CAPITALAND COMMERCIAL TRUST

C61U.SI

CAPITALAND COMMERCIAL TRUST

C61U.SI

CapitaLand Commercial Trust - Breakthrough Into Marina Bay

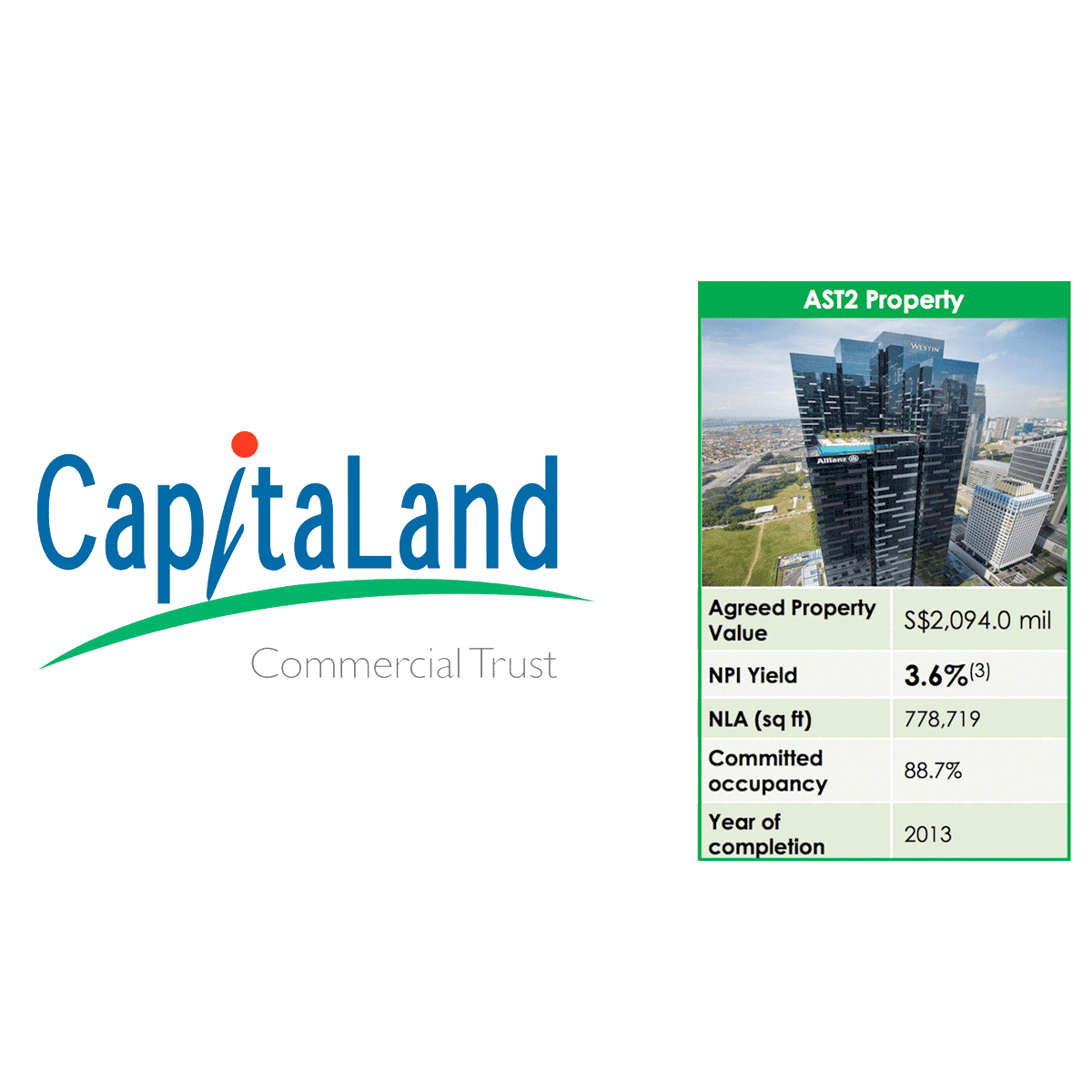

- Acquisition of Asia Square Tower 2 (AST2) for S$2,094mn or S$2,689/psf.

- Translates to NPI yield of 3.6% based on committed occupancy of 88.7% for total NLA of 778,719 sq ft.

- Total acquisition cost of S$2,151mn to be funded by 52% debt, 32% Rights offering, 16% internal cash from divestment proceeds.

- Pro forma DPU yield for 1H17 drops from 5.38% to 5.13%, but various NPI growth drivers exist for AST2.

- Maintain Accumulate with an unchanged DDM-derived target price of S$1.80. We recommend to subscribe to the rights issue.

What Is The News?

- CapitaLand Commercial Trust (CCT) announced the acquisition of Asia Square Tower 2, a premium Grade A office building from BlackRock Asia Property Fund III L.P. for S$2,096mn or S$2,689/psf.

- Total Net Lettable Area for AST 2 includes 753k sqft of office space and 25.3k sq ft of retail space. Completed in 2013, remaining land tenure for AST2 stands at 89 years.

- To be partially funded by debt/rights issue/divestment proceeds, pro-forma aggregate leverage of CCT will increase from 36% to 37.1% post acquisition.

How Do We View This?

Recycling capital into higher yield after recent divestments (3.2%-3.4% vs acquisition yield 3.6%).

- Recall CCT’s recent divestments of One George Street (50%, OGS) and Wilkie Edge at exit yields of 3.2% and 3.4% respectively. Partial divestment proceed is recycled into a higher yielding asset at 3.6% (assuming 2.5% interest cost), plus with a slightly longer land tenure (AST2’s 89 years vs OGS’s 85 years).

NPI yield on cost could be further boosted as occupancy has room to grow from 88.7% currently.

- CCT’s strong network of corporate tenants has enabled it to keep up its average overall portfolio occupancy at 97.3% over the past decade.

- We are also confident of the Group’s ability to boost occupancy from current level, given the tapering of supply of office properties, especially in the Marina Bay submarket over the next 3 years, following the completion of Marina One this year.

Acquisition price also at attractive valuations vs surrounding office properties:

- Acquisition price of S$2,689/psf is 7.3% lower than the average valuation of S$2,900/psf for 5 comparable Grade A office buildings in AST2’s vicinity (Marina Bay Financial Centres 1-3, One Raffles Quay and OUE Bayfront).

- All five buildings have remaining land tenures of 83-89 years, equal or less than AST2.

Peak rental contracts signed in 2015 due for renewal next year.

- Reversions likely to be weak. But impact to be mitigated by low percentage of expiries in 2018 (10% of NLA), and a potential uplift in NPI from improving occupancies.

- We expect rental reversions to come in at negative high single digits in 2018. Nonetheless, we estimate that just a 1% improvement in occupancy level will be able to fully offset the decline in NPI from the expected negative reversion in 2018. We expect occupancy to improve to mid-90s % by FY18.

Maintain ACCUMULATE with unchanged DDM-derived target price of S$1.80

- Post-acquisition and rights issue, our FY17e/FY18e DPU forecasts are adjusted by - 4.6%/0%.

- Our target price of S$1.80 represents a P/NAV of 1.0x and FY18e yield of 5%.

CCT's presentation slides available at CapitaLand Commercial Trust Announcements

(Announcement dated 2017-09-21 16:37:12)

(Announcement dated 2017-09-21 16:37:12)

Dehong Tan

Phillip Securities

|

http://www.poems.com.sg/

2017-09-22

Phillip Securities

SGX Stock

Analyst Report

1.800

Same

1.800