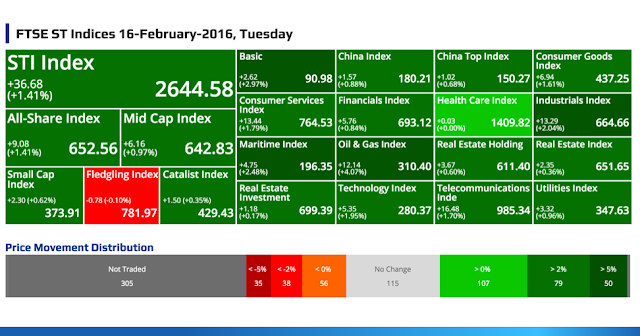

FTSE ST Indices 16-February-2016, Tuesday

STI Index

+36.68

(+1.41%)

(+1.41%)

2644.58

All-Share Index

+9.08

(+1.41%)

(+1.41%)

652.56

Mid Cap Index

+6.16

(+0.97%)

(+0.97%)

642.83

Small Cap Index

+2.30 (+0.62%)

373.91

Fledgling Index

-0.78 (-0.10%)

781.97

Catalist Index

+1.50 (+0.35%)

429.43

Basic

+2.62

(+2.97%)

(+2.97%)

90.98

China Index

+1.57

(+0.88%)

(+0.88%)

180.21

China Top Index

+1.02

(+0.68%)

(+0.68%)

150.27

Consumer Goods Index

+6.94

(+1.61%)

(+1.61%)

437.25

Consumer Services Index

+13.44

(+1.79%)

(+1.79%)

764.53

Financials Index

+5.76

(+0.84%)

(+0.84%)

693.12

Health Care Index

+0.03

(+0.00%)

(+0.00%)

1409.82

Industrials Index

+13.29

(+2.04%)

(+2.04%)

664.66

Maritime Index

+4.75

(+2.48%)

(+2.48%)

196.35

Oil & Gas Index

+12.14

(+4.07%)

(+4.07%)

310.40

Real Estate Holding

+3.67

(+0.60%)

(+0.60%)

611.40

Real Estate Index

+2.35

(+0.36%)

(+0.36%)

651.65

Real Estate Investment

+1.18

(+0.17%)

(+0.17%)

699.39

Technology Index

+5.35

(+1.95%)

(+1.95%)

280.37

Telecommunications Inde

+16.48

(+1.70%)

(+1.70%)

985.34

Utilities Index

+3.32

(+0.96%)

(+0.96%)

347.63

Price Movement Distribution

Top 20 Volume

EZRA HOLDINGS LIMITED

(5DN.SI)

(5DN.SI)

0.052

+0.003 /

+6.12%

Vol: 54214200

Value: 2752503

NOBLE GROUP LIMITED

(N21.SI)

(N21.SI)

0.335

+0.010 /

+3.08%

Vol: 49946700

Value: 16442087

SPACKMAN ENTERTAINMENT GRP LTD

(40E.SI)

(40E.SI)

0.084

+0.008 /

+10.53%

Vol: 48628300

Value: 3960480

LUZHOU BIO-CHEM TECHNOLOGY LTD

(L46.SI)

(L46.SI)

0.042

+0.005 /

+13.51%

Vol: 43444000

Value: 1778563

REX INTERNATIONAL HOLDING LTD

(5WH.SI)

(5WH.SI)

0.075

+0.002 /

+2.74%

Vol: 37704400

Value: 2826486

GOLDEN AGRI-RESOURCES LTD

(E5H.SI)

(E5H.SI)

0.375

+0.005 /

+1.35%

Vol: 30389100

Value: 11261230

SINGTEL

(Z74.SI)

(Z74.SI)

3.800

+0.060 /

+1.60%

Vol: 27816200

Value: 104509941

CAPITALAND LIMITED

(C31.SI)

(C31.SI)

2.900

+0.010 /

+0.35%

Vol: 27643200

Value: 79695059

GLOBAL LOGISTIC PROP LIMITED

(MC0.SI)

(MC0.SI)

1.650

+0.020 /

+1.23%

Vol: 25024900

Value: 41177689

HUTCHISON PORT HOLDINGS TRUST

(NS8U.SI)

(NS8U.SI)

USD 0.430

-0.015 /

-3.37%

Vol: 22911200

Value: 10101386

GENTING SINGAPORE PLC

(G13.SI)

(G13.SI)

0.690

- / -

Vol: 22822400

Value: 15733354

YANGZIJIANG SHIPBLDG HLDGS LTD

(BS6.SI)

(BS6.SI)

0.955

+0.045 /

+4.95%

Vol: 21753100

Value: 20379283

TECHNICS OIL & GAS LIMITED

(5CQ.SI)

(5CQ.SI)

0.144

+0.025 /

+21.01%

Vol: 20256200

Value: 2880566

CAPITALAND MALL TRUST

(C38U.SI)

(C38U.SI)

2.100

-0.010 /

-0.47%

Vol: 19734000

Value: 41383617

SINCAP GROUP LIMITED

(5UN.SI)

(5UN.SI)

0.032

- / -

Vol: 19497600

Value: 643872

VALLIANZ HOLDINGS LIMITED

(545.SI)

(545.SI)

0.040

+0.001 /

+2.56%

Vol: 18844400

Value: 751214

EZION HOLDINGS LIMITED

(5ME.SI)

(5ME.SI)

0.525

+0.020 /

+3.96%

Vol: 18768300

Value: 9814644

QT VASCULAR LTD.

(5I0.SI)

(5I0.SI)

0.103

+0.004 /

+4.04%

Vol: 17023900

Value: 1746618

SINGAPORE POST LIMITED

(S08.SI)

CD

(S08.SI)

CD

1.410

+0.070 /

+5.22%

Vol: 15525200

Value: 21542658

YUUZOO CORPORATION LIMITED

(AFC.SI)

(AFC.SI)

0.144

+0.003 /

+2.13%

Vol: 15438100

Value: 2223578

Top 20 Value

DBS GROUP HOLDINGS LTD

(D05.SI)

(D05.SI)

13.680

+0.270 /

+2.01%

Vol: 12601500

Value: 172496664

SINGTEL

(Z74.SI)

(Z74.SI)

3.800

+0.060 /

+1.60%

Vol: 27816200

Value: 104509941

UNITED OVERSEAS BANK LTD

(U11.SI)

CD

(U11.SI)

CD

17.810

-0.040 /

-0.22%

Vol: 5829700

Value: 102724407

CAPITALAND LIMITED

(C31.SI)

(C31.SI)

2.900

+0.010 /

+0.35%

Vol: 27643200

Value: 79695059

OVERSEA-CHINESE BANKING CORP

(O39.SI)

(O39.SI)

7.770

+0.130 /

+1.70%

Vol: 9055700

Value: 70240704

KEPPEL CORPORATION LIMITED

(BN4.SI)

CD

(BN4.SI)

CD

5.200

+0.180 /

+3.59%

Vol: 11857300

Value: 60918463

JARDINE MATHESON HLDGS LTD

(J36.SI)

(J36.SI)

USD 55.840

+1.340 /

+2.46%

Vol: 1015300

Value: 56237584

WILMAR INTERNATIONAL LIMITED

(F34.SI)

(F34.SI)

3.100

+0.100 /

+3.33%

Vol: 13656400

Value: 42166947

CAPITALAND MALL TRUST

(C38U.SI)

(C38U.SI)

2.100

-0.010 /

-0.47%

Vol: 19734000

Value: 41383617

GLOBAL LOGISTIC PROP LIMITED

(MC0.SI)

(MC0.SI)

1.650

+0.020 /

+1.23%

Vol: 25024900

Value: 41177689

SEMBCORP INDUSTRIES LTD

(U96.SI)

(U96.SI)

2.510

+0.100 /

+4.15%

Vol: 14084300

Value: 34491543

COMFORTDELGRO CORPORATION LTD

(C52.SI)

CD

(C52.SI)

CD

3.010

+0.140 /

+4.88%

Vol: 11370500

Value: 33613846

ASCENDAS REAL ESTATE INV TRUST

(A17U.SI)

(A17U.SI)

2.380

-0.020 /

-0.83%

Vol: 11414400

Value: 27351590

SINGAPORE PRESS HLDGS LTD

(T39.SI)

(T39.SI)

3.760

+0.090 /

+2.45%

Vol: 6087300

Value: 22599567

SINGAPORE POST LIMITED

(S08.SI)

CD

(S08.SI)

CD

1.410

+0.070 /

+5.22%

Vol: 15525200

Value: 21542658

HONGKONG LAND HOLDINGS LIMITED

(H78.SI)

(H78.SI)

USD 5.780

-0.010 /

-0.17%

Vol: 3547400

Value: 20446573

YANGZIJIANG SHIPBLDG HLDGS LTD

(BS6.SI)

(BS6.SI)

0.955

+0.045 /

+4.95%

Vol: 21753100

Value: 20379283

SINGAPORE EXCHANGE LIMITED

(S68.SI)

(S68.SI)

7.180

+0.160 /

+2.28%

Vol: 2677800

Value: 19122385

SINGAPORE AIRLINES LTD

(C6L.SI)

(C6L.SI)

11.210

+0.100 /

+0.90%

Vol: 1639600

Value: 18359862

JARDINE CYCLE & CARRIAGE LTD

(C07.SI)

(C07.SI)

40.320

+1.260 /

+3.23%

Vol: 455500

Value: 18279734

Top 20 Gainers ($)

JARDINE MATHESON HLDGS LTD

(J36.SI)

(J36.SI)

USD 55.840

+1.340 /

+2.46%

Vol: 1015300

Value: 56237584

JARDINE CYCLE & CARRIAGE LTD

(C07.SI)

(C07.SI)

40.320

+1.260 /

+3.23%

Vol: 455500

Value: 18279734

JARDINE STRATEGIC HLDGS LTD

(J37.SI)

(J37.SI)

USD 28.550

+0.950 /

+3.44%

Vol: 214700

Value: 6091118

DBS GROUP HOLDINGS LTD

(D05.SI)

(D05.SI)

13.680

+0.270 /

+2.01%

Vol: 12601500

Value: 172496664

KEPPEL CORPORATION LIMITED

(BN4.SI)

CD

(BN4.SI)

CD

5.200

+0.180 /

+3.59%

Vol: 11857300

Value: 60918463

VENTURE CORPORATION LIMITED

(V03.SI)

(V03.SI)

7.950

+0.170 /

+2.19%

Vol: 583700

Value: 4612484

SINGAPORE EXCHANGE LIMITED

(S68.SI)

(S68.SI)

7.180

+0.160 /

+2.28%

Vol: 2677800

Value: 19122385

DAIRY FARM INT'L HOLDINGS LTD

(D01.SI)

(D01.SI)

USD 5.750

+0.150 /

+2.68%

Vol: 460200

Value: 2611001

BUKIT SEMBAWANG ESTATES LTD

(B61.SI)

(B61.SI)

4.200

+0.140 /

+3.45%

Vol: 28300

Value: 117137

COMFORTDELGRO CORPORATION LTD

(C52.SI)

CD

(C52.SI)

CD

3.010

+0.140 /

+4.88%

Vol: 11370500

Value: 33613846

OVERSEA-CHINESE BANKING CORP

(O39.SI)

(O39.SI)

7.770

+0.130 /

+1.70%

Vol: 9055700

Value: 70240704

STARHUB LTD

(CC3.SI)

(CC3.SI)

3.800

+0.120 /

+3.26%

Vol: 3299600

Value: 12380617

UOL GROUP LIMITED

(U14.SI)

(U14.SI)

5.630

+0.120 /

+2.18%

Vol: 1564100

Value: 8718904

GREAT EASTERN HLDGS LTD

(G07.SI)

CD

(G07.SI)

CD

19.660

+0.110 /

+0.56%

Vol: 3700

Value: 72800

SEMBCORP MARINE LTD

(S51.SI)

CD

(S51.SI)

CD

1.570

+0.110 /

+7.53%

Vol: 8587800

Value: 12979882

WILMAR INTERNATIONAL LIMITED

(F34.SI)

(F34.SI)

3.100

+0.100 /

+3.33%

Vol: 13656400

Value: 42166947

SEMBCORP INDUSTRIES LTD

(U96.SI)

(U96.SI)

2.510

+0.100 /

+4.15%

Vol: 14084300

Value: 34491543

FORTUNE REAL ESTATE INV TRUST

(F25U.SI)

(F25U.SI)

HKD 7.900

+0.100 /

+1.28%

Vol: 98400

Value: 771565

UNITED OVERSEAS INSURANCE LTD

(U13.SI)

CD

(U13.SI)

CD

4.650

+0.100 /

+2.20%

Vol: 2900

Value: 13485

HAW PAR CORP LTD

(H02.SI)

(H02.SI)

7.490

+0.100 /

+1.35%

Vol: 13300

Value: 98505

Top 20 Losers ($)

ISETAN (SINGAPORE) LTD

(I15.SI)

(I15.SI)

3.200

-0.950 /

-22.89%

Vol: 3000

Value: 9605

YONGMAO HOLDINGS LIMITED

(BKX.SI)

(BKX.SI)

0.450

-0.300 /

-40.00%

Vol: 2000000

Value: 900000

PETRA FOODS LIMITED

(P34.SI)

(P34.SI)

2.140

-0.090 /

-4.04%

Vol: 264800

Value: 581455

UNIVERSAL RESOURCE & SVCS LTD

(BGO.SI)

(BGO.SI)

0.210

-0.060 /

-22.22%

Vol: 200

Value: 42

TIH LIMITED

(T55.SI)

(T55.SI)

0.390

-0.055 /

-12.36%

Vol: 16600

Value: 6474

ENVICTUS INTERNATIONAL HLDGLTD

(BQD.SI)

(BQD.SI)

0.450

-0.050 /

-10.00%

Vol: 6000

Value: 2700

SOON LIAN HOLDINGS LIMITED

(5MD.SI)

(5MD.SI)

0.063

-0.049 /

-43.75%

Vol: 4000

Value: 310

CH OFFSHORE LTD

(C13.SI)

(C13.SI)

0.345

-0.045 /

-11.54%

Vol: 20000

Value: 6900

SMRT CORPORATION LTD

(S53.SI)

(S53.SI)

1.590

-0.045 /

-2.75%

Vol: 5920900

Value: 9524293

UNITED OVERSEAS BANK LTD

(U11.SI)

CD

(U11.SI)

CD

17.810

-0.040 /

-0.22%

Vol: 5829700

Value: 102724407

LAFE CORPORATION LIMITED

(AYB.SI)

(AYB.SI)

0.760

-0.040 /

-5.00%

Vol: 3800

Value: 2888

JACKS INTERNATIONAL LIMITED

(BAC.SI)

(BAC.SI)

0.580

-0.030 /

-4.92%

Vol: 3000

Value: 1740

HALCYON AGRI CORPORATION LTD

(5VJ.SI)

(5VJ.SI)

0.685

-0.030 /

-4.20%

Vol: 1891500

Value: 1325947

QAF LTD

(Q01.SI)

(Q01.SI)

0.970

-0.030 /

-3.00%

Vol: 211900

Value: 204953

SINGAPORE REINSURANCE COR LTD

(S49.SI)

(S49.SI)

0.295

-0.025 /

-7.81%

Vol: 75000

Value: 22500

HWA HONG CORPORATION LIMITED

(H19.SI)

CD

(H19.SI)

CD

0.290

-0.020 /

-6.45%

Vol: 10000

Value: 2900

KING WAN CORPORATION LIMITED

(554.SI)

(554.SI)

0.185

-0.020 /

-9.76%

Vol: 58000

Value: 10862

CORDLIFE GROUP LIMITED

(P8A.SI)

(P8A.SI)

1.555

-0.020 /

-1.27%

Vol: 60900

Value: 95347

PERENNIAL REAL ESTATE HLDGSLTD

(40S.SI)

CD

(40S.SI)

CD

0.870

-0.020 /

-2.25%

Vol: 178900

Value: 155687

G. K. GOH HOLDINGS LIMITED

(G41.SI)

(G41.SI)

0.780

-0.020 /

-2.50%

Vol: 10500

Value: 8350

Top 20 Gainers (%)

NEXT-GEN SATELLITE COMM LTD

(B07.SI)

(B07.SI)

0.004

+0.002 /

+100.00%

Vol: 200

Value: 0

INFINIO GROUP LIMITED

(5G4.SI)

(5G4.SI)

0.002

+0.001 /

+100.00%

Vol: 500000

Value: 1000

FULL APEX (HOLDINGS) LIMITED

(F18.SI)

(F18.SI)

0.020

+0.008 /

+66.67%

Vol: 2100

Value: 42

ELEKTROMOTIVE GROUP LIMITED

(5VU.SI)

(5VU.SI)

0.004

+0.001 /

+33.33%

Vol: 200

Value: 0

MAXI-CASH FIN SVCS CORP LTD

(5UF.SI)

(5UF.SI)

0.110

+0.020 /

+22.22%

Vol: 61000

Value: 6710

TECHNICS OIL & GAS LIMITED

(5CQ.SI)

(5CQ.SI)

0.144

+0.025 /

+21.01%

Vol: 20256200

Value: 2880566

EUROPTRONIC GROUP LTD

(E23.SI)

(E23.SI)

0.006

+0.001 /

+20.00%

Vol: 800300

Value: 4001

LERENO BIO-CHEM LTD.

(42H.SI)

(42H.SI)

0.060

+0.010 /

+20.00%

Vol: 7300

Value: 303

NEW SILKROUTES GROUP LIMITED

(BMT.SI)

(BMT.SI)

0.425

+0.070 /

+19.72%

Vol: 138700

Value: 57429

SINGAPORE EDEVELOPMENT LTD

(40V.SI)

(40V.SI)

0.031

+0.005 /

+19.23%

Vol: 204100

Value: 6172

INDIABULLS PROPERTIES INVTRUST

(BESU.SI)

(BESU.SI)

0.235

+0.037 /

+18.69%

Vol: 30400

Value: 5820

SITRA HOLDINGS (INTL) LIMITED

(5LE.SI)

(5LE.SI)

0.013

+0.002 /

+18.18%

Vol: 100

Value: 1

SHC CAPITAL ASIA LIMITED

(5UE.SI)

(5UE.SI)

0.130

+0.019 /

+17.12%

Vol: 87300

Value: 11986

CHINA GAOXIAN FIBREFAB HLDGLTD

(AZZ.SI)

(AZZ.SI)

0.118

+0.017 /

+16.83%

Vol: 32800

Value: 3304

POLARIS LTD.

(5BI.SI)

(5BI.SI)

0.007

+0.001 /

+16.67%

Vol: 1295400

Value: 7772

JOYAS INTERNATIONAL HLDGS LTD

(E9L.SI)

(E9L.SI)

0.007

+0.001 /

+16.67%

Vol: 90000

Value: 630

NEW WAVE HOLDINGS LTD.

(5FX.SI)

(5FX.SI)

0.008

+0.001 /

+14.29%

Vol: 999200

Value: 7993

LUZHOU BIO-CHEM TECHNOLOGY LTD

(L46.SI)

(L46.SI)

0.042

+0.005 /

+13.51%

Vol: 43444000

Value: 1778563

NATURAL COOL HOLDINGS LIMITED

(5IF.SI)

(5IF.SI)

0.149

+0.017 /

+12.88%

Vol: 200000

Value: 28740

MULTI-CHEM LIMITED

(AWZ.SI)

CD

(AWZ.SI)

CD

0.495

+0.055 /

+12.50%

Vol: 200

Value: 99

Top 20 Losers (%)

SOON LIAN HOLDINGS LIMITED

(5MD.SI)

(5MD.SI)

0.063

-0.049 /

-43.75%

Vol: 4000

Value: 310

YONGMAO HOLDINGS LIMITED

(BKX.SI)

(BKX.SI)

0.450

-0.300 /

-40.00%

Vol: 2000000

Value: 900000

IPCO INT'L LIMITED

(I11.SI)

(I11.SI)

0.003

-0.001 /

-25.00%

Vol: 100100

Value: 300

ISETAN (SINGAPORE) LTD

(I15.SI)

(I15.SI)

3.200

-0.950 /

-22.89%

Vol: 3000

Value: 9605

ALPHA ENERGY HOLDINGS LIMITED

(5TS.SI)

(5TS.SI)

0.065

-0.019 /

-22.62%

Vol: 234600

Value: 11134

UNIVERSAL RESOURCE & SVCS LTD

(BGO.SI)

(BGO.SI)

0.210

-0.060 /

-22.22%

Vol: 200

Value: 42

OCEAN SKY INTERNATIONAL LTD

(O05.SI)

(O05.SI)

0.075

-0.019 /

-20.21%

Vol: 51600

Value: 3827

OCEANUS GROUP LIMITED

(579.SI)

(579.SI)

0.004

-0.001 /

-20.00%

Vol: 4060000

Value: 16240

ICP LTD

(5I4.SI)

(5I4.SI)

0.006

-0.001 /

-14.29%

Vol: 60100

Value: 360

SUNLIGHT GROUP HLDG LTD

(5AI.SI)

(5AI.SI)

0.012

-0.002 /

-14.29%

Vol: 23000

Value: 276

AA GROUP HOLDINGS LTD.

(5GZ.SI)

(5GZ.SI)

0.080

-0.013 /

-13.98%

Vol: 591000

Value: 47280

TIH LIMITED

(T55.SI)

(T55.SI)

0.390

-0.055 /

-12.36%

Vol: 16600

Value: 6474

CH OFFSHORE LTD

(C13.SI)

(C13.SI)

0.345

-0.045 /

-11.54%

Vol: 20000

Value: 6900

REGAL INTERNATIONAL GROUP LTD.

(UV1.SI)

(UV1.SI)

0.140

-0.018 /

-11.39%

Vol: 26200

Value: 3731

QIAN HU CORPORATION LIMITED

(BCV.SI)

CD

(BCV.SI)

CD

0.120

-0.015 /

-11.11%

Vol: 43100

Value: 5157

FIGTREE HOLDINGS LIMITED

(5F4.SI)

(5F4.SI)

0.143

-0.016 /

-10.06%

Vol: 32000

Value: 4554

ENVICTUS INTERNATIONAL HLDGLTD

(BQD.SI)

(BQD.SI)

0.450

-0.050 /

-10.00%

Vol: 6000

Value: 2700

KING WAN CORPORATION LIMITED

(554.SI)

(554.SI)

0.185

-0.020 /

-9.76%

Vol: 58000

Value: 10862

C&G ENV PROTECT HLDGS LTD

(D79.SI)

(D79.SI)

0.168

-0.016 /

-8.70%

Vol: 171000

Value: 28588

TOP GLOBAL LIMITED

(BHO.SI)

(BHO.SI)

0.193

-0.017 /

-8.10%

Vol: 700

Value: 135

Data Source:

http://www.sgx.com/

http://sg.finance.yahoo.com/

Archive: