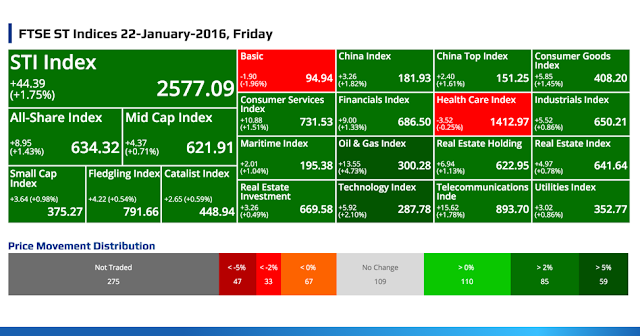

FTSE ST Indices 22-January-2016, Friday

STI Index

+44.39

(+1.75%)

(+1.75%)

2577.09

All-Share Index

+8.95

(+1.43%)

(+1.43%)

634.32

Mid Cap Index

+4.37

(+0.71%)

(+0.71%)

621.91

Small Cap Index

+3.64 (+0.98%)

375.27

Fledgling Index

+4.22 (+0.54%)

791.66

Catalist Index

+2.65 (+0.59%)

448.94

Basic

-1.90

(-1.96%)

(-1.96%)

94.94

China Index

+3.26

(+1.82%)

(+1.82%)

181.93

China Top Index

+2.40

(+1.61%)

(+1.61%)

151.25

Consumer Goods Index

+5.85

(+1.45%)

(+1.45%)

408.20

Consumer Services Index

+10.88

(+1.51%)

(+1.51%)

731.53

Financials Index

+9.00

(+1.33%)

(+1.33%)

686.50

Health Care Index

-3.52

(-0.25%)

(-0.25%)

1412.97

Industrials Index

+5.52

(+0.86%)

(+0.86%)

650.21

Maritime Index

+2.01

(+1.04%)

(+1.04%)

195.38

Oil & Gas Index

+13.55

(+4.73%)

(+4.73%)

300.28

Real Estate Holding

+6.94

(+1.13%)

(+1.13%)

622.95

Real Estate Index

+4.97

(+0.78%)

(+0.78%)

641.64

Real Estate Investment

+3.26

(+0.49%)

(+0.49%)

669.58

Technology Index

+5.92

(+2.10%)

(+2.10%)

287.78

Telecommunications Inde

+15.62

(+1.78%)

(+1.78%)

893.70

Utilities Index

+3.02

(+0.86%)

(+0.86%)

352.77

Price Movement Distribution

Top 20 Volume

LINC ENERGY LTD

(TI6.SI)

(TI6.SI)

0.088

+0.010 /

+12.82%

Vol: 75844200

Value: 6767085

NOBLE GROUP LIMITED

(N21.SI)

(N21.SI)

0.290

+0.010 /

+3.57%

Vol: 74233500

Value: 21838690

GLOBAL LOGISTIC PROP LIMITED

(MC0.SI)

(MC0.SI)

1.725

-0.030 /

-1.71%

Vol: 57166000

Value: 98963791

EZRA HOLDINGS LIMITED

(5DN.SI)

(5DN.SI)

0.058

+0.002 /

+3.57%

Vol: 53734200

Value: 3160026

THE STRATECH GROUP LIMITED

(ATN.SI)

(ATN.SI)

0.032

+0.001 /

+3.23%

Vol: 52183700

Value: 1713309

SINGTEL

(Z74.SI)

(Z74.SI)

3.460

+0.070 /

+2.06%

Vol: 31198500

Value: 107865289

REX INTERNATIONAL HOLDING LTD

(5WH.SI)

(5WH.SI)

0.073

+0.005 /

+7.35%

Vol: 30830000

Value: 2242860

GOLDEN AGRI-RESOURCES LTD

(E5H.SI)

(E5H.SI)

0.345

+0.010 /

+2.99%

Vol: 21098800

Value: 7203736

CAPITALAND LIMITED

(C31.SI)

(C31.SI)

2.990

+0.040 /

+1.36%

Vol: 19876100

Value: 59237920

EQUATION SUMMIT LIMITED

(532.SI)

(532.SI)

0.003

- / -

Vol: 19261200

Value: 48813

POLARIS LTD.

(5BI.SI)

(5BI.SI)

0.005

-0.001 /

-16.67%

Vol: 18469000

Value: 82445

WE HOLDINGS LTD.

(5RJ.SI)

(5RJ.SI)

0.004

- / -

Vol: 16150000

Value: 64600

DBS GROUP HOLDINGS LTD

(D05.SI)

(D05.SI)

13.870

+0.100 /

+0.73%

Vol: 16105600

Value: 224026720

GENTING SINGAPORE PLC

(G13.SI)

(G13.SI)

0.690

+0.010 /

+1.47%

Vol: 15868700

Value: 10885797

SEMBCORP INDUSTRIES LTD

(U96.SI)

(U96.SI)

2.340

+0.150 /

+6.85%

Vol: 15865000

Value: 36195696

COSCO CORPORATION (S) LTD

(F83.SI)

(F83.SI)

0.350

+0.010 /

+2.94%

Vol: 15737600

Value: 5527607

MMP RESOURCES LIMITED

(F3V.SI)

(F3V.SI)

0.006

- / -

Vol: 15579300

Value: 85836

SPACKMAN ENTERTAINMENT GRP LTD

(40E.SI)

(40E.SI)

0.094

- / -

Vol: 15520300

Value: 1479488

THAI BEVERAGE PUBLIC CO LTD

(Y92.SI)

(Y92.SI)

0.670

-0.010 /

-1.47%

Vol: 15359300

Value: 10406505

JUMBO GROUP LIMITED

(42R.SI)

(42R.SI)

0.470

+0.010 /

+2.17%

Vol: 14919100

Value: 7048918

Top 20 Value

DBS GROUP HOLDINGS LTD

(D05.SI)

(D05.SI)

13.870

+0.100 /

+0.73%

Vol: 16105600

Value: 224026720

SINGTEL

(Z74.SI)

(Z74.SI)

3.460

+0.070 /

+2.06%

Vol: 31198500

Value: 107865289

UNITED OVERSEAS BANK LTD

(U11.SI)

(U11.SI)

17.620

+0.550 /

+3.22%

Vol: 5666000

Value: 99887465

GLOBAL LOGISTIC PROP LIMITED

(MC0.SI)

(MC0.SI)

1.725

-0.030 /

-1.71%

Vol: 57166000

Value: 98963791

OVERSEA-CHINESE BANKING CORP

(O39.SI)

(O39.SI)

7.720

+0.150 /

+1.98%

Vol: 9024500

Value: 69899288

KEPPEL CORPORATION LIMITED

(BN4.SI)

CD

(BN4.SI)

CD

5.020

+0.220 /

+4.58%

Vol: 12603900

Value: 62917885

CAPITALAND LIMITED

(C31.SI)

(C31.SI)

2.990

+0.040 /

+1.36%

Vol: 19876100

Value: 59237920

JARDINE MATHESON HLDGS LTD

(J36.SI)

(J36.SI)

USD 51.000

+0.600 /

+1.19%

Vol: 818700

Value: 41567647

SEMBCORP INDUSTRIES LTD

(U96.SI)

(U96.SI)

2.340

+0.150 /

+6.85%

Vol: 15865000

Value: 36195696

ASCENDAS REAL ESTATE INV TRUST

(A17U.SI)

(A17U.SI)

2.170

+0.040 /

+1.88%

Vol: 13834400

Value: 29943035

HONGKONG LAND HOLDINGS LIMITED

(H78.SI)

(H78.SI)

USD 5.910

+0.200 /

+3.50%

Vol: 5100400

Value: 29655763

SINGAPORE AIRLINES LTD

(C6L.SI)

(C6L.SI)

10.970

+0.130 /

+1.20%

Vol: 2441700

Value: 26792776

CAPITALAND MALL TRUST

(C38U.SI)

CD

(C38U.SI)

CD

1.965

+0.005 /

+0.26%

Vol: 12025900

Value: 23497446

WILMAR INTERNATIONAL LIMITED

(F34.SI)

(F34.SI)

2.750

+0.110 /

+4.17%

Vol: 8367800

Value: 22906658

NOBLE GROUP LIMITED

(N21.SI)

(N21.SI)

0.290

+0.010 /

+3.57%

Vol: 74233500

Value: 21838690

SINGAPORE EXCHANGE LIMITED

(S68.SI)

CD

(S68.SI)

CD

6.820

+0.090 /

+1.34%

Vol: 3186800

Value: 21712075

CITY DEVELOPMENTS LIMITED

(C09.SI)

(C09.SI)

6.750

+0.010 /

+0.15%

Vol: 3214700

Value: 21681436

SEMBCORP MARINE LTD

(S51.SI)

(S51.SI)

1.555

+0.055 /

+3.67%

Vol: 10589300

Value: 16261288

SINGAPORE PRESS HLDGS LTD

(T39.SI)

(T39.SI)

3.600

+0.080 /

+2.27%

Vol: 4395900

Value: 15731554

COMFORTDELGRO CORPORATION LTD

(C52.SI)

(C52.SI)

2.880

+0.050 /

+1.77%

Vol: 4934400

Value: 14169651

Top 20 Gainers ($)

JARDINE MATHESON HLDGS LTD

(J36.SI)

(J36.SI)

USD 51.000

+0.600 /

+1.19%

Vol: 818700

Value: 41567647

UNITED OVERSEAS BANK LTD

(U11.SI)

(U11.SI)

17.620

+0.550 /

+3.22%

Vol: 5666000

Value: 99887465

JARDINE CYCLE & CARRIAGE LTD

(C07.SI)

(C07.SI)

34.440

+0.460 /

+1.35%

Vol: 310800

Value: 10690768

JARDINE STRATEGIC HLDGS LTD

(J37.SI)

(J37.SI)

USD 26.610

+0.420 /

+1.60%

Vol: 193500

Value: 5109056

KEPPEL CORPORATION LIMITED

(BN4.SI)

CD

(BN4.SI)

CD

5.020

+0.220 /

+4.58%

Vol: 12603900

Value: 62917885

HONGKONG LAND HOLDINGS LIMITED

(H78.SI)

(H78.SI)

USD 5.910

+0.200 /

+3.50%

Vol: 5100400

Value: 29655763

SEMBCORP INDUSTRIES LTD

(U96.SI)

(U96.SI)

2.340

+0.150 /

+6.85%

Vol: 15865000

Value: 36195696

OVERSEA-CHINESE BANKING CORP

(O39.SI)

(O39.SI)

7.720

+0.150 /

+1.98%

Vol: 9024500

Value: 69899288

SINGAPORE AIRLINES LTD

(C6L.SI)

(C6L.SI)

10.970

+0.130 /

+1.20%

Vol: 2441700

Value: 26792776

WILMAR INTERNATIONAL LIMITED

(F34.SI)

(F34.SI)

2.750

+0.110 /

+4.17%

Vol: 8367800

Value: 22906658

FORTUNE REAL ESTATE INV TRUST

(F25U.SI)

CD

(F25U.SI)

CD

HKD 7.790

+0.110 /

+1.43%

Vol: 181600

Value: 1410057

HOTEL ROYAL LTD

(H12.SI)

(H12.SI)

3.280

+0.110 /

+3.47%

Vol: 800

Value: 2633

DBS GROUP HOLDINGS LTD

(D05.SI)

(D05.SI)

13.870

+0.100 /

+0.73%

Vol: 16105600

Value: 224026720

SINGAPORE EXCHANGE LIMITED

(S68.SI)

CD

(S68.SI)

CD

6.820

+0.090 /

+1.34%

Vol: 3186800

Value: 21712075

HTL INT'L HOLDINGS LIMITED

(H64.SI)

(H64.SI)

0.705

+0.085 /

+13.71%

Vol: 3590600

Value: 2394470

CHINA YUANBANG PROP HLDGS LTD

(BCD.SI)

(BCD.SI)

0.340

+0.085 /

+33.33%

Vol: 700

Value: 195

SINGAPORE PRESS HLDGS LTD

(T39.SI)

(T39.SI)

3.600

+0.080 /

+2.27%

Vol: 4395900

Value: 15731554

VICOM LTD

(V01.SI)

(V01.SI)

5.950

+0.080 /

+1.36%

Vol: 3500

Value: 20825

CREATIVE TECHNOLOGY LTD

(C76.SI)

(C76.SI)

1.175

+0.075 /

+6.82%

Vol: 13900

Value: 15938

SINGTEL

(Z74.SI)

(Z74.SI)

3.460

+0.070 /

+2.06%

Vol: 31198500

Value: 107865289

Top 20 Losers ($)

DAIRY FARM INT'L HOLDINGS LTD

(D01.SI)

(D01.SI)

USD 5.960

-0.140 /

-2.30%

Vol: 1730000

Value: 10366178

WILLAS-ARRAY ELEC (HLDGS) LTD

(BDR.SI)

(BDR.SI)

0.580

-0.120 /

-17.14%

Vol: 127700

Value: 76020

S I2I LIMITED

(BAI.SI)

(BAI.SI)

0.860

-0.085 /

-8.99%

Vol: 600

Value: 542

SUTL ENTERPRISE LIMITED

(BHU.SI)

(BHU.SI)

0.350

-0.080 /

-18.60%

Vol: 7500

Value: 2625

COLEX HOLDINGS LIMITED

(567.SI)

(567.SI)

0.275

-0.065 /

-19.12%

Vol: 16000

Value: 4800

WEIYE HOLDINGS LIMITED

(BMA.SI)

(BMA.SI)

0.350

-0.050 /

-12.50%

Vol: 45100

Value: 15785

CWT LIMITED

(C14.SI)

(C14.SI)

1.765

-0.040 /

-2.22%

Vol: 223700

Value: 398078

HOTEL PROPERTIES LTD

(H15.SI)

(H15.SI)

3.550

-0.040 /

-1.11%

Vol: 6900

Value: 24399

SIA ENGINEERING CO LTD

(S59.SI)

(S59.SI)

3.430

-0.040 /

-1.15%

Vol: 305600

Value: 1051023

TALKMED GROUP LIMITED

(5G3.SI)

(5G3.SI)

0.920

-0.040 /

-4.17%

Vol: 200

Value: 184

PETRA FOODS LIMITED

(P34.SI)

(P34.SI)

2.250

-0.040 /

-1.75%

Vol: 65200

Value: 142687

M1 LIMITED

(B2F.SI)

CD

(B2F.SI)

CD

2.280

-0.040 /

-1.72%

Vol: 3228800

Value: 7358486

SINOSTAR PEC HOLDINGS LIMITED

(C9Q.SI)

(C9Q.SI)

0.085

-0.037 /

-30.33%

Vol: 30100

Value: 2438

CHANGTIAN PLASTIC & CHEM LTD

(AXV.SI)

(AXV.SI)

0.705

-0.035 /

-4.73%

Vol: 84100

Value: 61881

HOTUNG INVESTMENT HLDGS LTD

(BLS.SI)

(BLS.SI)

1.270

-0.030 /

-2.31%

Vol: 6800

Value: 8821

LH GROUP LIMITED

(BKB.SI)

(BKB.SI)

0.620

-0.030 /

-4.62%

Vol: 8000

Value: 4960

PARKWAYLIFE REIT

(C2PU.SI)

(C2PU.SI)

2.120

-0.030 /

-1.40%

Vol: 1194100

Value: 2555477

GLOBAL LOGISTIC PROP LIMITED

(MC0.SI)

(MC0.SI)

1.725

-0.030 /

-1.71%

Vol: 57166000

Value: 98963791

SUNVIC CHEMICAL HOLDINGS LTD

(A7S.SI)

(A7S.SI)

0.143

-0.026 /

-15.38%

Vol: 20100

Value: 3152

NOEL GIFTS INTERNATIONAL LTD

(543.SI)

(543.SI)

0.265

-0.025 /

-8.62%

Vol: 4800

Value: 1229

Top 20 Gainers (%)

ALLIED TECHNOLOGIES LIMITED

(A13.SI)

(A13.SI)

0.023

+0.013 /

+130.00%

Vol: 180000

Value: 4140

ELEKTROMOTIVE GROUP LIMITED

(5VU.SI)

(5VU.SI)

0.004

+0.002 /

+100.00%

Vol: 400

Value: 1

INNOPAC HOLDINGS LIMITED

(I26.SI)

(I26.SI)

0.003

+0.001 /

+50.00%

Vol: 14800000

Value: 38900

CPH LTD

(539.SI)

(539.SI)

0.006

+0.002 /

+50.00%

Vol: 490100

Value: 2150

CHINA YUANBANG PROP HLDGS LTD

(BCD.SI)

(BCD.SI)

0.340

+0.085 /

+33.33%

Vol: 700

Value: 195

MAGNUS ENERGY GROUP LTD.

(41S.SI)

(41S.SI)

0.004

+0.001 /

+33.33%

Vol: 100200

Value: 400

SINGAPORE EDEVELOPMENT LTD

(40V.SI)

(40V.SI)

0.029

+0.006 /

+26.09%

Vol: 243000

Value: 6354

CHINA HAIDA LTD.

(C92.SI)

(C92.SI)

0.022

+0.004 /

+22.22%

Vol: 100000

Value: 2200

LEADER ENVIRONMENTAL TECH LTD

(LS9.SI)

(LS9.SI)

0.041

+0.007 /

+20.59%

Vol: 14000

Value: 574

EUROPTRONIC GROUP LTD

(E23.SI)

(E23.SI)

0.006

+0.001 /

+20.00%

Vol: 1695400

Value: 8977

VIKING OFFSHORE AND MARINE LTD

(557.SI)

(557.SI)

0.048

+0.008 /

+20.00%

Vol: 90400

Value: 3177

AMPLEFIELD LIMITED

(AOF.SI)

(AOF.SI)

0.043

+0.006 /

+16.22%

Vol: 257100

Value: 8890

JADASON ENTERPRISES LTD

(J03.SI)

(J03.SI)

0.008

+0.001 /

+14.29%

Vol: 1730300

Value: 13822

HTL INT'L HOLDINGS LIMITED

(H64.SI)

(H64.SI)

0.705

+0.085 /

+13.71%

Vol: 3590600

Value: 2394470

KS ENERGY LIMITED

(578.SI)

(578.SI)

0.205

+0.024 /

+13.26%

Vol: 98300

Value: 18653

LINC ENERGY LTD

(TI6.SI)

(TI6.SI)

0.088

+0.010 /

+12.82%

Vol: 75844200

Value: 6767085

RICKMERS MARITIME

(B1ZU.SI)

(B1ZU.SI)

0.063

+0.007 /

+12.50%

Vol: 1262000

Value: 74886

AZTECH GROUP LTD.

(AVZ.SI)

(AVZ.SI)

0.500

+0.050 /

+11.11%

Vol: 11400

Value: 5240

GAYLIN HOLDINGS LIMITED

(RF7.SI)

(RF7.SI)

0.360

+0.035 /

+10.77%

Vol: 200

Value: 72

RYOBI KISO HOLDINGS LTD.

(BDN.SI)

(BDN.SI)

0.220

+0.021 /

+10.55%

Vol: 1100

Value: 241

Top 20 Losers (%)

CHINASING INVESTMENT HLDG LTD

(O2R.SI)

(O2R.SI)

0.005

-0.006 /

-54.55%

Vol: 400000

Value: 2000

BLUMONT GROUP LTD.

(A33.SI)

(A33.SI)

0.001

-0.001 /

-50.00%

Vol: 11099000

Value: 11406

INFINIO GROUP LIMITED

(5G4.SI)

(5G4.SI)

0.001

-0.001 /

-50.00%

Vol: 200

Value: 0

ATTILAN GROUP LIMITED

(5ET.SI)

(5ET.SI)

0.002

-0.001 /

-33.33%

Vol: 3359000

Value: 6718

SUNLIGHT GROUP HLDG LTD

(5AI.SI)

(5AI.SI)

0.017

-0.008 /

-32.00%

Vol: 301100

Value: 4618

SINOSTAR PEC HOLDINGS LIMITED

(C9Q.SI)

(C9Q.SI)

0.085

-0.037 /

-30.33%

Vol: 30100

Value: 2438

ITE ELECTRIC CO LTD

(581.SI)

(581.SI)

0.035

-0.014 /

-28.57%

Vol: 245300

Value: 10270

LERENO BIO-CHEM LTD.

(42H.SI)

(42H.SI)

0.050

-0.018 /

-26.47%

Vol: 79900

Value: 3995

NEXT-GEN SATELLITE COMM LTD

(B07.SI)

(B07.SI)

0.003

-0.001 /

-25.00%

Vol: 1000100

Value: 2300

LIFEBRANDZ LTD.

(L20.SI)

(L20.SI)

0.003

-0.001 /

-25.00%

Vol: 7165100

Value: 21595

COLEX HOLDINGS LIMITED

(567.SI)

(567.SI)

0.275

-0.065 /

-19.12%

Vol: 16000

Value: 4800

SUTL ENTERPRISE LIMITED

(BHU.SI)

(BHU.SI)

0.350

-0.080 /

-18.60%

Vol: 7500

Value: 2625

WILLAS-ARRAY ELEC (HLDGS) LTD

(BDR.SI)

(BDR.SI)

0.580

-0.120 /

-17.14%

Vol: 127700

Value: 76020

POLARIS LTD.

(5BI.SI)

(5BI.SI)

0.005

-0.001 /

-16.67%

Vol: 18469000

Value: 82445

SUNVIC CHEMICAL HOLDINGS LTD

(A7S.SI)

(A7S.SI)

0.143

-0.026 /

-15.38%

Vol: 20100

Value: 3152

SHC CAPITAL ASIA LIMITED

(5UE.SI)

(5UE.SI)

0.115

-0.020 /

-14.81%

Vol: 10000

Value: 1150

MATEX INTERNATIONAL LIMITED

(M15.SI)

(M15.SI)

0.023

-0.004 /

-14.81%

Vol: 630000

Value: 14250

ICP LTD

(5I4.SI)

(5I4.SI)

0.006

-0.001 /

-14.29%

Vol: 145900

Value: 875

USP GROUP LIMITED

(A6F.SI)

(A6F.SI)

0.033

-0.005 /

-13.16%

Vol: 1180400

Value: 38653

UNITED FOOD HOLDINGS LIMITED

(AZR.SI)

(AZR.SI)

0.118

-0.017 /

-12.59%

Vol: 374400

Value: 48247

Data Source:

http://www.sgx.com/

http://sg.finance.yahoo.com/

Archive: