CITY DEVELOPMENTS LIMITED

SGX:C09

CITY DEVELOPMENTS LIMITED

SGX:C09

City Developments - Deferring Launch Plans

Limited downside; maintain HOLD

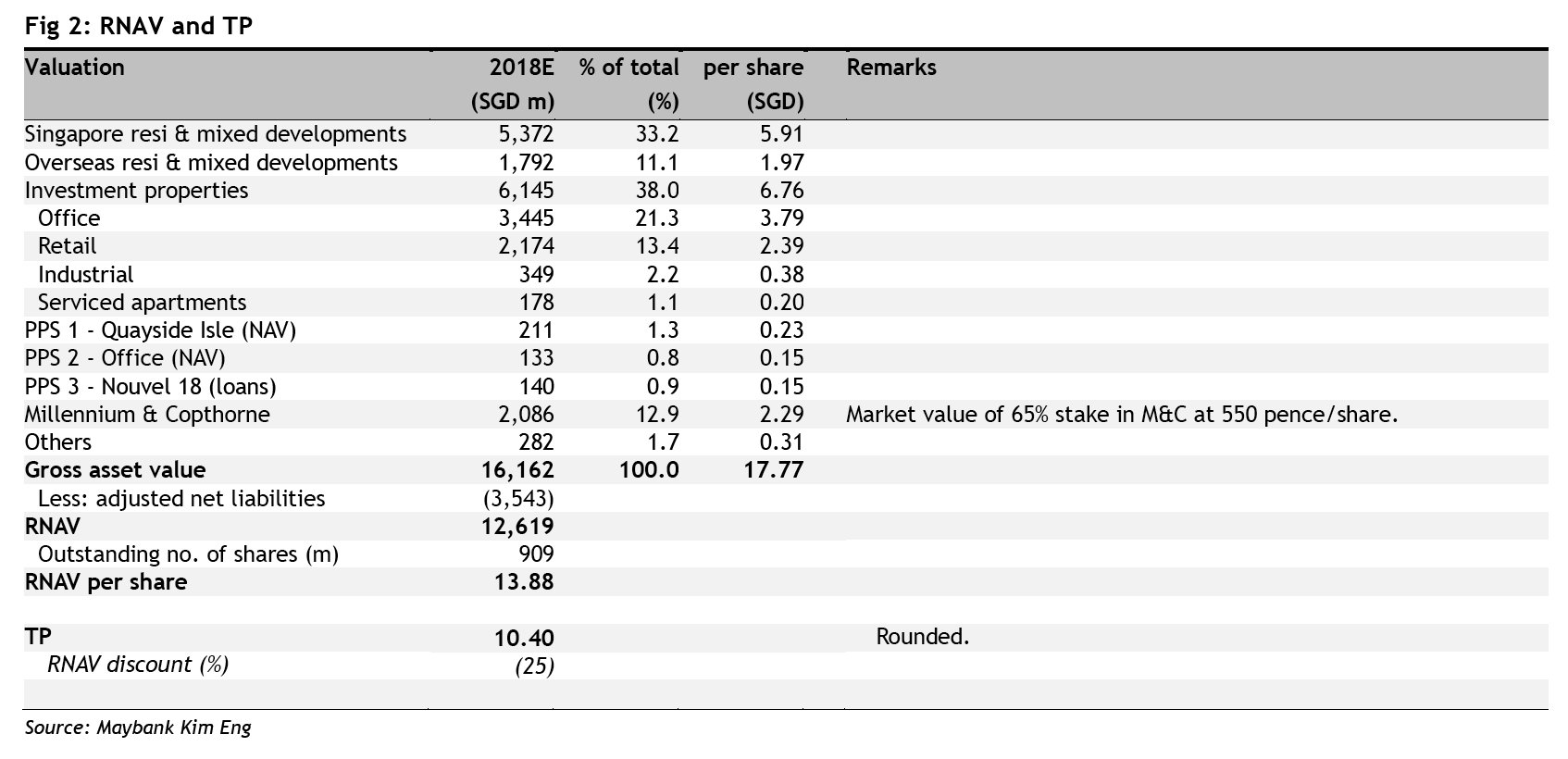

- City Developments’ 1H18 EPS is in line, at 44% of our FY18E estimate. Nonetheless, we trim FY18E EPS by 5% to adjust for its deferred launch plans, while keeping FY19-20E numbers. Consequently, our RNAV dips to SGD13.88 from SGD13.91.

- Our Target Price stays at SGD10.40, a 25% discount to RNAV. With the stock trading close to -1SD of its 10-year average RNAV discount, we believe the market has priced in potential residential-market weakness.

- Maintain HOLD. Prefer UOL (SGX:U14) and CapitaLand (SGX:C31) for sector exposure.

~ SGinvestors.io ~ Where SG investors share

Raised interim DPS

- City Developments’ 2Q18 profits were driven by New Futura & Gramercy Park in Singapore and contributions from Hong Leong City Center in Suzhou, completed in May.

- Interim DPS has been raised by 2 cts to 6 cts, to reflect its better y-o-y profitability. With no commitments to a higher full year payout, we have conservatively kept our FY18E DPS at 18 cts.

- City Developments and its JV partners have received several offers for Manulife Centre and Tampines Grande. These are office assets under its PPS 2 structure. It is in advanced negotiations on the sale of the former. Apart from participating as a cornerstone investor in the IPO of E-House (2048 HK), one of the largest real-estate brokers in China, City Developments has reached a strategic agreement with the company to market its properties in Singapore and London to Chinese buyers.

Responding to cooling measures

- After the recent property-cooling measures, City Developments is reviewing the launch timing for its JV projects, South Beach Residences and Boulevard 88.

- Plans for its mid-to-mass-market projects are unchanged, as these cater mostly to first-time home buyers, who should be less affected by the policy changes.

Targeting SGD900m of recurring EBITDA

- City Developments has a 10-year recurring-EBITDA target of SGD900m. This is a 50% increase from current levels of SGD600m. Plans to hit USD12b AUM for its fund-management platform should account for one-third of the increase, with the balance to come from acquisitions and improved yields for its properties.

- We believe stronger recurring income will enhance the stability of its earnings and offer scope for potentially higher payouts.

Swing Factors

Upside

- Monetisation of investment assets conservatively held at cost.

- Renewed interest in Singapore’s high-end residential market.

- Strong rebound in home sales.

Downside

- Sharp fall in home prices, necessitating impairment charges.

- Poor execution of overseas projects. Recent ventures into China, the UK and Japan have raised risk profile.

- Sharp increase in interest rates could hit demand for properties and drive down asset prices.

Derrick Heng CFA

Maybank Kim Eng Research

|

https://www.maybank-ke.com.sg/

2018-08-08

SGX Stock

Analyst Report

10.400

Same

10.400