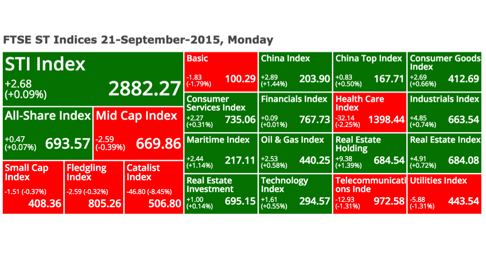

FTSE ST Indices 21-September-2015, Monday

STI Index

+2.68

(+0.09%)

(+0.09%)

2882.27

All-Share Index

+0.47

(+0.07%)

(+0.07%)

693.57

Mid Cap Index

-2.59

(-0.39%)

(-0.39%)

669.86

Small Cap Index

-1.51 (-0.37%)

408.36

Fledgling Index

-2.59 (-0.32%)

805.26

Catalist Index

-46.80 (-8.45%)

506.80

Basic

-1.83

(-1.79%)

(-1.79%)

100.29

China Index

+2.89

(+1.44%)

(+1.44%)

203.90

China Top Index

+0.83

(+0.50%)

(+0.50%)

167.71

Consumer Goods Index

+2.69

(+0.66%)

(+0.66%)

412.69

Consumer Services Index

+2.27

(+0.31%)

(+0.31%)

735.06

Financials Index

+0.09

(+0.01%)

(+0.01%)

767.73

Health Care Index

-32.14

(-2.25%)

(-2.25%)

1398.44

Industrials Index

+4.85

(+0.74%)

(+0.74%)

663.54

Maritime Index

+2.44

(+1.14%)

(+1.14%)

217.11

Oil & Gas Index

+2.53

(+0.58%)

(+0.58%)

440.25

Real Estate Holding

+9.38

(+1.39%)

(+1.39%)

684.54

Real Estate Index

+4.91

(+0.72%)

(+0.72%)

684.08

Real Estate Investment

+1.00

(+0.14%)

(+0.14%)

695.15

Technology Index

+1.61

(+0.55%)

(+0.55%)

294.57

Telecommunications Inde

-12.93

(-1.31%)

(-1.31%)

972.58

Utilities Index

-5.88

(-1.31%)

(-1.31%)

443.54

Top 20 Volume

INTL HEALTHWAY CORP LIMITED

(5WA.SI)

(5WA.SI)

0.099

Vol: 274514800

Value: 27082278

HEALTHWAY MEDICAL CORP LTD

(5NG.SI)

(5NG.SI)

0.028

Vol: 84947400

Value: 2385417

DEBAO PROPERTY DEVELOPMENT LTD

(K2M.SI)

(K2M.SI)

0.042

Vol: 45631600

Value: 1966420

SINOCLOUD GROUP LIMITED

(5EK.SI)

(5EK.SI)

0.002

Vol: 34710200

Value: 69420

GLOBAL LOGISTIC PROP LIMITED

(MC0.SI)

(MC0.SI)

2.050

Vol: 33030600

Value: 67365131

EZRA HOLDINGS LIMITED

(5DN.SI)

(5DN.SI)

0.124

Vol: 30269900

Value: 3737417

THE STRATECH GROUP LIMITED

(ATN.SI)

(ATN.SI)

0.045

Vol: 28010500

Value: 1278713

GEO ENERGY RESOURCES LIMITED

(RE4.SI)

(RE4.SI)

0.126

Vol: 26847000

Value: 3380745

GOLDEN AGRI-RESOURCES LTD

(E5H.SI)

(E5H.SI)

0.305

Vol: 20551700

Value: 6268112

CHINESE GLOBAL INVESTORS GRP

(5CJ.SI)

(5CJ.SI)

0.035

Vol: 18679400

Value: 642519

SINGTEL

(Z74.SI)

(Z74.SI)

3.750

Vol: 18353600

Value: 68794896

THAI BEVERAGE PUBLIC CO LTD

(Y92.SI)

(Y92.SI)

0.685

Vol: 18111300

Value: 12287306

CHINA BEARING (SINGAPORE) LTD.

(AD7.SI)

(AD7.SI)

0.026

Vol: 17239900

Value: 465227

YING LI INTL REAL ESTATE LTD

(5DM.SI)

(5DM.SI)

0.156

Vol: 17120100

Value: 2592301

NOBLE GROUP LIMITED

(N21.SI)

(N21.SI)

0.470

Vol: 16769200

Value: 7921121

TLV HOLDINGS LIMITED

(42L.SI)

(42L.SI)

0.305

Vol: 16567100

Value: 5087752

EZION HOLDINGS LIMITED

(5ME.SI)

(5ME.SI)

0.740

Vol: 15912900

Value: 11379487

LOYZ ENERGY LIMITED

(594.SI)

(594.SI)

0.047

Vol: 15730100

Value: 729084

YANGZIJIANG SHIPBLDG HLDGS LTD

(BS6.SI)

(BS6.SI)

1.190

Vol: 14282700

Value: 16843747

YAMADA GREEN RESOURCES LIMITED

(MC7.SI)

(MC7.SI)

0.088

Vol: 11913000

Value: 1009505

Top 20 Value

DBS GROUP HOLDINGS LTD

(D05.SI)

(D05.SI)

17.240

Vol: 6637100

Value: 114591105

SINGTEL

(Z74.SI)

(Z74.SI)

3.750

Vol: 18353600

Value: 68794896

GLOBAL LOGISTIC PROP LIMITED

(MC0.SI)

(MC0.SI)

2.050

Vol: 33030600

Value: 67365131

OVERSEA-CHINESE BANKING CORP

(O39.SI)

(O39.SI)

9.010

Vol: 5072800

Value: 45557418

UNITED OVERSEAS BANK LTD

(U11.SI)

(U11.SI)

19.160

Vol: 2176300

Value: 41636350

SINGAPORE EXCHANGE LIMITED

(S68.SI)

CD

(S68.SI)

CD

7.550

Vol: 3943800

Value: 29797358

INTL HEALTHWAY CORP LIMITED

(5WA.SI)

(5WA.SI)

0.099

Vol: 274514800

Value: 27082278

KEPPEL CORPORATION LIMITED

(BN4.SI)

(BN4.SI)

7.150

Vol: 2955600

Value: 20874553

ASCENDAS REAL ESTATE INV TRUST

(A17U.SI)

(A17U.SI)

2.260

Vol: 8587600

Value: 19203861

CAPITALAND LIMITED

(C31.SI)

(C31.SI)

2.800

Vol: 6850400

Value: 18988208

YANGZIJIANG SHIPBLDG HLDGS LTD

(BS6.SI)

(BS6.SI)

1.190

Vol: 14282700

Value: 16843747

SEMBCORP INDUSTRIES LTD

(U96.SI)

(U96.SI)

3.570

Vol: 4671700

Value: 16528105

THAI BEVERAGE PUBLIC CO LTD

(Y92.SI)

(Y92.SI)

0.685

Vol: 18111300

Value: 12287306

CAPITALAND MALL TRUST

(C38U.SI)

(C38U.SI)

1.905

Vol: 6363700

Value: 12054883

SATS LTD.

(S58.SI)

(S58.SI)

3.910

Vol: 2962300

Value: 11472380

SINGAPORE PRESS HLDGS LTD

(T39.SI)

(T39.SI)

3.910

Vol: 2952500

Value: 11440299

EZION HOLDINGS LIMITED

(5ME.SI)

(5ME.SI)

0.740

Vol: 15912900

Value: 11379487

JARDINE STRATEGIC HLDGS LTD

(J37.SI)

(J37.SI)

USD 27.000

Vol: 417900

Value: 11287813

JARDINE MATHESON HLDGS LTD

(J36.SI)

(J36.SI)

USD 47.000

Vol: 231100

Value: 10869521

HONGKONG LAND HOLDINGS LIMITED

(H78.SI)

(H78.SI)

USD 6.820

Vol: 1232900

Value: 8417952

Top 20 Gainers ($)

N710100Z 170401

(OM2S.SI)

CI

(OM2S.SI)

CI

102.719

Vol: 50

Value: 5135

SINGAPORE AIRLINES LTD

(C6L.SI)

(C6L.SI)

10.550

Vol: 787700

Value: 8204787

BRITISH & MALAYAN TRUSTEES LTD

(B08.SI)

CD

(B08.SI)

CD

3.500

Vol: 1500

Value: 5250

ALIBABA PICTURES GROUP LIMITED

(S91.SI)

(S91.SI)

HKD 1.460

Vol: 800

Value: 1168

GREAT EASTERN HLDGS LTD

(G07.SI)

(G07.SI)

20.550

Vol: 4700

Value: 96408

SATS LTD.

(S58.SI)

(S58.SI)

3.910

Vol: 2962300

Value: 11472380

SHANGRI-LA ASIA LIMITED

(S07.SI)

CD

(S07.SI)

CD

HKD 7.200

Vol: 20500

Value: 148860

FORTUNE REAL ESTATE INV TRUST

(F25U.SI)

(F25U.SI)

HKD 7.630

Vol: 38400

Value: 291976

UNI-ASIA HOLDINGS LIMITED

(AYF.SI)

(AYF.SI)

1.300

Vol: 1000

Value: 1317

HOTEL ROYAL LTD

(H12.SI)

(H12.SI)

3.550

Vol: 100

Value: 355

SEMBCORP INDUSTRIES LTD

(U96.SI)

(U96.SI)

3.570

Vol: 4671700

Value: 16528105

UOL GROUP LIMITED

(U14.SI)

(U14.SI)

6.080

Vol: 1093200

Value: 6626926

S I2I LIMITED

(BAI.SI)

(BAI.SI)

0.660

Vol: 500

Value: 329

CITY DEVELOPMENTS LIMITED

(C09.SI)

(C09.SI)

8.090

Vol: 767600

Value: 6163280

HONGKONG LAND HOLDINGS LIMITED

(H78.SI)

(H78.SI)

USD 6.820

Vol: 1232900

Value: 8417952

PNE INDUSTRIES LTD

(BDA.SI)

(BDA.SI)

0.600

Vol: 21200

Value: 12720

SINGAPORE PRESS HLDGS LTD

(T39.SI)

(T39.SI)

3.910

Vol: 2952500

Value: 11440299

PHARMESIS INTERNATIONAL LTD.

(BFK.SI)

(BFK.SI)

0.350

Vol: 5000

Value: 1750

FIRST SPONSOR GROUP LIMITED

(ADN.SI)

CD

(ADN.SI)

CD

1.250

Vol: 200

Value: 250

FRASER AND NEAVE, LIMITED

(F99.SI)

(F99.SI)

2.020

Vol: 513500

Value: 1033905

Top 20 Losers ($)

JARDINE CYCLE & CARRIAGE LTD

(C07.SI)

(C07.SI)

28.790

Vol: 226700

Value: 6506106

PAN OCEAN CO., LTD.

(AZY.SI)

(AZY.SI)

3.800

Vol: 100

Value: 380

INTL HEALTHWAY CORP LIMITED

(5WA.SI)

(5WA.SI)

0.099

Vol: 274514800

Value: 27082278

UNITED OVERSEAS BANK LTD

(U11.SI)

(U11.SI)

19.160

Vol: 2176300

Value: 41636350

SINGAPORE EXCHANGE LIMITED

(S68.SI)

CD

(S68.SI)

CD

7.550

Vol: 3943800

Value: 29797358

RAFFLES MEDICAL GROUP LTD

(R01.SI)

(R01.SI)

4.590

Vol: 261000

Value: 1203944

HOTEL PROPERTIES LTD

(H15.SI)

(H15.SI)

3.690

Vol: 27300

Value: 101213

DAIRY FARM INT'L HOLDINGS LTD

(D01.SI)

(D01.SI)

USD 6.020

Vol: 208700

Value: 1261254

VENTURE CORPORATION LIMITED

(V03.SI)

(V03.SI)

8.360

Vol: 331300

Value: 2776942

DBS GROUP HOLDINGS LTD

(D05.SI)

(D05.SI)

17.240

Vol: 6637100

Value: 114591105

SARINE TECHNOLOGIES LTD

(U77.SI)

(U77.SI)

1.720

Vol: 229900

Value: 400697

CREATIVE TECHNOLOGY LTD

(C76.SI)

(C76.SI)

0.855

Vol: 150

Value: 133

MANDARIN ORIENTAL INTL LTD

(M04.SI)

(M04.SI)

USD 1.640

Vol: 52600

Value: 82412

M1 LIMITED

(B2F.SI)

(B2F.SI)

2.940

Vol: 887700

Value: 2614661

SINGTEL

(Z74.SI)

(Z74.SI)

3.750

Vol: 18353600

Value: 68794896

SINGTEL 10

(Z77.SI)

(Z77.SI)

3.730

Vol: 32390

Value: 121171

G. K. GOH HOLDINGS LIMITED

(G41.SI)

(G41.SI)

0.800

Vol: 5000

Value: 4000

OLAM INTERNATIONAL LIMITED

(O32.SI)

(O32.SI)

1.995

Vol: 559500

Value: 1131168

HO BEE LAND LIMITED

(H13.SI)

(H13.SI)

1.960

Vol: 37700

Value: 73764

AUSNET SERVICES LTD

(AZI.SI)

(AZI.SI)

1.330

Vol: 32800

Value: 43899

Top 20 Gainers ($)

CHINA HONGCHENG HOLDINGS LTD

(C0Z.SI)

(C0Z.SI)

0.006

Vol: 300100

Value: 1200

ZIWO HOLDINGS LTD.

(I9T.SI)

(I9T.SI)

0.052

Vol: 200

Value: 9

TUNG LOK RESTAURANTS 2000 LTD

(540.SI)

(540.SI)

0.118

Vol: 203000

Value: 23067

JADASON ENTERPRISES LTD

(J03.SI)

(J03.SI)

0.017

Vol: 360100

Value: 5761

SUNRIGHT LTD

(S71.SI)

(S71.SI)

0.260

Vol: 10200

Value: 2158

CHINA HAIDA LTD.

(C92.SI)

(C92.SI)

0.020

Vol: 100100

Value: 1602

PHARMESIS INTERNATIONAL LTD.

(BFK.SI)

(BFK.SI)

0.350

Vol: 5000

Value: 1750

EUCON HOLDING LIMITED

(E27.SI)

(E27.SI)

0.015

Vol: 699100

Value: 10486

BROOKE ASIA LIMITED

(5OY.SI)

(5OY.SI)

0.151

Vol: 51000

Value: 7596

ATTILAN GROUP LIMITED

(5ET.SI)

(5ET.SI)

0.008

Vol: 511000

Value: 3378

HOE LEONG CORPORATION LTD.

(H20.SI)

(H20.SI)

0.048

Vol: 360000

Value: 15694

HL GLOBAL ENTERPRISES LIMITED

(AVX.SI)

(AVX.SI)

0.165

Vol: 5100

Value: 716

MAGNUS ENERGY GROUP LTD.

(41S.SI)

(41S.SI)

0.009

Vol: 6530300

Value: 56772

UNION STEEL HOLDINGS LIMITED

(V69.SI)

(V69.SI)

0.108

Vol: 80300

Value: 6428

SMARTFLEX HOLDINGS LTD

(5RE.SI)

(5RE.SI)

0.260

Vol: 711000

Value: 191075

ALIBABA PICTURES GROUP LIMITED

(S91.SI)

(S91.SI)

HKD 1.460

Vol: 800

Value: 1168

STARLAND HOLDINGS LIMITED

(5UA.SI)

(5UA.SI)

0.158

Vol: 180000

Value: 28592

S I2I LIMITED

(BAI.SI)

(BAI.SI)

0.660

Vol: 500

Value: 329

OSSIA INTERNATIONAL LTD

(O08.SI)

(O08.SI)

0.200

Vol: 10200

Value: 2040

PNE INDUSTRIES LTD

(BDA.SI)

(BDA.SI)

0.600

Vol: 21200

Value: 12720

Top 20 Losers ($)

INTL HEALTHWAY CORP LIMITED

(5WA.SI)

(5WA.SI)

0.099

Vol: 274514800

Value: 27082278

SINOCLOUD GROUP LIMITED

(5EK.SI)

(5EK.SI)

0.002

Vol: 34710200

Value: 69420

LEY CHOON GROUP HLDG LIMITED

(Q0X.SI)

(Q0X.SI)

0.034

Vol: 35100

Value: 1103

HEALTHWAY MEDICAL CORP LTD

(5NG.SI)

(5NG.SI)

0.028

Vol: 84947400

Value: 2385417

IPCO INT'L LIMITED

(I11.SI)

(I11.SI)

0.004

Vol: 1680000

Value: 6720

EQUATION SUMMIT LIMITED

(532.SI)

(532.SI)

0.004

Vol: 1757000

Value: 7108

TOP GLOBAL LIMITED

(519.SI)

(519.SI)

0.004

Vol: 900000

Value: 3600

JASPER INVESTMENTS LIMITED

(FQ7.SI)

(FQ7.SI)

0.005

Vol: 4358600

Value: 21604

MS HOLDINGS LIMITED

(40U.SI)

(40U.SI)

0.100

Vol: 110000

Value: 11000

ACE ACHIEVE INFOCOM LIMITED

(A75.SI)

(A75.SI)

0.017

Vol: 300000

Value: 5120

LERENO BIO-CHEM LTD.

(42H.SI)

(42H.SI)

0.061

Vol: 1600

Value: 97

OLS ENTERPRISE LTD.

(ADJ.SI)

(ADJ.SI)

0.007

Vol: 1290600

Value: 8833

ADVANCED HOLDINGS LTD.

(5IA.SI)

(5IA.SI)

0.119

Vol: 36000

Value: 4284

SOUTHERN PACKAGING GROUP LTD

(T77.SI)

(T77.SI)

0.110

Vol: 45800

Value: 5037

SUNVIC CHEMICAL HOLDINGS LTD

(A7S.SI)

(A7S.SI)

0.220

Vol: 72900

Value: 16149

POLARIS LTD.

(5BI.SI)

(5BI.SI)

0.015

Vol: 200600

Value: 3209

PAN OCEAN CO., LTD.

(AZY.SI)

(AZY.SI)

3.800

Vol: 100

Value: 380

DAPAI INTL HLDG CO. LTD.

(FP1.SI)

(FP1.SI)

0.008

Vol: 85000

Value: 680

CHASEN HOLDINGS LIMITED

(5NV.SI)

CD

(5NV.SI)

CD

0.059

Vol: 45800

Value: 2839

MERCURIUS CAP INVESTMENT LTD

(5RF.SI)

(5RF.SI)

0.009

Vol: 1470000

Value: 14630

Data Source:

http://www.sgx.com/

http://sg.finance.yahoo.com/