CAPITALAND LIMITED

SGX:C31

CAPITALAND LIMITED

SGX:C31

CapitaLand - Developer With A Solid Yield

Maintain BUY; Results in line

- CapitaLand’s 1H18 EBIT of SGD1.1b was in line at 47% of our full-year forecast. Trading at 0.7x P/BV, 40% RNAV discount and offering a solid 4% yield, we continue to see good value in the stock.

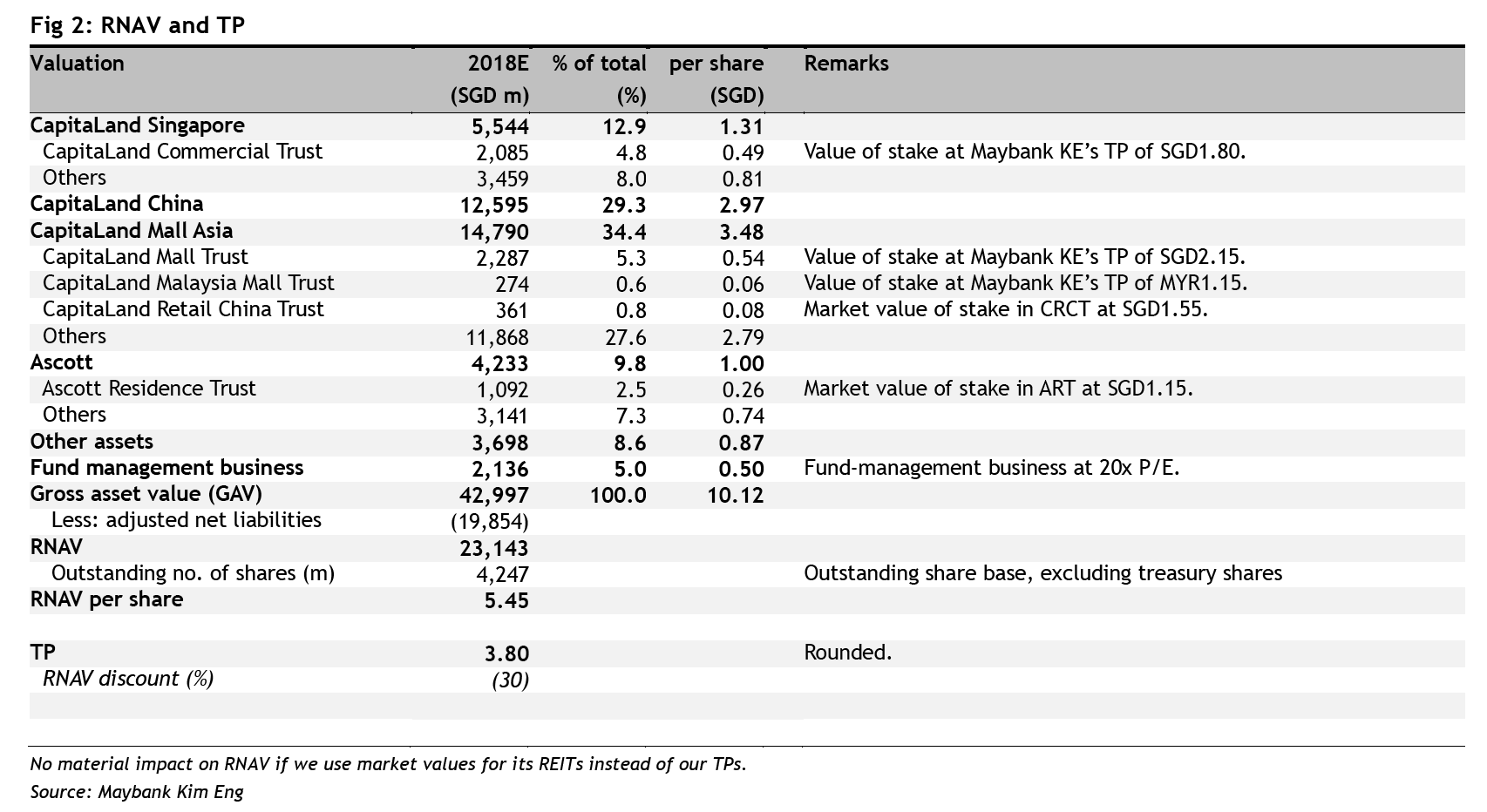

- Maintain BUY with SGD3.80 Target Price, based on 30% discount to RNAV of SGD5.45.

- In 2Q18, CapitaLand spent SGD191m buying back shares at prices mostly above SGD3.50. With the results blackout now over, the company could resume its share buyback programme and we expect this to support CapitaLand's share price.

~ SGinvestors.io ~ Where SG investors share

Delivering on portfolio reconstitution strategy

- 1H18 PATMI was boosted by portfolio gains of SGD82m (sale of Sembawang Shopping Centre), SGD360m of revaluation gains and SGD58m of realised gains (20 China Malls, Twenty Anson and Bugis Village).

- In 1H18, it divested SGD3.1b of properties and redeployed SGD1.8b into new acquisitions, which generated about SGD140m of gains. This is in line with its target to recycle SGD3b worth of assets annually for about SGD200m of gains.

- 1H18 ROE of 4.9% implies an annualised rate of 9.9%, which is on track for its target returns of > 8%.

Small exposure to residential headwinds in SG

- With just 33 units remaining unsold from previously launched projects and another 800 units from the redevelopment of Pearl Bank Apartments, this market segment accounts for less than 2% of its valuation.

- Unlike other developers that were more aggressive in restocking over the past two years, it has been disciplined in its land acquisition and is now one of the least exposed to the residential headwinds in the local market.

Shifting to its target asset mix could raise returns

- CapitaLand seeks to achieve an equal split between assets in the emerging and developed markets, from 57% in developed markets today. In terms of asset class, it aims to increase its share of trading properties to 20% from 13% today.

- We believe these targets imply CapitaLand’s capital allocation will see a shift up the risk curve for higher returns. This should eventually lead to stronger ROEs over time as it puts capital to work.

Swing Factors

Upside

- Strong rebound in China and Singapore home sales.

- Monetisation of assets via a sale to its funds under management or third parties.

- Higher market value of its listed REITs.

Downside

- Overpaying for assets or land.

- Poor execution of development projects.

- Sharp increase in interest rates could hit demand for properties and drive down asset prices.

Derrick Heng CFA

Maybank Kim Eng Research

|

https://www.maybank-ke.com.sg/

2018-08-08

SGX Stock

Analyst Report

3.800

Same

3.800