SINGTEL

SGX:Z74

SINGTEL

SGX:Z74

SingTel - Relief Rally Thanks To Australia

Potential consolidation in Australia; maintain HOLD

- TPG Australia disclosed it is in potential “merger of equals” talks with unlisted Vodafone Australia. Although there is no certainty the transaction will take place, Singtel’s share price has reacted positively to the news.

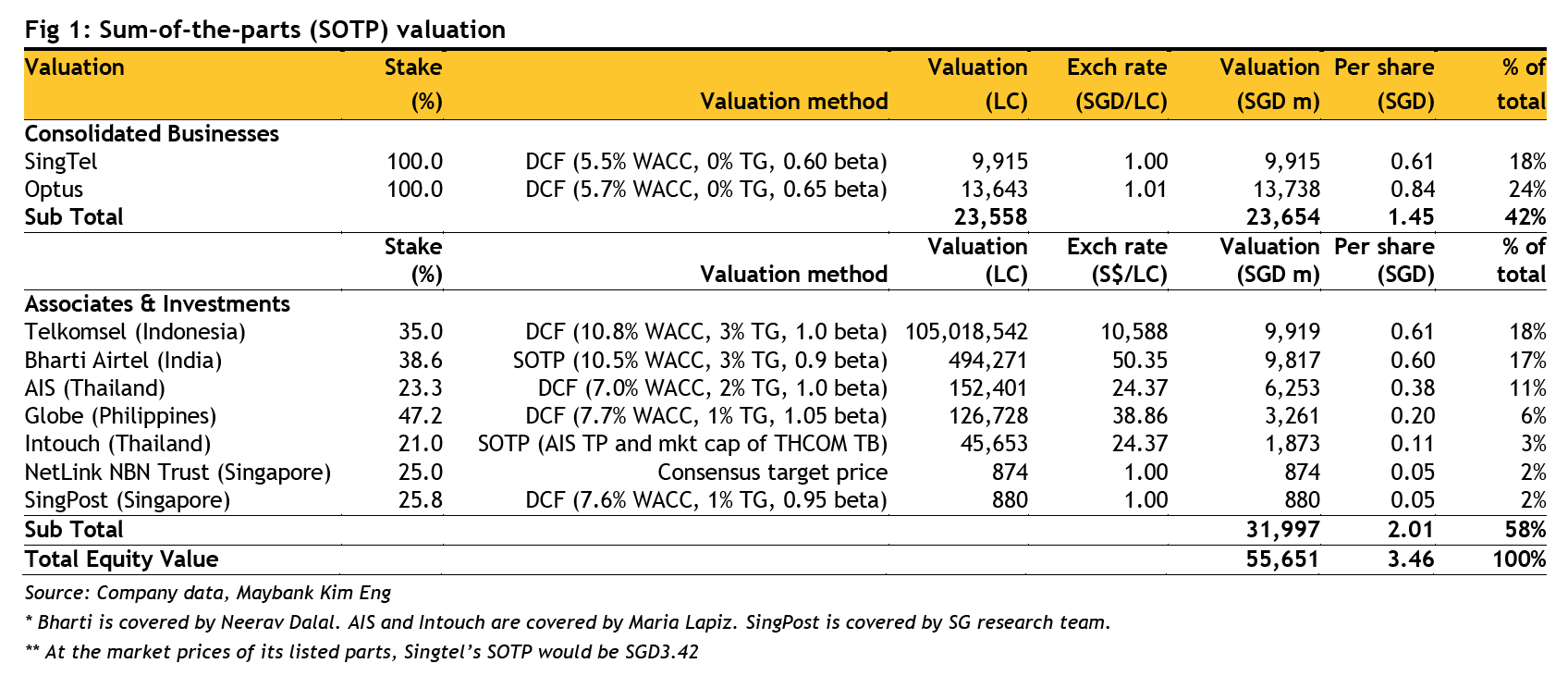

- A successful transaction could affect 24% of our DCF-based SOTP of SGD3.46. Until there is more clarity, we maintain our forecasts and HOLD.

- StarHub (SGX:CC3, Rating: BUY, Target Price: SGD1.96, see recent report: StarHub - CEO Briefing Highlights | SGinvestors.io) remains our preferred pick in the Singapore telco space as we believe its de-rating has been overdone.

Potential positive in Australia

~ SGinvestors.io ~ Where SG investors share

- TPG was planning to launch aggressive unlimited wireless data plans initially on a trial basis and eventually at AUD9.99/month. Whether this will change remains to be seen but we believe the market has priced into SingTel’s stock Australian competition and TPG’s Singapore launch in 4Q18.

- We currently forecast 7%/ 3% declines in SingTel Optus’ FY19-20E EBITDA.

What could it mean for Singapore operations?

- There has been scant detail on TPG’s Singapore MNO launch but we believe it is fair to assume that its Australian transaction, if any, will be confined to that market. On the downside, TPG could potentially be less distracted in competing in Australia and have more time to compete in Singapore.

- On the plus side, its early willingness to merge in Australia affirms market and incumbent telcos’ expectations that Singapore’s wireless market could eventually consolidate. However, as we noted previously (see report: Singapore Telcos - TPG Scenarios ~ The Base, The Blue Skies and The Ugly), Singapore regulators require a full network rollout - ie 2021 targets must be met - before TPG can consider such options.

Maintaining base case

- Pending further developments, we maintain our forecasts. Our key positive takeaway is rational behaviour exhibited early on by TPG.

- Upside potential and risks to our outlook remain the level of competitive intensity in SingTel’s major markets.

Swing Factors

Upside

- Strong growth in enterprise and Digital Life to economies of scale.

- Ebbing competitive heat in India.

- Subsidies per smartphone drop.

Downside

- Wireless margin compression triggered either by TPG in Singapore and / or Australia or pre-emptive strikes by incumbents. These are not likely in consensus forecasts.

- Long-term capex for 5G rollout not likely priced in.

- Worse-than-expected cannibalisation of wireless voice, SMS and roaming by data.

Luis Hilado

Maybank Kim Eng Research

|

https://www.maybank-ke.com.sg/

2018-08-23

SGX Stock

Analyst Report

3.460

Same

3.460