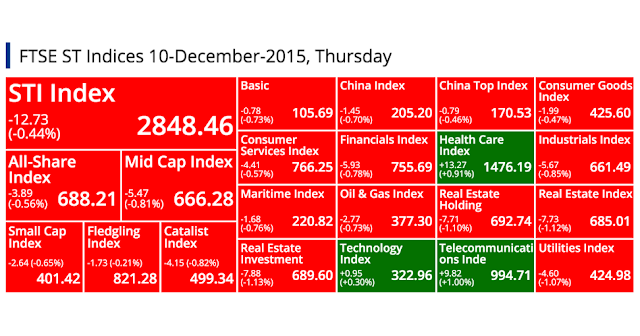

FTSE ST Indices 10-December-2015, Thursday

STI Index

-12.73

(-0.44%)

(-0.44%)

2848.46

All-Share Index

-3.89

(-0.56%)

(-0.56%)

688.21

Mid Cap Index

-5.47

(-0.81%)

(-0.81%)

666.28

Small Cap Index

-2.64 (-0.65%)

401.42

Fledgling Index

-1.73 (-0.21%)

821.28

Catalist Index

-4.15 (-0.82%)

499.34

Basic

-0.78

(-0.73%)

(-0.73%)

105.69

China Index

-1.45

(-0.70%)

(-0.70%)

205.20

China Top Index

-0.79

(-0.46%)

(-0.46%)

170.53

Consumer Goods Index

-1.99

(-0.47%)

(-0.47%)

425.60

Consumer Services Index

-4.41

(-0.57%)

(-0.57%)

766.25

Financials Index

-5.93

(-0.78%)

(-0.78%)

755.69

Health Care Index

+13.27

(+0.91%)

(+0.91%)

1476.19

Industrials Index

-5.67

(-0.85%)

(-0.85%)

661.49

Maritime Index

-1.68

(-0.76%)

(-0.76%)

220.82

Oil & Gas Index

-2.77

(-0.73%)

(-0.73%)

377.30

Real Estate Holding

-7.71

(-1.10%)

(-1.10%)

692.74

Real Estate Index

-7.73

(-1.12%)

(-1.12%)

685.01

Real Estate Investment

-7.88

(-1.13%)

(-1.13%)

689.60

Technology Index

+0.95

(+0.30%)

(+0.30%)

322.96

Telecommunications Inde

+9.82

(+1.00%)

(+1.00%)

994.71

Utilities Index

-4.60

(-1.07%)

(-1.07%)

424.98

Top 20 Volume

CHINA ENVIRONMENT LTD.

(5OU.SI)

(5OU.SI)

0.088

Vol: 67334300

Value: 5760664

NEW SILKROUTES GROUP LIMITED

(G77.SI)

(G77.SI)

0.001

Vol: 62219100

Value: 62219

ASCENDAS REAL ESTATE INV TRUST

(A17U.SI)

CD

(A17U.SI)

CD

2.280

Vol: 33368600

Value: 74637153

NOBLE GROUP LIMITED

(N21.SI)

(N21.SI)

0.390

Vol: 26625400

Value: 10519108

HUTCHISON PORT HOLDINGS TRUST

(NS8U.SI)

(NS8U.SI)

USD 0.545

Vol: 26413000

Value: 14448406

ROWSLEY LTD.

(A50.SI)

(A50.SI)

0.186

Vol: 25585800

Value: 4854297

TIGER AIRWAYS HOLDINGS LIMITED

(J7X.SI)

(J7X.SI)

0.410

Vol: 25368900

Value: 10402944

NEPTUNE ORIENT LINES LIMITED

(N03.SI)

(N03.SI)

1.220

Vol: 22821800

Value: 27828090

CSC HOLDINGS LTD R

(BLXR.SI)

(BLXR.SI)

0.013

Vol: 18642800

Value: 231137

SPACKMAN ENTERTAINMENT GRP LTD

(40E.SI)

(40E.SI)

0.146

Vol: 18339400

Value: 2727305

GOLDEN AGRI-RESOURCES LTD

(E5H.SI)

(E5H.SI)

0.330

Vol: 17457300

Value: 5743308

SINGTEL

(Z74.SI)

CD

(Z74.SI)

CD

3.850

Vol: 15850500

Value: 60887444

ENVIRO-HUB HOLDINGS LTD

(L23.SI)

(L23.SI)

0.085

Vol: 14735500

Value: 1373409

SINCAP GROUP LIMITED

(5UN.SI)

(5UN.SI)

0.064

Vol: 14153500

Value: 955676

SINOCLOUD GROUP LIMITED

(5EK.SI)

(5EK.SI)

0.003

Vol: 14060000

Value: 42180

ALLIANCE MINERAL ASSETSLIMITED

(40F.SI)

(40F.SI)

0.146

Vol: 13781500

Value: 2046978

CAPITALAND MALL TRUST

(C38U.SI)

(C38U.SI)

1.895

Vol: 13205900

Value: 24853371

YUUZOO CORPORATION LIMITED

(AFC.SI)

(AFC.SI)

0.192

Vol: 12934400

Value: 2504520

EZRA HOLDINGS LIMITED

(5DN.SI)

(5DN.SI)

0.103

Vol: 12395700

Value: 1283576

JUMBO GROUP LIMITED

(42R.SI)

(42R.SI)

0.395

Vol: 12037900

Value: 4859110

Top 20 Value

DBS GROUP HOLDINGS LTD

(D05.SI)

(D05.SI)

16.460

Vol: 5107400

Value: 84165301

ASCENDAS REAL ESTATE INV TRUST

(A17U.SI)

CD

(A17U.SI)

CD

2.280

Vol: 33368600

Value: 74637153

SINGTEL

(Z74.SI)

CD

(Z74.SI)

CD

3.850

Vol: 15850500

Value: 60887444

OVERSEA-CHINESE BANKING CORP

(O39.SI)

(O39.SI)

8.640

Vol: 6594400

Value: 57005527

UNITED OVERSEAS BANK LTD

(U11.SI)

(U11.SI)

19.250

Vol: 1999400

Value: 38497747

NEPTUNE ORIENT LINES LIMITED

(N03.SI)

(N03.SI)

1.220

Vol: 22821800

Value: 27828090

WILMAR INTERNATIONAL LIMITED

(F34.SI)

(F34.SI)

2.890

Vol: 9601300

Value: 27674987

CAPITALAND MALL TRUST

(C38U.SI)

(C38U.SI)

1.895

Vol: 13205900

Value: 24853371

CAPITALAND LIMITED

(C31.SI)

(C31.SI)

3.180

Vol: 7527500

Value: 23993966

CITY DEVELOPMENTS LIMITED

(C09.SI)

(C09.SI)

7.150

Vol: 2597400

Value: 18634058

SINGAPORE EXCHANGE LIMITED

(S68.SI)

(S68.SI)

7.400

Vol: 2394800

Value: 17753312

HONGKONG LAND HOLDINGS LIMITED

(H78.SI)

(H78.SI)

USD 6.930

Vol: 2523500

Value: 17604312

GLOBAL LOGISTIC PROP LIMITED

(MC0.SI)

(MC0.SI)

2.000

Vol: 8323200

Value: 16771158

SINGAPORE AIRLINES LTD

(C6L.SI)

(C6L.SI)

10.920

Vol: 1326900

Value: 14546804

HUTCHISON PORT HOLDINGS TRUST

(NS8U.SI)

(NS8U.SI)

USD 0.545

Vol: 26413000

Value: 14448406

SINGAPORE PRESS HLDGS LTD

(T39.SI)

XD

(T39.SI)

XD

3.870

Vol: 3266800

Value: 12655207

KEPPEL CORPORATION LIMITED

(BN4.SI)

(BN4.SI)

6.400

Vol: 1955800

Value: 12535264

COMFORTDELGRO CORPORATION LTD

(C52.SI)

(C52.SI)

2.990

Vol: 4107900

Value: 12444544

YANGZIJIANG SHIPBLDG HLDGS LTD

(BS6.SI)

(BS6.SI)

1.110

Vol: 10619400

Value: 11856832

NOBLE GROUP LIMITED

(N21.SI)

(N21.SI)

0.390

Vol: 26625400

Value: 10519108

Top 20 Gainers ($)

JARDINE CYCLE & CARRIAGE LTD

(C07.SI)

(C07.SI)

34.920

Vol: 278300

Value: 9713909

GREAT EASTERN HLDGS LTD

(G07.SI)

(G07.SI)

20.200

Vol: 3500

Value: 70034

HOTEL ROYAL LTD

(H12.SI)

(H12.SI)

3.600

Vol: 100

Value: 360

HAW PAR CORP LTD

(H02.SI)

(H02.SI)

8.290

Vol: 10900

Value: 89103

OVERSEAS EDUCATION LIMITED

(RQ1.SI)

(RQ1.SI)

0.580

Vol: 36500

Value: 18712

MYP LTD.

(F86.SI)

(F86.SI)

0.230

Vol: 3800

Value: 874

RAFFLES MEDICAL GROUP LTD

(R01.SI)

(R01.SI)

4.280

Vol: 260000

Value: 1101673

CHANGTIAN PLASTIC & CHEM LTD

(AXV.SI)

(AXV.SI)

0.740

Vol: 4000

Value: 2960

SHINVEST HOLDING LTD.

(BJW.SI)

(BJW.SI)

0.950

Vol: 14100

Value: 12729

RIVERSTONE HOLDINGS LIMITED

(AP4.SI)

(AP4.SI)

2.180

Vol: 526100

Value: 1112715

STRAITS TRADING CO. LTD

(S20.SI)

(S20.SI)

2.060

Vol: 5000

Value: 10300

STARHUB LTD

(CC3.SI)

(CC3.SI)

3.610

Vol: 2315600

Value: 8326588

VICOM LTD

(V01.SI)

(V01.SI)

6.050

Vol: 2800

Value: 16880

SINGTEL

(Z74.SI)

CD

(Z74.SI)

CD

3.850

Vol: 15850500

Value: 60887444

FAR EAST ORCHARD LIMITED

(O10.SI)

(O10.SI)

1.525

Vol: 10100

Value: 14885

TAN CHONG INT'L LTD

(T15.SI)

(T15.SI)

HKD 2.630

Vol: 71000

Value: 186730

NSL LTD.

(N02.SI)

(N02.SI)

1.480

Vol: 300

Value: 444

KEPPEL TELE & TRAN

(K11.SI)

(K11.SI)

1.470

Vol: 118900

Value: 173595

XYEC HOLDINGS CO., LTD.

(5WR.SI)

(5WR.SI)

0.225

Vol: 63000

Value: 13775

INTERNATIONAL PRESS SOFTCOM

(571.SI)

(571.SI)

0.049

Vol: 82100

Value: 1478

Top 20 Losers ($)

JARDINE MATHESON HLDGS LTD

(J36.SI)

(J36.SI)

USD 48.610

Vol: 162000

Value: 7866749

UNITED OVERSEAS BANK LTD

(U11.SI)

(U11.SI)

19.250

Vol: 1999400

Value: 38497747

ALIBABA PICTURES GROUP LIMITED

(S91.SI)

(S91.SI)

HKD 1.750

Vol: 800

Value: 1400

SINGAPORE AIRLINES LTD

(C6L.SI)

(C6L.SI)

10.920

Vol: 1326900

Value: 14546804

HONGKONG LAND HOLDINGS LIMITED

(H78.SI)

(H78.SI)

USD 6.930

Vol: 2523500

Value: 17604312

ASCENDAS REAL ESTATE INV TRUST

(A17U.SI)

CD

(A17U.SI)

CD

2.280

Vol: 33368600

Value: 74637153

S I2I LIMITED

(BAI.SI)

(BAI.SI)

0.720

Vol: 500

Value: 360

ADVANCED HOLDINGS LTD.

(BLZ.SI)

(BLZ.SI)

0.260

Vol: 6700

Value: 2219

SEMBCORP MARINE LTD

(S51.SI)

(S51.SI)

1.735

Vol: 5554900

Value: 9764950

CHINA INTERNATIONAL HLDGS LTD

(BEH.SI)

(BEH.SI)

0.270

Vol: 1100

Value: 298

IHH HEALTHCARE BERHAD

(Q0F.SI)

(Q0F.SI)

2.050

Vol: 1000

Value: 2050

DARCO WATER TECHNOLOGIES LTD

(BLR.SI)

(BLR.SI)

0.690

Vol: 17700

Value: 5500

FIRST RESOURCES LIMITED

(EB5.SI)

(EB5.SI)

1.920

Vol: 2272200

Value: 4389254

VENTURE CORPORATION LIMITED

(V03.SI)

(V03.SI)

8.350

Vol: 391300

Value: 3274769

FISCHER TECH LTD

(BDV.SI)

(BDV.SI)

0.895

Vol: 2000

Value: 1790

CREATIVE TECHNOLOGY LTD

(C76.SI)

(C76.SI)

1.010

Vol: 4550

Value: 4585

SINGAPORE EXCHANGE LIMITED

(S68.SI)

(S68.SI)

7.400

Vol: 2394800

Value: 17753312

COMFORTDELGRO CORPORATION LTD

(C52.SI)

(C52.SI)

2.990

Vol: 4107900

Value: 12444544

WILLAS-ARRAY ELEC (HLDGS) LTD

(BDR.SI)

(BDR.SI)

0.750

Vol: 8000

Value: 6000

DBS GROUP HOLDINGS LTD

(D05.SI)

(D05.SI)

16.460

Vol: 5107400

Value: 84165301

Top 20 Gainers (%)

INTERNATIONAL PRESS SOFTCOM

(571.SI)

(571.SI)

0.049

Vol: 82100

Value: 1478

MYP LTD.

(F86.SI)

(F86.SI)

0.230

Vol: 3800

Value: 874

ELEKTROMOTIVE GROUP LIMITED

(5VU.SI)

(5VU.SI)

0.004

Vol: 499900

Value: 1949

ATTILAN GROUP LIMITED

(5ET.SI)

(5ET.SI)

0.005

Vol: 100000

Value: 500

IPCO INT'L LIMITED

(I11.SI)

(I11.SI)

0.005

Vol: 5801100

Value: 23205

LIONGOLD CORP LTD

(A78.SI)

(A78.SI)

0.007

Vol: 1754000

Value: 12278

OVERSEAS EDUCATION LIMITED

(RQ1.SI)

(RQ1.SI)

0.580

Vol: 36500

Value: 18712

LERENO BIO-CHEM LTD.

(42H.SI)

(42H.SI)

0.074

Vol: 92600

Value: 6343

XYEC HOLDINGS CO., LTD.

(5WR.SI)

(5WR.SI)

0.225

Vol: 63000

Value: 13775

TEHO INTERNATIONAL INC LTD.

(5OQ.SI)

(5OQ.SI)

0.118

Vol: 400

Value: 47

PAVILLON HOLDINGS LTD.

(596.SI)

(596.SI)

0.050

Vol: 40100

Value: 2025

MERCURIUS CAP INVESTMENT LTD

(5RF.SI)

(5RF.SI)

0.010

Vol: 350000

Value: 3250

CHANGTIAN PLASTIC & CHEM LTD

(AXV.SI)

(AXV.SI)

0.740

Vol: 4000

Value: 2960

ASIAN MICRO HOLDINGS LTD

(585.SI)

(585.SI)

0.013

Vol: 550000

Value: 7150

LEY CHOON GROUP HLDG LIMITED

(Q0X.SI)

(Q0X.SI)

0.040

Vol: 17000

Value: 680

VIKING OFFSHORE AND MARINE LTD

(557.SI)

(557.SI)

0.054

Vol: 100000

Value: 5400

A-SONIC AEROSPACE LIMITED

(AWQ.SI)

(AWQ.SI)

0.270

Vol: 207300

Value: 54768

CHINA AUTO ELECTRONICS GRP LTD

(T42.SI)

(T42.SI)

0.081

Vol: 465000

Value: 36940

LHN LIMITED

(41O.SI)

(41O.SI)

0.140

Vol: 1000

Value: 140

ZICO HOLDINGS INC.

(40W.SI)

(40W.SI)

0.350

Vol: 50000

Value: 16875

Top 20 Losers (%)

FULL APEX (HOLDINGS) LIMITED

(F18.SI)

(F18.SI)

0.028

Vol: 40000

Value: 1040

BLUMONT GROUP LTD.

(A33.SI)

(A33.SI)

0.002

Vol: 8375000

Value: 16850

CSC HOLDINGS LTD R1

(BLYR.SI)

(BLYR.SI)

0.009

Vol: 19603

Value: 175

P99 HOLDINGS LIMITED

(5UV.SI)

(5UV.SI)

0.050

Vol: 110000

Value: 5500

ADVANCED HOLDINGS LTD.

(BLZ.SI)

(BLZ.SI)

0.260

Vol: 6700

Value: 2219

DAPAI INTL HLDG CO. LTD.

(FP1.SI)

(FP1.SI)

0.008

Vol: 40200

Value: 321

MDR LIMITED

(A27.SI)

(A27.SI)

0.004

Vol: 1000200

Value: 4000

ASIA-PACIFIC STRATEGIC INV LTD

(5RA.SI)

(5RA.SI)

0.004

Vol: 3901000

Value: 19499

CHINA INTERNATIONAL HLDGS LTD

(BEH.SI)

(BEH.SI)

0.270

Vol: 1100

Value: 298

KLW HOLDINGS LTD

(504.SI)

(504.SI)

0.005

Vol: 173900

Value: 973

SITRA HOLDINGS (INTL) LIMITED

(5LE.SI)

(5LE.SI)

0.012

Vol: 150000

Value: 1800

CACOLA FURNITURE INTL LIMITED

(D2U.SI)

(D2U.SI)

0.006

Vol: 500000

Value: 3000

KS ENERGY LIMITED

(578.SI)

(578.SI)

0.225

Vol: 3500

Value: 825

IMPERIUM CROWN LIMITED

(5HT.SI)

(5HT.SI)

0.067

Vol: 6323900

Value: 441129

TERRATECH GROUP LIMITED

(40I.SI)

(40I.SI)

0.043

Vol: 3760500

Value: 167328

TOP GLOBAL LIMITED

(BHO.SI)

(BHO.SI)

0.300

Vol: 2200

Value: 660

IFS CAPITAL LIMITED

(I49.SI)

(I49.SI)

0.305

Vol: 12600

Value: 3968

EUROPTRONIC GROUP LTD

(E23.SI)

(E23.SI)

0.008

Vol: 50200

Value: 401

SUNMOON FOOD COMPANY LIMITED

(AAJ.SI)

(AAJ.SI)

0.066

Vol: 6204700

Value: 418360

OUHUA ENERGY HOLDINGS LIMITED

(AJ2.SI)

(AJ2.SI)

0.042

Vol: 40000

Value: 1382

Data Source:

http://www.sgx.com/

http://sg.finance.yahoo.com/

Archive: