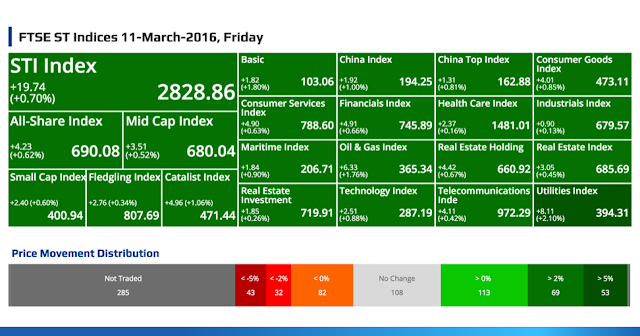

FTSE ST Indices 11-March-2016, Friday

STI Index

+19.74

(+0.70%)

(+0.70%)

2828.86

All-Share Index

+4.23

(+0.62%)

(+0.62%)

690.08

Mid Cap Index

+3.51

(+0.52%)

(+0.52%)

680.04

Small Cap Index

+2.40 (+0.60%)

400.94

Fledgling Index

+2.76 (+0.34%)

807.69

Catalist Index

+4.96 (+1.06%)

471.44

Basic

+1.82

(+1.80%)

(+1.80%)

103.06

China Index

+1.92

(+1.00%)

(+1.00%)

194.25

China Top Index

+1.31

(+0.81%)

(+0.81%)

162.88

Consumer Goods Index

+4.01

(+0.85%)

(+0.85%)

473.11

Consumer Services Index

+4.90

(+0.63%)

(+0.63%)

788.60

Financials Index

+4.91

(+0.66%)

(+0.66%)

745.89

Health Care Index

+2.37

(+0.16%)

(+0.16%)

1481.01

Industrials Index

+0.90

(+0.13%)

(+0.13%)

679.57

Maritime Index

+1.84

(+0.90%)

(+0.90%)

206.71

Oil & Gas Index

+6.33

(+1.76%)

(+1.76%)

365.34

Real Estate Holding

+4.42

(+0.67%)

(+0.67%)

660.92

Real Estate Index

+3.05

(+0.45%)

(+0.45%)

685.69

Real Estate Investment

+1.85

(+0.26%)

(+0.26%)

719.91

Technology Index

+2.51

(+0.88%)

(+0.88%)

287.19

Telecommunications Inde

+4.11

(+0.42%)

(+0.42%)

972.29

Utilities Index

+8.11

(+2.10%)

(+2.10%)

394.31

Price Movement Distribution

Top 20 Volume

EZRA HOLDINGS LIMITED

(5DN.SI)

(5DN.SI)

0.120

+0.002 /

+1.69%

Vol: 187310100

Value: 22553096

CHINA ENVIRONMENT LTD.

(5OU.SI)

(5OU.SI)

0.075

+0.016 /

+27.12%

Vol: 125888200

Value: 9556458

ECOWISE HOLDINGS LIMITED

(5CT.SI)

(5CT.SI)

0.046

+0.012 /

+35.29%

Vol: 106892000

Value: 5165922

ASIA-PACIFIC STRATEGIC INV LTD

(5RA.SI)

(5RA.SI)

0.007

+0.002 /

+40.00%

Vol: 73637200

Value: 510435

IEV HOLDINGS LIMITED

(5TN.SI)

(5TN.SI)

0.097

-0.017 /

-14.91%

Vol: 71164100

Value: 7983471

JIUTIAN CHEMICAL GROUP LIMITED

(C8R.SI)

(C8R.SI)

0.024

+0.001 /

+4.35%

Vol: 52720600

Value: 1350669

GOLDEN AGRI-RESOURCES LTD

(E5H.SI)

CD

(E5H.SI)

CD

0.420

+0.015 /

+3.70%

Vol: 36446600

Value: 15078852

CHINA SPORTS INTL LIMITED

(FQ8.SI)

(FQ8.SI)

0.018

- / -

Vol: 35852200

Value: 665779

NOBLE GROUP LIMITED

(N21.SI)

(N21.SI)

0.425

- / -

Vol: 35639400

Value: 14993740

CHASEN HOLDINGS LIMITED

(5NV.SI)

(5NV.SI)

0.047

-0.009 /

-16.07%

Vol: 33864500

Value: 1933365

INNOPAC HOLDINGS LIMITED

(I26.SI)

(I26.SI)

0.003

+0.001 /

+50.00%

Vol: 32077000

Value: 64246

MAGNUS ENERGY GROUP LTD.

(41S.SI)

(41S.SI)

0.003

- / -

Vol: 31800100

Value: 95400

DEBAO PROPERTY DEVELOPMENT LTD

(K2M.SI)

(K2M.SI)

0.041

+0.004 /

+10.81%

Vol: 28887300

Value: 1183399

CHINA NEW TOWN DEVT CO LIMITED

(D4N.SI)

(D4N.SI)

0.056

+0.004 /

+7.69%

Vol: 27874100

Value: 1546729

CHINESE GLOBAL INVESTORS GRP

(5CJ.SI)

(5CJ.SI)

0.026

+0.003 /

+13.04%

Vol: 27731500

Value: 754967

ADVENTUS HOLDINGS LIMITED

(5EF.SI)

(5EF.SI)

0.012

+0.001 /

+9.09%

Vol: 27210000

Value: 325656

THAI BEVERAGE PUBLIC CO LTD

(Y92.SI)

CD

(Y92.SI)

CD

0.740

-0.005 /

-0.67%

Vol: 25706900

Value: 18914233

GENTING SINGAPORE PLC

(G13.SI)

(G13.SI)

0.800

+0.020 /

+2.56%

Vol: 24582800

Value: 19451073

CHINA SKY CHEM FIBRE CO., LTD.

(E90.SI)

(E90.SI)

0.045

+0.007 /

+18.42%

Vol: 22250700

Value: 972372

THE STRATECH GROUP LIMITED

(ATN.SI)

(ATN.SI)

0.033

-0.001 /

-2.94%

Vol: 19691000

Value: 662352

Top 20 Value

DBS GROUP HOLDINGS LTD

(D05.SI)

CD

(D05.SI)

CD

15.240

+0.090 /

+0.59%

Vol: 4404212

Value: 66728646

KEPPEL CORPORATION LIMITED

(BN4.SI)

CD

(BN4.SI)

CD

6.060

+0.160 /

+2.71%

Vol: 8958500

Value: 53614556

OVERSEA-CHINESE BANKING CORP

(O39.SI)

CD

(O39.SI)

CD

8.800

+0.100 /

+1.15%

Vol: 5559100

Value: 48603922

SINGTEL

(Z74.SI)

(Z74.SI)

3.780

+0.020 /

+0.53%

Vol: 11890000

Value: 44906474

UNITED OVERSEAS BANK LTD

(U11.SI)

CD

(U11.SI)

CD

18.650

+0.160 /

+0.87%

Vol: 1847200

Value: 34269499

JARDINE MATHESON HLDGS LTD

(J36.SI)

CD

(J36.SI)

CD

USD 54.140

+0.140 /

+0.26%

Vol: 601900

Value: 32623302

WILMAR INTERNATIONAL LIMITED

(F34.SI)

CD

(F34.SI)

CD

3.230

+0.050 /

+1.57%

Vol: 7642600

Value: 24564302

GLOBAL LOGISTIC PROP LIMITED

(MC0.SI)

(MC0.SI)

1.860

+0.015 /

+0.81%

Vol: 12768500

Value: 23671835

COMFORTDELGRO CORPORATION LTD

(C52.SI)

CD

(C52.SI)

CD

2.950

-0.020 /

-0.67%

Vol: 7765600

Value: 22909161

EZRA HOLDINGS LIMITED

(5DN.SI)

(5DN.SI)

0.120

+0.002 /

+1.69%

Vol: 187310100

Value: 22553096

SEMBCORP INDUSTRIES LTD

(U96.SI)

CD

(U96.SI)

CD

3.030

+0.010 /

+0.33%

Vol: 7365000

Value: 22128502

HONGKONG LAND HOLDINGS LIMITED

(H78.SI)

CD

(H78.SI)

CD

USD 6.300

+0.120 /

+1.94%

Vol: 3133500

Value: 19719568

GENTING SINGAPORE PLC

(G13.SI)

(G13.SI)

0.800

+0.020 /

+2.56%

Vol: 24582800

Value: 19451073

THAI BEVERAGE PUBLIC CO LTD

(Y92.SI)

CD

(Y92.SI)

CD

0.740

-0.005 /

-0.67%

Vol: 25706900

Value: 18914233

SINGAPORE EXCHANGE LIMITED

(S68.SI)

(S68.SI)

7.680

+0.040 /

+0.52%

Vol: 2128500

Value: 16336892

STARHUB LTD

(CC3.SI)

(CC3.SI)

3.360

-0.010 /

-0.30%

Vol: 4821200

Value: 16049937

ASCENDAS REAL ESTATE INV TRUST

(A17U.SI)

(A17U.SI)

2.410

+0.010 /

+0.42%

Vol: 6591100

Value: 15821679

GOLDEN AGRI-RESOURCES LTD

(E5H.SI)

CD

(E5H.SI)

CD

0.420

+0.015 /

+3.70%

Vol: 36446600

Value: 15078852

NOBLE GROUP LIMITED

(N21.SI)

(N21.SI)

0.425

- / -

Vol: 35639400

Value: 14993740

CAPITALAND LIMITED

(C31.SI)

(C31.SI)

3.120

+0.010 /

+0.32%

Vol: 4727000

Value: 14754509

Top 20 Gainers ($)

JARDINE STRATEGIC HLDGS LTD

(J37.SI)

CD

(J37.SI)

CD

USD 28.730

+0.400 /

+1.41%

Vol: 222900

Value: 6389246

JARDINE CYCLE & CARRIAGE LTD

(C07.SI)

CD

(C07.SI)

CD

39.650

+0.370 /

+0.94%

Vol: 292100

Value: 11578690

UNITED OVERSEAS BANK LTD

(U11.SI)

CD

(U11.SI)

CD

18.650

+0.160 /

+0.87%

Vol: 1847200

Value: 34269499

KEPPEL CORPORATION LIMITED

(BN4.SI)

CD

(BN4.SI)

CD

6.060

+0.160 /

+2.71%

Vol: 8958500

Value: 53614556

JARDINE MATHESON HLDGS LTD

(J36.SI)

CD

(J36.SI)

CD

USD 54.140

+0.140 /

+0.26%

Vol: 601900

Value: 32623302

HONGKONG LAND HOLDINGS LIMITED

(H78.SI)

CD

(H78.SI)

CD

USD 6.300

+0.120 /

+1.94%

Vol: 3133500

Value: 19719568

SINGAPORE AIRLINES LTD

(C6L.SI)

(C6L.SI)

11.440

+0.120 /

+1.06%

Vol: 1101400

Value: 12599472

OVERSEA-CHINESE BANKING CORP

(O39.SI)

CD

(O39.SI)

CD

8.800

+0.100 /

+1.15%

Vol: 5559100

Value: 48603922

ENGRO CORPORATION LIMITED

(S44.SI)

(S44.SI)

0.930

+0.095 /

+11.38%

Vol: 2100

Value: 1833

DBS GROUP HOLDINGS LTD

(D05.SI)

CD

(D05.SI)

CD

15.240

+0.090 /

+0.59%

Vol: 4404212

Value: 66728646

HAW PAR CORP LTD

(H02.SI)

CD

(H02.SI)

CD

8.290

+0.080 /

+0.97%

Vol: 12800

Value: 106103

SELECT GROUP LIMITED

(5FQ.SI)

(5FQ.SI)

0.465

+0.075 /

+19.23%

Vol: 45000

Value: 18790

UNITED INDUSTRIAL CORP LTD

(U06.SI)

(U06.SI)

2.960

+0.060 /

+2.07%

Vol: 10100

Value: 29692

ELEC & ELTEK INT CO LTD

(E16.SI)

(E16.SI)

USD 0.850

+0.060 /

+7.59%

Vol: 48800

Value: 40087

LONGCHEER HOLDINGS LIMITED

(BJL.SI)

(BJL.SI)

0.800

+0.055 /

+7.38%

Vol: 20100

Value: 16036

TIH LIMITED

(T55.SI)

(T55.SI)

0.535

+0.055 /

+11.46%

Vol: 42600

Value: 21129

SINO GRANDNESS FOOD IND GP LTD

(T4B.SI)

(T4B.SI)

0.510

+0.055 /

+12.09%

Vol: 12744500

Value: 6218327

AZTECH GROUP LTD.

(AVZ.SI)

(AVZ.SI)

0.465

+0.050 /

+12.05%

Vol: 1400

Value: 588

WILMAR INTERNATIONAL LIMITED

(F34.SI)

CD

(F34.SI)

CD

3.230

+0.050 /

+1.57%

Vol: 7642600

Value: 24564302

DAIRY FARM INT'L HOLDINGS LTD

(D01.SI)

CD

(D01.SI)

CD

USD 5.950

+0.050 /

+0.85%

Vol: 253200

Value: 1507357

Top 20 Losers ($)

SAIZEN REAL ESTATE INV TRUST

(T8JU.SI)

XD

(T8JU.SI)

XD

0.085

-1.030 /

-92.38%

Vol: 2980400

Value: 234571

CHINA FLEXIBLE PACK HLDG LTD

(BCX.SI)

(BCX.SI)

0.760

-0.230 /

-23.23%

Vol: 8100

Value: 6679

SP CORPORATION LIMITED

(AWE.SI)

(AWE.SI)

1.000

-0.140 /

-12.28%

Vol: 700

Value: 656

FORTUNE REAL ESTATE INV TRUST

(F25U.SI)

(F25U.SI)

HKD 8.010

-0.070 /

-0.87%

Vol: 2000

Value: 16044

PSL HOLDINGS LTD

(BLL.SI)

(BLL.SI)

0.545

-0.055 /

-9.17%

Vol: 40000

Value: 21800

OUE HOSPITALITY TRUST

(SK7.SI)

XR

(SK7.SI)

XR

0.695

-0.055 /

-7.33%

Vol: 3424600

Value: 2379385

CIVMEC LIMITED

(P9D.SI)

(P9D.SI)

0.350

-0.050 /

-12.50%

Vol: 36400

Value: 11883

CITY DEVELOPMENTS LIMITED

(C09.SI)

CD

(C09.SI)

CD

7.490

-0.050 /

-0.66%

Vol: 1318300

Value: 9904960

HOR KEW CORPORATION LIMITED

(BBP.SI)

(BBP.SI)

0.285

-0.050 /

-14.93%

Vol: 1900

Value: 541

FAR EAST GROUP LIMITED

(5TJ.SI)

(5TJ.SI)

0.074

-0.048 /

-39.34%

Vol: 1200

Value: 99

LION ASIAPAC LTD

(BAZ.SI)

(BAZ.SI)

0.245

-0.045 /

-15.52%

Vol: 1700

Value: 400

M1 LIMITED

(B2F.SI)

CD

(B2F.SI)

CD

2.570

-0.040 /

-1.53%

Vol: 3964400

Value: 10168900

CREATIVE TECHNOLOGY LTD

(C76.SI)

(C76.SI)

1.065

-0.035 /

-3.18%

Vol: 3400

Value: 3621

ADVANCED HOLDINGS LTD.

(BLZ.SI)

(BLZ.SI)

0.200

-0.030 /

-13.04%

Vol: 40000

Value: 8400

RAFFLES MEDICAL GROUP LTD

(R01.SI)

(R01.SI)

4.370

-0.030 /

-0.68%

Vol: 981300

Value: 4309916

SIA ENGINEERING CO LTD

(S59.SI)

(S59.SI)

3.530

-0.030 /

-0.84%

Vol: 416900

Value: 1473684

UNI-ASIA HOLDINGS LIMITED

(AYF.SI)

(AYF.SI)

1.160

-0.030 /

-2.52%

Vol: 2300

Value: 2678

PERENNIAL REAL ESTATE HLDGSLTD

(40S.SI)

CD

(40S.SI)

CD

0.900

-0.030 /

-3.23%

Vol: 703900

Value: 640793

LINC ENERGY LTD

(BRE.SI)

(BRE.SI)

0.155

-0.029 /

-15.76%

Vol: 16029800

Value: 2686103

OLAM INTERNATIONAL LIMITED

(O32.SI)

CD

(O32.SI)

CD

1.740

-0.025 /

-1.42%

Vol: 139600

Value: 244700

Top 20 Gainers (%)

VASHION GROUP LTD.

(5BA.SI)

(5BA.SI)

0.002

+0.001 /

+100.00%

Vol: 1000100

Value: 1000

INNOPAC HOLDINGS LIMITED

(I26.SI)

(I26.SI)

0.003

+0.001 /

+50.00%

Vol: 32077000

Value: 64246

ASIA-PACIFIC STRATEGIC INV LTD

(5RA.SI)

(5RA.SI)

0.007

+0.002 /

+40.00%

Vol: 73637200

Value: 510435

ECOWISE HOLDINGS LIMITED

(5CT.SI)

(5CT.SI)

0.046

+0.012 /

+35.29%

Vol: 106892000

Value: 5165922

LIFEBRANDZ LTD.

(L20.SI)

(L20.SI)

0.004

+0.001 /

+33.33%

Vol: 5681100

Value: 20724

CHINA ENVIRONMENT LTD.

(5OU.SI)

(5OU.SI)

0.075

+0.016 /

+27.12%

Vol: 125888200

Value: 9556458

PLATO CAPITAL LIMITED

(5PI.SI)

(5PI.SI)

0.103

+0.020 /

+24.10%

Vol: 3000

Value: 309

CHINA KUNDA TECH HOLDINGS LTD

(GU5.SI)

(GU5.SI)

0.018

+0.003 /

+20.00%

Vol: 127900

Value: 2302

LEY CHOON GROUP HLDG LIMITED

(Q0X.SI)

(Q0X.SI)

0.030

+0.005 /

+20.00%

Vol: 50000

Value: 1459

AMPLEFIELD LIMITED

(AOF.SI)

(AOF.SI)

0.042

+0.007 /

+20.00%

Vol: 10700

Value: 375

SELECT GROUP LIMITED

(5FQ.SI)

(5FQ.SI)

0.465

+0.075 /

+19.23%

Vol: 45000

Value: 18790

CHINA SKY CHEM FIBRE CO., LTD.

(E90.SI)

(E90.SI)

0.045

+0.007 /

+18.42%

Vol: 22250700

Value: 972372

JEP HOLDINGS LTD.

(5FA.SI)

(5FA.SI)

0.029

+0.004 /

+16.00%

Vol: 780100

Value: 22723

SUNVIC CHEMICAL HOLDINGS LTD

(A7S.SI)

(A7S.SI)

0.133

+0.018 /

+15.65%

Vol: 1963400

Value: 249368

MMP RESOURCES LIMITED

(F3V.SI)

(F3V.SI)

0.008

+0.001 /

+14.29%

Vol: 17581000

Value: 156474

RYOBI KISO HOLDINGS LTD.

(BDN.SI)

(BDN.SI)

0.215

+0.026 /

+13.76%

Vol: 83600

Value: 17111

CHINESE GLOBAL INVESTORS GRP

(5CJ.SI)

(5CJ.SI)

0.026

+0.003 /

+13.04%

Vol: 27731500

Value: 754967

FORELAND FABRICTECH HLDS LTD

(B0I.SI)

(B0I.SI)

0.026

+0.003 /

+13.04%

Vol: 3943100

Value: 99193

JUBILEE INDUSTRIES HLDGS LTD.

(5OS.SI)

(5OS.SI)

0.036

+0.004 /

+12.50%

Vol: 3788100

Value: 137615

SINO GRANDNESS FOOD IND GP LTD

(T4B.SI)

(T4B.SI)

0.510

+0.055 /

+12.09%

Vol: 12744500

Value: 6218327

Top 20 Losers (%)

SAIZEN REAL ESTATE INV TRUST

(T8JU.SI)

XD

(T8JU.SI)

XD

0.085

-1.030 /

-92.38%

Vol: 2980400

Value: 234571

HUAN HSIN HOLDINGS LTD

(H16.SI)

(H16.SI)

0.011

-0.009 /

-45.00%

Vol: 40000

Value: 440

FAR EAST GROUP LIMITED

(5TJ.SI)

(5TJ.SI)

0.074

-0.048 /

-39.34%

Vol: 1200

Value: 99

INFINIO GROUP LIMITED

(5G4.SI)

(5G4.SI)

0.002

-0.001 /

-33.33%

Vol: 1000200

Value: 2000

NICO STEEL HOLDINGS LIMITED

(5GF.SI)

(5GF.SI)

0.025

-0.012 /

-32.43%

Vol: 100300

Value: 2654

CPH LTD

(539.SI)

(539.SI)

0.005

-0.002 /

-28.57%

Vol: 3293600

Value: 16468

SEROJA INVESTMENTS LIMITED

(IW5.SI)

(IW5.SI)

0.048

-0.017 /

-26.15%

Vol: 10000

Value: 480

EUROPTRONIC GROUP LTD

(E23.SI)

(E23.SI)

0.003

-0.001 /

-25.00%

Vol: 1298200

Value: 5144

LIONGOLD CORP LTD

(A78.SI)

(A78.SI)

0.003

-0.001 /

-25.00%

Vol: 10000

Value: 30

NEXT-GEN SATELLITE COMM LTD

(B07.SI)

(B07.SI)

0.003

-0.001 /

-25.00%

Vol: 100200

Value: 300

CHINA FLEXIBLE PACK HLDG LTD

(BCX.SI)

(BCX.SI)

0.760

-0.230 /

-23.23%

Vol: 8100

Value: 6679

MDR LIMITED

(A27.SI)

CD

(A27.SI)

CD

0.004

-0.001 /

-20.00%

Vol: 7363600

Value: 29454

ATTILAN GROUP LIMITED

(5ET.SI)

(5ET.SI)

0.004

-0.001 /

-20.00%

Vol: 1162000

Value: 4648

KTL GLOBAL LIMITED

(EB7.SI)

(EB7.SI)

0.054

-0.011 /

-16.92%

Vol: 30000

Value: 1610

CHASEN HOLDINGS LIMITED

(5NV.SI)

(5NV.SI)

0.047

-0.009 /

-16.07%

Vol: 33864500

Value: 1933365

LINC ENERGY LTD

(BRE.SI)

(BRE.SI)

0.155

-0.029 /

-15.76%

Vol: 16029800

Value: 2686103

LION ASIAPAC LTD

(BAZ.SI)

(BAZ.SI)

0.245

-0.045 /

-15.52%

Vol: 1700

Value: 400

HOR KEW CORPORATION LIMITED

(BBP.SI)

(BBP.SI)

0.285

-0.050 /

-14.93%

Vol: 1900

Value: 541

IEV HOLDINGS LIMITED

(5TN.SI)

(5TN.SI)

0.097

-0.017 /

-14.91%

Vol: 71164100

Value: 7983471

USP GROUP LIMITED

(A6F.SI)

(A6F.SI)

0.029

-0.005 /

-14.71%

Vol: 264600

Value: 7442

Data Source:

http://www.sgx.com/

http://sg.finance.yahoo.com/

Archive: