UOL GROUP LIMITED (SGX:U14)

CITY DEVELOPMENTS LIMITED (SGX:C09)

HOTEL PROPERTIES LTD (SGX:H15)

MAPLETREE COMMERCIAL TRUST (SGX:N2IU)

UOL GROUP LIMITED (SGX:U14)

CITY DEVELOPMENTS LIMITED (SGX:C09)

HOTEL PROPERTIES LTD (SGX:H15)

MAPLETREE COMMERCIAL TRUST (SGX:N2IU)

SG Property - A Master Plan With Building Blocks For The Future

- Building capacity.

- Rejuvenation plans with incentives.

- Identifying potential beneficiaries.

URA unveils Draft Master Plan for 2019…

- The Urban Redevelopment Authority (URA) unveiled its Draft Master Plan 2019 (DMP19) yesterday. The Master Plan refers to the statutory land use plan guiding Singapore’s development of land and property over the next 10 to 15 years, and is reviewed every 5 years.

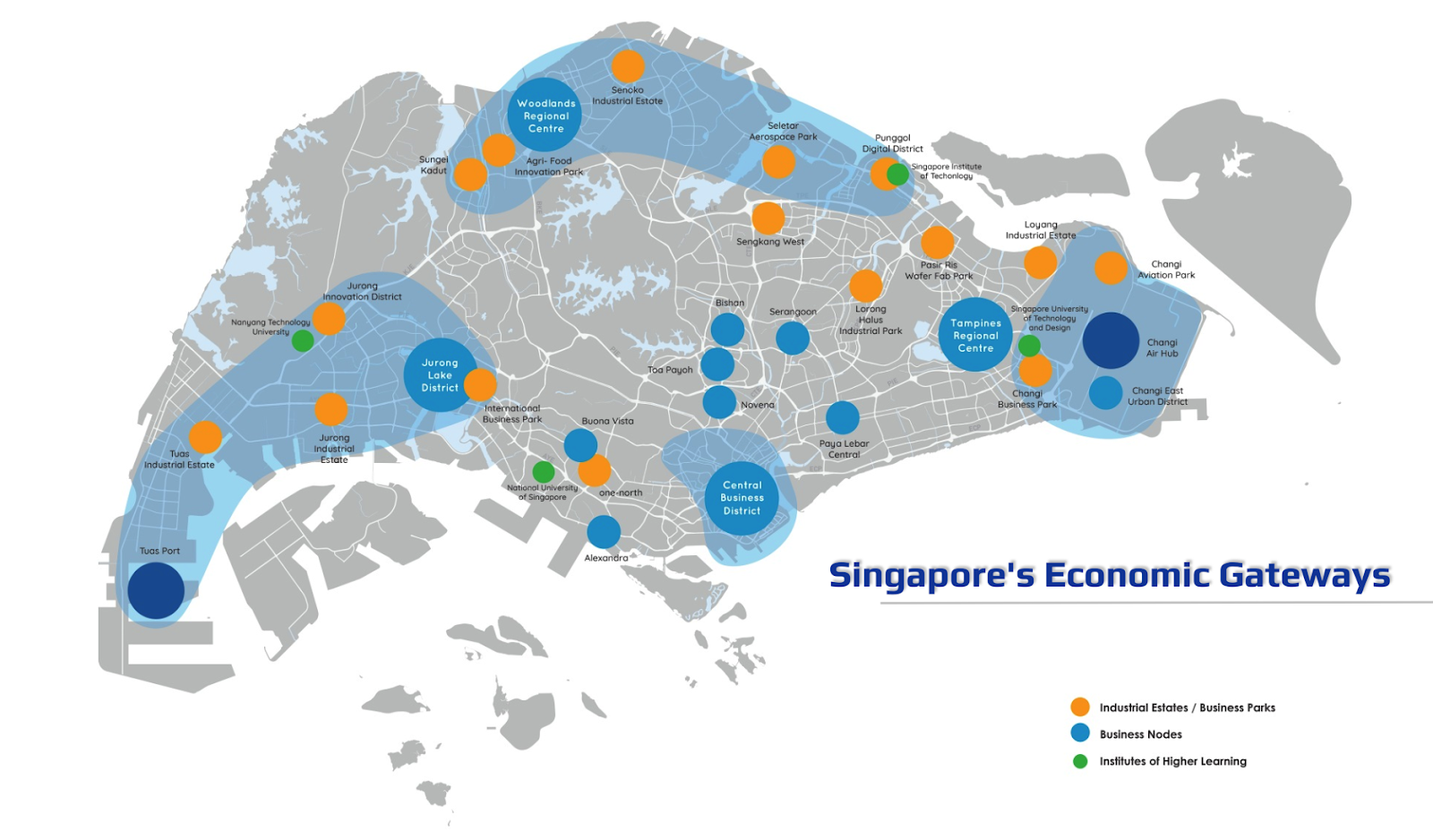

- One of the key strategies being highlighted in DMP19 includes developing economic gateways for the future economy. This would encompass not just the South, where Singapore’s city centre is, but also the Eastern, Western and Northern parts of Singapore to broaden her development.

Retail and office landlords to benefit from land optimisation plans

- Minister for National Development Mr. Lawrence Wong also mentioned during the DMP19 launch that in order to build capacity and resilience for the longer-term, Singapore would need to optimise her land use. This would involve the transformation of the Greater Southern Waterfront (GSW) and Paya Lebar Air Base (PLAB), which would result in better connectivity and more liveable space being formed, thus providing a potential boost to the commercial properties in the precincts, albeit in the longer-term.

- We see UOL GROUP LIMITED (SGX:U14) as a key beneficiary of both the GSW and PLAB transformation, while a number of MAPLETREE COMMERCIAL TRUST (SGX:N2IU)’s properties are expected to gain from the GSW development.

- Overall, we maintain NEUTRAL on the SG property sector.

Identifying potential beneficiaries of the Draft Master Plan 2019 (DMP19)

Introduction of a new CBD Incentive Scheme and Strategic Development Incentive Scheme

- In order to grow the vibrancy and increase the number of living communities in the CBD area (“work-live-play” concept), URA will introduce a new CBD Incentive Scheme. This will apply to Anson Road, Cecil Street, Shenton Way, Robinson Road and Tanjong Pagar areas within the CBD. A higher gross plot ratio for the conversion of existing office developments to hotel and residential use will be allowed. This is subjected to conditions such as

- Buildings in Anson Road and Cecil Street that qualify should be at least 20 years old from the TOP date and be predominantly used for offices,

- minimum site area of 1k-2k sqm depending on location,

- gross plot ratio will increase by up to 25% for both Anson Road and Cecil Street if intended land use post conversion is for hotels or mixed use.

- The idea for this scheme is to encourage property owners with older buildings in the CBD to consider rejuvenating their buildings. In this regard, we see opportunities for developers with sizeable office assets in the CBD area, such as CITY DEVELOPMENTS LIMITED (SGX:C09) (potential assets include City House and Fuji Xerox Towers) and UOL GROUP LIMITED (SGX:U14) (potential assets include SGX Centre 2 and UIC Building, which are held by UNITED INDUSTRIAL CORP LTD (SGX:U06)), to evaluate their options to potentially benefit from this initiative.

- For the Strategic Development Incentive Scheme, this goes beyond the CBD area, and comes with a mix of incentives such as an increase in gross plot ratio and flexibility on other development controls. This is applicable islandwide with the aim of enticing commercial property owners to collaborate and comprehensively redevelop adjacent properties.

Enhancing Orchard Road:

- Orchard Road will be enhanced as a lifestyle destination offering differentiated experiences for each sub-precinct, with an urban corridor that connects the Singapore Botanic Gardens and Fort Canning Park. URA, STB and NParks had jointly announced on 30 Jan this year on plans to introduce innovative retail concepts, attractions, entertainment and events to revitalise Singapore’s prime shopping belt. As highlighted previously, we believe these initiatives would be beneficial to asset values in the precinct.

- There are a number of S-REITs with relatively large exposure to Orchard Road, such as STARHILL GLOBAL REIT (SGX:P40U), OUE HOSPITALITY TRUST (SGX:SK7), and SPH REIT (SGX:SK6U). For non-REITs, HOTEL PROPERTIES LTD (SGX:H15) would likely benefit from this Orchard Road transformation (largely due to its hotel assets).

Greater Southern Waterfront (GSW) transformation:

- The Greater Southern Waterfront (GSW) spans across Singapore’s Southern coastline from Pasir Panjang to Marina East. Approximately 1k ha of land will be freed up for development once the Pasir Panjang and City Terminals are relocated to Tuas in the future. The total area of the GSW will be ~2k ha if we also include other areas such as Keppel Club and Sentosa. Hence, we believe the whole precinct will be transformed into a waterfront lifestyle destination.

- With that in mind, UOL GROUP’s Avenue South Residence project (1,074 residential units to be launched in 2Q19) should have an added demand driver. Meanwhile, MAPLETREE COMMERCIAL TRUST (SGX:N2IU), with VivoCity as the largest mall in Singapore, should also benefit from increased footfall and vibrancy in the future. This would also be supported by the return of the Keppel Club site to the State, which will subsequently be used for residential purposes. MAPLETREE COMMERCIAL TRUST’s other properties which would benefit from the transformation include Mapletree Business City I, PSA Building and Bank of America Merrill Lynch HarbourFront.

Paya Lebar Air Base (PLAB) transformation:

- Paya Lebar Air Base (PLAB) will be relocated in the longer-term and eventually free up 800 ha of land. The site and the surroundings will be transformed into a new town with improved accessibility.

- Beneficiaries of this transformation will be commercial landlords with properties in the Paya Lebar precinct, such as UOL GROUP and ASX-listed Lendlease Group.

Punggol Digital District (PDD):

- Punggol Digital District (PDD) is earmarked to be Singapore’s first Enterprise District with the aim of housing key growth sectors of the digital economy where cutting-edge technology is used. It will include a business park, a university (Singapore Institute of Technology) and community facilities.

- Likely beneficiaries of this will be CITY DEVELOPMENTS, which is planning to launch its 820-unit Sumang Walk waterfront Executive Condominium in 2H19. This project is within a 10-min walk to Punggol MRT station. FRASERS PROPERTY LIMITED (SGX:TQ5)’s Waterway Point mall (33.3% stake) will also clearly benefit from the enlarged workforce and tertiary students.

Woodlands Regional Centre (WRC):

- Woodlands Regional Centre (WRC) is expected to grow as the largest economic hub in the north region. New spaces for business, industry, R&D, and learning and innovation will be introduced to WRC over the next 15 years on over 100 ha of developable land. One of the precincts of WRC is the Woodlands North Coast, with plans to make it a unique mixed-use waterfront destination featuring offices, industrial and business parks, new homes and public spaces.

- We see FRASERS CENTREPOINT TRUST (SGX:J69U) as a key beneficiary given that its Causeway Point mall is the dominant mall in the Woodlands area. Causeway Point contributed 47.6% of FRASERS CENTREPOINT TRUST’s NPI in 1QFY19.

Wong Teck Ching Andy CFA

OCBC Investment Research

|

Deborah Ong

OCBC Investment

|

Joseph Ng

OCBC Investment

|

https://www.iocbc.com/

2019-03-28

SGX Stock

Analyst Report

8.450

SAME

8.450

10.680

SAME

10.680

4.740

SAME

4.740

1.790

SAME

1.790