KEPPEL CORPORATION LIMITED

SGX: BN4

KEPPEL CORPORATION LIMITED

SGX: BN4

Keppel Corporation - Limited Impact From New Property Measures

- Singapore residential curbs have limited impact on Keppel.

- Singapore residential exposure accounts for < 10% of RNAV.

- Maintain BUY; Target Price reduced to S$9.10.

Limited impact from new property measures

- Reiterate BUY; Target Price reduced to S$9.10, as we widened the RNAV discount to 25% (previously 10%). This is in line with peer CapitaLand, reflecting the recent Singapore residential curbs.

- The property measures should have limited impact on Keppel, whose Singapore residential exposure forms only < 10% of RNAV.

- We continue to favour Keppel as a safer proxy to ride the O&M recovery, given its multi-pronged businesses.

- Keppel’s decent dividend yield of 3% (based on 40% payout ratio) also lends support to its share price.

Where We Differ: Positive on Tianjin Eco-City.

- Keppel’s huge historical land bank of ~6.5m sqm is held at a low cost. Half of the land bank is currently under development, progressively realising its RNAV over the next 3-5 years. Out of its remaining undeveloped land bank, 40% is for development projects in Tianjin Eco-city, which Keppel acquired in 2009 at less than one-tenth of the current land price which has yet to be reflected in our RNAV.

- In addition, the ongoing portfolio rebalancing exercise will unlock values of completed projects.

O&M on the cusp of recovery.

- O&M’s contract wins in 2017 bucked the declining trend as the division clinched S$1.2bn worth of new orders, which doubled over 2016. The momentum should continue into 2018 with S$3bn new orders assumed. YTD, Keppel has won ~S$840m new contracts. io. New orders are expected to come from gas and FPSO projects buoyed by sustained oil prices above US$70/bbl.

- The recovery in new orders towards our assumption could prompt further re-rating of the O&M business.

Valuation

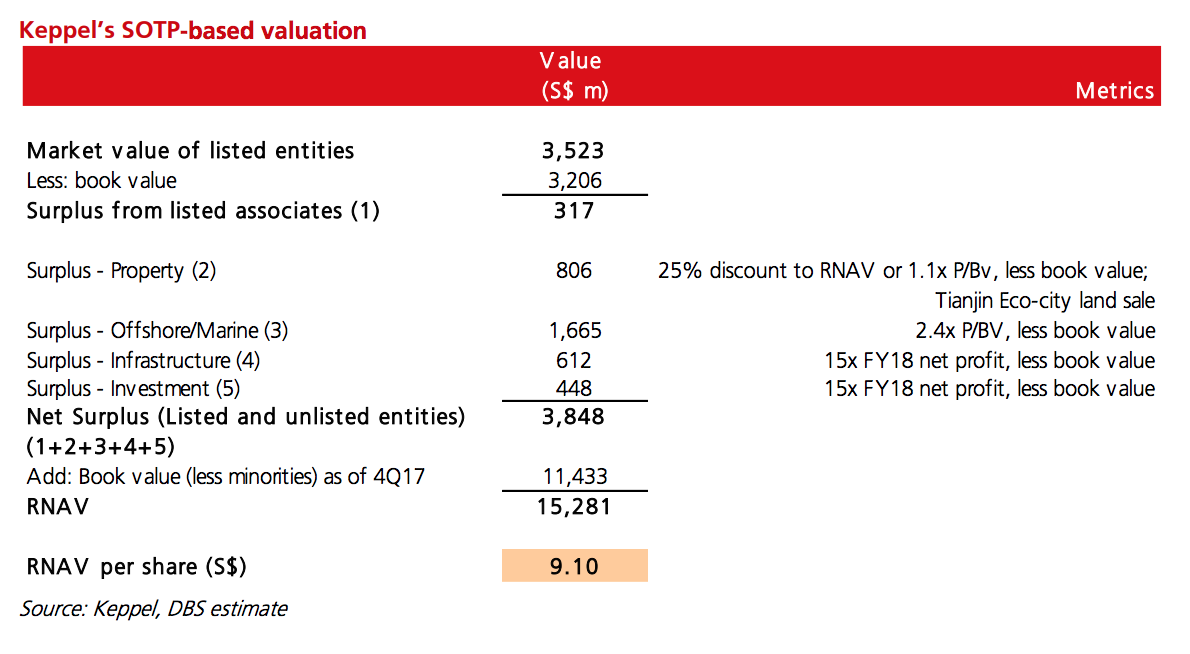

- Our Target Price of S$9.10 is based on sum-of-parts valuation:

- O&M segment is valued at 2.4x P/BV,

- infrastructure at 15x PE on FY18F earnings, SGinvestors.io.

- property segment at 25% discount to RNAV,

- investment (Keppel Capital) at 15x FY18F earnings, and

- market values/estimated fair values are used for listed subsidiaries.

- Our Target Price implies 1.3x FY18 P/BV.

Key Risks to Our View

- O&M segment could fare worse than expected. We forecast annual revenues from Keppel O&M to fall to the ~S$2-4bn level in FY18- 19, from S$7-8bn during FY12-14.

- If contract flows do not come through as expected, continued depletion of its orderbook could pose downside risks to our forecast.

WHAT’S NEW

Re-introduction of Singapore property measures

- Property curbs reinstated. On 5 July, the Singapore authorities announced further property curbs by raising Additional Buyer’s Stamp Duty (ABSD) rates by 5ppts and tightening Loan-to-Value (LTV) limits by 5ppts. The aim of these measures is to curb excessive property price increases, which came as a surprise to us. The measures were to be effective from 6 July.

Sales momentum to turn cold.

- Our property analyst estimates that the combined impact of these measures raises the cost of ownership on an assumed S$1.5m property purchase by S$75,000 (first-time buyer) and S$150,000 (investor). With the increased upfront capital commitment, we expect demand from investors and foreigners to cool in the immediate term. SGinvestors.io.

- In terms of sales momentum, we expect total volumes to fall to 9,000-10,000 units in 2018, and potentially even further if these curbs remain.

Limited impact on Keppel.

- Keppel’s Singapore residential book has been substantially sold. Its only has two launched residential projects in Singapore - Reflections and Corals at Keppel Bay, with c.20% of units remaining for sale. Keppel hasn’t been actively bidding for land in Singapore. The only addition in recent years to Singapore landbank was the Serangoon North Ave 1 (60% stake) with 463k GFA acquired in mid-2017.

- Singapore residential exposure forms only ~9% of RNAV.

Pei Hwa HO

DBS Group Research Research

|

https://www.dbsvickers.com/

2018-07-09

SGX Stock

Analyst Report

9.10

Down

10.200