CAPITALAND LIMITED

C31.SI

CITY DEVELOPMENTS LIMITED

C09.SI

UOL GROUP LIMITED

U14.SI

CAPITALAND LIMITED

C31.SI

CITY DEVELOPMENTS LIMITED

C09.SI

UOL GROUP LIMITED

U14.SI

Singapore Property - Mindful of potential macro headwinds

- Sep 16 sales +22%y-o-y despite lower launches, YTD sales +13% y-o-y.

- Resale transactions +25% y-o-y; total sales +14%.

- Potential headwinds if economic growth and employment continues to weaken.

- Developers’ valuation still attractive. Top picks are CDL, CapitaLand and UOL Group.

Sep16 sales volume up 22% y-o-y led by private homes, despite lower launches.

- Despite the lack of new launches (- 48% y-o-y) in Sep 16, primary sales rose 22% y-o-y led by private homes (+49%). EC sales fell 10%.

- While there were no exceptionally large sales by each project (partially due to the absence of new property launches), the sales volume for each project was moderate, with 20 to 38 units sold among each of the top 10 sales by project.

- In spite of EC sales falling, Treasure Crest, Sol Acres and The Terrace were among the top 5 selling projects while Lake Grande and The Trilinq were the two private projects in the list, implying some clearance of the residential supply.

- Sales volume in Oct 16 should stay strong due to the launch of Forest Woods and Alps Residences.

- In 9M16, units launched fell 15% while sales volume grew 13% y-o-y, led by EC sales.

- Private sales fell marginally, -3% y-o-y.

Sep 16 resale transactions continue to rise (+25% y-o-y).

- Resale volume grew 25%.

- Similar to Aug, these came from the re-launches of The Interlace (19 units), D’Leedon (15 units) and OUE Twin Peaks (15 units) in the central region.

- Total sales (primary+resale) grew 14% y-o-y (private +6%; EC +55%).

Keeping an eye on employment outlook key to future price direction.

- We currently project the Singapore property market to be moving in two gears – prices in the core central region (CCR) bottoming out while prices in the Rest of Central region (RCR) still reporting declines of up to 5% going forward.

- However, recent macro data-points indicate

- a sharper-than-expected slowdown in Singapore’s economic growth to 0.6% in 3Q16, and

- the rise in Singapore citizens’ unemployment rate in 3Q16 to 3.1% (vs 2.6% q-o-q) is expected to cast a pall over future price rises.

- We note that the worsening outlook of both data-points might result in weaker- than-expected prices.

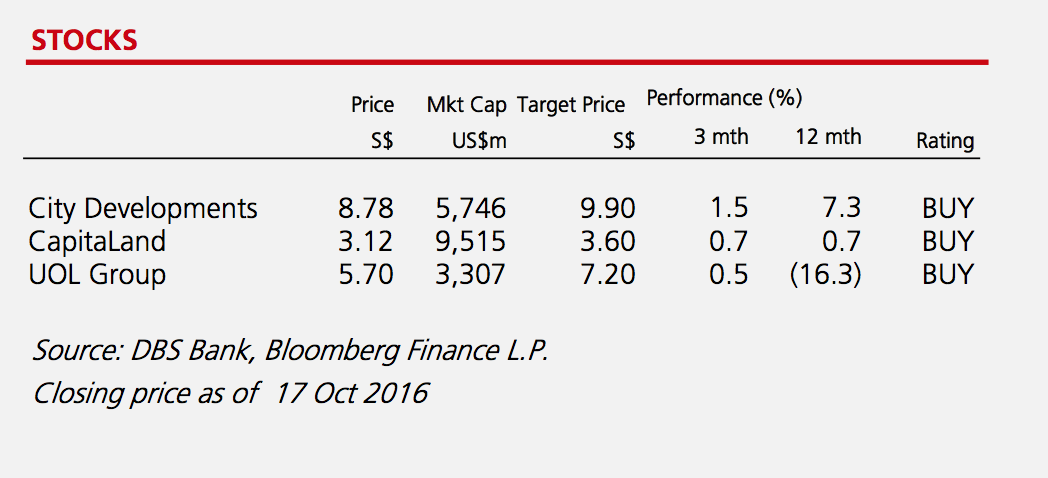

Developer picks.

- Developers trading at 0.75x P/NAV are still attractive.

- Our top picks are City Developments (CDL), CapitaLand and UOL Group, given their

- diversified earnings streams that offer strong earnings visibility,

- strong balance sheets which imply ample capital to deploy opportunistically, and

- catalysts from asset-recycling activities.

Derek TAN

DBS Vickers

|

Rachel TAN

DBS Vickers

|

http://www.dbsvickers.com/

2016-10-18

DBS Vickers

SGX Stock

Analyst Report

3.60

Same

3.60

9.90

Same

9.90

7.20

Same

7.20