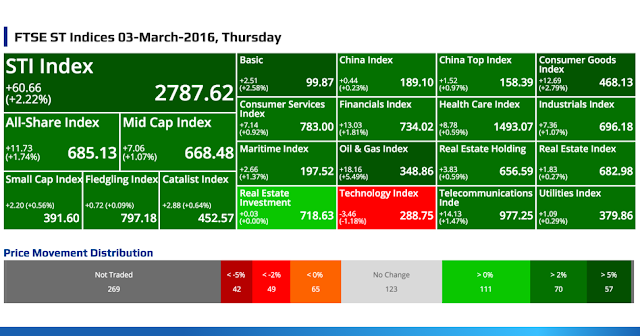

FTSE ST Indices 03-March-2016, Thursday

STI Index

+60.66

(+2.22%)

(+2.22%)

2787.62

All-Share Index

+11.73

(+1.74%)

(+1.74%)

685.13

Mid Cap Index

+7.06

(+1.07%)

(+1.07%)

668.48

Small Cap Index

+2.20 (+0.56%)

391.60

Fledgling Index

+0.72 (+0.09%)

797.18

Catalist Index

+2.88 (+0.64%)

452.57

Basic

+2.51

(+2.58%)

(+2.58%)

99.87

China Index

+0.44

(+0.23%)

(+0.23%)

189.10

China Top Index

+1.52

(+0.97%)

(+0.97%)

158.39

Consumer Goods Index

+12.69

(+2.79%)

(+2.79%)

468.13

Consumer Services Index

+7.14

(+0.92%)

(+0.92%)

783.00

Financials Index

+13.03

(+1.81%)

(+1.81%)

734.02

Health Care Index

+8.78

(+0.59%)

(+0.59%)

1493.07

Industrials Index

+7.36

(+1.07%)

(+1.07%)

696.18

Maritime Index

+2.66

(+1.37%)

(+1.37%)

197.52

Oil & Gas Index

+18.16

(+5.49%)

(+5.49%)

348.86

Real Estate Holding

+3.83

(+0.59%)

(+0.59%)

656.59

Real Estate Index

+1.83

(+0.27%)

(+0.27%)

682.98

Real Estate Investment

+0.03

(+0.00%)

(+0.00%)

718.63

Technology Index

-3.46

(-1.18%)

(-1.18%)

288.75

Telecommunications Inde

+14.13

(+1.47%)

(+1.47%)

977.25

Utilities Index

+1.09

(+0.29%)

(+0.29%)

379.86

Price Movement Distribution

Top 20 Volume

EZRA HOLDINGS LIMITED

(5DN.SI)

(5DN.SI)

0.077

+0.003 /

+4.05%

Vol: 178243600

Value: 13734684

NOBLE GROUP LIMITED

(N21.SI)

(N21.SI)

0.380

+0.035 /

+10.14%

Vol: 165796300

Value: 60332686

TECHNICS OIL & GAS LIMITED

(5CQ.SI)

(5CQ.SI)

0.163

+0.033 /

+25.38%

Vol: 103821700

Value: 16285725

EZION HOLDINGS LIMITED

(5ME.SI)

(5ME.SI)

0.550

+0.035 /

+6.80%

Vol: 72022300

Value: 38861373

LOYZ ENERGY LIMITED

(594.SI)

(594.SI)

0.046

-0.002 /

-4.17%

Vol: 61769300

Value: 3039940

XINREN ALUMINUM HOLDINGS LTD

(MN5.SI)

(MN5.SI)

0.600

- / -

Vol: 56556000

Value: 33933601

MAGNUS ENERGY GROUP LTD.

(41S.SI)

(41S.SI)

0.004

+0.001 /

+33.33%

Vol: 46984000

Value: 140952

VARD HOLDINGS LIMITED

(MS7.SI)

(MS7.SI)

0.189

+0.012 /

+6.78%

Vol: 44286400

Value: 8378315

REX INTERNATIONAL HOLDING LTD

(5WH.SI)

(5WH.SI)

0.088

+0.002 /

+2.33%

Vol: 35179900

Value: 3137168

QT VASCULAR LTD.

(5I0.SI)

(5I0.SI)

0.115

+0.003 /

+2.68%

Vol: 32474500

Value: 3773219

LIONGOLD CORP LTD

(A78.SI)

(A78.SI)

0.004

-0.001 /

-20.00%

Vol: 31713100

Value: 126852

THAI BEVERAGE PUBLIC CO LTD

(Y92.SI)

CD

(Y92.SI)

CD

0.770

+0.025 /

+3.36%

Vol: 31082500

Value: 23602782

SINGTEL

(Z74.SI)

(Z74.SI)

3.800

+0.060 /

+1.60%

Vol: 30706300

Value: 116605357

GENTING SINGAPORE PLC

(G13.SI)

(G13.SI)

0.765

+0.015 /

+2.00%

Vol: 30428900

Value: 23216144

YUUZOO CORPORATION LIMITED

(AFC.SI)

(AFC.SI)

0.196

+0.001 /

+0.51%

Vol: 30327400

Value: 6016968

GLOBAL LOGISTIC PROP LIMITED

(MC0.SI)

(MC0.SI)

1.850

-0.010 /

-0.54%

Vol: 29484100

Value: 54754221

TERRATECH GROUP LIMITED

(40I.SI)

(40I.SI)

0.047

+0.003 /

+6.82%

Vol: 29342500

Value: 1407414

GOLDEN AGRI-RESOURCES LTD

(E5H.SI)

CD

(E5H.SI)

CD

0.385

+0.020 /

+5.48%

Vol: 28894600

Value: 10920461

ROWSLEY LTD.

(A50.SI)

(A50.SI)

0.153

-0.002 /

-1.29%

Vol: 26489000

Value: 4111277

DAPAI INTL HLDG CO. LTD.

(FP1.SI)

(FP1.SI)

0.013

- / -

Vol: 26299300

Value: 387338

Top 20 Value

DBS GROUP HOLDINGS LTD

(D05.SI)

CD

(D05.SI)

CD

14.710

+0.470 /

+3.30%

Vol: 14440500

Value: 210774937

OVERSEA-CHINESE BANKING CORP

(O39.SI)

CD

(O39.SI)

CD

8.600

+0.290 /

+3.49%

Vol: 17036400

Value: 145152031

UNITED OVERSEAS BANK LTD

(U11.SI)

CD

(U11.SI)

CD

18.210

+0.560 /

+3.17%

Vol: 6666500

Value: 120273771

SINGTEL

(Z74.SI)

(Z74.SI)

3.800

+0.060 /

+1.60%

Vol: 30706300

Value: 116605357

JARDINE MATHESON HLDGS LTD

(J36.SI)

(J36.SI)

USD 57.720

+0.700 /

+1.23%

Vol: 1213800

Value: 69311843

CAPITALAND LIMITED

(C31.SI)

(C31.SI)

3.150

+0.080 /

+2.61%

Vol: 20230600

Value: 63356773

KEPPEL CORPORATION LIMITED

(BN4.SI)

CD

(BN4.SI)

CD

5.800

+0.310 /

+5.65%

Vol: 10715000

Value: 61562671

NOBLE GROUP LIMITED

(N21.SI)

(N21.SI)

0.380

+0.035 /

+10.14%

Vol: 165796300

Value: 60332686

CAPITALAND MALL TRUST

(C38U.SI)

(C38U.SI)

2.130

-0.030 /

-1.39%

Vol: 26184600

Value: 55940986

GLOBAL LOGISTIC PROP LIMITED

(MC0.SI)

(MC0.SI)

1.850

-0.010 /

-0.54%

Vol: 29484100

Value: 54754221

SEMBCORP INDUSTRIES LTD

(U96.SI)

CD

(U96.SI)

CD

3.030

+0.160 /

+5.57%

Vol: 13206000

Value: 39730778

EZION HOLDINGS LIMITED

(5ME.SI)

(5ME.SI)

0.550

+0.035 /

+6.80%

Vol: 72022300

Value: 38861373

COMFORTDELGRO CORPORATION LTD

(C52.SI)

CD

(C52.SI)

CD

3.030

+0.020 /

+0.66%

Vol: 11959600

Value: 36177910

XINREN ALUMINUM HOLDINGS LTD

(MN5.SI)

(MN5.SI)

0.600

- / -

Vol: 56556000

Value: 33933601

HONGKONG LAND HOLDINGS LIMITED

(H78.SI)

(H78.SI)

USD 6.020

-0.050 /

-0.82%

Vol: 5207000

Value: 31441461

SINGAPORE EXCHANGE LIMITED

(S68.SI)

(S68.SI)

7.540

+0.160 /

+2.17%

Vol: 3800600

Value: 28536112

WILMAR INTERNATIONAL LIMITED

(F34.SI)

CD

(F34.SI)

CD

3.180

+0.050 /

+1.60%

Vol: 8523400

Value: 27211679

THAI BEVERAGE PUBLIC CO LTD

(Y92.SI)

CD

(Y92.SI)

CD

0.770

+0.025 /

+3.36%

Vol: 31082500

Value: 23602782

SINGAPORE PRESS HLDGS LTD

(T39.SI)

(T39.SI)

3.880

+0.100 /

+2.65%

Vol: 6120700

Value: 23592559

GENTING SINGAPORE PLC

(G13.SI)

(G13.SI)

0.765

+0.015 /

+2.00%

Vol: 30428900

Value: 23216144

Top 20 Gainers ($)

JARDINE MATHESON HLDGS LTD

(J36.SI)

(J36.SI)

USD 57.720

+0.700 /

+1.23%

Vol: 1213800

Value: 69311843

UNITED OVERSEAS BANK LTD

(U11.SI)

CD

(U11.SI)

CD

18.210

+0.560 /

+3.17%

Vol: 6666500

Value: 120273771

DBS GROUP HOLDINGS LTD

(D05.SI)

CD

(D05.SI)

CD

14.710

+0.470 /

+3.30%

Vol: 14440500

Value: 210774937

GREAT EASTERN HLDGS LTD

(G07.SI)

CD

(G07.SI)

CD

22.700

+0.400 /

+1.79%

Vol: 10200

Value: 231253

KEPPEL CORPORATION LIMITED

(BN4.SI)

CD

(BN4.SI)

CD

5.800

+0.310 /

+5.65%

Vol: 10715000

Value: 61562671

OVERSEA-CHINESE BANKING CORP

(O39.SI)

CD

(O39.SI)

CD

8.600

+0.290 /

+3.49%

Vol: 17036400

Value: 145152031

LH GROUP LIMITED

(BKB.SI)

(BKB.SI)

0.680

+0.190 /

+38.78%

Vol: 1200

Value: 701

SINGAPORE AIRLINES LTD

(C6L.SI)

(C6L.SI)

11.550

+0.170 /

+1.49%

Vol: 1331000

Value: 15323269

JARDINE STRATEGIC HLDGS LTD

(J37.SI)

(J37.SI)

USD 29.940

+0.160 /

+0.54%

Vol: 245800

Value: 7306486

SINGAPORE EXCHANGE LIMITED

(S68.SI)

(S68.SI)

7.540

+0.160 /

+2.17%

Vol: 3800600

Value: 28536112

SEMBCORP INDUSTRIES LTD

(U96.SI)

CD

(U96.SI)

CD

3.030

+0.160 /

+5.57%

Vol: 13206000

Value: 39730778

HAW PAR CORP LTD

(H02.SI)

CD

(H02.SI)

CD

8.200

+0.130 /

+1.61%

Vol: 46600

Value: 380236

UOL GROUP LIMITED

(U14.SI)

(U14.SI)

5.820

+0.130 /

+2.28%

Vol: 2659100

Value: 15382900

SINGAPORE PRESS HLDGS LTD

(T39.SI)

(T39.SI)

3.880

+0.100 /

+2.65%

Vol: 6120700

Value: 23592559

WILLAS-ARRAY ELEC (HLDGS) LTD

(BDR.SI)

(BDR.SI)

0.660

+0.100 /

+17.86%

Vol: 26300

Value: 17291

SHANGRI-LA ASIA LIMITED

(S07.SI)

(S07.SI)

HKD 7.500

+0.100 /

+1.35%

Vol: 45500

Value: 334750

S I2I LIMITED

(BAI.SI)

(BAI.SI)

1.300

+0.090 /

+7.44%

Vol: 30200

Value: 39236

CITY DEVELOPMENTS LIMITED

(C09.SI)

CD

(C09.SI)

CD

7.760

+0.090 /

+1.17%

Vol: 2599700

Value: 20172835

OLAM INTERNATIONAL LIMITED

(O32.SI)

CD

(O32.SI)

CD

1.710

+0.085 /

+5.23%

Vol: 929100

Value: 1569988

DELONG HOLDINGS LIMITED

(BQO.SI)

(BQO.SI)

0.405

+0.080 /

+24.62%

Vol: 30300

Value: 9251

Top 20 Losers ($)

JARDINE CYCLE & CARRIAGE LTD

(C07.SI)

CD

(C07.SI)

CD

39.000

-0.370 /

-0.94%

Vol: 492400

Value: 19441020

CHINA FLEXIBLE PACK HLDG LTD

(BCX.SI)

(BCX.SI)

0.840

-0.180 /

-17.65%

Vol: 4600

Value: 3782

STRAITS TRADING CO. LTD

(S20.SI)

CD

(S20.SI)

CD

2.100

-0.130 /

-5.83%

Vol: 44100

Value: 93271

SOUTHERN PACKAGING GROUP LTD

(BQP.SI)

(BQP.SI)

0.500

-0.100 /

-16.67%

Vol: 75300

Value: 37650

LINDETEVES-JACOBERG LTD

(AWC.SI)

(AWC.SI)

0.500

-0.070 /

-12.28%

Vol: 1200

Value: 576

SATS LTD.

(S58.SI)

(S58.SI)

3.930

-0.070 /

-1.75%

Vol: 4215700

Value: 16584137

HONGKONG LAND HOLDINGS LIMITED

(H78.SI)

(H78.SI)

USD 6.020

-0.050 /

-0.82%

Vol: 5207000

Value: 31441461

GAYLIN HOLDINGS LIMITED

(RF7.SI)

(RF7.SI)

0.300

-0.040 /

-11.76%

Vol: 1100

Value: 342

ASIA FASHION HOLDINGS LIMITED

(BQI.SI)

(BQI.SI)

0.290

-0.040 /

-12.12%

Vol: 400

Value: 116

CMC INFOCOMM LIMITED

(42F.SI)

(42F.SI)

0.053

-0.034 /

-39.08%

Vol: 2100

Value: 99

CAPITALAND MALL TRUST

(C38U.SI)

(C38U.SI)

2.130

-0.030 /

-1.39%

Vol: 26184600

Value: 55940986

CREATIVE TECHNOLOGY LTD

(C76.SI)

(C76.SI)

1.050

-0.030 /

-2.78%

Vol: 14950

Value: 16414

HO BEE LAND LIMITED

(H13.SI)

CD

(H13.SI)

CD

1.915

-0.030 /

-1.54%

Vol: 166000

Value: 320874

AZTECH GROUP LTD.

(AVZ.SI)

(AVZ.SI)

0.455

-0.030 /

-6.19%

Vol: 7000

Value: 3185

AIMS AMP CAP INDUSTRIAL REIT

(O5RU.SI)

(O5RU.SI)

1.340

-0.025 /

-1.83%

Vol: 377700

Value: 509776

IHH HEALTHCARE BERHAD

(Q0F.SI)

(Q0F.SI)

2.130

-0.020 /

-0.93%

Vol: 109600

Value: 233548

PARKWAYLIFE REIT

(C2PU.SI)

(C2PU.SI)

2.340

-0.020 /

-0.85%

Vol: 1222000

Value: 2847639

MEGHMANI ORGANICS LIMITED

(M30.SI)

(M30.SI)

0.180

-0.020 /

-10.00%

Vol: 15000

Value: 3150

GLOBAL TESTING CORPORATION LTD

(AYN.SI)

(AYN.SI)

0.980

-0.020 /

-2.00%

Vol: 7000

Value: 6860

DAIRY FARM INT'L HOLDINGS LTD

(D01.SI)

(D01.SI)

USD 6.140

-0.020 /

-0.32%

Vol: 75700

Value: 466731

Top 20 Gainers (%)

CHINA HAIDA LTD.

(C92.SI)

(C92.SI)

0.024

+0.009 /

+60.00%

Vol: 100

Value: 2

FAR EAST GROUP LIMITED

(5TJ.SI)

(5TJ.SI)

0.127

+0.040 /

+45.98%

Vol: 130900

Value: 16621

ABUNDANCE INTERNATIONAL LTD

(541.SI)

(541.SI)

0.035

+0.010 /

+40.00%

Vol: 160100

Value: 6003

LH GROUP LIMITED

(BKB.SI)

(BKB.SI)

0.680

+0.190 /

+38.78%

Vol: 1200

Value: 701

MAGNUS ENERGY GROUP LTD.

(41S.SI)

(41S.SI)

0.004

+0.001 /

+33.33%

Vol: 46984000

Value: 140952

ICP LTD

(5I4.SI)

(5I4.SI)

0.008

+0.002 /

+33.33%

Vol: 15886000

Value: 127080

CHINA KUNDA TECH HOLDINGS LTD

(GU5.SI)

(GU5.SI)

0.021

+0.005 /

+31.25%

Vol: 204000

Value: 2884

AXCELASIA INC.

(42U.SI)

(42U.SI)

0.210

+0.047 /

+28.83%

Vol: 100000

Value: 20369

JOYAS INTERNATIONAL HLDGS LTD

(E9L.SI)

(E9L.SI)

0.009

+0.002 /

+28.57%

Vol: 900

Value: 8

TECHNICS OIL & GAS LIMITED

(5CQ.SI)

(5CQ.SI)

0.163

+0.033 /

+25.38%

Vol: 103821700

Value: 16285725

IPCO INT'L LIMITED

(I11.SI)

(I11.SI)

0.005

+0.001 /

+25.00%

Vol: 1200000

Value: 5000

DELONG HOLDINGS LIMITED

(BQO.SI)

(BQO.SI)

0.405

+0.080 /

+24.62%

Vol: 30300

Value: 9251

HEATEC JIETONG HOLDINGS LTD.

(5OR.SI)

(5OR.SI)

0.044

+0.008 /

+22.22%

Vol: 25100

Value: 1104

MERCURIUS CAP INVESTMENT LTD

(5RF.SI)

(5RF.SI)

0.006

+0.001 /

+20.00%

Vol: 2515100

Value: 15099

COMPACT METAL INDUSTRIES LTD

(T4E.SI)

(T4E.SI)

0.025

+0.004 /

+19.05%

Vol: 10200

Value: 215

WILLAS-ARRAY ELEC (HLDGS) LTD

(BDR.SI)

(BDR.SI)

0.660

+0.100 /

+17.86%

Vol: 26300

Value: 17291

OUHUA ENERGY HOLDINGS LIMITED

(AJ2.SI)

(AJ2.SI)

0.058

+0.008 /

+16.00%

Vol: 200000

Value: 11600

VIKING OFFSHORE AND MARINE LTD

(557.SI)

(557.SI)

0.046

+0.006 /

+15.00%

Vol: 13770500

Value: 606893

LION ASIAPAC LTD

(BAZ.SI)

(BAZ.SI)

0.250

+0.030 /

+13.64%

Vol: 3100

Value: 774

HIAP TONG CORPORATION LTD.

(5PO.SI)

(5PO.SI)

0.080

+0.009 /

+12.68%

Vol: 68700

Value: 4989

Top 20 Losers (%)

NEXT-GEN SATELLITE COMM LTD

(B07.SI)

(B07.SI)

0.002

-0.002 /

-50.00%

Vol: 200

Value: 0

BLUMONT GROUP LTD.

(A33.SI)

(A33.SI)

0.001

-0.001 /

-50.00%

Vol: 312300

Value: 312

EUROPTRONIC GROUP LTD

(E23.SI)

(E23.SI)

0.003

-0.002 /

-40.00%

Vol: 4875200

Value: 19550

CMC INFOCOMM LIMITED

(42F.SI)

(42F.SI)

0.053

-0.034 /

-39.08%

Vol: 2100

Value: 99

CPH LTD

(539.SI)

(539.SI)

0.004

-0.002 /

-33.33%

Vol: 200

Value: 1

INNOPAC HOLDINGS LIMITED

(I26.SI)

(I26.SI)

0.002

-0.001 /

-33.33%

Vol: 17599000

Value: 35198

MIYOSHI LIMITED

(M03.SI)

(M03.SI)

0.043

-0.018 /

-29.51%

Vol: 213000

Value: 8969

CFM HOLDINGS LIMITED

(5EB.SI)

(5EB.SI)

0.033

-0.012 /

-26.67%

Vol: 20000

Value: 660

ELEKTROMOTIVE GROUP LIMITED

(5VU.SI)

(5VU.SI)

0.003

-0.001 /

-25.00%

Vol: 200

Value: 0

LIFEBRANDZ LTD.

(L20.SI)

(L20.SI)

0.003

-0.001 /

-25.00%

Vol: 2000200

Value: 6000

ISR CAPITAL LIMITED

(5EC.SI)

(5EC.SI)

0.004

-0.001 /

-20.00%

Vol: 100

Value: 0

LIONGOLD CORP LTD

(A78.SI)

(A78.SI)

0.004

-0.001 /

-20.00%

Vol: 31713100

Value: 126852

CHINA FLEXIBLE PACK HLDG LTD

(BCX.SI)

(BCX.SI)

0.840

-0.180 /

-17.65%

Vol: 4600

Value: 3782

SOUTHERN PACKAGING GROUP LTD

(BQP.SI)

(BQP.SI)

0.500

-0.100 /

-16.67%

Vol: 75300

Value: 37650

KLW HOLDINGS LTD

(504.SI)

(504.SI)

0.006

-0.001 /

-14.29%

Vol: 2044200

Value: 12265

VGO CORPORATION LIMITED

(PH0.SI)

(PH0.SI)

0.060

-0.010 /

-14.29%

Vol: 41400

Value: 2943

SINOSTAR PEC HOLDINGS LIMITED

(C9Q.SI)

(C9Q.SI)

0.082

-0.013 /

-13.68%

Vol: 20100

Value: 1908

MMP RESOURCES LIMITED

(F3V.SI)

(F3V.SI)

0.007

-0.001 /

-12.50%

Vol: 10339000

Value: 72373

LINDETEVES-JACOBERG LTD

(AWC.SI)

(AWC.SI)

0.500

-0.070 /

-12.28%

Vol: 1200

Value: 576

ASIA FASHION HOLDINGS LIMITED

(BQI.SI)

(BQI.SI)

0.290

-0.040 /

-12.12%

Vol: 400

Value: 116

Data Source:

http://www.sgx.com/

http://sg.finance.yahoo.com/

Archive: