KEPPEL DC REIT

SGX:AJBU

KEPPEL DC REIT

SGX:AJBU

Keppel DC REIT - Acquisition Growth Booster

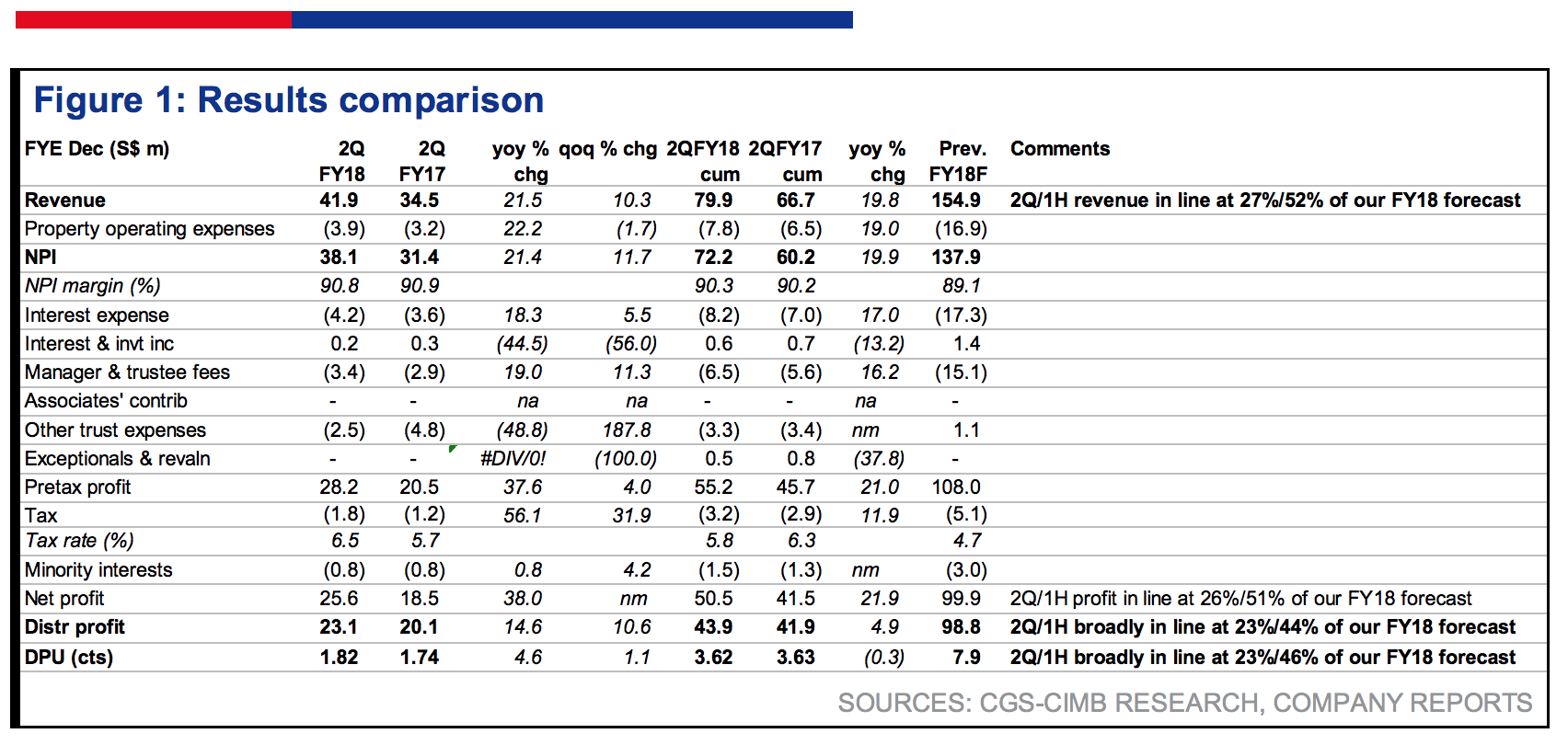

- Keppel DC REIT's 2Q18 DPU broadly in line with expectations, at 23% of our FY18 forecast.

- Keppel DC REIT's 1H18 DPU at 46% of our FY18 forecast.

- Topline boost came mainly from new acquisitions.

- Low gearing of 31.7% provides debt headroom for new acquisition opportunities.

- Maintain ADD with an unchanged Target Price of S$1.49.

2Q18 Results Highlights

- Keppel DC REIT (KDCREIT)’s 2Q18 results were broadly in line, with DPU of 1.82 Scts (+4.6% y-o-y), making up 23% of our FY18 forecast. The improvement was underpinned by a 21.5% rise in gross revenue and 22.2% rise net property income, albeit partly offset by higher finance costs and Manager’s fees.

- At halftime, its cumulative DPU of 3.62 Scts is 4% higher y-o-y, after adjusting for the one-time capital distribution in 1Q17.

Boosted by new contributions from recent acquisitions

- 2Q18 topline growth was driven largely by contributions from new additions such as maincubes Data Centre (acquisition completed in Mar 2018), and recent purchase of 99% interest in KDC SGP5 (formerly known as Kingsland Data Centre) and Dublin 2 (DUB2) as well as forex strength. There was also higher variable income from the other data centres in its portfolio - SGP1, SGP2, SGP3 and higher rental income from DUB1.

- This was partly offset by lower rental income from Basis Bay Data Centre.

High portfolio occupancy

- Portfolio occupancy remained fairly high at 92% in 2Q18, although it dipped slightly on a q-o-q basis. There was occupancy improvements at SGP 1 (+2.6% pts to 87.3%) while SGP 5’s underlying occupancy rose to 73.9%.

- With minimal lease expiries of 1.2-4.8% annually between FY18-20F, we anticipate Keppel DC REIT (KDCREIT)’s income to remain relatively stable.

Lower gearing post recent equity raising

- With its recent private placement in May 2018, Keppel DC REIT (KDCREIT)’s gearing has improved to 31.7% as at Jun, which provides the REIT with a potential debt headroom of S$290m, assuming an optimal gearing level of 40%. This puts it in a good position to explore new acquisition opportunities.

- Moreover, its foreign-sourced distributions are hedged till 2H19, providing the REIT with good income visibility.

Maintain ADD

- We leave our FY18-20F DPU unchanged post results. Our ADD rating and DDM-based Target Price of S$1.49 are maintained.

- We continue to like Keppel DC REIT (KDCREIT) for its exposure to the positive fundamentals of data centres as well as potential for acquisitive growth.

- Potential re-rating catalysts are accretive acquisitions.

- Downside risk could come from unexpected rate hikes.

LOCK Mun Yee

CGS-CIMB Research

|

https://research.itradecimb.com/

2018-07-17

SGX Stock

Analyst Report

1.490

Same

1.490