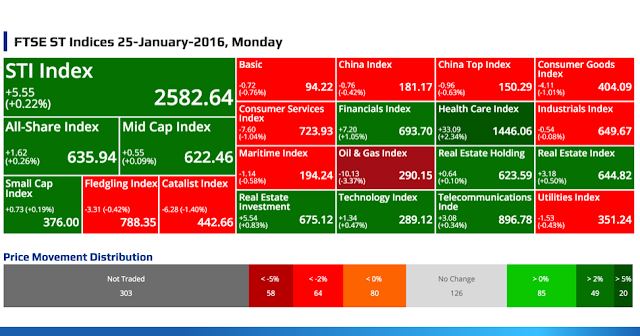

FTSE ST Indices 25-January-2016, Monday

STI Index

+5.55

(+0.22%)

(+0.22%)

2582.64

All-Share Index

+1.62

(+0.26%)

(+0.26%)

635.94

Mid Cap Index

+0.55

(+0.09%)

(+0.09%)

622.46

Small Cap Index

+0.73 (+0.19%)

376.00

Fledgling Index

-3.31 (-0.42%)

788.35

Catalist Index

-6.28 (-1.40%)

442.66

Basic

-0.72

(-0.76%)

(-0.76%)

94.22

China Index

-0.76

(-0.42%)

(-0.42%)

181.17

China Top Index

-0.96

(-0.63%)

(-0.63%)

150.29

Consumer Goods Index

-4.11

(-1.01%)

(-1.01%)

404.09

Consumer Services Index

-7.60

(-1.04%)

(-1.04%)

723.93

Financials Index

+7.20

(+1.05%)

(+1.05%)

693.70

Health Care Index

+33.09

(+2.34%)

(+2.34%)

1446.06

Industrials Index

-0.54

(-0.08%)

(-0.08%)

649.67

Maritime Index

-1.14

(-0.58%)

(-0.58%)

194.24

Oil & Gas Index

-10.13

(-3.37%)

(-3.37%)

290.15

Real Estate Holding

+0.64

(+0.10%)

(+0.10%)

623.59

Real Estate Index

+3.18

(+0.50%)

(+0.50%)

644.82

Real Estate Investment

+5.54

(+0.83%)

(+0.83%)

675.12

Technology Index

+1.34

(+0.47%)

(+0.47%)

289.12

Telecommunications Inde

+3.08

(+0.34%)

(+0.34%)

896.78

Utilities Index

-1.53

(-0.43%)

(-0.43%)

351.24

Price Movement Distribution

Top 20 Volume

INNOPAC HOLDINGS LIMITED

(I26.SI)

(I26.SI)

0.002

-0.001 /

-33.33%

Vol: 82986000

Value: 166972

NOBLE GROUP LIMITED

(N21.SI)

(N21.SI)

0.285

-0.005 /

-1.72%

Vol: 52073400

Value: 15417451

EZRA HOLDINGS LIMITED

(5DN.SI)

(5DN.SI)

0.058

- / -

Vol: 44127400

Value: 2625155

GLOBAL LOGISTIC PROP LIMITED

(MC0.SI)

(MC0.SI)

1.730

+0.005 /

+0.29%

Vol: 32089800

Value: 55631104

VALLIANZ HOLDINGS LIMITED

(545.SI)

(545.SI)

0.039

-0.002 /

-4.88%

Vol: 31668700

Value: 1340728

SINGTEL

(Z74.SI)

(Z74.SI)

3.470

+0.010 /

+0.29%

Vol: 28650900

Value: 99987278

CHINA SPORTS INTL LIMITED

(FQ8.SI)

(FQ8.SI)

0.016

-0.001 /

-5.88%

Vol: 24913000

Value: 433446

HUTCHISON PORT HOLDINGS TRUST

(NS8U.SI)

(NS8U.SI)

USD 0.475

-0.010 /

-2.06%

Vol: 20616500

Value: 9883273

REX INTERNATIONAL HOLDING LTD

(5WH.SI)

(5WH.SI)

0.071

-0.002 /

-2.74%

Vol: 18817000

Value: 1384672

ASCENDAS REAL ESTATE INV TRUST

(A17U.SI)

(A17U.SI)

2.220

+0.050 /

+2.30%

Vol: 18354600

Value: 40835374

KEPPEL CORPORATION LIMITED

(BN4.SI)

CD

(BN4.SI)

CD

4.810

-0.210 /

-4.18%

Vol: 16130600

Value: 79516830

LINC ENERGY LTD

(TI6.SI)

(TI6.SI)

0.088

- / -

Vol: 14718200

Value: 1351890

MMP RESOURCES LIMITED

(F3V.SI)

(F3V.SI)

0.006

- / -

Vol: 14279700

Value: 78594

THAI BEVERAGE PUBLIC CO LTD

(Y92.SI)

(Y92.SI)

0.675

+0.005 /

+0.75%

Vol: 14238200

Value: 9567075

GOLDEN AGRI-RESOURCES LTD

(E5H.SI)

(E5H.SI)

0.335

-0.010 /

-2.90%

Vol: 13334400

Value: 4513354

GENTING SINGAPORE PLC

(G13.SI)

(G13.SI)

0.675

-0.015 /

-2.17%

Vol: 12871700

Value: 8746365

CAPITALAND LIMITED

(C31.SI)

(C31.SI)

2.970

-0.020 /

-0.67%

Vol: 12694900

Value: 37951889

EZION HOLDINGS LIMITED

(5ME.SI)

(5ME.SI)

0.510

-0.015 /

-2.86%

Vol: 12131700

Value: 6402516

YUUZOO CORPORATION LIMITED

(AFC.SI)

(AFC.SI)

0.147

-0.004 /

-2.65%

Vol: 11865400

Value: 1809120

DBS GROUP HOLDINGS LTD

(D05.SI)

(D05.SI)

14.150

+0.280 /

+2.02%

Vol: 10554600

Value: 150294172

Top 20 Value

DBS GROUP HOLDINGS LTD

(D05.SI)

(D05.SI)

14.150

+0.280 /

+2.02%

Vol: 10554600

Value: 150294172

SINGTEL

(Z74.SI)

(Z74.SI)

3.470

+0.010 /

+0.29%

Vol: 28650900

Value: 99987278

KEPPEL CORPORATION LIMITED

(BN4.SI)

CD

(BN4.SI)

CD

4.810

-0.210 /

-4.18%

Vol: 16130600

Value: 79516830

UNITED OVERSEAS BANK LTD

(U11.SI)

(U11.SI)

18.000

+0.380 /

+2.16%

Vol: 3550738

Value: 64149175

GLOBAL LOGISTIC PROP LIMITED

(MC0.SI)

(MC0.SI)

1.730

+0.005 /

+0.29%

Vol: 32089800

Value: 55631104

OVERSEA-CHINESE BANKING CORP

(O39.SI)

(O39.SI)

7.770

+0.050 /

+0.65%

Vol: 7035700

Value: 55192317

ASCENDAS REAL ESTATE INV TRUST

(A17U.SI)

(A17U.SI)

2.220

+0.050 /

+2.30%

Vol: 18354600

Value: 40835374

CAPITALAND LIMITED

(C31.SI)

(C31.SI)

2.970

-0.020 /

-0.67%

Vol: 12694900

Value: 37951889

SINGAPORE EXCHANGE LIMITED

(S68.SI)

CD

(S68.SI)

CD

6.910

+0.090 /

+1.32%

Vol: 3302100

Value: 23078318

SEMBCORP INDUSTRIES LTD

(U96.SI)

(U96.SI)

2.310

-0.030 /

-1.28%

Vol: 9027500

Value: 21417918

CAPITALAND MALL TRUST

(C38U.SI)

CD

(C38U.SI)

CD

1.965

- / -

Vol: 9665800

Value: 18938640

NOBLE GROUP LIMITED

(N21.SI)

(N21.SI)

0.285

-0.005 /

-1.72%

Vol: 52073400

Value: 15417451

JARDINE MATHESON HLDGS LTD

(J36.SI)

(J36.SI)

USD 51.200

+0.200 /

+0.39%

Vol: 245100

Value: 12517600

HONGKONG LAND HOLDINGS LIMITED

(H78.SI)

(H78.SI)

USD 5.950

+0.040 /

+0.68%

Vol: 2088300

Value: 12438970

SINGAPORE PRESS HLDGS LTD

(T39.SI)

(T39.SI)

3.540

-0.060 /

-1.67%

Vol: 3382200

Value: 12065984

SINGAPORE AIRLINES LTD

(C6L.SI)

(C6L.SI)

10.860

-0.110 /

-1.00%

Vol: 1108500

Value: 12063723

SEMBCORP MARINE LTD

(S51.SI)

(S51.SI)

1.495

-0.060 /

-3.86%

Vol: 7750800

Value: 12008932

NEPTUNE ORIENT LINES LIMITED

(N03.SI)

(N03.SI)

1.230

-0.005 /

-0.40%

Vol: 9506500

Value: 11743134

WILMAR INTERNATIONAL LIMITED

(F34.SI)

(F34.SI)

2.680

-0.070 /

-2.55%

Vol: 4291500

Value: 11679268

HUTCHISON PORT HOLDINGS TRUST

(NS8U.SI)

(NS8U.SI)

USD 0.475

-0.010 /

-2.06%

Vol: 20616500

Value: 9883273

Top 20 Gainers ($)

UNITED OVERSEAS BANK LTD

(U11.SI)

(U11.SI)

18.000

+0.380 /

+2.16%

Vol: 3550738

Value: 64149175

DBS GROUP HOLDINGS LTD

(D05.SI)

(D05.SI)

14.150

+0.280 /

+2.02%

Vol: 10554600

Value: 150294172

JARDINE MATHESON HLDGS LTD

(J36.SI)

(J36.SI)

USD 51.200

+0.200 /

+0.39%

Vol: 245100

Value: 12517600

HAW PAR CORP LTD

(H02.SI)

(H02.SI)

7.680

+0.180 /

+2.40%

Vol: 122900

Value: 924580

RAFFLES MEDICAL GROUP LTD

(R01.SI)

(R01.SI)

4.090

+0.150 /

+3.81%

Vol: 2202400

Value: 8789016

BUKIT SEMBAWANG ESTATES LTD

(B61.SI)

(B61.SI)

4.500

+0.100 /

+2.27%

Vol: 600

Value: 2695

JARDINE STRATEGIC HLDGS LTD

(J37.SI)

(J37.SI)

USD 26.700

+0.090 /

+0.34%

Vol: 163400

Value: 4343294

SINGAPORE EXCHANGE LIMITED

(S68.SI)

CD

(S68.SI)

CD

6.910

+0.090 /

+1.32%

Vol: 3302100

Value: 23078318

UNITED INDUSTRIAL CORP LTD

(U06.SI)

(U06.SI)

3.000

+0.070 /

+2.39%

Vol: 27400

Value: 80866

STARHUB LTD

(CC3.SI)

(CC3.SI)

3.370

+0.060 /

+1.81%

Vol: 2143800

Value: 7190891

FORTUNE REAL ESTATE INV TRUST

(F25U.SI)

CD

(F25U.SI)

CD

HKD 7.850

+0.060 /

+0.77%

Vol: 777800

Value: 6072980

RIVERSTONE HOLDINGS LIMITED

(AP4.SI)

XB

(AP4.SI)

XB

1.215

+0.060 /

+5.19%

Vol: 174700

Value: 208631

ASCENDAS REAL ESTATE INV TRUST

(A17U.SI)

(A17U.SI)

2.220

+0.050 /

+2.30%

Vol: 18354600

Value: 40835374

YHI INTERNATIONAL LIMITED

(BPF.SI)

(BPF.SI)

0.340

+0.050 /

+17.24%

Vol: 25300

Value: 7141

OVERSEA-CHINESE BANKING CORP

(O39.SI)

(O39.SI)

7.770

+0.050 /

+0.65%

Vol: 7035700

Value: 55192317

FRASERS CENTREPOINT TRUST

(J69U.SI)

CD

(J69U.SI)

CD

1.925

+0.050 /

+2.67%

Vol: 2236200

Value: 4256244

FRASER AND NEAVE, LIMITED

(F99.SI)

CD

(F99.SI)

CD

1.990

+0.045 /

+2.31%

Vol: 38300

Value: 75915

WEIYE HOLDINGS LIMITED

(BMA.SI)

(BMA.SI)

0.395

+0.045 /

+12.86%

Vol: 26500

Value: 9732

CHANGTIAN PLASTIC & CHEM LTD

(AXV.SI)

(AXV.SI)

0.750

+0.045 /

+6.38%

Vol: 200300

Value: 147087

HONGKONG LAND HOLDINGS LIMITED

(H78.SI)

(H78.SI)

USD 5.950

+0.040 /

+0.68%

Vol: 2088300

Value: 12438970

Top 20 Losers ($)

KEPPEL CORPORATION LIMITED

(BN4.SI)

CD

(BN4.SI)

CD

4.810

-0.210 /

-4.18%

Vol: 16130600

Value: 79516830

GREAT EASTERN HLDGS LTD

(G07.SI)

(G07.SI)

19.770

-0.200 /

-1.00%

Vol: 4700

Value: 93331

UG HEALTHCARE CORPORATION LTD

(41A.SI)

(41A.SI)

0.300

-0.140 /

-31.82%

Vol: 8769800

Value: 2797493

PETRA FOODS LIMITED

(P34.SI)

(P34.SI)

2.140

-0.110 /

-4.89%

Vol: 41900

Value: 91124

SINGAPORE AIRLINES LTD

(C6L.SI)

(C6L.SI)

10.860

-0.110 /

-1.00%

Vol: 1108500

Value: 12063723

CREATIVE TECHNOLOGY LTD

(C76.SI)

(C76.SI)

1.080

-0.095 /

-8.09%

Vol: 58600

Value: 66024

HOTEL PROPERTIES LTD

(H15.SI)

(H15.SI)

3.470

-0.080 /

-2.25%

Vol: 3000

Value: 10410

WILMAR INTERNATIONAL LIMITED

(F34.SI)

(F34.SI)

2.680

-0.070 /

-2.55%

Vol: 4291500

Value: 11679268

SIN HENG HEAVY MACHINERY LTD

(BKA.SI)

(BKA.SI)

0.550

-0.070 /

-11.29%

Vol: 57000

Value: 33500

SEMBCORP MARINE LTD

(S51.SI)

(S51.SI)

1.495

-0.060 /

-3.86%

Vol: 7750800

Value: 12008932

SINGAPORE PRESS HLDGS LTD

(T39.SI)

(T39.SI)

3.540

-0.060 /

-1.67%

Vol: 3382200

Value: 12065984

KENCANA AGRI LIMITED

(BNE.SI)

(BNE.SI)

0.405

-0.055 /

-11.96%

Vol: 50000

Value: 20250

IPC CORPORATION LIMITED

(AZA.SI)

(AZA.SI)

1.935

-0.045 /

-2.27%

Vol: 17100

Value: 33019

CHINA YUANBANG PROP HLDGS LTD

(BCD.SI)

(BCD.SI)

0.300

-0.040 /

-11.76%

Vol: 100

Value: 30

HUPSTEEL LTD

(BMH.SI)

(BMH.SI)

0.525

-0.040 /

-7.08%

Vol: 3800

Value: 1995

TRAVELITE HOLDINGS LTD.

(BCZ.SI)

(BCZ.SI)

0.200

-0.040 /

-16.67%

Vol: 7000

Value: 1450

OLAM INTERNATIONAL LIMITED

(O32.SI)

(O32.SI)

1.590

-0.040 /

-2.45%

Vol: 323600

Value: 525790

M1 LIMITED

(B2F.SI)

CD

(B2F.SI)

CD

2.240

-0.040 /

-1.75%

Vol: 2923600

Value: 6601007

TAN CHONG INT'L LTD

(T15.SI)

(T15.SI)

HKD 2.460

-0.040 /

-1.60%

Vol: 6000

Value: 14760

COMFORTDELGRO CORPORATION LTD

(C52.SI)

(C52.SI)

2.840

-0.040 /

-1.39%

Vol: 2303400

Value: 6568196

Top 20 Gainers (%)

INFINIO GROUP LIMITED

(5G4.SI)

(5G4.SI)

0.002

+0.001 /

+100.00%

Vol: 1000200

Value: 2000

SITRA HOLDINGS (INTL) LIMITED

(5LE.SI)

(5LE.SI)

0.014

+0.003 /

+27.27%

Vol: 500200

Value: 6002

YHI INTERNATIONAL LIMITED

(BPF.SI)

(BPF.SI)

0.340

+0.050 /

+17.24%

Vol: 25300

Value: 7141

CPH LTD

(539.SI)

(539.SI)

0.007

+0.001 /

+16.67%

Vol: 200

Value: 1

KIMHENG OFFSHORE&MARINE HLDLTD

(5G2.SI)

(5G2.SI)

0.099

+0.013 /

+15.12%

Vol: 2000

Value: 198

VALUEMAX GROUP LIMITED

(T6I.SI)

(T6I.SI)

0.285

+0.035 /

+14.00%

Vol: 1000

Value: 285

WEIYE HOLDINGS LIMITED

(BMA.SI)

(BMA.SI)

0.395

+0.045 /

+12.86%

Vol: 26500

Value: 9732

FORELAND FABRICTECH HLDS LTD

(B0I.SI)

(B0I.SI)

0.021

+0.002 /

+10.53%

Vol: 100

Value: 2

ECOWISE HOLDINGS LIMITED

(5CT.SI)

(5CT.SI)

0.033

+0.003 /

+10.00%

Vol: 111100

Value: 3084

TRANSCORP HOLDINGS LIMITED

(T19.SI)

(T19.SI)

0.150

+0.013 /

+9.49%

Vol: 424600

Value: 60921

GOODLAND GROUP LIMITED

(5PC.SI)

(5PC.SI)

0.290

+0.025 /

+9.43%

Vol: 940800

Value: 258724

MONEYMAX FINANCIAL SERVICESLTD

(5WJ.SI)

(5WJ.SI)

0.141

+0.012 /

+9.30%

Vol: 38200

Value: 5450

CSC HOLDINGS LTD

(C06.SI)

(C06.SI)

0.014

+0.001 /

+7.69%

Vol: 34800

Value: 455

CHANGTIAN PLASTIC & CHEM LTD

(AXV.SI)

(AXV.SI)

0.750

+0.045 /

+6.38%

Vol: 200300

Value: 147087

BROADWAY INDUSTRIAL GROUP LTD

(B69.SI)

(B69.SI)

0.168

+0.010 /

+6.33%

Vol: 32000

Value: 5004

ACE ACHIEVE INFOCOM LIMITED

(A75.SI)

(A75.SI)

0.018

+0.001 /

+5.88%

Vol: 1000

Value: 18

CASA HOLDINGS LIMITED

(C04.SI)

(C04.SI)

0.108

+0.006 /

+5.88%

Vol: 7000

Value: 746

EMAS OFFSHORE LIMITED

(UQ4.SI)

(UQ4.SI)

0.109

+0.006 /

+5.83%

Vol: 3000

Value: 326

TERRATECH GROUP LIMITED

(40I.SI)

(40I.SI)

0.040

+0.002 /

+5.26%

Vol: 6399200

Value: 262609

FAR EAST GROUP LIMITED

(5TJ.SI)

(5TJ.SI)

0.120

+0.006 /

+5.26%

Vol: 10000

Value: 1200

Top 20 Losers (%)

ELEKTROMOTIVE GROUP LIMITED

(5VU.SI)

(5VU.SI)

0.002

-0.002 /

-50.00%

Vol: 200

Value: 0

INNOPAC HOLDINGS LIMITED

(I26.SI)

(I26.SI)

0.002

-0.001 /

-33.33%

Vol: 82986000

Value: 166972

NEXT-GEN SATELLITE COMM LTD

(B07.SI)

(B07.SI)

0.002

-0.001 /

-33.33%

Vol: 1500100

Value: 4000

METECH INTERNATIONAL LIMITED

(QG1.SI)

(QG1.SI)

0.002

-0.001 /

-33.33%

Vol: 5870000

Value: 11390

UG HEALTHCARE CORPORATION LTD

(41A.SI)

(41A.SI)

0.300

-0.140 /

-31.82%

Vol: 8769800

Value: 2797493

COMPACT METAL INDUSTRIES LTD

(T4E.SI)

(T4E.SI)

0.020

-0.008 /

-28.57%

Vol: 200000

Value: 4000

JADASON ENTERPRISES LTD

(J03.SI)

(J03.SI)

0.006

-0.002 /

-25.00%

Vol: 566000

Value: 3782

MDR LIMITED

(A27.SI)

(A27.SI)

0.003

-0.001 /

-25.00%

Vol: 1130200

Value: 4490

MAGNUS ENERGY GROUP LTD.

(41S.SI)

(41S.SI)

0.003

-0.001 /

-25.00%

Vol: 1717500

Value: 5152

OCEAN SKY INTERNATIONAL LTD

(O05.SI)

(O05.SI)

0.063

-0.013 /

-17.11%

Vol: 25100

Value: 1580

TRAVELITE HOLDINGS LTD.

(BCZ.SI)

(BCZ.SI)

0.200

-0.040 /

-16.67%

Vol: 7000

Value: 1450

HLH GROUP LIMITED

(H27.SI)

(H27.SI)

0.006

-0.001 /

-14.29%

Vol: 4771000

Value: 29476

JIUTIAN CHEMICAL GROUP LIMITED

(C8R.SI)

(C8R.SI)

0.012

-0.002 /

-14.29%

Vol: 2771000

Value: 36441

HU AN CABLE HOLDINGS LTD.

(KI3.SI)

(KI3.SI)

0.006

-0.001 /

-14.29%

Vol: 520300

Value: 3621

FUJI OFFSET PLATES MFG LTD

(508.SI)

(508.SI)

0.200

-0.030 /

-13.04%

Vol: 12500

Value: 2500

KOP LIMITED

(5I1.SI)

(5I1.SI)

0.080

-0.012 /

-13.04%

Vol: 200

Value: 16

SAN TEH LIMITED

(S46.SI)

(S46.SI)

0.240

-0.035 /

-12.73%

Vol: 10000

Value: 2400

JASPER INVESTMENTS LIMITED

(FQ7.SI)

(FQ7.SI)

0.007

-0.001 /

-12.50%

Vol: 105200

Value: 736

KENCANA AGRI LIMITED

(BNE.SI)

(BNE.SI)

0.405

-0.055 /

-11.96%

Vol: 50000

Value: 20250

CHINA YUANBANG PROP HLDGS LTD

(BCD.SI)

(BCD.SI)

0.300

-0.040 /

-11.76%

Vol: 100

Value: 30

Data Source:

http://www.sgx.com/

http://sg.finance.yahoo.com/

Archive: