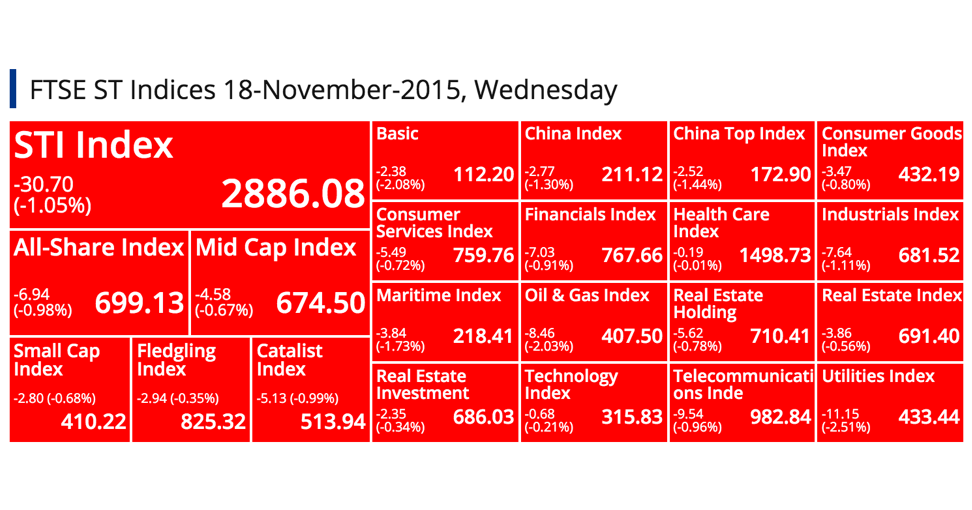

FTSE ST Indices 18-November-2015, Wednesday

STI Index

-30.70

(-1.05%)

(-1.05%)

2886.08

All-Share Index

-6.94

(-0.98%)

(-0.98%)

699.13

Mid Cap Index

-4.58

(-0.67%)

(-0.67%)

674.50

Small Cap Index

-2.80 (-0.68%)

410.22

Fledgling Index

-2.94 (-0.35%)

825.32

Catalist Index

-5.13 (-0.99%)

513.94

Basic

-2.38

(-2.08%)

(-2.08%)

112.20

China Index

-2.77

(-1.30%)

(-1.30%)

211.12

China Top Index

-2.52

(-1.44%)

(-1.44%)

172.90

Consumer Goods Index

-3.47

(-0.80%)

(-0.80%)

432.19

Consumer Services Index

-5.49

(-0.72%)

(-0.72%)

759.76

Financials Index

-7.03

(-0.91%)

(-0.91%)

767.66

Health Care Index

-0.19

(-0.01%)

(-0.01%)

1498.73

Industrials Index

-7.64

(-1.11%)

(-1.11%)

681.52

Maritime Index

-3.84

(-1.73%)

(-1.73%)

218.41

Oil & Gas Index

-8.46

(-2.03%)

(-2.03%)

407.50

Real Estate Holding

-5.62

(-0.78%)

(-0.78%)

710.41

Real Estate Index

-3.86

(-0.56%)

(-0.56%)

691.40

Real Estate Investment

-2.35

(-0.34%)

(-0.34%)

686.03

Technology Index

-0.68

(-0.21%)

(-0.21%)

315.83

Telecommunications Inde

-9.54

(-0.96%)

(-0.96%)

982.84

Utilities Index

-11.15

(-2.51%)

(-2.51%)

433.44

Top 20 Volume

SIIC ENVIRONMENT HOLDINGS LTD.

(BHK.SI)

(BHK.SI)

0.785

Vol: 106931700

Value: 82594379

YUUZOO CORPORATION LIMITED

(AFC.SI)

(AFC.SI)

0.220

Vol: 74975100

Value: 17027236

QT VASCULAR LTD.

(5I0.SI)

(5I0.SI)

0.098

Vol: 45094900

Value: 4940454

SPACKMAN ENTERTAINMENT GRP LTD

(40E.SI)

(40E.SI)

0.138

Vol: 44792400

Value: 5991475

NEPTUNE ORIENT LINES LIMITED

(N03.SI)

(N03.SI)

1.130

Vol: 32149000

Value: 36435633

NOBLE GROUP LIMITED

(N21.SI)

(N21.SI)

0.420

Vol: 29481900

Value: 12383594

ASIA-PACIFIC STRATEGIC INV LTD

(5RA.SI)

(5RA.SI)

0.007

Vol: 29433200

Value: 205582

SINGTEL

(Z74.SI)

(Z74.SI)

3.800

Vol: 19876800

Value: 75727448

EZRA HOLDINGS LIMITED

(5DN.SI)

(5DN.SI)

0.110

Vol: 19641700

Value: 2178424

HUTCHISON PORT HOLDINGS TRUST

(NS8U.SI)

(NS8U.SI)

USD 0.525

Vol: 18457500

Value: 9642324

YANGZIJIANG SHIPBLDG HLDGS LTD

(BS6.SI)

(BS6.SI)

1.110

Vol: 18392500

Value: 20474528

GENTING SINGAPORE PLC

(G13.SI)

(G13.SI)

0.740

Vol: 17271400

Value: 12770096

GOLDEN AGRI-RESOURCES LTD

(E5H.SI)

(E5H.SI)

0.355

Vol: 14518600

Value: 5212611

THE STRATECH GROUP LIMITED

(ATN.SI)

(ATN.SI)

0.041

Vol: 12707700

Value: 528676

ARTIVISION TECHNOLOGIES LTD.

(5NK.SI)

(5NK.SI)

0.061

Vol: 12639600

Value: 785439

MMP RESOURCES LIMITED

(F3V.SI)

(F3V.SI)

0.015

Vol: 10877000

Value: 175749

PACIFIC ANDES RESOURCES DEVLTD

(P11.SI)

(P11.SI)

0.022

Vol: 9569900

Value: 218227

CHINA SPORTS INTL LIMITED

(FQ8.SI)

(FQ8.SI)

0.011

Vol: 9121000

Value: 98831

REX INTERNATIONAL HOLDING LTD

(5WH.SI)

(5WH.SI)

0.126

Vol: 8874900

Value: 1133242

CAPITALAND LIMITED

(C31.SI)

(C31.SI)

3.070

Vol: 8683800

Value: 26757973

Top 20 Value

DBS GROUP HOLDINGS LTD

(D05.SI)

(D05.SI)

16.810

Vol: 5471600

Value: 92101158

SIIC ENVIRONMENT HOLDINGS LTD.

(BHK.SI)

(BHK.SI)

0.785

Vol: 106931700

Value: 82594379

SINGTEL

(Z74.SI)

(Z74.SI)

3.800

Vol: 19876800

Value: 75727448

UNITED OVERSEAS BANK LTD

(U11.SI)

XD

(U11.SI)

XD

19.640

Vol: 3348300

Value: 65655335

OVERSEA-CHINESE BANKING CORP

(O39.SI)

(O39.SI)

8.820

Vol: 6348300

Value: 56195375

NEPTUNE ORIENT LINES LIMITED

(N03.SI)

(N03.SI)

1.130

Vol: 32149000

Value: 36435633

KEPPEL CORPORATION LIMITED

(BN4.SI)

(BN4.SI)

6.690

Vol: 5255700

Value: 35380231

CAPITALAND LIMITED

(C31.SI)

(C31.SI)

3.070

Vol: 8683800

Value: 26757973

YANGZIJIANG SHIPBLDG HLDGS LTD

(BS6.SI)

(BS6.SI)

1.110

Vol: 18392500

Value: 20474528

SINGAPORE EXCHANGE LIMITED

(S68.SI)

(S68.SI)

7.570

Vol: 2661600

Value: 20134176

WILMAR INTERNATIONAL LIMITED

(F34.SI)

(F34.SI)

2.940

Vol: 6080600

Value: 17885446

GLOBAL LOGISTIC PROP LIMITED

(MC0.SI)

(MC0.SI)

2.100

Vol: 8251000

Value: 17425300

SINGAPORE TECH ENGINEERING LTD

(S63.SI)

(S63.SI)

2.880

Vol: 5914900

Value: 17132048

HONGKONG LAND HOLDINGS LIMITED

(H78.SI)

(H78.SI)

USD 7.200

Vol: 2357500

Value: 17061530

YUUZOO CORPORATION LIMITED

(AFC.SI)

(AFC.SI)

0.220

Vol: 74975100

Value: 17027236

ASCENDAS REAL ESTATE INV TRUST

(A17U.SI)

(A17U.SI)

2.260

Vol: 7192800

Value: 16343481

COMFORTDELGRO CORPORATION LTD

(C52.SI)

(C52.SI)

3.020

Vol: 4505400

Value: 13685145

JARDINE MATHESON HLDGS LTD

(J36.SI)

(J36.SI)

USD 51.130

Vol: 269400

Value: 13669177

GENTING SINGAPORE PLC

(G13.SI)

(G13.SI)

0.740

Vol: 17271400

Value: 12770096

NOBLE GROUP LIMITED

(N21.SI)

(N21.SI)

0.420

Vol: 29481900

Value: 12383594

Top 20 Gainers ($)

GREAT EASTERN HLDGS LTD

(G07.SI)

(G07.SI)

21.450

Vol: 7900

Value: 168746

COURAGE MARINE GROUP LIMITED

(ATL.SI)

(ATL.SI)

0.880

Vol: 23700

Value: 20206

LONGCHEER HOLDINGS LIMITED

(BJL.SI)

(BJL.SI)

0.890

Vol: 10100

Value: 8089

CITIC ENVIROTECH LTD.

(U19.SI)

(U19.SI)

1.475

Vol: 576500

Value: 828510

TAN CHONG INT'L LTD

(T15.SI)

(T15.SI)

HKD 2.630

Vol: 414700

Value: 1088774

RIVERSTONE HOLDINGS LIMITED

(AP4.SI)

(AP4.SI)

2.580

Vol: 423600

Value: 1090543

INTRACO LIMITED

(I06.SI)

(I06.SI)

0.340

Vol: 8100

Value: 2285

C&G ENV PROTECT HLDGS LTD

(D79.SI)

(D79.SI)

0.205

Vol: 1769400

Value: 344348

BOUSTEAD SINGAPORE LIMITED

(F9D.SI)

(F9D.SI)

0.915

Vol: 205400

Value: 186449

AUSNET SERVICES LTD

(AZI.SI)

CD

(AZI.SI)

CD

1.530

Vol: 1003100

Value: 1544169

UG HEALTHCARE CORPORATION LTD

(41A.SI)

(41A.SI)

0.500

Vol: 2191700

Value: 1051313

M1 LIMITED

(B2F.SI)

(B2F.SI)

2.810

Vol: 2330100

Value: 6520433

FIRST RESOURCES LIMITED

(EB5.SI)

(EB5.SI)

1.945

Vol: 1289200

Value: 2487317

JAPFA LTD.

(UD2.SI)

(UD2.SI)

0.515

Vol: 5238500

Value: 2631499

HAW PAR CORP LTD

(H02.SI)

(H02.SI)

8.420

Vol: 10300

Value: 86690

UNIVERSAL RESOURCE & SVCS LTD

(BGO.SI)

(BGO.SI)

0.320

Vol: 20000

Value: 6400

HIAP SENG ENGINEERING LTD

(510.SI)

(510.SI)

0.133

Vol: 22000

Value: 2926

ASCENDAS REAL ESTATE INV TRUST

(A17U.SI)

(A17U.SI)

2.260

Vol: 7192800

Value: 16343481

INNOVALUES LIMITED

(591.SI)

(591.SI)

0.770

Vol: 517600

Value: 390400

RAFFLES MEDICAL GROUP LTD

(R01.SI)

(R01.SI)

4.280

Vol: 712100

Value: 3046580

Top 20 Losers ($)

JARDINE MATHESON HLDGS LTD

(J36.SI)

(J36.SI)

USD 51.130

Vol: 269400

Value: 13669177

JARDINE CYCLE & CARRIAGE LTD

(C07.SI)

(C07.SI)

31.950

Vol: 337400

Value: 10851912

JARDINE STRATEGIC HLDGS LTD

(J37.SI)

(J37.SI)

USD 27.350

Vol: 301400

Value: 8273449

DBS GROUP HOLDINGS LTD

(D05.SI)

(D05.SI)

16.810

Vol: 5471600

Value: 92101158

UNITED OVERSEAS BANK LTD

(U11.SI)

XD

(U11.SI)

XD

19.640

Vol: 3348300

Value: 65655335

SUTL ENTERPRISE LIMITED

(BHU.SI)

(BHU.SI)

0.360

Vol: 700

Value: 242

HONGKONG LAND HOLDINGS LIMITED

(H78.SI)

(H78.SI)

USD 7.200

Vol: 2357500

Value: 17061530

KEPPEL CORPORATION LIMITED

(BN4.SI)

(BN4.SI)

6.690

Vol: 5255700

Value: 35380231

SEMBCORP INDUSTRIES LTD

(U96.SI)

(U96.SI)

3.300

Vol: 3494800

Value: 11629397

SINGAPORE AIRLINES LTD

(C6L.SI)

XD

(C6L.SI)

XD

10.500

Vol: 920700

Value: 9717354

VENTURE CORPORATION LIMITED

(V03.SI)

(V03.SI)

8.550

Vol: 362100

Value: 3111456

YEO HIAP SENG LTD

(Y03.SI)

(Y03.SI)

1.315

Vol: 500

Value: 657

UNITED OVERSEAS INSURANCE LTD

(U13.SI)

(U13.SI)

4.420

Vol: 5000

Value: 22100

OVERSEA-CHINESE BANKING CORP

(O39.SI)

(O39.SI)

8.820

Vol: 6348300

Value: 56195375

CITY DEVELOPMENTS LIMITED

(C09.SI)

(C09.SI)

7.530

Vol: 1169500

Value: 8818128

HOTEL PROPERTIES LTD

(H15.SI)

(H15.SI)

3.790

Vol: 3800

Value: 14158

SINGAPORE TECH ENGINEERING LTD

(S63.SI)

(S63.SI)

2.880

Vol: 5914900

Value: 17132048

SINGTEL 10

(Z77.SI)

(Z77.SI)

3.810

Vol: 44750

Value: 169800

S I2I LIMITED

(BAI.SI)

(BAI.SI)

0.665

Vol: 100

Value: 66

SIIC ENVIRONMENT HOLDINGS LTD.

(BHK.SI)

(BHK.SI)

0.785

Vol: 106931700

Value: 82594379

Top 20 Gainers (%)

BLUMONT GROUP LTD.

(A33.SI)

(A33.SI)

0.003

Vol: 219000

Value: 657

C&G ENV PROTECT HLDGS LTD

(D79.SI)

(D79.SI)

0.205

Vol: 1769400

Value: 344348

ZHONGXIN FRUIT AND JUICE LTD

(5EG.SI)

(5EG.SI)

0.025

Vol: 10000

Value: 250

INTRACO LIMITED

(I06.SI)

(I06.SI)

0.340

Vol: 8100

Value: 2285

HIAP SENG ENGINEERING LTD

(510.SI)

(510.SI)

0.133

Vol: 22000

Value: 2926

EDITION LTD.

(5HG.SI)

(5HG.SI)

0.012

Vol: 130100

Value: 1432

LIONGOLD CORP LTD

(A78.SI)

(A78.SI)

0.012

Vol: 3720400

Value: 40974

COURAGE MARINE GROUP LIMITED

(ATL.SI)

(ATL.SI)

0.880

Vol: 23700

Value: 20206

OCEAN SKY INTERNATIONAL LTD

(O05.SI)

(O05.SI)

0.087

Vol: 300

Value: 26

MATEX INTERNATIONAL LIMITED

(M15.SI)

(M15.SI)

0.045

Vol: 60000

Value: 2700

LONGCHEER HOLDINGS LIMITED

(BJL.SI)

(BJL.SI)

0.890

Vol: 10100

Value: 8089

NIPPECRAFT LIMITED

(N32.SI)

(N32.SI)

0.040

Vol: 63000

Value: 2207

ASIAMEDIC LIMITED

(505.SI)

(505.SI)

0.067

Vol: 160000

Value: 10544

MS HOLDINGS LIMITED

(40U.SI)

(40U.SI)

0.109

Vol: 2000

Value: 183

UG HEALTHCARE CORPORATION LTD

(41A.SI)

(41A.SI)

0.500

Vol: 2191700

Value: 1051313

SPACKMAN ENTERTAINMENT GRP LTD

(40E.SI)

(40E.SI)

0.138

Vol: 44792400

Value: 5991475

UNIVERSAL RESOURCE & SVCS LTD

(BGO.SI)

(BGO.SI)

0.320

Vol: 20000

Value: 6400

SITRA HOLDINGS (INTL) LIMITED

(5LE.SI)

(5LE.SI)

0.014

Vol: 748200

Value: 9678

MERCURIUS CAP INVESTMENT LTD

(5RF.SI)

(5RF.SI)

0.014

Vol: 590200

Value: 8332

CFM HOLDINGS LIMITED

(5EB.SI)

(5EB.SI)

0.043

Vol: 90000

Value: 3870

Top 20 Losers (%)

SUTL ENTERPRISE LIMITED

(BHU.SI)

(BHU.SI)

0.360

Vol: 700

Value: 242

ICP LTD

(5I4.SI)

(5I4.SI)

0.008

Vol: 200

Value: 1

QT VASCULAR LTD.

(5I0.SI)

(5I0.SI)

0.098

Vol: 45094900

Value: 4940454

LEADER ENVIRONMENTAL TECH LTD

(LS9.SI)

(LS9.SI)

0.027

Vol: 151600

Value: 4594

SINOTEL TECHNOLOGIES LTD.

(D3W.SI)

(D3W.SI)

0.091

Vol: 3000

Value: 273

USP GROUP LIMITED

(A6F.SI)

(A6F.SI)

0.034

Vol: 262800

Value: 9435

CHINA KUNDA TECH HOLDINGS LTD

(GU5.SI)

(GU5.SI)

0.024

Vol: 110000

Value: 2640

ASIA-PACIFIC STRATEGIC INV LTD

(5RA.SI)

(5RA.SI)

0.007

Vol: 29433200

Value: 205582

MMP RESOURCES LIMITED

(F3V.SI)

(F3V.SI)

0.015

Vol: 10877000

Value: 175749

SUNTAR ECO-CITY LIMITED

(CZ3.SI)

(CZ3.SI)

0.055

Vol: 22000

Value: 1210

XPRESS HOLDINGS LTD

(I04.SI)

(I04.SI)

0.016

Vol: 3722900

Value: 62935

JASPER INVESTMENTS LIMITED

(FQ7.SI)

(FQ7.SI)

0.008

Vol: 946300

Value: 7570

KING WAN CORPORATION LIMITED

(554.SI)

(554.SI)

0.205

Vol: 148000

Value: 31272

DEBAO PROPERTY DEVELOPMENT LTD

(K2M.SI)

(K2M.SI)

0.043

Vol: 4782700

Value: 216976

JUBILEE INDUSTRIES HLDGS LTD.

(5OS.SI)

(5OS.SI)

0.026

Vol: 100000

Value: 2600

VALUEMAX GROUP LIMITED

(T6I.SI)

(T6I.SI)

0.270

Vol: 35000

Value: 9550

UNITED FOOD HOLDINGS LIMITED

(AZR.SI)

(AZR.SI)

0.159

Vol: 1000

Value: 159

CHINA SPORTS INTL LIMITED

(FQ8.SI)

(FQ8.SI)

0.011

Vol: 9121000

Value: 98831

CNMC GOLDMINE HOLDINGS LIMITED

(5TP.SI)

(5TP.SI)

0.188

Vol: 323800

Value: 61827

SAPPHIRE CORPORATION LIMITED

(NF1.SI)

(NF1.SI)

0.104

Vol: 1285000

Value: 140344

Data Source:

http://www.sgx.com/

http://sg.finance.yahoo.com/

Archive: