KEPPEL REIT

SGX:K71U

KEPPEL REIT

SGX:K71U

Keppel REIT - Follow Management’s Lead

- 2Q18 DPU of 1.42 Scts (flat y-o-y) in line withexpectations.

- Results boosted by one-off pre-termination payment ofS$12m.

- Mid-single digit rental reversions achieved in 2Q18.

- To initiate share buy-back for up to 1.5% of issuedunits.

Rally to resume.

- We maintain our BUY call on Keppel REIT (KREIT) with a Target Price of S$1.41.

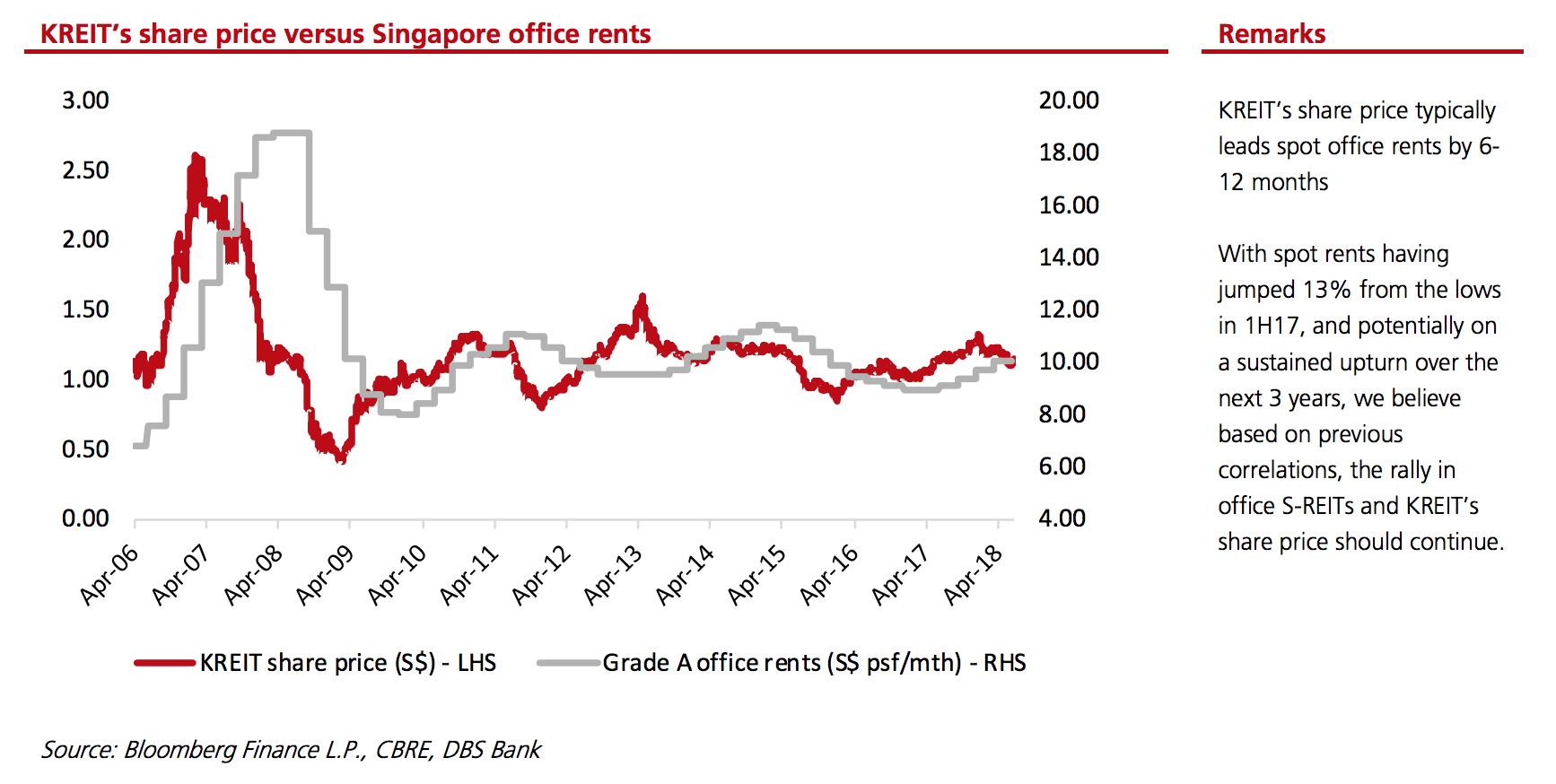

- Keppel REIT (SGX:K71U)’s share price typically leads a recovery in spot office rents by 6-12 months. According to CBRE, Grade A CBD rents has risen by another 4% q-o-q to S$10.10 psf/month by end 2Q18, and is 13% higher from the low of S$8.95 psf/month in 1H17. Thus, we believe office rents are on a sustained upturn and Keppel REIT’s share price should start to stage a rally following the correction over the past few months.

Where we differ – Discount to book not justified.

- Consensus has a HOLD rating on Keppel REIT given the expected fall in FY18 DPU and implying Keppel REIT should trade at a discount to book value. However, with FY18 marking the cyclical low in Keppel REIT’s DPU, we are more forward looking and are focusing on the projected growth in DPU from 2019 onwards which would be the first y-o-y increase in DPU in over 5 years.

- In addition, with management announcing its intention to start a buyback, the first S-REIT to do so, this should send a strong signal that Keppel REIT is significantly undervalued, considering several office buildings in less prime locations have been sold at a cap rate of between 1.7-3.2%, below the 3.75% used to value Keppel REIT’s best in class Grade A buildings in Singapore.

Recovery in office rents.

- We believe the expected recovery in office rents would be a catalyst to close the discount to Keppel REIT’s book value of c.S$1.41. The earlier-than-expected upturn in spot rents should provide confidence that market rents would eventually recover to S$12-14 psf/month.

Valuation:

- We maintain our DCF-based Target Price of S$1.41.

- With c.29% potential total return on a 12-month basis, we retain our BUY call.

Key Risks to Our View:

- Key risks to our positive view are weaker-than-expected rents causing DPU to come in below expectations.

First S-REIT to announce share buybacks

2Q18 DPU of 1.42 Scts flat y-o-y

- Keppel REIT‘s 2Q18 DPU was flat y-o-y at 1.42 Scts, resulting in 1H18 DPU of 2.84 Scts (-1% y-o-y). 1H18 DPU represented c.51% of our original FY18F DPU which was in line with our expectations. However, stripping out c.S$12m (equivalent to c.0.35 Scts/share) representing one-off income from the early pre-termination of a long term lease, underlying 2Q18 DPU would have come in at 1.07 Scts (-25% y-o-y) which would have been below expectations.

- We suspect ANZ was the tenant that pre-terminated the lease given that ANZ is now the sixth largest tenant by NLA, down from second largest tenant at end 1Q18 and its contribution by NLA drops to 3.8% from 5.1% previously. We understand Keppel REIT has been able to fill a large proportion of the vacated space at higher rents.

- The underperformance in underlying 2Q18 DPU can also be largely attributed to a weaker AUD/SGD FX rate (see SGD Currency Exchange Rate) which we had assumed to average around 1.08 versus 1.01, slower than expected uplift in occupancy at 275 George Street, higher marketing costs for its associates as well as timing differences between accounting profits and cash received.

Announces intention to initiate share buyback and suspend distribution reinvestment plan

- In conjunction with its 2Q18 results, Keppel REIT announced its intention to initiate a share buyback following the approval by unitholders at its recent AGM. Keppel REIT would be the first S-REIT to commence share buybacks.

- Keppel REIT may potentially buy up to 1.5% of issued units over a 6-month period. The 1.5% limit is due to restrictions placed by the Singapore Code of Take-overs and Mergers, to ensure Keppel Corporation (SGX:BN4), Keppel REIT’s sponsor, does not increase its stake beyond 1% over a 6 month period. At the current price of S$1.14, total consideration for the buyback is approximately S$58m. Furthermore, with a potential buyback, Keppel REIT also intends to suspend its distribution reinvestment plan (DRP).

- We believe investors will react positively to these announcements given their desire for Keppel REIT to close its 18% discount to book value, concerns over dilution to DPU with the DRP operating when Keppel REIT is trading below book and management signalling to the market that Keppel REIT is undervalued. This positive move is likely to outweigh the potential concerns should Keppel REIT fully debt fund the share buyback resulting in gearing ticking slightly over 40%.

- Near term, we understand a buyback would be funded from savings achieved by optimising its working capital.

Flattish contribution from Singapore properties with lower income from Australia and associates

- Excluding the S$12m one off income, NPI from Keppel REIT’s Singapore properties would be flattish y-o-y. The lower underlying income at Ocean Financial Centre (-1% y- o-y) was offset by 13% higher earnings at Bugis Junction as the property is now being fully occupied compared to 97.5% occupancy in 2Q17.

- Meanwhile, 2Q18 NPI from 275 George Street in Brisbane and 8 Exhibition in Melbourne, fell 21% and 4% respectively largely due to the depreciation of the AUD. The property at 275 George Street was also impacted by lower committed occupancy of 93.4%, down from 99.3% at end 2Q17 (flat q-o-q).

- In addition, contribution from associates was lower by 7% y-o-y due to absence of income support at Ocean Financial Centre (S$0.9m in 2Q17) and one-off pre-termination income, higher marketing expenses, and impact from negative rental reversions in prior quarters.

- Overall portfolio occupancy remains high at around 99.3%, though marginally down from 99.8% at end 2Q17 and 99.4% at end 1Q18. With the exception of 275 George Street and 8 Exhibition Street (97.2%), Keppel REIT’s buildings are fully or close to being fully occupied.

Trend of positive rental reversion continues into 2Q18

- Following the 3.6% positive rental reversions achieved in 1Q18, we understand Keppel REIT was able to achieve on average positive rental reversions in the mid-single digit range. This is the second consecutive quarter of positive rental reversions after a difficult 2-3 years.

- On the back of spot Grade A rents rising another 4% q-o-q to S$10.10 psf/month according to CBRE, Keppel REIT achieved average signing rents of c.S$10.74 psf/month for its Singapore portfolio in 1H18, up from S$10.05 psf/month in 1Q18 and S$9.80 psf/month for the whole of FY17. However, due to the higher rents, the retention rate fell to 77% from 93%.

- Over the quarter, new leases signed in Singapore were mainly from the banking, insurance financial services sector versus the legal sector in 1Q18. In Australia, demand came from a government agency taking up space at 275 George Street.

- Following the renewal of leases in 2Q18, only 2.9% of leases by NLA are due to expire for the remainder of FY18, down from 6.2% at end March 2018. For FY19, another 10.2% of leases are up for renewal with a large proportion we understand related to leases at Marina Bay Financial Centre (MBFC). In terms of rent reviews, another 8.8%of leases are subject to negotiation and the majority related to DBS Group (SGX:D05)’s leases at MBFC. DBS Group (SGX:D05) represents c.6.2% of leases by NLA.

- Going forward, with Grade A CBD rents expected to remain on an upward trend, we believe there is a high likelihood of positive rental reversions continuing in 1H18, and higher rents achieved post the various rent reviews. As reminder, Keppel REIT had previously disclosed that the majority of leases in Singapore due for renewal and review in FY18 had been inked at between S$8.50-S$12.00 psf.

Steady gearing with marginal uptick in borrowing costs

- Keppel REIT’s gearing was stable at 38.6% with its all-in costs of debt ticking up marginally to 2.77% from 2.75% at end 1Q18.

- Going forward, gearing should climb closer to the 40% level once the recently acquired 311 Spencer Street development is completed in 4Q19 and will inch above 40% should Keppel REIT fully debt fund its announced share buy-back.

- Meanwhile, the proportion of fixed-rate loans and NAV per unit were stable at 77% and S$1.41 respectively.

Trimming FY18-19 DPU by 1% each

- On the back of cutting our AUDSGD FX assumption rate from 1.08-1.10 to 1.01-1.06 over FY18-19F and tweaking occupancies at 275 George Street to 94- 97% from 99.5% previously, we trimmed our FY18- 19F DPU by 1%.

- Our DPU estimates would have been lower if not for the removal of DRP and our conservative assumption that Keppel REIT would buy back 0.4% of units outstanding S$1.15, which is a quarter of its intention to buyback up to 1.5% of units outstanding.

- Nevertheless, we maintain our DCF-based Target Price of S$1.41 as we rolled forward our valuation to FY19.

Maintain BUY with a Target Price of S$1.41

- While underlying 2Q18 DPU disappointed, we believe with office rents expected to remain on an uptrend over the next 2-3 years and Keppel REIT yet to fully benefit from the positive rental achieved over the last two quarters, we maintain our BUY call with a Target Price of S$1.41.

- Furthermore, with KREIT announcing its intention to buyback up to 1.5% of units outstanding, we believe this is clear signal by management that Keppel REIT is significantly undervalued given the stock trades at 18% discount to its book value.

Mervin SONG CFA

DBS Group Research Research

|

Derek TAN

DBS Research

|

https://www.dbsvickers.com/

2018-07-17

SGX Stock

Analyst Report

1.410

Same

1.410