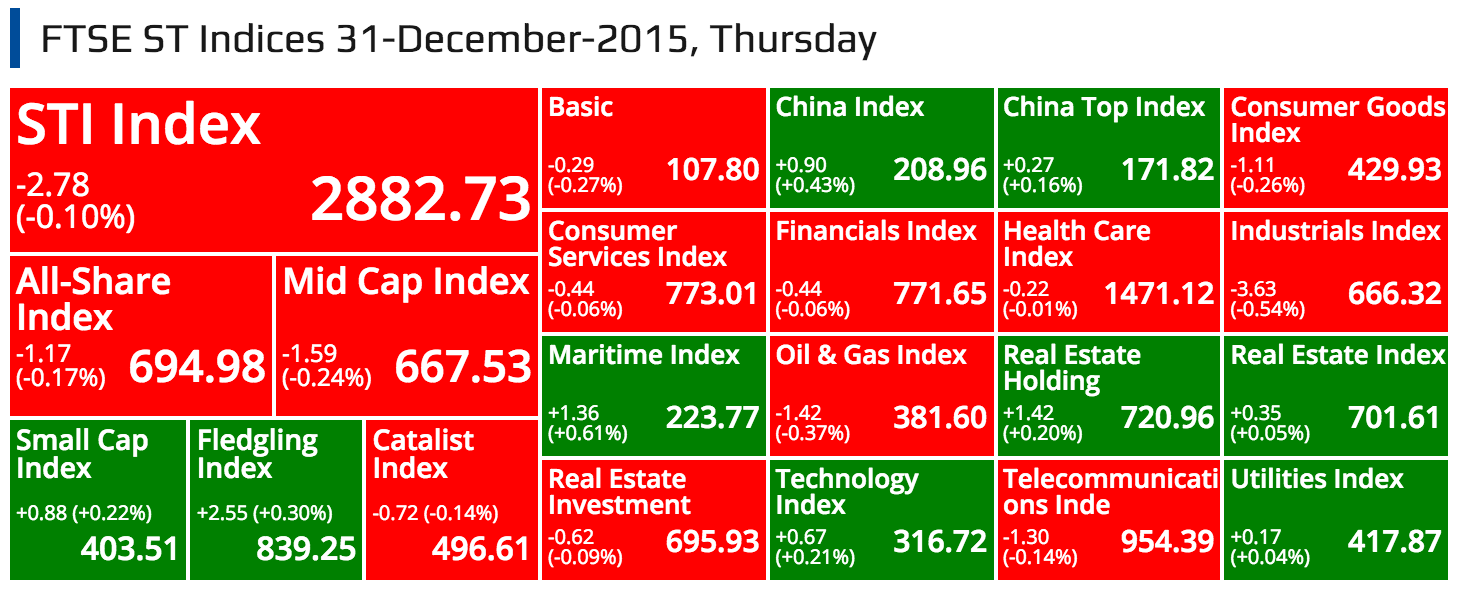

FTSE ST Indices 31-December-2015, Thursday

STI Index

-2.78

(-0.10%)

(-0.10%)

2882.73

All-Share Index

-1.17

(-0.17%)

(-0.17%)

694.98

Mid Cap Index

-1.59

(-0.24%)

(-0.24%)

667.53

Small Cap Index

+0.88 (+0.22%)

403.51

Fledgling Index

+2.55 (+0.30%)

839.25

Catalist Index

-0.72 (-0.14%)

496.61

Basic

-0.29

(-0.27%)

(-0.27%)

107.80

China Index

+0.90

(+0.43%)

(+0.43%)

208.96

China Top Index

+0.27

(+0.16%)

(+0.16%)

171.82

Consumer Goods Index

-1.11

(-0.26%)

(-0.26%)

429.93

Consumer Services Index

-0.44

(-0.06%)

(-0.06%)

773.01

Financials Index

-0.44

(-0.06%)

(-0.06%)

771.65

Health Care Index

-0.22

(-0.01%)

(-0.01%)

1471.12

Industrials Index

-3.63

(-0.54%)

(-0.54%)

666.32

Maritime Index

+1.36

(+0.61%)

(+0.61%)

223.77

Oil & Gas Index

-1.42

(-0.37%)

(-0.37%)

381.60

Real Estate Holding

+1.42

(+0.20%)

(+0.20%)

720.96

Real Estate Index

+0.35

(+0.05%)

(+0.05%)

701.61

Real Estate Investment

-0.62

(-0.09%)

(-0.09%)

695.93

Technology Index

+0.67

(+0.21%)

(+0.21%)

316.72

Telecommunications Inde

-1.30

(-0.14%)

(-0.14%)

954.39

Utilities Index

+0.17

(+0.04%)

(+0.04%)

417.87

Top 20 Volume

CHINA SPORTS INTL LIMITED

(FQ8.SI)

(FQ8.SI)

0.020

Vol: 79603000

Value: 1192970

ASIA-PACIFIC STRATEGIC INV LTD

(5RA.SI)

(5RA.SI)

0.006

Vol: 29561900

Value: 177371

NOBLE GROUP LIMITED

(N21.SI)

(N21.SI)

0.400

Vol: 17084500

Value: 6802386

IMPERIUM CROWN LIMITED

(5HT.SI)

(5HT.SI)

0.062

Vol: 16198900

Value: 1009903

MMP RESOURCES LIMITED

(F3V.SI)

(F3V.SI)

0.011

Vol: 15768900

Value: 172757

REX INTERNATIONAL HOLDING LTD

(5WH.SI)

(5WH.SI)

0.089

Vol: 14446500

Value: 1301668

CHINA ENVIRONMENT LTD.

(5OU.SI)

(5OU.SI)

0.076

Vol: 14337000

Value: 1086023

SINCAP GROUP LIMITED

(5UN.SI)

(5UN.SI)

0.055

Vol: 13707400

Value: 746733

GEO ENERGY RESOURCES LIMITED

(RE4.SI)

(RE4.SI)

0.140

Vol: 13001400

Value: 1807427

JIUTIAN CHEMICAL GROUP LIMITED

(C8R.SI)

(C8R.SI)

0.023

Vol: 12574100

Value: 280668

SPACKMAN ENTERTAINMENT GRP LTD

(40E.SI)

(40E.SI)

0.145

Vol: 11847600

Value: 1734188

CSC HOLDINGS LTD

(C06.SI)

(C06.SI)

0.014

Vol: 11360700

Value: 149161

SINGTEL

(Z74.SI)

(Z74.SI)

3.670

Vol: 9883500

Value: 36347997

KRISENERGY LTD.

(SK3.SI)

(SK3.SI)

0.166

Vol: 9506400

Value: 1618241

GENTING SINGAPORE PLC

(G13.SI)

(G13.SI)

0.770

Vol: 9246600

Value: 7186050

GOLDEN AGRI-RESOURCES LTD

(E5H.SI)

(E5H.SI)

0.340

Vol: 9078400

Value: 3102945

GENTING HONG KONG LIMITED

(S21.SI)

(S21.SI)

USD 0.320

Vol: 8974100

Value: 2912332

GLOBAL TECH (HLDGS) LIMITED

(G11.SI)

(G11.SI)

0.051

Vol: 8141200

Value: 414775

LINC ENERGY LTD

(TI6.SI)

(TI6.SI)

0.096

Vol: 7454300

Value: 751786

INFORMATICS EDUCATION LTD.

(I03.SI)

CE

(I03.SI)

CE

0.033

Vol: 6993700

Value: 244534

Top 20 Value

SINGTEL

(Z74.SI)

(Z74.SI)

3.670

Vol: 9883500

Value: 36347997

DBS GROUP HOLDINGS LTD

(D05.SI)

(D05.SI)

16.690

Vol: 1500200

Value: 25115756

KEPPEL CORPORATION LIMITED

(BN4.SI)

(BN4.SI)

6.510

Vol: 3637800

Value: 23609103

OVERSEA-CHINESE BANKING CORP

(O39.SI)

(O39.SI)

8.800

Vol: 2468500

Value: 21802848

UNITED OVERSEAS BANK LTD

(U11.SI)

(U11.SI)

19.610

Vol: 1104500

Value: 21683660

CAPITALAND LIMITED

(C31.SI)

(C31.SI)

3.350

Vol: 2945900

Value: 9915563

GLOBAL LOGISTIC PROP LIMITED

(MC0.SI)

(MC0.SI)

2.150

Vol: 4049500

Value: 8704021

CITY DEVELOPMENTS LIMITED

(C09.SI)

(C09.SI)

7.650

Vol: 1085000

Value: 8315023

SINGAPORE EXCHANGE LIMITED

(S68.SI)

(S68.SI)

7.700

Vol: 1033300

Value: 7954691

COMFORTDELGRO CORPORATION LTD

(C52.SI)

(C52.SI)

3.050

Vol: 2594100

Value: 7880844

HONGKONG LAND HOLDINGS LIMITED

(H78.SI)

(H78.SI)

USD 7.000

Vol: 1083800

Value: 7533626

ASCENDAS REAL ESTATE INV TRUST

(A17U.SI)

(A17U.SI)

2.280

Vol: 3169800

Value: 7222062

GENTING SINGAPORE PLC

(G13.SI)

(G13.SI)

0.770

Vol: 9246600

Value: 7186050

NOBLE GROUP LIMITED

(N21.SI)

(N21.SI)

0.400

Vol: 17084500

Value: 6802386

SINGAPORE POST LIMITED

(S08.SI)

(S08.SI)

1.640

Vol: 3661900

Value: 5990322

WILMAR INTERNATIONAL LIMITED

(F34.SI)

(F34.SI)

2.940

Vol: 1982400

Value: 5830693

NEPTUNE ORIENT LINES LIMITED

(N03.SI)

(N03.SI)

1.230

Vol: 4556600

Value: 5622834

SUNTEC REAL ESTATE INV TRUST

(T82U.SI)

(T82U.SI)

1.550

Vol: 3417600

Value: 5369028

SINGAPORE AIRLINES LTD

(C6L.SI)

(C6L.SI)

11.200

Vol: 466300

Value: 5215254

JARDINE MATHESON HLDGS LTD

(J36.SI)

(J36.SI)

USD 48.730

Vol: 90500

Value: 4416620

Top 20 Gainers ($)

JARDINE CYCLE & CARRIAGE LTD

(C07.SI)

(C07.SI)

34.850

Vol: 106700

Value: 3727541

CHINA MINZHONG FOOD CORP LTD

(K2N.SI)

(K2N.SI)

0.835

Vol: 209900

Value: 173354

GREAT EASTERN HLDGS LTD

(G07.SI)

(G07.SI)

20.240

Vol: 300

Value: 6078

HOTEL PROPERTIES LTD

(H15.SI)

(H15.SI)

3.810

Vol: 200

Value: 765

PLASTOFORM HOLDINGS LIMITED

(AYD.SI)

(AYD.SI)

0.300

Vol: 1000

Value: 300

GLOBAL TESTING CORPORATION LTD

(AYN.SI)

(AYN.SI)

1.100

Vol: 200

Value: 220

SP CORPORATION LIMITED

(AWE.SI)

(AWE.SI)

1.095

Vol: 11100

Value: 11056

HONGKONG LAND HOLDINGS LIMITED

(H78.SI)

(H78.SI)

USD 7.000

Vol: 1083800

Value: 7533626

SINGTEL 10

(Z77.SI)

(Z77.SI)

3.740

Vol: 22410

Value: 82280

CHINA DAIRY GROUP LTD

(T16.SI)

(T16.SI)

0.188

Vol: 316600

Value: 58957

CWT LIMITED

(C14.SI)

(C14.SI)

1.920

Vol: 534300

Value: 1015605

KHONG GUAN FLOUR MILLING LTD

(K03.SI)

(K03.SI)

2.030

Vol: 1900

Value: 3863

UNITED OVERSEAS BANK LTD

(U11.SI)

(U11.SI)

19.610

Vol: 1104500

Value: 21683660

MICRO-MECHANICS (HOLDINGS) LTD

(5DD.SI)

(5DD.SI)

0.895

Vol: 44200

Value: 37290

STARHUB LTD

(CC3.SI)

(CC3.SI)

3.700

Vol: 939700

Value: 3461258

S I2I LIMITED

(BAI.SI)

(BAI.SI)

0.960

Vol: 1900

Value: 1824

MEWAH INTERNATIONAL INC.

(MV4.SI)

(MV4.SI)

0.350

Vol: 800600

Value: 268623

YEO HIAP SENG LTD

(Y03.SI)

(Y03.SI)

1.340

Vol: 800

Value: 1056

VENTURE CORPORATION LIMITED

(V03.SI)

(V03.SI)

8.200

Vol: 182500

Value: 1500166

PTERIS GLOBAL LIMITED

(UD3.SI)

(UD3.SI)

0.580

Vol: 11200

Value: 6039

Top 20 Losers ($)

JARDINE MATHESON HLDGS LTD

(J36.SI)

(J36.SI)

USD 48.730

Vol: 90500

Value: 4416620

JARDINE STRATEGIC HLDGS LTD

(J37.SI)

(J37.SI)

USD 27.330

Vol: 28300

Value: 774637

PSL HOLDINGS LTD

(BLL.SI)

(BLL.SI)

0.525

Vol: 5768199

Value: 2884349

CITY DEVELOPMENTS LIMITED

(C09.SI)

(C09.SI)

7.650

Vol: 1085000

Value: 8315023

CHINA INTERNATIONAL HLDGS LTD

(BEH.SI)

(BEH.SI)

0.290

Vol: 300

Value: 87

FRASER AND NEAVE, LIMITED

(F99.SI)

CD

(F99.SI)

CD

2.080

Vol: 100200

Value: 210491

TPV TECHNOLOGY LIMITED

(T18.SI)

(T18.SI)

0.141

Vol: 1000

Value: 141

SATS LTD.

(S58.SI)

(S58.SI)

3.840

Vol: 496400

Value: 1914711

OVERSEA-CHINESE BANKING CORP

(O39.SI)

(O39.SI)

8.800

Vol: 2468500

Value: 21802848

SIA ENGINEERING CO LTD

(S59.SI)

(S59.SI)

3.700

Vol: 45700

Value: 169577

SUNTEC REAL ESTATE INV TRUST

(T82U.SI)

(T82U.SI)

1.550

Vol: 3417600

Value: 5369028

CAPITALAND LIMITED

(C31.SI)

(C31.SI)

3.350

Vol: 2945900

Value: 9915563

DBS GROUP HOLDINGS LTD

(D05.SI)

(D05.SI)

16.690

Vol: 1500200

Value: 25115756

BUKIT SEMBAWANG ESTATES LTD

(B61.SI)

(B61.SI)

4.500

Vol: 6600

Value: 29714

OVERSEAS EDUCATION LIMITED

(RQ1.SI)

(RQ1.SI)

0.495

Vol: 25200

Value: 12269

HAW PAR CORP LTD

(H02.SI)

(H02.SI)

8.270

Vol: 1000

Value: 8340

SINGAPORE TECH ENGINEERING LTD

(S63.SI)

(S63.SI)

3.010

Vol: 1145900

Value: 3464134

CAPITALAND RETAIL CHINA TRUST

(AU8U.SI)

(AU8U.SI)

1.490

Vol: 326100

Value: 488659

LHT HOLDINGS LIMITED

(BEI.SI)

(BEI.SI)

0.470

Vol: 200

Value: 94

HIAP SENG ENGINEERING LTD

(510.SI)

(510.SI)

0.105

Vol: 1500

Value: 157

Top 20 Gainers (%)

CHINA SPORTS INTL LIMITED

(FQ8.SI)

(FQ8.SI)

0.020

Vol: 79603000

Value: 1192970

CHINA DAIRY GROUP LTD

(T16.SI)

(T16.SI)

0.188

Vol: 316600

Value: 58957

INNOPAC HOLDINGS LIMITED

(I26.SI)

(I26.SI)

0.003

Vol: 352000

Value: 1056

PLASTOFORM HOLDINGS LIMITED

(AYD.SI)

(AYD.SI)

0.300

Vol: 1000

Value: 300

CHINA MINZHONG FOOD CORP LTD

(K2N.SI)

(K2N.SI)

0.835

Vol: 209900

Value: 173354

CPH LTD

(539.SI)

(539.SI)

0.006

Vol: 180100

Value: 900

OUHUA ENERGY HOLDINGS LIMITED

(AJ2.SI)

(AJ2.SI)

0.033

Vol: 40000

Value: 1320

MEWAH INTERNATIONAL INC.

(MV4.SI)

(MV4.SI)

0.350

Vol: 800600

Value: 268623

YHI INTERNATIONAL LIMITED

(Y08.SI)

(Y08.SI)

0.190

Vol: 210100

Value: 36559

JIUTIAN CHEMICAL GROUP LIMITED

(C8R.SI)

(C8R.SI)

0.023

Vol: 12574100

Value: 280668

EUROPTRONIC GROUP LTD

(E23.SI)

(E23.SI)

0.008

Vol: 1000100

Value: 8000

IPS SECUREX HOLDINGS LIMITED

(42N.SI)

(42N.SI)

0.310

Vol: 1933700

Value: 570610

JASPER INVESTMENTS LIMITED

(FQ7.SI)

(FQ7.SI)

0.009

Vol: 1400100

Value: 12600

SP CORPORATION LIMITED

(AWE.SI)

(AWE.SI)

1.095

Vol: 11100

Value: 11056

GLOBAL TESTING CORPORATION LTD

(AYN.SI)

(AYN.SI)

1.100

Vol: 200

Value: 220

MYP LTD.

(F86.SI)

(F86.SI)

0.235

Vol: 8000

Value: 1842

CHINA YUANBANG PROP HLDGS LTD

(BCD.SI)

(BCD.SI)

0.295

Vol: 11900

Value: 3584

SITRA HOLDINGS (INTL) LIMITED

(5LE.SI)

(5LE.SI)

0.013

Vol: 1650100

Value: 21451

VALUEMAX GROUP LIMITED

(T6I.SI)

(T6I.SI)

0.290

Vol: 100

Value: 29

SAMUDERA SHIPPING LINE LTD

(S56.SI)

(S56.SI)

0.220

Vol: 100200

Value: 21619

Top 20 Losers (%)

CHASEN HOLDINGS LIMITED

(5NV.SI)

XR

(5NV.SI)

XR

0.040

Vol: 992800

Value: 42516

BLUMONT GROUP LTD.

(A33.SI)

(A33.SI)

0.002

Vol: 500000

Value: 1000

TPV TECHNOLOGY LIMITED

(T18.SI)

(T18.SI)

0.141

Vol: 1000

Value: 141

CACOLA FURNITURE INTL LIMITED

(D2U.SI)

(D2U.SI)

0.006

Vol: 1015000

Value: 6090

DAPAI INTL HLDG CO. LTD.

(FP1.SI)

(FP1.SI)

0.007

Vol: 324000

Value: 2268

HIAP SENG ENGINEERING LTD

(510.SI)

(510.SI)

0.105

Vol: 1500

Value: 157

CHINA INTERNATIONAL HLDGS LTD

(BEH.SI)

(BEH.SI)

0.290

Vol: 300

Value: 87

PSL HOLDINGS LTD

(BLL.SI)

(BLL.SI)

0.525

Vol: 5768199

Value: 2884349

FORELAND FABRICTECH HLDS LTD

(B0I.SI)

(B0I.SI)

0.020

Vol: 100

Value: 2

TRANSCORP HOLDINGS LIMITED

(T19.SI)

(T19.SI)

0.105

Vol: 3700

Value: 388

OLS ENTERPRISE LTD.

(ADJ.SI)

(ADJ.SI)

0.006

Vol: 500

Value: 3

ASIA-PACIFIC STRATEGIC INV LTD

(5RA.SI)

(5RA.SI)

0.006

Vol: 29561900

Value: 177371

LINC ENERGY LTD

(TI6.SI)

(TI6.SI)

0.096

Vol: 7454300

Value: 751786

INFORMATICS EDUCATION LTD.

(I03.SI)

CE

(I03.SI)

CE

0.033

Vol: 6993700

Value: 244534

IEV HOLDINGS LIMITED

(5TN.SI)

(5TN.SI)

0.055

Vol: 100

Value: 5

BLUE SKY POWER HOLDINGSLIMITED

(UQ7.SI)

(UQ7.SI)

0.083

Vol: 100000

Value: 8300

MERCURIUS CAP INVESTMENT LTD

(5RF.SI)

(5RF.SI)

0.009

Vol: 2365000

Value: 21485

KRISENERGY LTD.

(SK3.SI)

(SK3.SI)

0.166

Vol: 9506400

Value: 1618241

OSSIA INTERNATIONAL LTD

(O08.SI)

(O08.SI)

0.190

Vol: 1000

Value: 190

HIAP TONG CORPORATION LTD.

(5PO.SI)

(5PO.SI)

0.082

Vol: 132700

Value: 9604

Data Source:

http://www.sgx.com/

http://sg.finance.yahoo.com/

Archive: