Singapore Stock Strategy 2018

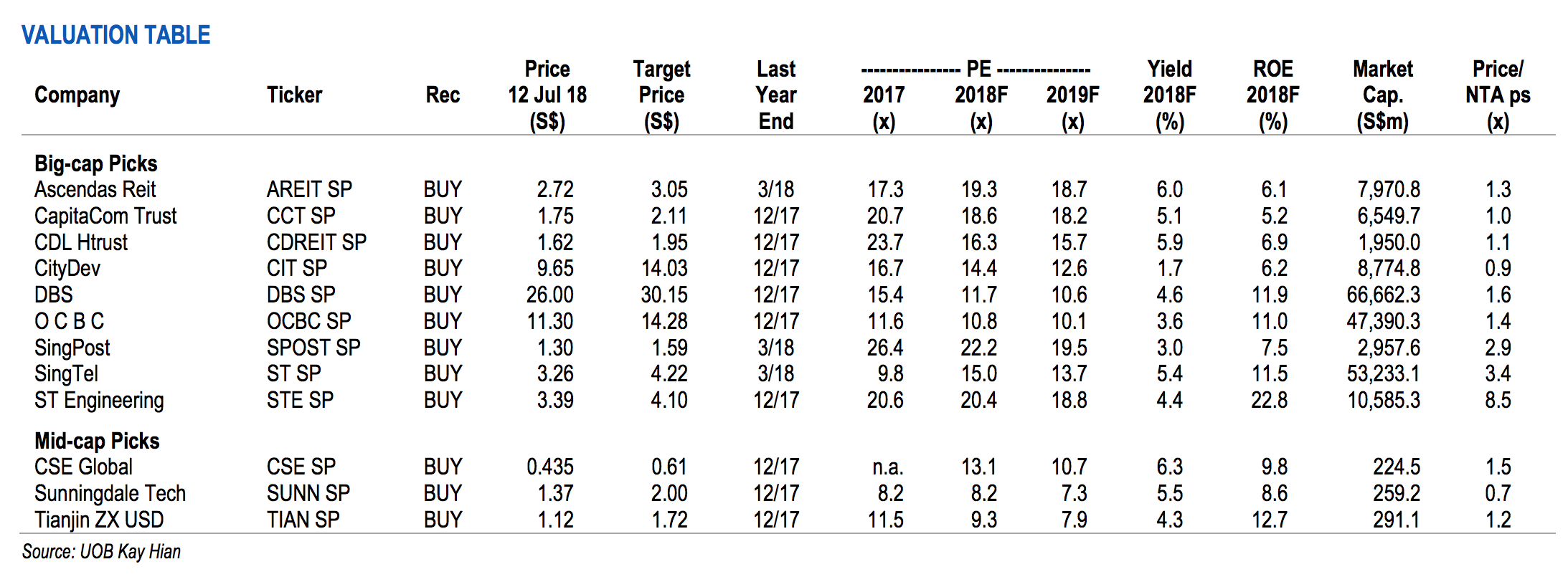

Stock Recommendations

ASCENDAS REAL ESTATE INV TRUST

SGX:A17U

CAPITALAND COMMERCIAL TRUST

SGX:C61U

CDL HOSPITALITY TRUSTS

SGX:J85

CITY DEVELOPMENTS LIMITED

SGX:C09

DBS GROUP HOLDINGS LTD

SGX:D05

OVERSEA-CHINESE BANKING CORP

SGX:O39

SINGAPORE POST LIMITED

SGX:S08

SINGTEL

SGX:Z74

SINGAPORE TECH ENGINEERING LTD

SGX:S63

CSE GLOBAL LTD

SGX:544

TIANJIN ZHONG XIN PHARM GROUP

SGX:T14

SUNNINGDALE TECH LTD

SGX:BHQ

Singapore Stock Strategy 2018

Stock Recommendations

ASCENDAS REAL ESTATE INV TRUST

SGX:A17U

CAPITALAND COMMERCIAL TRUST

SGX:C61U

CDL HOSPITALITY TRUSTS

SGX:J85

CITY DEVELOPMENTS LIMITED

SGX:C09

DBS GROUP HOLDINGS LTD

SGX:D05

OVERSEA-CHINESE BANKING CORP

SGX:O39

SINGAPORE POST LIMITED

SGX:S08

SINGTEL

SGX:Z74

SINGAPORE TECH ENGINEERING LTD

SGX:S63

CSE GLOBAL LTD

SGX:544

TIANJIN ZHONG XIN PHARM GROUP

SGX:T14

SUNNINGDALE TECH LTD

SGX:BHQ

Strategy - Singapore - A More Challenging Landscape To Navigate

- We have re-worked our FSSTI target to reflect a more uncertain external environment and a higher risk-free rate.

- Our latest FSSTI target of 3,450 implies a 6% upside and a stock-picking approach for the rest of 2018.

WHAT’S NEW

Heightening trade war tensions and rising rates.

- We have reviewed our year-end FSSTI target as a result of the escalating trade tensions and the change in expectations of four hikes in FED funds rate in 2018 rather than three. Hence, we adjust our risk-free rate assumption for Singapore and highlight a sensitivity analysis on sectors/stocks that would be negatively impacted.

ACTION

Lowering year-end target.

- In our earlier report dated 1 June, we urged investors to tread carefully after the market run-up but we had under-estimated the extent of the sharp pull-back in FSSTI due to the escalating trade tensions (see report: 2H18 Market Strategy Singapore: Treading Carefully After Market Run).

- In addition, interest rates expectations have also been adjusted upward to four hikes rather than three in 2018 after the latest June FOMC. As a result, we reduce our year-end FSSTI target to 3,450 (from 3,720), which is based on a blended 15% discount to long-term mean PE and mean P/B.

Corporate earnings growth still robust.

- We forecast market EPS growth at 8.6% y-o-y in 2018 and 9.5% y-o-y in 2019. On our estimates, 2018 earnings growth will be driven by the banks before broadening out to other sectors such as plantations and shipyards in 2019. However, we see possible downside risk in 2019 earnings from developers as a result of the recent property cooling measures.

- As for the banks, we see limited impact on loans growth from the recent property cooling measures as the recent demand recovery in residential properties was relatively short-lived and homes purchased for investment accounted for just 27% of the new housing loan limit granted in 4Q17, as past cooling measures had already moderated investment demand.

Sector/stocks impacted by rising rates.

- Given the expectations that the FED will hike rates four times this year, our base-case risk-free rate (RFR) assumption is raised from 2.5% to 2.75%. Sectors or stocks that could be negatively impacted are the S-REITs, banks, telecommunications and stocks that are valued on a DCF-basis. We will adjust our target prices once the upcoming 2Q18 results are announced.

- We have done a sensitivity analysis to find out how various interest rate-sensitive stocks will react to a 25bp and 50bp rise in RFR.

Investment themes for the rest of the year.

- Beyond the near-term external noise, we see selective bargains after the recent pull-back. Key reasons include reasonable valuations and relatively attractive EPS growth.

- 2H18 investment themes to consider include:

- Mature growth plays –

- KEPPEL CORPORATION LIMITED (SGX:BN4) Keppel Corp (SGX:BN4) Share Price Keppel Corp (SGX:BN4) Target Price Keppel Corp (SGX:BN4) Analyst Reports Keppel Corp (SGX:BN4) Corporate Actions Keppel Corp (SGX:BN4) Announcements Keppel Corp (SGX:BN4) Latest News Keppel Corp (SGX:BN4) Blog Articles

- CITY DEVELOPMENTS LIMITED (SGX:C09) City Developments (SGX:C09) Share Price City Developments (SGX:C09) Target Price City Developments (SGX:C09) Analyst Reports City Developments (SGX:C09) Corporate Actions City Developments (SGX:C09) Announcements City Developments (SGX:C09) Latest News City Developments (SGX:C09) Blog Articles

- CDL HOSPITALITY TRUSTS (SGX:J85) CDL Hospitality Trust (SGX:J85) Share Price CDL Hospitality Trust (SGX:J85) Target Price CDL Hospitality Trust (SGX:J85) Analyst Reports CDL Hospitality Trust (SGX:J85) Corporate Actions CDL Hospitality Trust (SGX:J85) Announcements CDL Hospitality Trust (SGX:J85)Latest News CDL Hospitality Trust (SGX:J85) Blog Articles

- RAFFLES MEDICAL GROUP LTD (SGX:BSL) Raffles Medical (SGX:BSL) Share Price Raffles Medical (SGX:BSL) Target Price Raffles Medical (SGX:BSL) Analyst Reports Raffles Medical (SGX:BSL) Corporate Actions Raffles Medical (SGX:BSL) Announcements Raffles Medical (SGX:BSL) Latest News Raffles Medical (SGX:BSL) Blog Articles

- Unloved stocks at attractive valuations –

- SUNNINGDALE TECH LTD (SGX:BHQ) Sunningdale Tech (SGX:BHQ) Share Price Sunningdale Tech (SGX:BHQ) Target Price Sunningdale Tech (SGX:BHQ) Analyst Reports Sunningdale Tech (SGX:BHQ) Corporate Actions Sunningdale Tech (SGX:BHQ) Announcements Sunningdale Tech (SGX:BHQ) Latest News Sunningdale Tech (SGX:BHQ) Blog Articles

- SINGAPORE POST LIMITED (SGX:S08) SingPost (SGX:S08) Share Price SingPost (SGX:S08) Target Price SingPost (SGX:S08) Analyst Reports SingPost (SGX:S08) Corporate Actions SingPost (SGX:S08) Announcements SingPost (SGX:S08) Latest News SingPost (SGX:S08) Blog Articles

- CSE GLOBAL LTD (SGX:544) CSE Global (SGX:544) Share Price CSE Global (SGX:544) Target Price CSE Global (SGX:544) Analyst Reports CSE Global (SGX:544) Corporate Actions CSE Global (SGX:544) Announcements CSE Global (SGX:544) Latest News CSE Global (SGX:544) Blog Articles,

- TIANJIN ZHONG XIN PHARM GROUP (SGX:T14) Tianjin Zhongxin Pharmaceutical (SGX:T14) Share Price Tianjin Zhongxin Pharmaceutical (SGX:T14) Target Price Tianjin Zhongxin Pharmaceutical (SGX:T14) Analyst Reports Tianjin Zhongxin Pharmaceutical (SGX:T14) Corporate Actions Tianjin Zhongxin Pharmaceutical (SGX:T14) Announcements Tianjin Zhongxin Pharmaceutical (SGX:T14) Latest News Tianjin Zhongxin Pharmaceutical (SGX:T14) Blog Articles

- Stocks with potential earnings upside –

- (tactical buy) SINGAPORE AIRLINES LTD (SGX:C6L) Singapore Airlines (SGX:C6L) Share Price Singapore Airlines (SGX:C6L) Target Price Singapore Airlines (SGX:C6L) Analyst Reports Singapore Airlines (SGX:C6L) Corporate Actions Singapore Airlines (SGX:C6L) Announcements Singapore Airlines (SGX:C6L) Latest News Singapore Airlines (SGX:C6L) Blog Articles

- CDL HOSPITALITY TRUSTS (SGX:J85) CDL Hospitality Trust (SGX:J85) Share Price CDL Hospitality Trust (SGX:J85) Target Price CDL Hospitality Trust (SGX:J85) Analyst Reports CDL Hospitality Trust (SGX:J85) Corporate Actions CDL Hospitality Trust (SGX:J85) Announcements CDL Hospitality Trust (SGX:J85)Latest News CDL Hospitality Trust (SGX:J85) Blog Articles

- SINGAPORE POST LIMITED (SGX:S08) SingPost (SGX:S08) Share Price SingPost (SGX:S08) Target Price SingPost (SGX:S08) Analyst Reports SingPost (SGX:S08) Corporate Actions SingPost (SGX:S08) Announcements SingPost (SGX:S08) Latest News SingPost (SGX:S08) Blog Articles

- Defensive stocks at reasonable valuation and dividend yield –

- SINGTEL (SGX:Z74) SingTel (SGX:Z74) Share Price SingTel (SGX:Z74) Target Price SingTel (SGX:Z74) Analyst Reports SingTel (SGX:Z74) Corporate Actions SingTel (SGX:Z74) Announcements SingTel (SGX:Z74) Latest News SingTel (SGX:Z74) Blog Articles

- SINGAPORE TECH ENGINEERING LTD (SGX:S63) ST Engineering (SGX:S63) Share Price ST Engineering (SGX:S63) Target Price ST Engineering (SGX:S63) Analyst Reports ST Engineering (SGX:S63) Corporate Actions ST Engineering (SGX:S63) Announcements ST Engineering (SGX:S63) Latest News ST Engineering (SGX:S63) Blog Articles

- Mature growth plays –

More palatable after recent pull-back.

- Since hitting the 12-month high of 3,615 in May 18, the FSSTI has pulled back by 10%. At the latest closing price, the FSSTI is trading at a FY18PE of 14.2x, which compares with its long-term mean of 15.0x. FY18F P/B of 1.28x also remains inexpensive, at a 18% discount to long-term mean.

- Given reasonable valuation, we would look to accumulate our key picks on sharp pull-backs.

Andrew CHOW CFA

UOB Kay Hian Research

|

https://research.uobkayhian.com/

2018-07-13

SGX Stock

Analyst Report

3.050

Same

3.050

2.110

Same

2.110

1.950

Same

1.950

14.030

Same

14.030

30.150

Same

30.150

14.280

Same

14.280

1.590

Same

1.590

4.220

Same

4.220

4.100

Same

4.100

0.610

Same

0.610

1.720

Same

1.720

2.000

Same

2.000