CITY DEVELOPMENTS LIMITED

C09.SI

CAPITALAND LIMITED

C31.SI

UOL GROUP LIMITED

U14.SI

CITY DEVELOPMENTS LIMITED

C09.SI

CAPITALAND LIMITED

C31.SI

UOL GROUP LIMITED

U14.SI

Property Devt & Invt - Bumper July

- Strong July sales, led by MCL Land’s Lake Grande.

- Transaction volumes stabilising, but looming supply will continue to be a drag on prices, especially in the suburban areas.

- Concerns priced in, maintain sector Overweight; top picks are UOL, City Dev and Capitaland.

Healthy July sales

- July primary home sales came in at 1,921 units, 2.5x Jun’s volume but down 9% yoy.

- Excluding ECs, take up would have been 1,091 units. 76% of this were in the suburban areas, led by the launch of MCL Land’s Lake Grande, with 464 units changing hands at a median price of S$1,368psf.

- City fringe projects made up 20% of sales.

- Centrally located projects that drew attention include the newly-launched Gramercy Park and Victoria Park Villas.

Volume stabilising but prices drifting down on large supply

- YTD July sales totaled 4,901 units (7,613 including ECs) and looks on track to reach our 8,000-9,000 target for this year. But with looming incoming supply and a weak rental market, we expect pressure on prices to continue.

- We maintain our expectation for a 5-8% decline in home prices in 2016.

More pressure on suburban prices over the next two years...

- There is another 10,262 units and 14,578 units due to be completed in 2H16 and 2017, respectively, before dwindling to 9,526 units in 2018. Of this, 26% are in the Core Central Region, while another 27% and 47% are in the city fringe and suburban areas, respectively. This will be drag on suburban home prices, in particular.

- Post 2017, completions in the central area will decline significantly to below 10% of incoming stock and this could provide some support to homes prices in this locality.

...and developer penalties to drag

- In addition, the looming deadline for unsold inventory facing Qualifying Certificate and Additional Buyers’ Stamp Duty penalties should intensify from 2017 and we anticipate developers lowering prices to clear stock. This will provide another drag to private home prices, on top of the near-term supply issue.

Much is in the price, maintain Overweight

- Developer stocks are trading at a 40% discount to sector RNAV and we think much of the negative newsflow is in the price. Any policy relaxation expectation is likely to be a medium-term catalyst, hence, we expect the sector to trade range-bound in the immediate term.

- Maintain Overweight with our picks of UOL, City Dev and Capitaland.

- The risk to our call is if any of the residential micro-market bottoms out earlier than expected or a sharp spike in the interest rate cycle.

Highlighted companies

CapitaLand

- ADD, TP S$4.17, S$3.16 close

- We like CAPL for its ROE-boosting capital recycling activities. The stock is trading at a 38% discount to RNAV

City Developments

- ADD, TP S$10.38, S$8.78 close

- CIT’s valuations are attractive, at a 36% discount to RNAV. Gearing is low at 0.27x, providing the group with deep capacity to recycle and reinvest. Catalyst could emerge when overseas contributions ramp up and spur earnings growth.

UOL Group

- ADD, TP S$7.96, S$5.75 close

- UOL has high recycling income underpinned by rentals, hotels and investment holdings, providing the group with a recurring income base. The stock is trading at a 43% discount to RNAV.

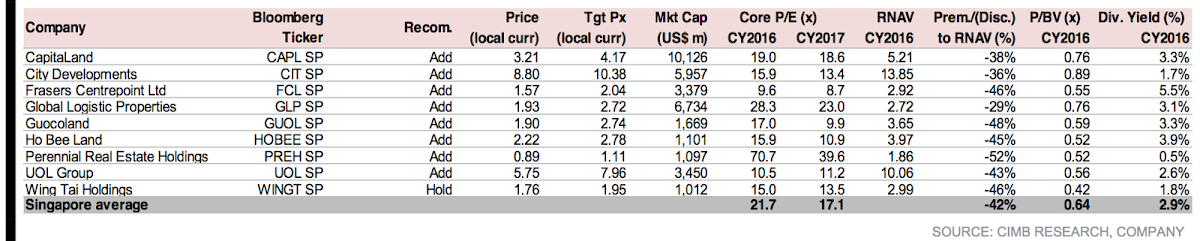

Peer Comparisons

LOCK Mun Yee

CIMB Securities

|

Yeo Zhi Bin

CIMB Securities

|

http://research.itradecimb.com/

2016-08-16

CIMB Securities

SGX Stock

Analyst Report

10.38

Same

10.38

4.17

Same

4.17

7.96

Same

7.96