value: 254595

NICO STEEL HOLDINGS LIMITED

(5GF.SI)

(5GF.SI)

0.023

+0.003 /

+15.00%

Vol: 167100

Value: 3221

EINDEC CORPORATION LIMITED

(42Z.SI)

(42Z.SI)

0.115

+0.014 /

+13.86%

Vol: 80200

Value: 8351

MFS TECHNOLOGY LTD

(5BM.SI)

XE

(5BM.SI)

XE

0.028

+0.003 /

+12.00%

Vol: 28202000

Value: 778877

LEADER ENVIRONMENTAL TECH LTD

(LS9.SI)

(LS9.SI)

0.039

+0.004 /

+11.43%

Vol: 3000

Value: 115

AIMS PROPERTY SECURITIES FUND

(A0P.SI)

(A0P.SI)

0.119

+0.012 /

+11.21%

Vol: 3900

Value: 464

SRI TRANG AGRO-INDUSTRY PCL

(NC2.SI)

CD

(NC2.SI)

CD

0.500

+0.050 /

+11.11%

Vol: 30000

Value: 14517

ASL MARINE HOLDINGS LTD

(A04.SI)

(A04.SI)

0.325

+0.030 /

+10.17%

Vol: 5300

Value: 1670

CHARISMA ENERGY SERVICES LTD

(5QT.SI)

(5QT.SI)

0.013

+0.001 /

+8.33%

Vol: 7058000

Value: 86196

YUEXIU PROPERTY CO LIMITED

(G10.SI)

CD

(G10.SI)

CD

0.200

+0.015 /

+8.11%

Vol: 5000

Value: 1000

VIKING OFFSHORE AND MARINE LTD

(557.SI)

(557.SI)

0.044

+0.003 /

+7.32%

Vol: 231500

Value: 9851

Top 20 Losers (%)

VASHION GROUP LTD.

(5BA.SI)

(5BA.SI)

0.001

-0.001 /

-50.00%

Vol: 10200

Value: 10

MAGNUS ENERGY GROUP LTD.

(41S.SI)

(41S.SI)

0.002

-0.001 /

-33.33%

Vol: 3562200

Value: 10629

NEXT-GEN SATELLITE COMM LTD

(B07.SI)

(B07.SI)

0.002

-0.001 /

-33.33%

Vol: 4000200

Value: 12000

LOGISTICS HOLDINGS LIMITED

(5VI.SI)

(5VI.SI)

0.225

-0.070 /

-23.73%

Vol: 2100

Value: 442

WE HOLDINGS LTD.

(5RJ.SI)

(5RJ.SI)

0.004

-0.001 /

-20.00%

Vol: 200000

Value: 900

IPCO INT'L LIMITED

(I11.SI)

(I11.SI)

0.005

-0.001 /

-16.67%

Vol: 39966800

Value: 199834

USP GROUP LIMITED

(A6F.SI)

CE

(A6F.SI)

CE

0.022

-0.004 /

-15.38%

Vol: 264100

Value: 5901

CHINA ENVIRONMENTAL RES GP LTD

(RS1.SI)

(RS1.SI)

0.034

-0.005 /

-12.82%

Vol: 200

Value: 6

ICP LTD

(5I4.SI)

(5I4.SI)

0.007

-0.001 /

-12.50%

Vol: 100200

Value: 701

AVIC INTL MARITIME HLDGLIMITED

(O2I.SI)

(O2I.SI)

0.045

-0.005 /

-10.00%

Vol: 15100

Value: 904

GLOBAL PALM RESOURCES HLGS LTD

(BLW.SI)

(BLW.SI)

0.230

-0.025 /

-9.80%

Vol: 2500

Value: 575

ACE ACHIEVE INFOCOM LIMITED

(A75.SI)

(A75.SI)

0.019

-0.002 /

-9.52%

Vol: 488900

Value: 9289

SEN YUE HOLDINGS LIMITED

(5BS.SI)

(5BS.SI)

0.019

-0.002 /

-9.52%

Vol: 300000

Value: 5700

DAPAI INTL HLDG CO. LTD.

(FP1.SI)

(FP1.SI)

0.011

-0.001 /

-8.33%

Vol: 80100

Value: 881

RAFFLES UNITED HOLDINGS LTD.

(K22.SI)

(K22.SI)

0.190

-0.015 /

-7.32%

Vol: 20300

Value: 3676

SEROJA INVESTMENTS LIMITED

(IW5.SI)

(IW5.SI)

0.066

-0.005 /

-7.04%

Vol: 200

Value: 12

THE STRATECH GROUP LIMITED

(ATN.SI)

CE

(ATN.SI)

CE

0.027

-0.002 /

-6.90%

Vol: 17067800

Value: 464065

EMS ENERGY LIMITED

(42O.SI)

(42O.SI)

0.054

-0.004 /

-6.90%

Vol: 119300

Value: 6452

HUATIONG GLOBAL LIMITED

(41B.SI)

(41B.SI)

0.135

-0.010 /

-6.90%

Vol: 230000

Value: 31050

SAN TEH LIMITED

(S46.SI)

CD

(S46.SI)

CD

0.215

-0.015 /

-6.52%

Vol: 83100

Value: 17867

Data Source:

http://www.sgx.com/

http://sg.finance.yahoo.com/

Archive: