SREIT

ASCENDAS REAL ESTATE INV TRUST

A17U.SI

MAPLETREE INDUSTRIAL TRUST

ME8U.SI

CACHE LOGISTICS TRUST

K2LU.SI

AIMS AMP CAP INDUSTRIAL REIT

O5RU.SI

SREIT

ASCENDAS REAL ESTATE INV TRUST

A17U.SI

MAPLETREE INDUSTRIAL TRUST

ME8U.SI

CACHE LOGISTICS TRUST

K2LU.SI

AIMS AMP CAP INDUSTRIAL REIT

O5RU.SI

Singapore Industrial REITs - Sweet Spot for Industrial Landlords

Long-term support for R&D, high-value industries

- Too much capital in residential properties has been stifling consumption, entrepreneurship and innovation, as suggested by our recent macro- analysis (Singapore Strategy, 30 June). As such, the government may maintain its property-cooling measures longer than widely expected.

- A lack of further capital gains coupled with depressed yields should then re-direct capital to better-yielding assets, commercial and industrial REITs included.

- Public spending is expected to keep up the focus on boosting productivity, innovation & enterprise: industrial space will be required for R&D, high-value industries, start-ups and SMEs.

- Our top picks for positioning for this are AREIT (BUY, TP SGD2.57) and MINT (BUY, TP SGD1.78).

AREIT & MINT should be top beneficiaries

- R&D outfits, high-value industries and start-ups are all going to need business-park, science-park and high-spec industrial space in particular. Our top SREIT picks, AREIT and MINT, have 60% and 41% of their portfolios committed to these types of spaces, with spare capacity to fill.

- Moreover, supply is likely to be very tight for business/science parks, while high-spec space will be similarly tight as most of the upcoming supply has been designated for data-centre use, not high-value industrial use. Not forgetting, the latest budget is very SME-centric and SMEs form the bulk of AREIT’s and MINT’s tenants.

- All in all, we continue to favour industrial SREITs over retail and office ones.

Australia provides the next lap of growth

- AREIT and CACHE (BUY, TP SGD0.87) took the plunge into Australia last year, boosting their exposure there to more than 11%. AAREIT (BUY, TP SGD1.55) was the early mover with 16% exposure as early as 2014.

- And why not? With freehold properties commanding cap rates much higher than Singapore’s, declining interest rates and a low AUD/SGD, Australia makes for an attractive proposition. We expect AREIT to build up its presence there, to realise value from a large platform bought at a premium.

Retail & office REITs: risks prevail

- There is no change to our negative view on retail and neutral position on office REITs (SREITs: To flow or not to flow, 12 Apr).

- For retail SREITs, tapering DPU growth & occupancy, smaller rent reversions and upcoming supply make us wary of the tight valuations in the sub-sector.

- For office SREITs, we highlighted the weak pre-leasing at the upcoming Marina One (29%), Guoco Tower (18%) and Duo (33%) on 22 Jun (Office REITs: Marine One 29% pre-leased). Rents may have been sacrificed at Marina One, with large tenants reportedly signing for only SGD7 psfpm. An upcoming supply deluge has been depressing rents and office revenue for CCT (HOLD, TP SGD1.40), KREIT (HOLD, TP SGD0.97) and MCT (SELL, TP SGD1.35).

- Occupancy has been more challenged at non-prime location Grade-A assets, thus MCT’s and Suntec’s portfolios (SREITs: Canaries in the coal mine, 17 May).

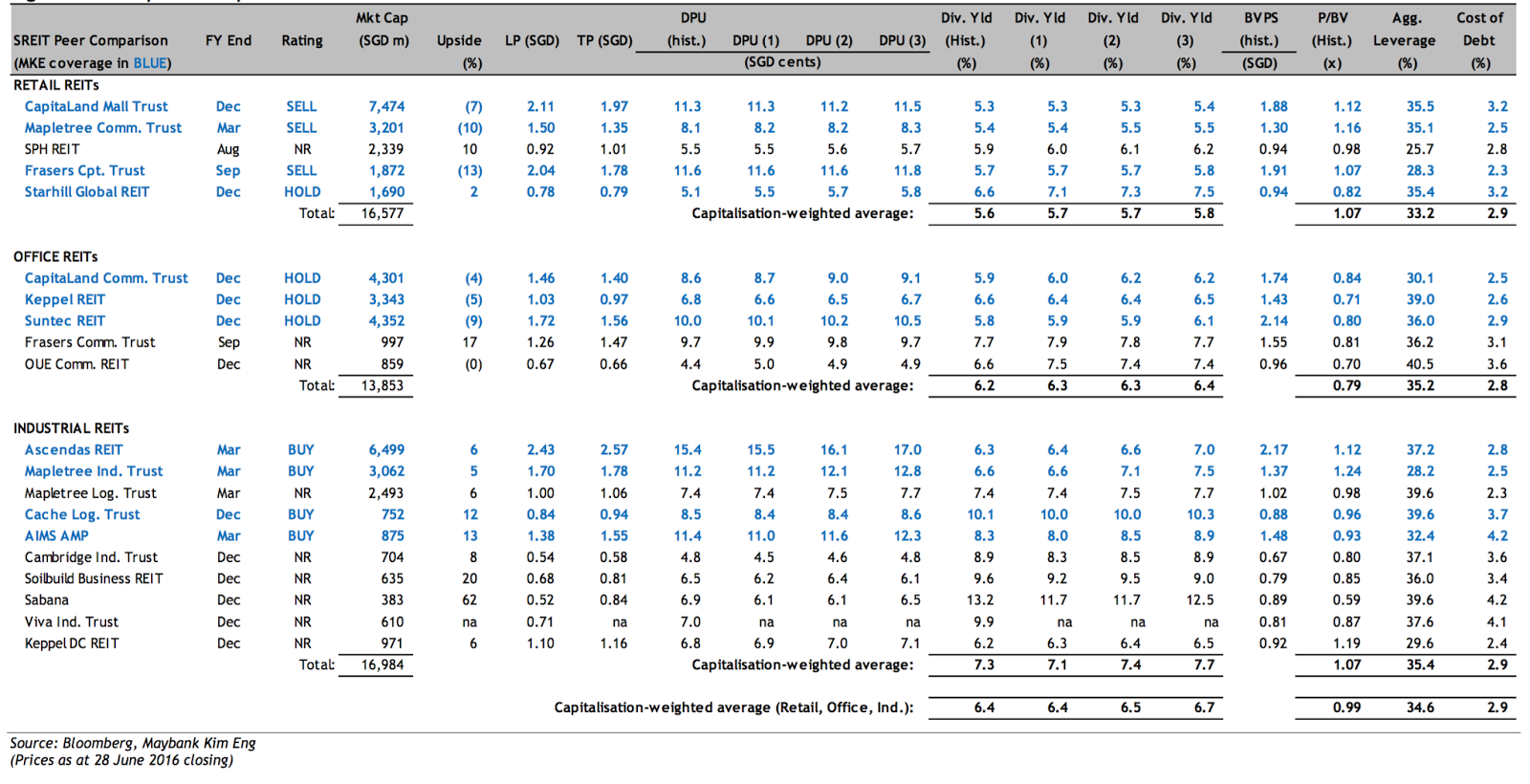

SREITs Peer Comparison

Joshua Tan

Maybank Kim Eng

|

Derrick Heng CFA

Maybank Kim Eng

|

http://www.maybank-ke.com.sg/

2016-06-29

Maybank Kim Eng

SGX Stock

Analyst Report

1.78

Same

1.78

2.57

Same

2.57

0.87

Down

0.94

1.55

Same

1.55