ASCENDAS REAL ESTATE INV TRUST

SGX:A17U

ASCENDAS REAL ESTATE INV TRUST

SGX:A17U

Ascendas REIT - A New Growth Lever

Deal marks Europe entry, BUY

- Ascendas REIT has marked its entry into Europe with its latest acquisition of a UK freehold logistics portfolio, with risks largely mitigated by its long WALEs and high-quality tenancies. Low GBP-denominated debt funding costs have enhanced yields to drive a +1.2% DPU accretion, while favourable macros should support a stronger medium term rental outlook on its assets.

- Ascendas REIT’s portfolio diversification efforts have accelerated under its new CEO with the announcement of this deal. We see further momentum as it targets to scale its Europe AUM.

- We are keeping our forecasts for now with 1Q19 results to be announced on 30 Jul.

- Valuations based on our DDM-based SGD3.05 Target Price (WACC: 7.0%, LTG: 1.5%) remain undemanding given its scale, liquidity and improving fundamentals. BUY.

Acquires UK logistics portfolio at 5.3% NPI yield

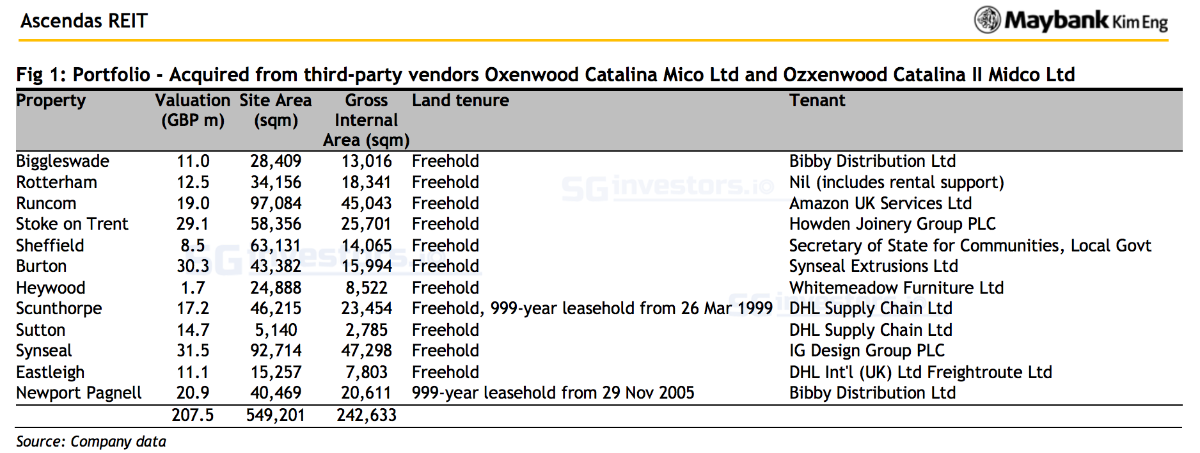

- Ascendas REIT announced a portfolio acquisition of 12 freehold logistics properties in the UK for GBP207.3m (SGD373.2m). The properties are fully occupied with WALE at 14.6 years and tenants include DHL, Bibby Distribution, and Amazon, amongst others. This deal should boost Ascendas REIT’s portfolio WALEs from 4.2 to 4.4 years.

- The acquisition will be funded by GBP-denominated debt – a five-year fixed term loan with all-in interest cost at 2.6-2.8%, with the first year NPI yield expected to be 5.32% (5.22% post-cost yield) and DPU accretion at +1.2% or S0.194cts.

- Ascendas REIT raises its overseas investments from 15% to 17% of total assets, as aggregate leverage rises from 34.4% to 36.7%, with an estimated debt headroom of SGD600m to support further deals.

~ SGinvestors.io ~ Where SG investors share

Risks mitigated, fundamentals supportive

- This announcement did not surprise us as the new CEO hinted just three months ago, Ascendas REIT’s readiness to push into other developed markets (Europe and US). Market fundamentals are supportive as the UK is a large market and shares similarities to the Singapore and Australian operations in terms of regime and risk profile.

- Logistics supply remains a constraint as 1Q18 vacancy at 2.7m sqm is below the 8-year historical average of 4.2m sqm, and new supply manageable at 0.7m sqm. Logistics properties further command an attractive 470-plus bp spread above the 10-year UK government bond yield, against an improving rental outlook.

- SGinvestors.io ~ Where SG investors share

- Ascendas REIT views this deal as a key part of its initial expansion into the UK, as it targets to grow its AUM in Europe to SGD1-2bn in the next two years.

- The portfolio profile, with 6.4% of leases expiring in FY22 at the earliest, coupled with support on asset management and related services from its sponsor should boost bandwidth for Ascendas REIT to execute on its expansion plans.

Chua Su Tye

Maybank Kim Eng Research

|

https://www.maybank-ke.com.sg/

2018-07-27

SGX Stock

Analyst Report

3.050

Same

3.050