SREIT

ASCENDAS REAL ESTATE INV TRUST

A17U.SI

CDL HOSPITALITY TRUSTS

J85.SI

FRASERS LOGISTICS & IND TRUST

BUOU.SI

KEPPEL REIT

K71U.SI

SREIT

ASCENDAS REAL ESTATE INV TRUST

A17U.SI

CDL HOSPITALITY TRUSTS

J85.SI

FRASERS LOGISTICS & IND TRUST

BUOU.SI

KEPPEL REIT

K71U.SI

Singapore REITs - Buying into value

- Majority of REITs continue to grind out stable or incremental rise in DPU.

- Yield spreads still wide despite post-Brexit rally.

- Selectively shift towards unloved office and hospitality REITs, away from REITs where investors are seeking refuge.

- Top picks: AREIT, CDREIT, FLT and KREIT.

S-REITs grinding out steady returns despite weak fundamentals.

- The recent 2Q16 result season saw S-REITs delivering a 1.5% growth in distribution per unit (DPUs) although ongoing rental pressures persist due to the oversupply situation in various property sub-segments. We see Retail REITs delivering most steady organic growth and will likely continue, while a majority of S-REITs inch out stable or incremental rise in DPUs on the back of acquisitions and capital distributions.

- Looking ahead, we see increasing challenges to portfolio occupancies in industrial REITs given expected tenant consolidations resulting in higher portfolio vacancies. While the performance of Singapore-focused hospitality REITs will likely remain weak on the back of soft corporate demand and heightened price competition, we expect an improvement in 2H16 due to a seasonal uplift and delay in the completion of some new hotels. Office REITs are expected to deliver steady returns as the majority of leases expiring this year have already been renewed.

Yield spreads of 4.5% to cushion valuations despite macro noises from Fed rate hikes in Sep/Dec.

- We expect macro noises to persist in the coming 2H16 but think that the current yield spreads of 4.5% are sufficient to buffer valuations. Even after accounting for a further 50-bp hike in benchmark 10-year bond yields to 2.3% vs the current 1.8%, spreads remain wide at 4.0%, which is appealing in our view.

Better value in select office and hospitality REITs.

- Diving deeper, the high headline yield masks yield spreads of between 3.7-3.9% for defensive retail REITs (CMT and FCT) which investors had been “hiding in” during a period of uncertainty, especially post the Brexit referendum.

- While we expect the prices for both to remain elevated given their defensive nature, we believe investors should selectively pick names in the office (KREIT) and hospitality (CDREIT) sectors which offer better value in terms of

- trading at a 12-23% discount to recent physical market transactions on an implied price per sqft or per key basis, and

- where investors are typically underweight.

- Our other top picks include: AREIT and FLT for a combination of market liquidity, decent yields, clear growth drivers and upside to earnings from deploying their strong balance sheets

Salient Operational Highlights

Retail REITs

- Most retailers registered low, if not negative, y-o-y growth in footfall and sales in 2Q16.

- While it is too early to conclude that this could spark further weakness going forward, we see challenges in Orchard road- focused malls given the 11.3% y- o-y increase in visitor arrivals1 has not appeared to spur spending for malls like (Vivocity and Wisma Atria and Paragon).

- DPU growths fell to low single digits; occupancy rate, though was still above 90% but there was greater dispersion between retail malls.

- The higher vacancy rates seen across selected malls (especially in Central Singapore) may provide more bargaining power to tenants, hence we expect flat to low rental reversions, as Managers aim for tenant retention.

- Many S-REIT Managers have been utilising the soft environment as an opportunity to refresh their offerings by introducing some new brands and concepts. Major developments have also taken off, for instance, AEI works at Northpoint (FCT) commenced in March, and the redevelopment of Funan started in July.

Office REITs

- Near-term bottom in capital values following recent sale of Asia Square Tower 1, Straits Trading Building and 60% stake in CapitaGreen.

- Physical buyers likely to take a view that the current weakness in rents is a function of a cyclical oversupply in completions over 2016-2017, with the medium-term outlook remaining robust given limited completions after 2019.

- At current levels, office REITs trade at a discount to the implied price of recent Grade A office transactions which we believe is unwarranted

- Reduced earnings risks for FY16 as the majority of leases expiring this year for various office REITs have already been renewed.

Industrial REITs

- Most Industrial REITs have been pro-active in engaging expiring leases early and have another 3-15% of income to be renewed in 2H16.

- The number of property conversions are likely to taper off from 2016 onwards and thus pressure to margins are likely to ease.

- Portfolio occupancies are expected to ease marginally but should remain substantially full.

Hospitality REITs

- 2Q16 RevPAR in general fell at a faster rate than 1Q16 due to impact from AEIs (CDREIT & FEHT), lack of boost from SEA Games last year as well as continued soft corporate demand and excess supply.

- FHT outperformed the sector with RevPAR increasing y-o-y largely due to the completion of AEI at Intercontinental Hotel

- Going into 2H16, the decline in RevPAR could potentially decelerate as some hotels scheduled to be completed later this year have been delayed into 2017 (2,866 net new rooms to be added in 2016 versus 3,930 in the prior estimate). In addition, hotels should benefit from the general seasonal uplift.

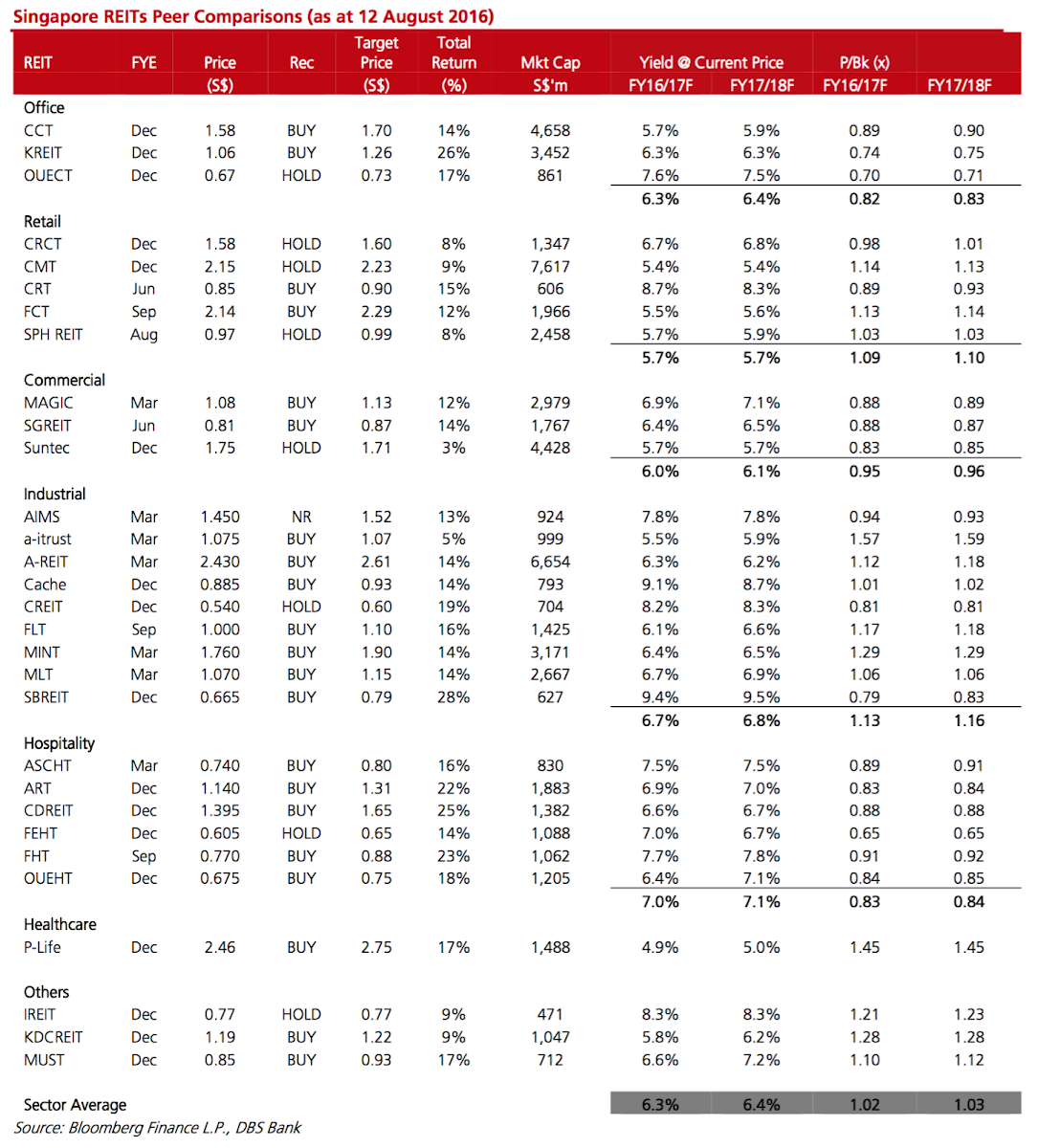

Peer Comparisons

Derek TAN

DBS Vickers

|

Melvin SONG CFA

DBS Vickers

|

http://www.dbsvickers.com/

2016-08-16

DBS Vickers

SGX Stock

Analyst Report

1.26

Same

1.26

2.61

Same

2.61

1.65

Same

1.65

1.10

Same

1.10