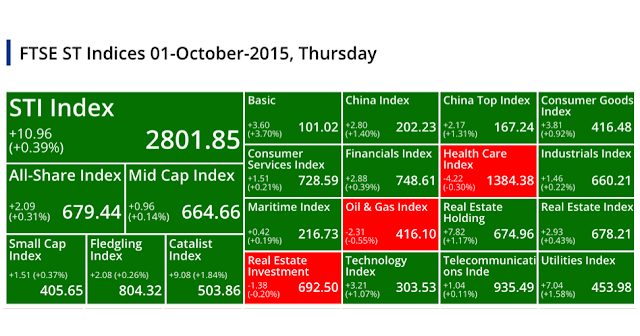

FTSE ST Indices 01-October-2015, Thursday

STI Index

+10.96

(+0.39%)

(+0.39%)

2801.85

All-Share Index

+2.09

(+0.31%)

(+0.31%)

679.44

Mid Cap Index

+0.96

(+0.14%)

(+0.14%)

664.66

Small Cap Index

+1.51 (+0.37%)

405.65

Fledgling Index

+2.08 (+0.26%)

804.32

Catalist Index

+9.08 (+1.84%)

503.86

Basic

+3.60

(+3.70%)

(+3.70%)

101.02

China Index

+2.80

(+1.40%)

(+1.40%)

202.23

China Top Index

+2.17

(+1.31%)

(+1.31%)

167.24

Consumer Goods Index

+3.81

(+0.92%)

(+0.92%)

416.48

Consumer Services Index

+1.51

(+0.21%)

(+0.21%)

728.59

Financials Index

+2.88

(+0.39%)

(+0.39%)

748.61

Health Care Index

-4.22

(-0.30%)

(-0.30%)

1384.38

Industrials Index

+1.46

(+0.22%)

(+0.22%)

660.21

Maritime Index

+0.42

(+0.19%)

(+0.19%)

216.73

Oil & Gas Index

-2.31

(-0.55%)

(-0.55%)

416.10

Real Estate Holding

+7.82

(+1.17%)

(+1.17%)

674.96

Real Estate Index

+2.93

(+0.43%)

(+0.43%)

678.21

Real Estate Investment

-1.38

(-0.20%)

(-0.20%)

692.50

Technology Index

+3.21

(+1.07%)

(+1.07%)

303.53

Telecommunications Inde

+1.04

(+0.11%)

(+0.11%)

935.49

Utilities Index

+7.04

(+1.58%)

(+1.58%)

453.98

Top 20 Volume

THE STRATECH GROUP LIMITED

(ATN.SI)

(ATN.SI)

0.043

Vol: 126596700

Value: 5145937

INTL HEALTHWAY CORP LIMITED

(5WA.SI)

(5WA.SI)

0.085

Vol: 111208000

Value: 9047463

QT VASCULAR LTD.

(5I0.SI)

(5I0.SI)

0.140

Vol: 71363800

Value: 9006503

MDR LIMITED

(A27.SI)

(A27.SI)

0.005

Vol: 51824600

Value: 259123

EZRA HOLDINGS LIMITED

(5DN.SI)

(5DN.SI)

0.116

Vol: 43410000

Value: 5090082

ROWSLEY LTD.

(A50.SI)

(A50.SI)

0.181

Vol: 38438400

Value: 6880035

NOBLE GROUP LIMITED

(N21.SI)

(N21.SI)

0.410

Vol: 37771000

Value: 15627680

PACIFIC ANDES RESOURCES DEVLTD

(P11.SI)

(P11.SI)

0.022

Vol: 35728500

Value: 809446

CAPITALAND LIMITED

(C31.SI)

(C31.SI)

2.710

Vol: 23250900

Value: 63409030

GOLDEN AGRI-RESOURCES LTD

(E5H.SI)

(E5H.SI)

0.335

Vol: 20539900

Value: 6739979

SINGTEL

(Z74.SI)

(Z74.SI)

3.600

Vol: 19489700

Value: 70171242

HEALTHWAY MEDICAL CORP LTD

(5NG.SI)

(5NG.SI)

0.035

Vol: 19188600

Value: 664714

NAM CHEONG LIMITED

(N4E.SI)

(N4E.SI)

0.159

Vol: 18662400

Value: 3038067

CHINESE GLOBAL INVESTORS GRP

(5CJ.SI)

(5CJ.SI)

0.032

Vol: 18459900

Value: 572841

LUZHOU BIO-CHEM TECHNOLOGY LTD

(L46.SI)

(L46.SI)

0.034

Vol: 18172100

Value: 625897

YUUZOO CORPORATION LIMITED

(AFC.SI)

(AFC.SI)

0.159

Vol: 15769200

Value: 2537038

WEIYE HOLDINGS LIMITED

(ON7.SI)

(ON7.SI)

0.038

Vol: 15284500

Value: 624289

EZION HOLDINGS LIMITED

(5ME.SI)

(5ME.SI)

0.645

Vol: 13134700

Value: 8591796

YANGZIJIANG SHIPBLDG HLDGS LTD

(BS6.SI)

(BS6.SI)

1.145

Vol: 12866300

Value: 14687823

GENTING SINGAPORE PLC

(G13.SI)

(G13.SI)

0.725

Vol: 12537100

Value: 9123144

Top 20 Value

DBS GROUP HOLDINGS LTD

(D05.SI)

(D05.SI)

16.270

Vol: 5325900

Value: 86866021

SINGTEL

(Z74.SI)

(Z74.SI)

3.600

Vol: 19489700

Value: 70171242

CAPITALAND LIMITED

(C31.SI)

(C31.SI)

2.710

Vol: 23250900

Value: 63409030

UNITED OVERSEAS BANK LTD

(U11.SI)

(U11.SI)

18.600

Vol: 2081300

Value: 38909469

OVERSEA-CHINESE BANKING CORP

(O39.SI)

(O39.SI)

8.800

Vol: 3734400

Value: 33039669

SEMBCORP INDUSTRIES LTD

(U96.SI)

(U96.SI)

3.490

Vol: 6672900

Value: 23424701

SINGAPORE EXCHANGE LIMITED

(S68.SI)

XD

(S68.SI)

XD

7.150

Vol: 3113400

Value: 22203171

KEPPEL CORPORATION LIMITED

(BN4.SI)

(BN4.SI)

6.720

Vol: 3208300

Value: 21763828

ASCENDAS REAL ESTATE INV TRUST

(A17U.SI)

(A17U.SI)

2.330

Vol: 8582400

Value: 20064340

GLOBAL LOGISTIC PROP LIMITED

(MC0.SI)

(MC0.SI)

2.030

Vol: 9660700

Value: 19731886

COMFORTDELGRO CORPORATION LTD

(C52.SI)

(C52.SI)

2.930

Vol: 6593700

Value: 19254598

WILMAR INTERNATIONAL LIMITED

(F34.SI)

(F34.SI)

2.590

Vol: 7373500

Value: 19205428

NOBLE GROUP LIMITED

(N21.SI)

(N21.SI)

0.410

Vol: 37771000

Value: 15627680

YANGZIJIANG SHIPBLDG HLDGS LTD

(BS6.SI)

(BS6.SI)

1.145

Vol: 12866300

Value: 14687823

SINGAPORE AIRLINES LTD

(C6L.SI)

(C6L.SI)

10.720

Vol: 1219600

Value: 13143189

HONGKONG LAND HOLDINGS LIMITED

(H78.SI)

(H78.SI)

USD 6.780

Vol: 1443400

Value: 9649666

CAPITALAND MALL TRUST

(C38U.SI)

(C38U.SI)

1.895

Vol: 5026900

Value: 9558440

SINGAPORE PRESS HLDGS LTD

(T39.SI)

(T39.SI)

3.820

Vol: 2434600

Value: 9316266

CITY DEVELOPMENTS LIMITED

(C09.SI)

(C09.SI)

7.740

Vol: 1184500

Value: 9232907

CAPITALAND COMMERCIAL TRUST

(C61U.SI)

(C61U.SI)

1.320

Vol: 6923900

Value: 9185001

Top 20 Gainers ($)

SHANGRI-LA ASIA LIMITED

(S07.SI)

(S07.SI)

HKD 7.200

Vol: 22900

Value: 161220

HONGKONG LAND HOLDINGS LIMITED

(H78.SI)

(H78.SI)

USD 6.780

Vol: 1443400

Value: 9649666

ALIBABA PICTURES GROUP LIMITED

(S91.SI)

(S91.SI)

HKD 1.610

Vol: 10000

Value: 16100

SINGAPORE EXCHANGE LIMITED

(S68.SI)

XD

(S68.SI)

XD

7.150

Vol: 3113400

Value: 22203171

SATS LTD.

(S58.SI)

(S58.SI)

3.950

Vol: 2298800

Value: 9009555

JARDINE STRATEGIC HLDGS LTD

(J37.SI)

(J37.SI)

USD 26.950

Vol: 147700

Value: 3967864

PETRA FOODS LIMITED

(P34.SI)

(P34.SI)

2.620

Vol: 1126300

Value: 2890791

TIONG SENG HOLDINGS LIMITED

(BFI.SI)

(BFI.SI)

0.275

Vol: 36000

Value: 8132

DBS GROUP HOLDINGS LTD

(D05.SI)

(D05.SI)

16.270

Vol: 5325900

Value: 86866021

RIVERSTONE HOLDINGS LIMITED

(AP4.SI)

(AP4.SI)

1.660

Vol: 458000

Value: 754864

COMFORTDELGRO CORPORATION LTD

(C52.SI)

(C52.SI)

2.930

Vol: 6593700

Value: 19254598

FIRST RESOURCES LIMITED

(EB5.SI)

(EB5.SI)

1.690

Vol: 3964200

Value: 6629964

UNITED OVERSEAS BANK LTD

(U11.SI)

(U11.SI)

18.600

Vol: 2081300

Value: 38909469

QT VASCULAR LTD.

(5I0.SI)

(5I0.SI)

0.140

Vol: 71363800

Value: 9006503

IHH HEALTHCARE BERHAD

(Q0F.SI)

(Q0F.SI)

1.910

Vol: 14400

Value: 27445

CITY DEVELOPMENTS LIMITED

(C09.SI)

(C09.SI)

7.740

Vol: 1184500

Value: 9232907

RYOBI KISO HOLDINGS LTD.

(BDN.SI)

CD

(BDN.SI)

CD

0.245

Vol: 2000

Value: 490

SARINE TECHNOLOGIES LTD

(U77.SI)

(U77.SI)

1.740

Vol: 455500

Value: 782804

STARHUB LTD

(CC3.SI)

(CC3.SI)

3.500

Vol: 1486800

Value: 5199741

VICOM LTD

(V01.SI)

(V01.SI)

6.040

Vol: 2200

Value: 13258

Top 20 Losers ($)

GREAT EASTERN HLDGS LTD

(G07.SI)

(G07.SI)

20.150

Vol: 16400

Value: 328897

JARDINE MATHESON HLDGS LTD

(J36.SI)

(J36.SI)

USD 47.010

Vol: 189400

Value: 8909000

JARDINE CYCLE & CARRIAGE LTD

(C07.SI)

(C07.SI)

26.820

Vol: 201500

Value: 5452185

CREATIVE TECHNOLOGY LTD

(C76.SI)

(C76.SI)

0.910

Vol: 5600

Value: 5896

VENTURE CORPORATION LIMITED

(V03.SI)

(V03.SI)

8.160

Vol: 425300

Value: 3479384

HOTEL ROYAL LTD

(H12.SI)

(H12.SI)

3.480

Vol: 4800

Value: 16697

LHT HOLDINGS LIMITED

(BEI.SI)

(BEI.SI)

0.470

Vol: 1400

Value: 748

RAFFLES MEDICAL GROUP LTD

(R01.SI)

(R01.SI)

4.450

Vol: 471800

Value: 2114045

BUKIT SEMBAWANG ESTATES LTD

(B61.SI)

(B61.SI)

4.520

Vol: 45600

Value: 208151

CHINA GAOXIAN FIBREFAB HLDGLTD

(AZZ.SI)

(AZZ.SI)

0.300

Vol: 59600

Value: 17930

KEPPEL CORPORATION LIMITED

(BN4.SI)

(BN4.SI)

6.720

Vol: 3208300

Value: 21763828

UOL GROUP LIMITED

(U14.SI)

(U14.SI)

5.960

Vol: 929400

Value: 5593691

DAIRY FARM INT'L HOLDINGS LTD

(D01.SI)

(D01.SI)

USD 6.020

Vol: 205400

Value: 1240251

TIH LIMITED

(T55.SI)

(T55.SI)

0.560

Vol: 28000

Value: 15590

SWING MEDIA TECHNOLOGY GRP LTD

(BEV.SI)

(BEV.SI)

0.485

Vol: 800

Value: 400

CHALLENGER TECHNOLOGIES LTD

(573.SI)

(573.SI)

0.460

Vol: 15700

Value: 7482

OUE LIMITED

(LJ3.SI)

XD

(LJ3.SI)

XD

1.755

Vol: 333900

Value: 584112

ABR HOLDINGS LIMITED

(533.SI)

(533.SI)

0.770

Vol: 25200

Value: 19404

HONG LEONG ASIA LTD.

(H22.SI)

(H22.SI)

0.860

Vol: 348700

Value: 300261

FRASER AND NEAVE, LIMITED

(F99.SI)

(F99.SI)

2.150

Vol: 20200

Value: 43551

Top 20 Gainers (%)

GLOBAL TECH (HLDGS) LIMITED

(G11.SI)

(G11.SI)

0.019

Vol: 52000

Value: 692

CPH LTD

(539.SI)

(539.SI)

0.008

Vol: 120000

Value: 960

QT VASCULAR LTD.

(5I0.SI)

(5I0.SI)

0.140

Vol: 71363800

Value: 9006503

METECH INTERNATIONAL LIMITED

(QG1.SI)

(QG1.SI)

0.003

Vol: 675000

Value: 2025

TIONG SENG HOLDINGS LIMITED

(BFI.SI)

(BFI.SI)

0.275

Vol: 36000

Value: 8132

MAGNUS ENERGY GROUP LTD.

(41S.SI)

(41S.SI)

0.009

Vol: 6630000

Value: 53064

EQUATION SUMMIT LIMITED

(532.SI)

(532.SI)

0.005

Vol: 3201000

Value: 12954

JASPER INVESTMENTS LIMITED

(FQ7.SI)

(FQ7.SI)

0.005

Vol: 1200000

Value: 5620

PAVILLON HOLDINGS LTD.

(596.SI)

(596.SI)

0.075

Vol: 6300

Value: 348

THE STRATECH GROUP LIMITED

(ATN.SI)

(ATN.SI)

0.043

Vol: 126596700

Value: 5145937

KLW HOLDINGS LTD

(504.SI)

(504.SI)

0.011

Vol: 5903000

Value: 59266

CHINA SPORTS INTL LIMITED

(FQ8.SI)

(FQ8.SI)

0.012

Vol: 1600000

Value: 17650

RYOBI KISO HOLDINGS LTD.

(BDN.SI)

CD

(BDN.SI)

CD

0.245

Vol: 2000

Value: 490

EUROPTRONIC GROUP LTD

(E23.SI)

(E23.SI)

0.008

Vol: 200000

Value: 1500

OLS ENTERPRISE LTD.

(ADJ.SI)

(ADJ.SI)

0.008

Vol: 145000

Value: 1055

HOE LEONG CORPORATION LTD.

(H20.SI)

(H20.SI)

0.051

Vol: 100000

Value: 4819

DAPAI INTL HLDG CO. LTD.

(FP1.SI)

(FP1.SI)

0.009

Vol: 540100

Value: 4861

ALBEDO LIMITED

(5IB.SI)

(5IB.SI)

0.009

Vol: 500000

Value: 4500

HU AN CABLE HOLDINGS LTD.

(KI3.SI)

(KI3.SI)

0.009

Vol: 500000

Value: 4200

HTL INT'L HOLDINGS LIMITED

(H64.SI)

(H64.SI)

0.235

Vol: 47200

Value: 10147

Top 20 Losers (%)

LEY CHOON GROUP HLDG LIMITED

(Q0X.SI)

(Q0X.SI)

0.031

Vol: 163200

Value: 5101

CHINA ENVIRONMENTAL RES GP LTD

(RS1.SI)

(RS1.SI)

0.030

Vol: 10000

Value: 300

CHINA AUTO ELECTRONICS GRP LTD

(T42.SI)

(T42.SI)

0.045

Vol: 230000

Value: 10350

LUXKING GROUP HOLDINGS LIMITED

(L34.SI)

(L34.SI)

0.021

Vol: 41000

Value: 861

NEXT-GEN SATELLITE COMM LTD

(B07.SI)

(B07.SI)

0.002

Vol: 2859600

Value: 8219

CACOLA FURNITURE INTL LIMITED

(D2U.SI)

(D2U.SI)

0.005

Vol: 3734000

Value: 22464

BLUMONT GROUP LTD.

(A33.SI)

(A33.SI)

0.004

Vol: 615100

Value: 2960

CHINA GAOXIAN FIBREFAB HLDGLTD

(AZZ.SI)

(AZZ.SI)

0.300

Vol: 59600

Value: 17930

CREATIVE TECHNOLOGY LTD

(C76.SI)

(C76.SI)

0.910

Vol: 5600

Value: 5896

LHT HOLDINGS LIMITED

(BEI.SI)

(BEI.SI)

0.470

Vol: 1400

Value: 748

SUNRIGHT LTD

(S71.SI)

CD

(S71.SI)

CD

0.210

Vol: 36100

Value: 7292

CSC HOLDINGS LTD

(C06.SI)

(C06.SI)

0.028

Vol: 30000

Value: 861

JADASON ENTERPRISES LTD

(J03.SI)

(J03.SI)

0.015

Vol: 110000

Value: 1653

CHINA HONGCHENG HOLDINGS LTD

(C0Z.SI)

(C0Z.SI)

0.008

Vol: 730000

Value: 3927

ASIA FASHION HOLDINGS LIMITED

(GH3.SI)

(GH3.SI)

0.017

Vol: 100

Value: 1

MONEYMAX FINANCIAL SERVICESLTD

(5WJ.SI)

(5WJ.SI)

0.160

Vol: 82000

Value: 13192

RAFFLES UNITED HOLDINGS LTD.

(K22.SI)

(K22.SI)

0.171

Vol: 15000

Value: 2565

CHINA GREAT LAND HOLDINGS LTD.

(D50.SI)

(D50.SI)

0.030

Vol: 50000

Value: 1500

CHALLENGER TECHNOLOGIES LTD

(573.SI)

(573.SI)

0.460

Vol: 15700

Value: 7482

PSL HOLDINGS LTD

(L6T.SI)

(L6T.SI)

0.064

Vol: 351800

Value: 22530

Data Source:

http://www.sgx.com/

http://sg.finance.yahoo.com/