KEPPEL CORPORATION LIMITED

SGX:BN4

KEPPEL CORPORATION LIMITED

SGX:BN4

Keppel Corporation - Dividend Surprise

- 2Q18 profit above expectations, boosted by property en bloc sales and Nassim Woods revaluation gain.

- O&M saw a marginal recovery, aided by Borr deal.

- 2H18 bottomline will be bolstered by CBD Aether divestment gain (c.S$114m) and Tianjin Eco-city land sale (DBS est S$150m).

- Yield lifted by special dividend; Reiterate BUY; Target Price S$9.00.

Reiterate BUY; Target Price adjusted slightly to S$9.00

- Reiterate BUY; Target Price adjusted slightly to S$9.00, reflecting price weakness in listed entities. 1H18 results were boosted by property en bloc sales and Nassim Woods revaluation gain.

- On top of 10 Scts interim dividend (vs 8 Scts in1H17), Keppel declared a special dividend of 5 Scts, which lifts our full year DPS projection to 27 Scts, translating to c.3.9% yield (prev 3.2%).

- We continue to favour Keppel as a safer proxy to ride the O&M recovery, given its multi-pronged businesses.

Where we differ: Positive on Tianjin Eco-City.

- Keppel’s huge development projects in Tianjin Eco-city. The land was acquired in 2009 at less than one-tenth of the current land price and yet to be reflected in our RNAV.

- In addition, the ongoing portfolio rebalancing exercise will unlock values of completed projects.

O&M on the cusp of recovery.

- O&M’s contract wins in 2017 bucked the declining trend as the division clinched S$1.2bn worth of new orders, which doubled over 2016. The momentum should continue into 2018 with S$3bn new orders assumed.

- YTD, Keppel has won ~S$890m new contracts. New orders are expected to come from gas and FPSO projects buoyed by sustained oil prices above US$70/bbl. The recovery in new orders towards our assumption could prompt further re-rating of the O&M business.

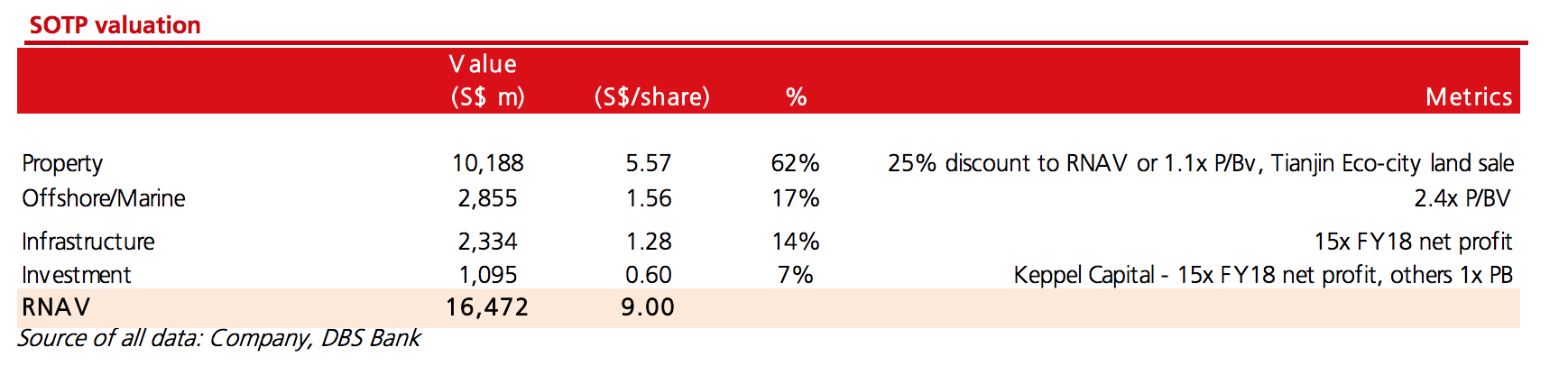

Valuation:

- Our Target Price of S$9.00 is based on sum-of-parts valuation:

- O&M segment is valued at 2.4x P/BV,

- infrastructure at 15x PE on FY18F earnings,

- property segment at 25% discount to RNAV,

- investment (Keppel Capital) at 15x FY18F earnings, and

- market values/estimated fair values are used for listed subsidiaries.

- Our Target Price implies 1.3x FY18 P/BV.

Key Risks to Our View:

- O&M segment could fare worse than expected. We forecast annual revenues from Keppel O&M to fall to the ~S$2-4bn level in FY18-19, from S$7-8bn during FY12-14. If contract flows do not come through as expected, continued depletion of its orderbook could pose downside risks to our forecast.

WHAT’S NEW - Boosted by Nassim Woods revaluation gain

2Q18 above; boosted by Nassim Woods revaluation gain.

- Keppel’s core net profit grew 42% y-o-y to S$111m gain from en bloc sales and sales of stakes in Quoc Loc Phat, which were previously announced.

Property contributed ~91% of profit.

- Property segment generated S$22540m revaluation gain on investment property Nassim Woods that has been designated for redevelopment for sale.

- Keppel sold 1,420,900 overseas home worth ~S$2.4bn would be recognised upon completion from 3Q18 to 2021. Out of its residential landbank of 50,000 homes, 16,000 are launch-ready.

O&M losses narrowed.

- Revenue rose 82% q-o-q and 11% y-o-y to ~S$100m loss (excluding one-off) in 4Q17. Stripping out forex loss, O&M may have reported a slight profit.

- Net orderbook inched up to S$4.6bn in 2Q18 (vs S$4.3bn in 1Q18) following S$680m worth of new contracts secured in the quarter, which comprise two jackups (speculative units) for Borr Drilling, two high-specification dredgers, and one LNG bunkering vessel.

- Keppel’s first “Can Do” drillship is scheduled to complete by 4Q18 and it is actively engaging with potential customers. In Brazil, while Sete Brasil seems to have reached an agreement with Petrobras on rig charters, there has yet to be confirmation with yards on rig deliveries.

Investment dragged by share of loss associates and absence of Tianjin Eco-city land sale.

- Investment segment reported a net loss of S$218m that was incurred in 1Q18 (one quarter lag in recognition). In addition, there was no Tianjin Eco-city land sales in 1H18, which tend to be lumpy.

Infrastructure relatively stable; 2Q aided by Keppel DC Reit share placement dilution gains.

- Infrastructure division posted a stronger net profit of S$40m (+53% q-o-q; +63% y-o-y). The increase was attributable largely to the S$16m dilution gain following Keppel DC REIT (SGX:AJBU)’s private placement. Otherwise core business was relatively stable.

- Special dividend of 5 Scts was declared, on top of interim dividend of 10 Scts (vs 8 Scts in 1H17). Assuming its usual 40% payout ratio, we can expect another 12 Scts final dividend. This lifts the dividend yield c.4%.

Maintain our forecasts.

- Divestment gains amounted to ~S$410m in 1H18, bringing group net profit to S$584m, accounting for c.58% of our full year estimate.

- We believe Keppel is on track to meet our full year profit forecast of S$1bn. CBD Aether has exercised its options to acquire up to 16,702,500 shares of HK Aether on 19 Jul, which could translate to S$114m gain in 3Q18. Management is confident to conclude some Tianjin Eco-city land sales in 2H, and we have factored in ~S$150m profit for 2018F.

Pei Hwa HO

DBS Group Research Research

|

https://www.dbsvickers.com/

2018-07-20

SGX Stock

Analyst Report

9.00

Down

9.100