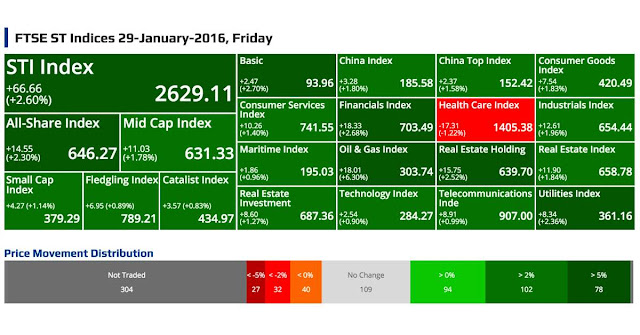

FTSE ST Indices 29-January-2016, Friday

STI Index

+66.66

(+2.60%)

(+2.60%)

2629.11

All-Share Index

+14.55

(+2.30%)

(+2.30%)

646.27

Mid Cap Index

+11.03

(+1.78%)

(+1.78%)

631.33

Small Cap Index

+4.27 (+1.14%)

379.29

Fledgling Index

+6.95 (+0.89%)

789.21

Catalist Index

+3.57 (+0.83%)

434.97

Basic

+2.47

(+2.70%)

(+2.70%)

93.96

China Index

+3.28

(+1.80%)

(+1.80%)

185.58

China Top Index

+2.37

(+1.58%)

(+1.58%)

152.42

Consumer Goods Index

+7.54

(+1.83%)

(+1.83%)

420.49

Consumer Services Index

+10.26

(+1.40%)

(+1.40%)

741.55

Financials Index

+18.33

(+2.68%)

(+2.68%)

703.49

Health Care Index

-17.31

(-1.22%)

(-1.22%)

1405.38

Industrials Index

+12.61

(+1.96%)

(+1.96%)

654.44

Maritime Index

+1.86

(+0.96%)

(+0.96%)

195.03

Oil & Gas Index

+18.01

(+6.30%)

(+6.30%)

303.74

Real Estate Holding

+15.75

(+2.52%)

(+2.52%)

639.70

Real Estate Index

+11.90

(+1.84%)

(+1.84%)

658.78

Real Estate Investment

+8.60

(+1.27%)

(+1.27%)

687.36

Technology Index

+2.54

(+0.90%)

(+0.90%)

284.27

Telecommunications Inde

+8.91

(+0.99%)

(+0.99%)

907.00

Utilities Index

+8.34

(+2.36%)

(+2.36%)

361.16

Price Movement Distribution

Top 20 Volume

NOBLE GROUP LIMITED

(N21.SI)

(N21.SI)

0.310

+0.040 /

+14.81%

Vol: 92803500

Value: 27392372

EZRA HOLDINGS LIMITED

(5DN.SI)

(5DN.SI)

0.057

+0.003 /

+5.56%

Vol: 54401600

Value: 3058193

GLOBAL LOGISTIC PROP LIMITED

(MC0.SI)

(MC0.SI)

1.690

+0.020 /

+1.20%

Vol: 47328300

Value: 79196332

REX INTERNATIONAL HOLDING LTD

(5WH.SI)

(5WH.SI)

0.074

+0.002 /

+2.78%

Vol: 34374200

Value: 2556821

GOLDEN AGRI-RESOURCES LTD

(E5H.SI)

(E5H.SI)

0.370

+0.020 /

+5.71%

Vol: 30670600

Value: 11159871

SINGTEL

(Z74.SI)

(Z74.SI)

3.510

+0.030 /

+0.86%

Vol: 28927200

Value: 100918664

SINCAP GROUP LIMITED

(5UN.SI)

(5UN.SI)

0.035

+0.001 /

+2.94%

Vol: 28410900

Value: 1038966

CHINA SPORTS INTL LIMITED

(FQ8.SI)

(FQ8.SI)

0.016

+0.001 /

+6.67%

Vol: 24362100

Value: 385450

EZION HOLDINGS LIMITED

(5ME.SI)

(5ME.SI)

0.515

+0.025 /

+5.10%

Vol: 21768200

Value: 11087795

GENTING SINGAPORE PLC

(G13.SI)

(G13.SI)

0.705

+0.010 /

+1.44%

Vol: 20556400

Value: 14325426

SPACKMAN ENTERTAINMENT GRP LTD

(40E.SI)

(40E.SI)

0.082

+0.004 /

+5.13%

Vol: 20445800

Value: 1675930

KEPPEL CORPORATION LIMITED

(BN4.SI)

CD

(BN4.SI)

CD

5.020

+0.250 /

+5.24%

Vol: 19496600

Value: 96461237

SINGAPORE POST LIMITED

(S08.SI)

(S08.SI)

1.335

+0.035 /

+2.69%

Vol: 18941400

Value: 25205989

THE STRATECH GROUP LIMITED

(ATN.SI)

(ATN.SI)

0.030

+0.002 /

+7.14%

Vol: 18414100

Value: 549493

HUTCHISON PORT HOLDINGS TRUST

(NS8U.SI)

(NS8U.SI)

USD 0.475

- / -

Vol: 18122900

Value: 8608494

SEMBCORP INDUSTRIES LTD

(U96.SI)

(U96.SI)

2.510

+0.280 /

+12.56%

Vol: 16998800

Value: 40881566

ROWSLEY LTD.

(A50.SI)

(A50.SI)

0.149

+0.003 /

+2.05%

Vol: 16068200

Value: 2389941

CAPITALAND MALL TRUST

(C38U.SI)

XD

(C38U.SI)

XD

1.990

+0.020 /

+1.02%

Vol: 15217500

Value: 30155446

LOYZ ENERGY LIMITED

(594.SI)

(594.SI)

0.034

+0.001 /

+3.03%

Vol: 13983200

Value: 478663

CAPITALAND LIMITED

(C31.SI)

(C31.SI)

3.070

+0.100 /

+3.37%

Vol: 13646200

Value: 41326614

Top 20 Value

DBS GROUP HOLDINGS LTD

(D05.SI)

(D05.SI)

14.060

+0.520 /

+3.84%

Vol: 8487200

Value: 117157964

SINGTEL

(Z74.SI)

(Z74.SI)

3.510

+0.030 /

+0.86%

Vol: 28927200

Value: 100918664

KEPPEL CORPORATION LIMITED

(BN4.SI)

CD

(BN4.SI)

CD

5.020

+0.250 /

+5.24%

Vol: 19496600

Value: 96461237

UNITED OVERSEAS BANK LTD

(U11.SI)

(U11.SI)

18.090

+0.520 /

+2.96%

Vol: 4900100

Value: 87788557

OVERSEA-CHINESE BANKING CORP

(O39.SI)

(O39.SI)

7.920

+0.290 /

+3.80%

Vol: 10548300

Value: 81978107

GLOBAL LOGISTIC PROP LIMITED

(MC0.SI)

(MC0.SI)

1.690

+0.020 /

+1.20%

Vol: 47328300

Value: 79196332

CAPITALAND LIMITED

(C31.SI)

(C31.SI)

3.070

+0.100 /

+3.37%

Vol: 13646200

Value: 41326614

SEMBCORP INDUSTRIES LTD

(U96.SI)

(U96.SI)

2.510

+0.280 /

+12.56%

Vol: 16998800

Value: 40881566

WILMAR INTERNATIONAL LIMITED

(F34.SI)

(F34.SI)

2.850

+0.080 /

+2.89%

Vol: 10876200

Value: 31002820

CAPITALAND MALL TRUST

(C38U.SI)

XD

(C38U.SI)

XD

1.990

+0.020 /

+1.02%

Vol: 15217500

Value: 30155446

ASCENDAS REAL ESTATE INV TRUST

(A17U.SI)

(A17U.SI)

2.320

+0.060 /

+2.65%

Vol: 12534700

Value: 28869193

CITY DEVELOPMENTS LIMITED

(C09.SI)

(C09.SI)

6.960

+0.250 /

+3.73%

Vol: 4144200

Value: 28238419

NOBLE GROUP LIMITED

(N21.SI)

(N21.SI)

0.310

+0.040 /

+14.81%

Vol: 92803500

Value: 27392372

HONGKONG LAND HOLDINGS LIMITED

(H78.SI)

(H78.SI)

USD 6.270

+0.160 /

+2.62%

Vol: 4208000

Value: 26144421

SINGAPORE AIRLINES LTD

(C6L.SI)

(C6L.SI)

11.030

+0.110 /

+1.01%

Vol: 2348900

Value: 25734544

SINGAPORE POST LIMITED

(S08.SI)

(S08.SI)

1.335

+0.035 /

+2.69%

Vol: 18941400

Value: 25205989

SINGAPORE EXCHANGE LIMITED

(S68.SI)

(S68.SI)

7.080

+0.170 /

+2.46%

Vol: 2806000

Value: 19663495

JARDINE MATHESON HLDGS LTD

(J36.SI)

(J36.SI)

USD 52.500

+1.310 /

+2.56%

Vol: 371400

Value: 19208586

SINGAPORE TECH ENGINEERING LTD

(S63.SI)

(S63.SI)

2.870

+0.020 /

+0.70%

Vol: 6629200

Value: 18822700

COMFORTDELGRO CORPORATION LTD

(C52.SI)

(C52.SI)

2.830

-0.010 /

-0.35%

Vol: 6496300

Value: 18334803

Top 20 Gainers ($)

JARDINE CYCLE & CARRIAGE LTD

(C07.SI)

(C07.SI)

37.290

+1.840 /

+5.19%

Vol: 366700

Value: 13361058

JARDINE MATHESON HLDGS LTD

(J36.SI)

(J36.SI)

USD 52.500

+1.310 /

+2.56%

Vol: 371400

Value: 19208586

JARDINE STRATEGIC HLDGS LTD

(J37.SI)

(J37.SI)

USD 27.210

+0.560 /

+2.10%

Vol: 308500

Value: 8266658

DBS GROUP HOLDINGS LTD

(D05.SI)

(D05.SI)

14.060

+0.520 /

+3.84%

Vol: 8487200

Value: 117157964

UNITED OVERSEAS BANK LTD

(U11.SI)

(U11.SI)

18.090

+0.520 /

+2.96%

Vol: 4900100

Value: 87788557

GREAT EASTERN HLDGS LTD

(G07.SI)

(G07.SI)

20.050

+0.450 /

+2.30%

Vol: 36600

Value: 730512

OVERSEA-CHINESE BANKING CORP

(O39.SI)

(O39.SI)

7.920

+0.290 /

+3.80%

Vol: 10548300

Value: 81978107

SEMBCORP INDUSTRIES LTD

(U96.SI)

(U96.SI)

2.510

+0.280 /

+12.56%

Vol: 16998800

Value: 40881566

KEPPEL CORPORATION LIMITED

(BN4.SI)

CD

(BN4.SI)

CD

5.020

+0.250 /

+5.24%

Vol: 19496600

Value: 96461237

CITY DEVELOPMENTS LIMITED

(C09.SI)

(C09.SI)

6.960

+0.250 /

+3.73%

Vol: 4144200

Value: 28238419

HAW PAR CORP LTD

(H02.SI)

(H02.SI)

7.710

+0.180 /

+2.39%

Vol: 22700

Value: 174429

SINGAPORE EXCHANGE LIMITED

(S68.SI)

(S68.SI)

7.080

+0.170 /

+2.46%

Vol: 2806000

Value: 19663495

HONGKONG LAND HOLDINGS LIMITED

(H78.SI)

(H78.SI)

USD 6.270

+0.160 /

+2.62%

Vol: 4208000

Value: 26144421

DAIRY FARM INT'L HOLDINGS LTD

(D01.SI)

(D01.SI)

USD 6.170

+0.150 /

+2.49%

Vol: 426600

Value: 2612106

UOL GROUP LIMITED

(U14.SI)

(U14.SI)

5.600

+0.120 /

+2.19%

Vol: 1529500

Value: 8518212

SINGAPORE AIRLINES LTD

(C6L.SI)

(C6L.SI)

11.030

+0.110 /

+1.01%

Vol: 2348900

Value: 25734544

CAPITALAND LIMITED

(C31.SI)

(C31.SI)

3.070

+0.100 /

+3.37%

Vol: 13646200

Value: 41326614

COURAGE MARINE GROUP LIMITED

(ATL.SI)

(ATL.SI)

0.770

+0.090 /

+13.24%

Vol: 49100

Value: 36270

STARHUB LTD

(CC3.SI)

(CC3.SI)

3.380

+0.080 /

+2.42%

Vol: 3995300

Value: 13366006

SUTL ENTERPRISE LIMITED

(BHU.SI)

(BHU.SI)

0.430

+0.080 /

+22.86%

Vol: 1200

Value: 516

Top 20 Losers ($)

PRUDENTIAL PLC

(K6S.SI)

(K6S.SI)

USD 19.500

-2.100 /

-9.72%

Vol: 200

Value: 3900

LAFE CORPORATION LIMITED

(AYB.SI)

(AYB.SI)

0.860

-0.100 /

-10.42%

Vol: 600

Value: 516

RIVERSTONE HOLDINGS LIMITED

(AP4.SI)

(AP4.SI)

1.060

-0.095 /

-8.23%

Vol: 921800

Value: 991543

LANTROVISION (S) LTD

(BJK.SI)

(BJK.SI)

3.020

-0.080 /

-2.58%

Vol: 102300

Value: 312275

HTL INT'L HOLDINGS LIMITED

(H64.SI)

(H64.SI)

0.665

-0.055 /

-7.64%

Vol: 9367300

Value: 5696267

DUKANG DISTILLERS HLDGS LTD

(BKV.SI)

(BKV.SI)

0.660

-0.040 /

-5.71%

Vol: 7900

Value: 5559

GLOBAL TESTING CORPORATION LTD

(AYN.SI)

(AYN.SI)

1.010

-0.035 /

-3.35%

Vol: 40700

Value: 41100

EMS ENERGY LIMITED

(42O.SI)

(42O.SI)

0.065

-0.035 /

-35.00%

Vol: 10714000

Value: 696451

HUPSTEEL LTD

(BMH.SI)

(BMH.SI)

0.530

-0.030 /

-5.36%

Vol: 6200

Value: 3264

SHC CAPITAL ASIA LIMITED

(5UE.SI)

(5UE.SI)

0.106

-0.029 /

-21.48%

Vol: 150000

Value: 15900

WEIYE HOLDINGS LIMITED

(BMA.SI)

(BMA.SI)

0.350

-0.025 /

-6.67%

Vol: 43500

Value: 15875

GUOCOLAND LIMITED

(F17.SI)

(F17.SI)

1.695

-0.025 /

-1.45%

Vol: 204100

Value: 347375

TAN CHONG INT'L LTD

(T15.SI)

(T15.SI)

HKD 2.400

-0.020 /

-0.83%

Vol: 116900

Value: 280560

MAPLETREE LOGISTICS TRUST

(M44U.SI)

XD

(M44U.SI)

XD

0.940

-0.020 /

-2.08%

Vol: 3703400

Value: 3465277

MULTI-CHEM LIMITED

(AWZ.SI)

(AWZ.SI)

0.480

-0.020 /

-4.00%

Vol: 2600

Value: 1152

OUE HOSPITALITY TRUST

(SK7.SI)

XD

(SK7.SI)

XD

0.730

-0.020 /

-2.67%

Vol: 1062200

Value: 780903

SHINVEST HOLDING LTD.

(BJW.SI)

(BJW.SI)

0.920

-0.020 /

-2.13%

Vol: 95000

Value: 87790

YEO HIAP SENG LTD

(Y03.SI)

(Y03.SI)

1.300

-0.020 /

-1.52%

Vol: 22400

Value: 28835

CH OFFSHORE LTD

(C13.SI)

(C13.SI)

0.380

-0.020 /

-5.00%

Vol: 10200

Value: 3931

KS ENERGY LIMITED

(578.SI)

(578.SI)

0.180

-0.018 /

-9.09%

Vol: 61600

Value: 11542

Top 20 Gainers (%)

BLUMONT GROUP LTD.

(A33.SI)

(A33.SI)

0.002

+0.001 /

+100.00%

Vol: 1000000

Value: 2000

ATTILAN GROUP LIMITED

(5ET.SI)

(5ET.SI)

0.003

+0.001 /

+50.00%

Vol: 4515800

Value: 13547

NEXT-GEN SATELLITE COMM LTD

(B07.SI)

(B07.SI)

0.003

+0.001 /

+50.00%

Vol: 11395100

Value: 27282

ELEKTROMOTIVE GROUP LIMITED

(5VU.SI)

(5VU.SI)

0.003

+0.001 /

+50.00%

Vol: 600200

Value: 1800

CPH LTD

(539.SI)

(539.SI)

0.006

+0.002 /

+50.00%

Vol: 300

Value: 1

USP GROUP LIMITED

(A6F.SI)

(A6F.SI)

0.028

+0.007 /

+33.33%

Vol: 100

Value: 2

MDR LIMITED

(A27.SI)

(A27.SI)

0.004

+0.001 /

+33.33%

Vol: 1035000

Value: 4105

EQUATION SUMMIT LIMITED

(532.SI)

(532.SI)

0.004

+0.001 /

+33.33%

Vol: 3050000

Value: 9200

ADVANCED SYSTEMS AUTOMATION

(5TY.SI)

(5TY.SI)

0.004

+0.001 /

+33.33%

Vol: 800000

Value: 3200

LIONGOLD CORP LTD

(A78.SI)

(A78.SI)

0.004

+0.001 /

+33.33%

Vol: 1810200

Value: 7190

ICP LTD

(5I4.SI)

(5I4.SI)

0.008

+0.002 /

+33.33%

Vol: 82100

Value: 574

IPCO INT'L LIMITED

(I11.SI)

(I11.SI)

0.004

+0.001 /

+33.33%

Vol: 20100

Value: 60

LIFEBRANDZ LTD.

(L20.SI)

(L20.SI)

0.004

+0.001 /

+33.33%

Vol: 5600000

Value: 16800

HOR KEW CORPORATION LIMITED

(BBP.SI)

(BBP.SI)

0.360

+0.075 /

+26.32%

Vol: 3900

Value: 1128

UNIVERSAL RESOURCE & SVCS LTD

(BGO.SI)

(BGO.SI)

0.250

+0.050 /

+25.00%

Vol: 200

Value: 50

SUTL ENTERPRISE LIMITED

(BHU.SI)

(BHU.SI)

0.430

+0.080 /

+22.86%

Vol: 1200

Value: 516

NTEGRATOR INTERNATIONAL LTD

(5HC.SI)

(5HC.SI)

0.012

+0.002 /

+20.00%

Vol: 375000

Value: 4110

CACOLA FURNITURE INTL LIMITED

(D2U.SI)

(D2U.SI)

0.006

+0.001 /

+20.00%

Vol: 1195200

Value: 6718

MMP RESOURCES LIMITED

(F3V.SI)

(F3V.SI)

0.006

+0.001 /

+20.00%

Vol: 7029600

Value: 35048

MYP LTD.

(F86.SI)

(F86.SI)

0.260

+0.040 /

+18.18%

Vol: 144400

Value: 36269

Top 20 Losers (%)

FULL APEX (HOLDINGS) LIMITED

(F18.SI)

(F18.SI)

0.010

-0.008 /

-44.44%

Vol: 13000

Value: 75

EMS ENERGY LIMITED

(42O.SI)

(42O.SI)

0.065

-0.035 /

-35.00%

Vol: 10714000

Value: 696451

ALLIED TECHNOLOGIES LIMITED

(A13.SI)

(A13.SI)

0.015

-0.008 /

-34.78%

Vol: 265900

Value: 3987

METECH INTERNATIONAL LIMITED

(QG1.SI)

(QG1.SI)

0.002

-0.001 /

-33.33%

Vol: 900100

Value: 1800

LEY CHOON GROUP HLDG LIMITED

(Q0X.SI)

(Q0X.SI)

0.029

-0.009 /

-23.68%

Vol: 10100

Value: 222

SHC CAPITAL ASIA LIMITED

(5UE.SI)

(5UE.SI)

0.106

-0.029 /

-21.48%

Vol: 150000

Value: 15900

DRAGON GROUP INTL LIMITED

(MT1.SI)

(MT1.SI)

0.041

-0.010 /

-19.61%

Vol: 7088500

Value: 330619

OCEAN SKY INTERNATIONAL LTD

(O05.SI)

(O05.SI)

0.055

-0.011 /

-16.67%

Vol: 120000

Value: 6605

NEW WAVE HOLDINGS LTD.

(5FX.SI)

(5FX.SI)

0.008

-0.001 /

-11.11%

Vol: 1000100

Value: 8000

KOP LIMITED

(5I1.SI)

(5I1.SI)

0.082

-0.010 /

-10.87%

Vol: 45000

Value: 3770

LAFE CORPORATION LIMITED

(AYB.SI)

(AYB.SI)

0.860

-0.100 /

-10.42%

Vol: 600

Value: 516

PRUDENTIAL PLC

(K6S.SI)

(K6S.SI)

USD 19.500

-2.100 /

-9.72%

Vol: 200

Value: 3900

KS ENERGY LIMITED

(578.SI)

(578.SI)

0.180

-0.018 /

-9.09%

Vol: 61600

Value: 11542

RIVERSTONE HOLDINGS LIMITED

(AP4.SI)

(AP4.SI)

1.060

-0.095 /

-8.23%

Vol: 921800

Value: 991543

HTL INT'L HOLDINGS LIMITED

(H64.SI)

(H64.SI)

0.665

-0.055 /

-7.64%

Vol: 9367300

Value: 5696267

TOP GLOBAL LIMITED

(BHO.SI)

(BHO.SI)

0.190

-0.015 /

-7.32%

Vol: 4000

Value: 760

UNITED FOOD HOLDINGS LIMITED

(AZR.SI)

(AZR.SI)

0.103

-0.008 /

-7.21%

Vol: 2000

Value: 206

MONEYMAX FINANCIAL SERVICESLTD

(5WJ.SI)

(5WJ.SI)

0.140

-0.010 /

-6.67%

Vol: 31900

Value: 4466

WEIYE HOLDINGS LIMITED

(BMA.SI)

(BMA.SI)

0.350

-0.025 /

-6.67%

Vol: 43500

Value: 15875

KING WAN CORPORATION LIMITED

(554.SI)

(554.SI)

0.187

-0.013 /

-6.50%

Vol: 900

Value: 174

Data Source:

http://www.sgx.com/

http://sg.finance.yahoo.com/

Archive: