FTSE ST Indices 29-March-2016, Tuesday

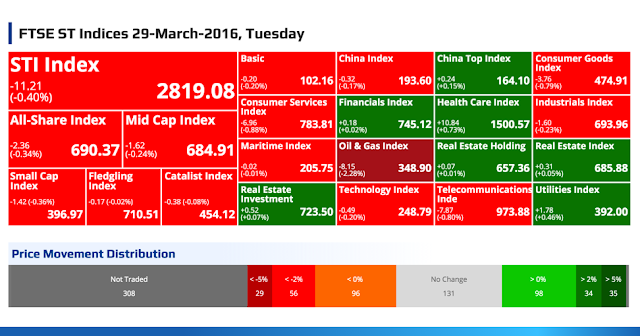

STI Index

-11.21

(-0.40%)

(-0.40%)

2819.08

All-Share Index

-2.36

(-0.34%)

(-0.34%)

690.37

Mid Cap Index

-1.62

(-0.24%)

(-0.24%)

684.91

Small Cap Index

-1.42 (-0.36%)

396.97

Fledgling Index

-0.17 (-0.02%)

710.51

Catalist Index

-0.38 (-0.08%)

454.12

Basic

-0.20

(-0.20%)

(-0.20%)

102.16

China Index

-0.32

(-0.17%)

(-0.17%)

193.60

China Top Index

+0.24

(+0.15%)

(+0.15%)

164.10

Consumer Goods Index

-3.76

(-0.79%)

(-0.79%)

474.91

Consumer Services Index

-6.96

(-0.88%)

(-0.88%)

783.81

Financials Index

+0.18

(+0.02%)

(+0.02%)

745.12

Health Care Index

+10.84

(+0.73%)

(+0.73%)

1500.57

Industrials Index

-1.60

(-0.23%)

(-0.23%)

693.96

Maritime Index

-0.02

(-0.01%)

(-0.01%)

205.75

Oil & Gas Index

-8.15

(-2.28%)

(-2.28%)

348.90

Real Estate Holding

+0.07

(+0.01%)

(+0.01%)

657.36

Real Estate Index

+0.31

(+0.05%)

(+0.05%)

685.88

Real Estate Investment

+0.52

(+0.07%)

(+0.07%)

723.50

Technology Index

-0.49

(-0.20%)

(-0.20%)

248.79

Telecommunications Inde

-7.87

(-0.80%)

(-0.80%)

973.88

Utilities Index

+1.78

(+0.46%)

(+0.46%)

392.00

Price Movement Distribution

Top 20 Volume

YUUZOO CORPORATION LIMITED

(AFC.SI)

(AFC.SI)

0.199

+0.014 /

+7.57%

Vol: 83217900

Value: 16297411

OKH GLOBAL LTD.

(S3N.SI)

(S3N.SI)

0.134

-0.006 /

-4.29%

Vol: 81413300

Value: 10921203

MAGNUS ENERGY GROUP LTD.

(41S.SI)

(41S.SI)

0.003

- / -

Vol: 77628300

Value: 232884

EZRA HOLDINGS LIMITED

(5DN.SI)

(5DN.SI)

0.109

-0.004 /

-3.54%

Vol: 72279000

Value: 7975280

REX INTERNATIONAL HOLDING LTD

(5WH.SI)

(5WH.SI)

0.116

-0.007 /

-5.69%

Vol: 63892400

Value: 7634757

SPACKMAN ENTERTAINMENT GRP LTD

(40E.SI)

(40E.SI)

0.136

+0.002 /

+1.49%

Vol: 57148000

Value: 7917543

AUSGROUP LIMITED

(5GJ.SI)

(5GJ.SI)

0.125

+0.002 /

+1.63%

Vol: 42633800

Value: 5565278

NOBLE GROUP LIMITED

(N21.SI)

(N21.SI)

0.445

-0.005 /

-1.11%

Vol: 42000500

Value: 18538965

TERRATECH GROUP LIMITED

(40I.SI)

(40I.SI)

0.051

+0.005 /

+10.87%

Vol: 40404600

Value: 2136370

PARKSON RETAIL ASIA LIMITED

(O9E.SI)

(O9E.SI)

0.189

-0.021 /

-10.00%

Vol: 34112700

Value: 6669991

NAM CHEONG LIMITED

(N4E.SI)

(N4E.SI)

0.114

+0.004 /

+3.64%

Vol: 31261300

Value: 3589995

GOLDEN AGRI-RESOURCES LTD

(E5H.SI)

CD

(E5H.SI)

CD

0.405

-0.015 /

-3.57%

Vol: 30545100

Value: 12541947

ALLIANCE MINERAL ASSETSLIMITED

(40F.SI)

(40F.SI)

0.072

+0.005 /

+7.46%

Vol: 27703300

Value: 2025807

YOMA STRATEGIC HOLDINGS LTD

(Z59.SI)

(Z59.SI)

0.535

+0.020 /

+3.88%

Vol: 26506700

Value: 13901416

JIUTIAN CHEMICAL GROUP LIMITED

(C8R.SI)

(C8R.SI)

0.026

-0.001 /

-3.70%

Vol: 23995100

Value: 662781

CHINA ENVIRONMENT LTD.

(5OU.SI)

(5OU.SI)

0.073

-0.004 /

-5.19%

Vol: 23951700

Value: 1781689

BHG RETAIL REIT

(BMGU.SI)

(BMGU.SI)

0.800

- / -

Vol: 23092700

Value: 18820550

ANNICA HOLDINGS LIMITED

(5AL.SI)

(5AL.SI)

0.001

- / -

Vol: 20200000

Value: 20200

HALCYON AGRI CORPORATION LTD

(5VJ.SI)

(5VJ.SI)

0.735

-0.005 /

-0.68%

Vol: 17799300

Value: 13120001

ROWSLEY LTD.

(A50.SI)

(A50.SI)

0.148

+0.002 /

+1.37%

Vol: 17458300

Value: 2606761

Top 20 Value

OVERSEA-CHINESE BANKING CORP

(O39.SI)

CD

(O39.SI)

CD

8.820

-0.010 /

-0.11%

Vol: 7883600

Value: 69608755

DBS GROUP HOLDINGS LTD

(D05.SI)

CD

(D05.SI)

CD

15.180

+0.010 /

+0.07%

Vol: 4000200

Value: 60810290

SINGTEL

(Z74.SI)

(Z74.SI)

3.790

-0.030 /

-0.79%

Vol: 15248500

Value: 58069958

UNITED OVERSEAS BANK LTD

(U11.SI)

CD

(U11.SI)

CD

18.500

-0.060 /

-0.32%

Vol: 3073400

Value: 56838838

KEPPEL CORPORATION LIMITED

(BN4.SI)

CD

(BN4.SI)

CD

5.780

-0.110 /

-1.87%

Vol: 5891300

Value: 34296091

COMFORTDELGRO CORPORATION LTD

(C52.SI)

CD

(C52.SI)

CD

2.930

-0.040 /

-1.35%

Vol: 9898500

Value: 29010639

JARDINE MATHESON HLDGS LTD

(J36.SI)

(J36.SI)

USD 56.120

-0.280 /

-0.50%

Vol: 475900

Value: 26954682

WILMAR INTERNATIONAL LIMITED

(F34.SI)

CD

(F34.SI)

CD

3.350

- / -

Vol: 7031000

Value: 23718680

CAPITALAND LIMITED

(C31.SI)

CD

(C31.SI)

CD

3.070

- / -

Vol: 7645500

Value: 23372708

SEMBCORP INDUSTRIES LTD

(U96.SI)

CD

(U96.SI)

CD

2.980

-0.090 /

-2.93%

Vol: 7754100

Value: 23186431

HONGKONG LAND HOLDINGS LIMITED

(H78.SI)

(H78.SI)

USD 6.000

-0.040 /

-0.66%

Vol: 3427500

Value: 20551878

ASCENDAS REAL ESTATE INV TRUST

(A17U.SI)

(A17U.SI)

2.420

+0.010 /

+0.41%

Vol: 7820500

Value: 18871328

BHG RETAIL REIT

(BMGU.SI)

(BMGU.SI)

0.800

- / -

Vol: 23092700

Value: 18820550

NOBLE GROUP LIMITED

(N21.SI)

(N21.SI)

0.445

-0.005 /

-1.11%

Vol: 42000500

Value: 18538965

SINGAPORE AIRLINES LTD

(C6L.SI)

(C6L.SI)

11.340

-0.110 /

-0.96%

Vol: 1615800

Value: 18331208

YUUZOO CORPORATION LIMITED

(AFC.SI)

(AFC.SI)

0.199

+0.014 /

+7.57%

Vol: 83217900

Value: 16297411

CITY DEVELOPMENTS LIMITED

(C09.SI)

CD

(C09.SI)

CD

7.950

+0.090 /

+1.15%

Vol: 1821500

Value: 14390452

SINGAPORE EXCHANGE LIMITED

(S68.SI)

(S68.SI)

7.720

+0.100 /

+1.31%

Vol: 1831800

Value: 14027780

YOMA STRATEGIC HOLDINGS LTD

(Z59.SI)

(Z59.SI)

0.535

+0.020 /

+3.88%

Vol: 26506700

Value: 13901416

HALCYON AGRI CORPORATION LTD

(5VJ.SI)

(5VJ.SI)

0.735

-0.005 /

-0.68%

Vol: 17799300

Value: 13120001

Top 20 Gainers ($)

JARDINE STRATEGIC HLDGS LTD

(J37.SI)

(J37.SI)

USD 29.300

+0.160 /

+0.55%

Vol: 248100

Value: 7262807

ISETAN (SINGAPORE) LTD

(I15.SI)

(I15.SI)

3.990

+0.150 /

+3.91%

Vol: 3300

Value: 13159

BUKIT SEMBAWANG ESTATES LTD

(B61.SI)

(B61.SI)

4.370

+0.140 /

+3.31%

Vol: 17800

Value: 77376

SINGAPORE EXCHANGE LIMITED

(S68.SI)

(S68.SI)

7.720

+0.100 /

+1.31%

Vol: 1831800

Value: 14027780

CITY DEVELOPMENTS LIMITED

(C09.SI)

CD

(C09.SI)

CD

7.950

+0.090 /

+1.15%

Vol: 1821500

Value: 14390452

ZHONGMIN BAIHUI RETAIL GRP LTD

(5SR.SI)

CD

(5SR.SI)

CD

1.410

+0.080 /

+6.02%

Vol: 1400

Value: 1940

REGAL INTERNATIONAL GROUP LTD.

(UV1.SI)

(UV1.SI)

0.165

+0.075 /

+83.33%

Vol: 12100

Value: 2001

PSL HOLDINGS LTD

(BLL.SI)

(BLL.SI)

0.630

+0.060 /

+10.53%

Vol: 36000

Value: 23127

ELEC & ELTEK INT CO LTD

(E16.SI)

CD

(E16.SI)

CD

USD 0.995

+0.055 /

+5.85%

Vol: 114800

Value: 111651

RAFFLES MEDICAL GROUP LTD

(R01.SI)

(R01.SI)

4.510

+0.050 /

+1.12%

Vol: 982200

Value: 4394781

UOL GROUP LIMITED

(U14.SI)

(U14.SI)

5.980

+0.050 /

+0.84%

Vol: 985900

Value: 5889274

SINO GRANDNESS FOOD IND GP LTD

(T4B.SI)

(T4B.SI)

0.700

+0.045 /

+6.87%

Vol: 9093300

Value: 6244246

HONG LEONG FINANCE LIMITED

(S41.SI)

CD

(S41.SI)

CD

2.330

+0.040 /

+1.75%

Vol: 400

Value: 932

CHINA FLEXIBLE PACK HLDG LTD

(BCX.SI)

(BCX.SI)

0.870

+0.040 /

+4.82%

Vol: 400

Value: 348

BOUSTEAD SINGAPORE LIMITED

(F9D.SI)

(F9D.SI)

0.860

+0.035 /

+4.24%

Vol: 1431000

Value: 1217963

GREAT EASTERN HLDGS LTD

(G07.SI)

CD

(G07.SI)

CD

21.810

+0.030 /

+0.14%

Vol: 3100

Value: 67986

HO BEE LAND LIMITED

(H13.SI)

CD

(H13.SI)

CD

2.160

+0.030 /

+1.41%

Vol: 164800

Value: 356033

ENVICTUS INTERNATIONAL HLDGLTD

(BQD.SI)

(BQD.SI)

0.575

+0.030 /

+5.50%

Vol: 118500

Value: 66763

SAN TEH LIMITED

(S46.SI)

CD

(S46.SI)

CD

0.260

+0.030 /

+13.04%

Vol: 100

Value: 26

COURTS ASIA LIMITED

(RE2.SI)

(RE2.SI)

0.350

+0.025 /

+7.69%

Vol: 2886100

Value: 1003397

Top 20 Losers ($)

FORTUNE REAL ESTATE INV TRUST

(F25U.SI)

(F25U.SI)

HKD 8.000

-0.380 /

-4.53%

Vol: 74900

Value: 613600

JARDINE CYCLE & CARRIAGE LTD

(C07.SI)

CD

(C07.SI)

CD

39.520

-0.380 /

-0.95%

Vol: 168300

Value: 6660656

JARDINE MATHESON HLDGS LTD

(J36.SI)

(J36.SI)

USD 56.120

-0.280 /

-0.50%

Vol: 475900

Value: 26954682

KEPPEL CORPORATION LIMITED

(BN4.SI)

CD

(BN4.SI)

CD

5.780

-0.110 /

-1.87%

Vol: 5891300

Value: 34296091

SINGAPORE AIRLINES LTD

(C6L.SI)

(C6L.SI)

11.340

-0.110 /

-0.96%

Vol: 1615800

Value: 18331208

SEMBCORP INDUSTRIES LTD

(U96.SI)

CD

(U96.SI)

CD

2.980

-0.090 /

-2.93%

Vol: 7754100

Value: 23186431

ADVANCED HOLDINGS LTD.

(BLZ.SI)

(BLZ.SI)

0.255

-0.085 /

-25.00%

Vol: 14000

Value: 3421

KING WAN CORPORATION LIMITED

(554.SI)

(554.SI)

0.225

-0.075 /

-25.00%

Vol: 13200

Value: 2418

TA CORPORATION LTD

(PA3.SI)

CD

(PA3.SI)

CD

0.215

-0.070 /

-24.56%

Vol: 4200

Value: 833

SARINE TECHNOLOGIES LTD

(U77.SI)

CD

(U77.SI)

CD

1.665

-0.060 /

-3.48%

Vol: 21800

Value: 36682

UNITED OVERSEAS BANK LTD

(U11.SI)

CD

(U11.SI)

CD

18.500

-0.060 /

-0.32%

Vol: 3073400

Value: 56838838

PNE INDUSTRIES LTD

(BDA.SI)

(BDA.SI)

0.615

-0.060 /

-8.89%

Vol: 20300

Value: 12561

EINDEC CORPORATION LIMITED

(42Z.SI)

(42Z.SI)

0.130

-0.055 /

-29.73%

Vol: 200000

Value: 27750

UNITED OVERSEAS INSURANCE LTD

(U13.SI)

CD

(U13.SI)

CD

4.750

-0.050 /

-1.04%

Vol: 3000

Value: 14280

SEMBCORP MARINE LTD

(S51.SI)

CD

(S51.SI)

CD

1.630

-0.045 /

-2.69%

Vol: 2598800

Value: 4269555

HONGKONG LAND HOLDINGS LIMITED

(H78.SI)

(H78.SI)

USD 6.000

-0.040 /

-0.66%

Vol: 3427500

Value: 20551878

STARHUB LTD

(CC3.SI)

CD

(CC3.SI)

CD

3.310

-0.040 /

-1.19%

Vol: 3002400

Value: 9994580

COMFORTDELGRO CORPORATION LTD

(C52.SI)

CD

(C52.SI)

CD

2.930

-0.040 /

-1.35%

Vol: 9898500

Value: 29010639

DAIRY FARM INT'L HOLDINGS LTD

(D01.SI)

(D01.SI)

USD 5.970

-0.040 /

-0.67%

Vol: 71500

Value: 427209

CREATIVE TECHNOLOGY LTD

(C76.SI)

(C76.SI)

1.120

-0.035 /

-3.03%

Vol: 5700

Value: 6380

Top 20 Gainers (%)

REGAL INTERNATIONAL GROUP LTD.

(UV1.SI)

(UV1.SI)

0.165

+0.075 /

+83.33%

Vol: 12100

Value: 2001

EUROPTRONIC GROUP LTD

(E23.SI)

(E23.SI)

0.003

+0.001 /

+50.00%

Vol: 6749100

Value: 13498

METECH INTERNATIONAL LIMITED

(QG1.SI)

(QG1.SI)

0.003

+0.001 /

+50.00%

Vol: 1090300

Value: 3270

EQUATION SUMMIT LIMITED

(532.SI)

(532.SI)

0.004

+0.001 /

+33.33%

Vol: 20000

Value: 80

KOYO INTERNATIONAL LIMITED

(5OC.SI)

CD

(5OC.SI)

CD

0.078

+0.014 /

+21.88%

Vol: 3486000

Value: 268230

8TELECOM INTL HOLDINGS CO LTD

(AZG.SI)

(AZG.SI)

0.118

+0.020 /

+20.41%

Vol: 120400

Value: 12058

CHINA KANGDA FOOD COMPANY LTD

(P74.SI)

(P74.SI)

0.100

+0.015 /

+17.65%

Vol: 30000

Value: 3000

HLH GROUP LIMITED

(H27.SI)

(H27.SI)

0.007

+0.001 /

+16.67%

Vol: 3350100

Value: 20100

CHIWAYLAND INTERNATIONAL LTD

(ACW.SI)

(ACW.SI)

0.078

+0.010 /

+14.71%

Vol: 2767900

Value: 210600

MMP RESOURCES LIMITED

(F3V.SI)

(F3V.SI)

0.008

+0.001 /

+14.29%

Vol: 279200

Value: 1954

ICP LTD

(5I4.SI)

(5I4.SI)

0.008

+0.001 /

+14.29%

Vol: 700100

Value: 4900

CACOLA FURNITURE INTL LIMITED

(D2U.SI)

(D2U.SI)

0.008

+0.001 /

+14.29%

Vol: 219100

Value: 1612

SAN TEH LIMITED

(S46.SI)

CD

(S46.SI)

CD

0.260

+0.030 /

+13.04%

Vol: 100

Value: 26

OUE HOSPITALITY TRUST R

(BRIR.SI)

(BRIR.SI)

0.107

+0.011 /

+11.46%

Vol: 5735000

Value: 583398

LEY CHOON GROUP HLDG LIMITED

(Q0X.SI)

(Q0X.SI)

0.030

+0.003 /

+11.11%

Vol: 30700

Value: 921

TERRATECH GROUP LIMITED

(40I.SI)

(40I.SI)

0.051

+0.005 /

+10.87%

Vol: 40404600

Value: 2136370

PSL HOLDINGS LTD

(BLL.SI)

(BLL.SI)

0.630

+0.060 /

+10.53%

Vol: 36000

Value: 23127

OUE HOSPITALITY TRUST R1

(BRJR.SI)

(BRJR.SI)

0.106

+0.010 /

+10.42%

Vol: 60420

Value: 5971

DAPAI INTL HLDG CO. LTD.

(FP1.SI)

(FP1.SI)

0.012

+0.001 /

+9.09%

Vol: 9033100

Value: 109596

HOSEN GROUP LTD

(5EV.SI)

(5EV.SI)

0.049

+0.004 /

+8.89%

Vol: 136000

Value: 5852

Top 20 Losers (%)

EINDEC CORPORATION LIMITED

(42Z.SI)

(42Z.SI)

0.130

-0.055 /

-29.73%

Vol: 200000

Value: 27750

ELEKTROMOTIVE GROUP LIMITED

(5VU.SI)

(5VU.SI)

0.003

-0.001 /

-25.00%

Vol: 25700

Value: 77

ADVANCED HOLDINGS LTD.

(BLZ.SI)

(BLZ.SI)

0.255

-0.085 /

-25.00%

Vol: 14000

Value: 3421

KING WAN CORPORATION LIMITED

(554.SI)

(554.SI)

0.225

-0.075 /

-25.00%

Vol: 13200

Value: 2418

TA CORPORATION LTD

(PA3.SI)

CD

(PA3.SI)

CD

0.215

-0.070 /

-24.56%

Vol: 4200

Value: 833

SERRANO LIMITED

(40R.SI)

(40R.SI)

0.040

-0.008 /

-16.67%

Vol: 208100

Value: 7788

POLARIS LTD.

(5BI.SI)

(5BI.SI)

0.006

-0.001 /

-14.29%

Vol: 200

Value: 1

OCEAN SKY INTERNATIONAL LTD

(O05.SI)

(O05.SI)

0.061

-0.008 /

-11.59%

Vol: 371000

Value: 23351

PARKSON RETAIL ASIA LIMITED

(O9E.SI)

(O9E.SI)

0.189

-0.021 /

-10.00%

Vol: 34112700

Value: 6669991

SITRA HOLDINGS (INTL) LIMITED

(5LE.SI)

(5LE.SI)

0.009

-0.001 /

-10.00%

Vol: 5300000

Value: 52900

PNE INDUSTRIES LTD

(BDA.SI)

(BDA.SI)

0.615

-0.060 /

-8.89%

Vol: 20300

Value: 12561

RH PETROGAS LIMITED

(T13.SI)

(T13.SI)

0.189

-0.016 /

-7.80%

Vol: 1360800

Value: 262099

USP GROUP LIMITED

(A6F.SI)

(A6F.SI)

0.025

-0.002 /

-7.41%

Vol: 86500

Value: 2209

SUNRIGHT LTD

(S71.SI)

(S71.SI)

0.190

-0.015 /

-7.32%

Vol: 64700

Value: 12476

NTEGRATOR INTERNATIONAL LTD

(5HC.SI)

(5HC.SI)

0.013

-0.001 /

-7.14%

Vol: 1510000

Value: 19630

NICO STEEL HOLDINGS LIMITED

(5GF.SI)

(5GF.SI)

0.026

-0.002 /

-7.14%

Vol: 87900

Value: 2339

CEFC INTERNATIONAL LIMITED

(Y35.SI)

(Y35.SI)

0.265

-0.020 /

-7.02%

Vol: 860700

Value: 236206

KRISENERGY LTD.

(SK3.SI)

(SK3.SI)

0.191

-0.014 /

-6.83%

Vol: 7503200

Value: 1517473

SYSMA HOLDINGS LIMITED

(5UO.SI)

(5UO.SI)

0.134

-0.009 /

-6.29%

Vol: 9052100

Value: 1231150

ANCHUN INTERNATIONAL HLDGS LTD

(MF5.SI)

(MF5.SI)

0.049

-0.003 /

-5.77%

Vol: 50200

Value: 2147

Data Source:

http://www.sgx.com/

http://sg.finance.yahoo.com/

Archive: