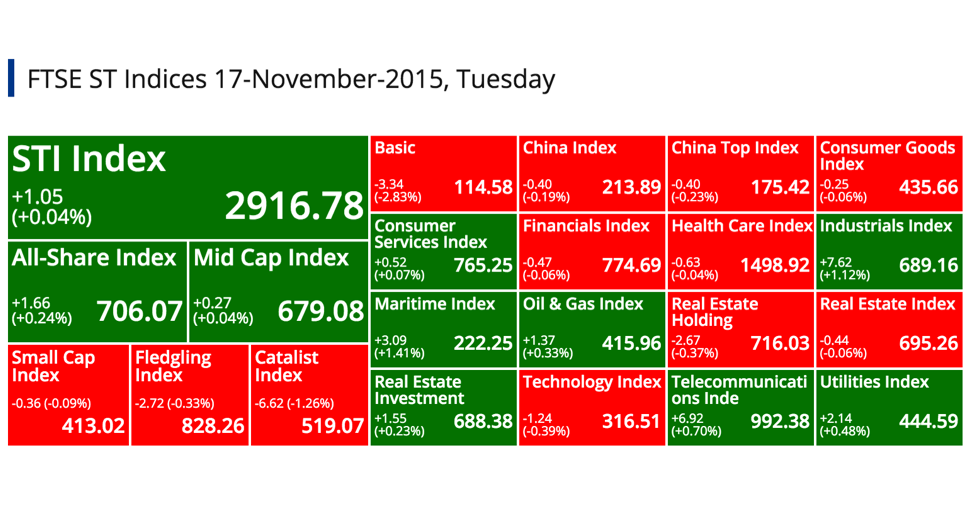

FTSE ST Indices 17-November-2015, Tuesday

STI Index

+1.05

(+0.04%)

(+0.04%)

2916.78

All-Share Index

+1.66

(+0.24%)

(+0.24%)

706.07

Mid Cap Index

+0.27

(+0.04%)

(+0.04%)

679.08

Small Cap Index

-0.36 (-0.09%)

413.02

Fledgling Index

-2.72 (-0.33%)

828.26

Catalist Index

-6.62 (-1.26%)

519.07

Basic

-3.34

(-2.83%)

(-2.83%)

114.58

China Index

-0.40

(-0.19%)

(-0.19%)

213.89

China Top Index

-0.40

(-0.23%)

(-0.23%)

175.42

Consumer Goods Index

-0.25

(-0.06%)

(-0.06%)

435.66

Consumer Services Index

+0.52

(+0.07%)

(+0.07%)

765.25

Financials Index

-0.47

(-0.06%)

(-0.06%)

774.69

Health Care Index

-0.63

(-0.04%)

(-0.04%)

1498.92

Industrials Index

+7.62

(+1.12%)

(+1.12%)

689.16

Maritime Index

+3.09

(+1.41%)

(+1.41%)

222.25

Oil & Gas Index

+1.37

(+0.33%)

(+0.33%)

415.96

Real Estate Holding

-2.67

(-0.37%)

(-0.37%)

716.03

Real Estate Index

-0.44

(-0.06%)

(-0.06%)

695.26

Real Estate Investment

+1.55

(+0.23%)

(+0.23%)

688.38

Technology Index

-1.24

(-0.39%)

(-0.39%)

316.51

Telecommunications Inde

+6.92

(+0.70%)

(+0.70%)

992.38

Utilities Index

+2.14

(+0.48%)

(+0.48%)

444.59

Top 20 Volume

YUUZOO CORPORATION LIMITED

(AFC.SI)

(AFC.SI)

0.230

Vol: 156310000

Value: 39426313

THE STRATECH GROUP LIMITED

(ATN.SI)

(ATN.SI)

0.044

Vol: 86013900

Value: 3802434

NOBLE GROUP LIMITED

(N21.SI)

(N21.SI)

0.420

Vol: 76707000

Value: 33184219

AUSGROUP LIMITED

(5GJ.SI)

(5GJ.SI)

0.168

Vol: 56915200

Value: 10118002

NEPTUNE ORIENT LINES LIMITED

(N03.SI)

(N03.SI)

1.120

Vol: 51011200

Value: 56776590

NAM CHEONG LIMITED

(N4E.SI)

(N4E.SI)

0.150

Vol: 46315100

Value: 7208754

REX INTERNATIONAL HOLDING LTD

(5WH.SI)

(5WH.SI)

0.132

Vol: 36188000

Value: 5016436

EZRA HOLDINGS LIMITED

(5DN.SI)

(5DN.SI)

0.112

Vol: 35478500

Value: 4048191

SPACKMAN ENTERTAINMENT GRP LTD

(40E.SI)

(40E.SI)

0.127

Vol: 34081300

Value: 4489755

GEO ENERGY RESOURCES LIMITED

(RE4.SI)

(RE4.SI)

0.133

Vol: 28364300

Value: 3899645

LOYZ ENERGY LIMITED

(594.SI)

(594.SI)

0.076

Vol: 26581400

Value: 2089416

INFORMATICS EDUCATION LTD.

(I03.SI)

(I03.SI)

0.048

Vol: 23001700

Value: 1142176

HUTCHISON PORT HOLDINGS TRUST

(NS8U.SI)

(NS8U.SI)

USD 0.525

Vol: 20324000

Value: 10742268

SINGTEL

(Z74.SI)

(Z74.SI)

3.840

Vol: 20275600

Value: 77907147

GENTING SINGAPORE PLC

(G13.SI)

(G13.SI)

0.745

Vol: 20265400

Value: 15193085

EZION HOLDINGS LIMITED

(5ME.SI)

(5ME.SI)

0.650

Vol: 19698800

Value: 13204090

NTEGRATOR INTERNATIONAL LTD

(5HC.SI)

XB

(5HC.SI)

XB

0.016

Vol: 19416500

Value: 341670

ADDVALUE TECHNOLOGIES LTD

(A31.SI)

(A31.SI)

0.049

Vol: 18259100

Value: 926950

GOLDEN AGRI-RESOURCES LTD

(E5H.SI)

(E5H.SI)

0.360

Vol: 16465100

Value: 5967282

MMP RESOURCES LIMITED

(F3V.SI)

(F3V.SI)

0.017

Vol: 13504600

Value: 237784

Top 20 Value

SINGTEL

(Z74.SI)

(Z74.SI)

3.840

Vol: 20275600

Value: 77907147

NEPTUNE ORIENT LINES LIMITED

(N03.SI)

(N03.SI)

1.120

Vol: 51011200

Value: 56776590

OVERSEA-CHINESE BANKING CORP

(O39.SI)

(O39.SI)

8.900

Vol: 4890900

Value: 43730792

UNITED OVERSEAS BANK LTD

(U11.SI)

XD

(U11.SI)

XD

19.890

Vol: 2101400

Value: 41780215

DBS GROUP HOLDINGS LTD

(D05.SI)

(D05.SI)

17.080

Vol: 2432000

Value: 41688157

YUUZOO CORPORATION LIMITED

(AFC.SI)

(AFC.SI)

0.230

Vol: 156310000

Value: 39426313

NOBLE GROUP LIMITED

(N21.SI)

(N21.SI)

0.420

Vol: 76707000

Value: 33184219

SINGAPORE PRESS HLDGS LTD

(T39.SI)

CD

(T39.SI)

CD

4.010

Vol: 6746200

Value: 26873888

GLOBAL LOGISTIC PROP LIMITED

(MC0.SI)

(MC0.SI)

2.120

Vol: 11966800

Value: 25520679

CAPITALAND LIMITED

(C31.SI)

(C31.SI)

3.060

Vol: 7368500

Value: 22693249

KEPPEL CORPORATION LIMITED

(BN4.SI)

(BN4.SI)

6.810

Vol: 3130000

Value: 21415347

GENTING SINGAPORE PLC

(G13.SI)

(G13.SI)

0.745

Vol: 20265400

Value: 15193085

HONGKONG LAND HOLDINGS LIMITED

(H78.SI)

(H78.SI)

USD 7.320

Vol: 2072700

Value: 15128973

UOL GROUP LIMITED

(U14.SI)

(U14.SI)

6.130

Vol: 2347900

Value: 14476355

ASCENDAS REAL ESTATE INV TRUST

(A17U.SI)

(A17U.SI)

2.240

Vol: 6251800

Value: 14075424

COMFORTDELGRO CORPORATION LTD

(C52.SI)

(C52.SI)

3.050

Vol: 4513700

Value: 13808209

EZION HOLDINGS LIMITED

(5ME.SI)

(5ME.SI)

0.650

Vol: 19698800

Value: 13204090

JARDINE MATHESON HLDGS LTD

(J36.SI)

(J36.SI)

USD 51.740

Vol: 257000

Value: 13146200

CAPITALAND MALL TRUST

(C38U.SI)

(C38U.SI)

1.870

Vol: 7000600

Value: 13138723

WILMAR INTERNATIONAL LIMITED

(F34.SI)

(F34.SI)

2.970

Vol: 4153200

Value: 12375922

Top 20 Gainers ($)

JARDINE MATHESON HLDGS LTD

(J36.SI)

(J36.SI)

USD 51.740

Vol: 257000

Value: 13146200

JARDINE STRATEGIC HLDGS LTD

(J37.SI)

(J37.SI)

USD 27.830

Vol: 184600

Value: 5110422

JARDINE CYCLE & CARRIAGE LTD

(C07.SI)

(C07.SI)

32.490

Vol: 172100

Value: 5640367

HAW PAR CORP LTD

(H02.SI)

(H02.SI)

8.390

Vol: 1300

Value: 10867

PETRA FOODS LIMITED

(P34.SI)

(P34.SI)

2.400

Vol: 4900

Value: 11278

TAN CHONG INT'L LTD

(T15.SI)

(T15.SI)

HKD 2.560

Vol: 97200

Value: 247390

UNITED OVERSEAS BANK LTD

(U11.SI)

XD

(U11.SI)

XD

19.890

Vol: 2101400

Value: 41780215

VENTURE CORPORATION LIMITED

(V03.SI)

(V03.SI)

8.640

Vol: 609700

Value: 5256381

YEO HIAP SENG LTD

(Y03.SI)

(Y03.SI)

1.395

Vol: 100

Value: 139

CHINA YUANBANG PROP HLDGS LTD

(BCD.SI)

(BCD.SI)

0.300

Vol: 4500

Value: 1350

SINGTEL 10

(Z77.SI)

(Z77.SI)

3.870

Vol: 28340

Value: 109070

DAIRY FARM INT'L HOLDINGS LTD

(D01.SI)

(D01.SI)

USD 6.050

Vol: 190700

Value: 1151506

AUSNET SERVICES LTD

(AZI.SI)

CD

(AZI.SI)

CD

1.485

Vol: 369200

Value: 544524

NEPTUNE ORIENT LINES LIMITED

(N03.SI)

(N03.SI)

1.120

Vol: 51011200

Value: 56776590

IHH HEALTHCARE BERHAD

(Q0F.SI)

(Q0F.SI)

2.130

Vol: 54100

Value: 114711

COMFORTDELGRO CORPORATION LTD

(C52.SI)

(C52.SI)

3.050

Vol: 4513700

Value: 13808209

SHINVEST HOLDING LTD.

(BJW.SI)

(BJW.SI)

0.800

Vol: 9800

Value: 7840

FORTUNE REAL ESTATE INV TRUST

(F25U.SI)

(F25U.SI)

HKD 7.850

Vol: 106000

Value: 831060

FIRST RESOURCES LIMITED

(EB5.SI)

(EB5.SI)

1.910

Vol: 1659600

Value: 3174390

RIVERSTONE HOLDINGS LIMITED

(AP4.SI)

(AP4.SI)

2.520

Vol: 299000

Value: 749357

Top 20 Losers ($)

SINGAPORE AIRLINES LTD

(C6L.SI)

XD

(C6L.SI)

XD

10.600

Vol: 790600

Value: 8423760

UOL GROUP LIMITED

(U14.SI)

(U14.SI)

6.130

Vol: 2347900

Value: 14476355

ARA ASSET MANAGEMENT LIMITED

(D1R.SI)

XR

(D1R.SI)

XR

1.300

Vol: 484300

Value: 631854

CHINA GAOXIAN FIBREFAB HLDGLTD

(AZZ.SI)

(AZZ.SI)

0.160

Vol: 36000

Value: 6135

TIONG SENG HOLDINGS LIMITED

(BFI.SI)

(BFI.SI)

0.235

Vol: 25000

Value: 5775

DBS GROUP HOLDINGS LTD

(D05.SI)

(D05.SI)

17.080

Vol: 2432000

Value: 41688157

LONGCHEER HOLDINGS LIMITED

(BJL.SI)

(BJL.SI)

0.800

Vol: 5300

Value: 4240

RAFFLES MEDICAL GROUP LTD

(R01.SI)

(R01.SI)

4.260

Vol: 461800

Value: 1976727

PARKWAYLIFE REIT

(C2PU.SI)

(C2PU.SI)

2.260

Vol: 475800

Value: 1082275

FRASER AND NEAVE, LIMITED

(F99.SI)

CD

(F99.SI)

CD

2.200

Vol: 83800

Value: 185497

LEADER ENVIRONMENTAL TECH LTD

(LS9.SI)

(LS9.SI)

0.033

Vol: 135000

Value: 4455

TIANJIN ZHONG XIN PHARM GROUP

(T14.SI)

(T14.SI)

USD 1.195

Vol: 136400

Value: 166017

CHINA MINING INTERNATIONAL LTD

(BHD.SI)

(BHD.SI)

0.650

Vol: 60000

Value: 39200

CHANGTIAN PLASTIC & CHEM LTD

(AXV.SI)

(AXV.SI)

0.750

Vol: 24000

Value: 18000

LANTROVISION (S) LTD

(Q7W.SI)

(Q7W.SI)

0.420

Vol: 200

Value: 87

PTERIS GLOBAL LIMITED

(UD3.SI)

(UD3.SI)

0.555

Vol: 18900

Value: 10659

JAPAN FOODS HOLDING LTD.

(5OI.SI)

XD

(5OI.SI)

XD

0.450

Vol: 1800

Value: 810

HALCYON AGRI CORPORATION LTD

(5VJ.SI)

(5VJ.SI)

0.710

Vol: 940500

Value: 683298

BANYAN TREE HOLDINGS LIMITED

(B58.SI)

(B58.SI)

0.465

Vol: 3000

Value: 1395

GRAND BANKS YACHTS LIMITED

(G50.SI)

(G50.SI)

0.240

Vol: 40000

Value: 9800

Top 20 Gainers (%)

ICP LTD

(5I4.SI)

(5I4.SI)

0.010

Vol: 207800

Value: 1869

CHINA YUANBANG PROP HLDGS LTD

(BCD.SI)

(BCD.SI)

0.300

Vol: 4500

Value: 1350

ANNAIK LIMITED

(A52.SI)

(A52.SI)

0.099

Vol: 25100

Value: 2034

HIAP TONG CORPORATION LTD.

(5PO.SI)

(5PO.SI)

0.109

Vol: 100

Value: 10

LINC ENERGY LTD

(TI6.SI)

(TI6.SI)

0.145

Vol: 3019800

Value: 413867

OLS ENTERPRISE LTD.

(ADJ.SI)

(ADJ.SI)

0.008

Vol: 31000

Value: 227

VIBROPOWER CORPORATION LIMITED

(BJD.SI)

(BJD.SI)

0.330

Vol: 12500

Value: 3772

BENG KUANG MARINE LIMITED

(BEZ.SI)

(BEZ.SI)

0.147

Vol: 67400

Value: 10484

UNITED FOOD HOLDINGS LIMITED

(AZR.SI)

(AZR.SI)

0.175

Vol: 43500

Value: 7612

YONGMAO HOLDINGS LIMITED

(E6A.SI)

(E6A.SI)

0.150

Vol: 95900

Value: 13906

UNION STEEL HOLDINGS LIMITED

(V69.SI)

(V69.SI)

0.091

Vol: 50100

Value: 4059

LCD GLOBAL INVESTMENTS LTD.

(L38.SI)

(L38.SI)

0.260

Vol: 85400

Value: 21745

STAR PHARMACEUTICAL LIMITED

(AYL.SI)

(AYL.SI)

0.280

Vol: 34400

Value: 8148

LERENO BIO-CHEM LTD.

(42H.SI)

(42H.SI)

0.060

Vol: 12800

Value: 759

PEC LTD.

(IX2.SI)

CD

(IX2.SI)

CD

0.405

Vol: 135000

Value: 51344

PAVILLON HOLDINGS LTD.

(596.SI)

(596.SI)

0.055

Vol: 20000

Value: 1100

TYE SOON LTD

(BFU.SI)

(BFU.SI)

0.355

Vol: 12100

Value: 4295

A-SONIC AEROSPACE LIMITED

(AWQ.SI)

(AWQ.SI)

0.215

Vol: 172000

Value: 36800

EUCON HOLDING LIMITED

(E27.SI)

(E27.SI)

0.015

Vol: 180000

Value: 2700

SHINVEST HOLDING LTD.

(BJW.SI)

(BJW.SI)

0.800

Vol: 9800

Value: 7840

Top 20 Losers (%)

LEADER ENVIRONMENTAL TECH LTD

(LS9.SI)

(LS9.SI)

0.033

Vol: 135000

Value: 4455

NTEGRATOR INTERNATIONAL LTD

(5HC.SI)

XB

(5HC.SI)

XB

0.016

Vol: 19416500

Value: 341670

CHINA GAOXIAN FIBREFAB HLDGLTD

(AZZ.SI)

(AZZ.SI)

0.160

Vol: 36000

Value: 6135

METECH INTERNATIONAL LIMITED

(QG1.SI)

(QG1.SI)

0.003

Vol: 130100

Value: 390

SINOCLOUD GROUP LIMITED

(5EK.SI)

(5EK.SI)

0.003

Vol: 2200000

Value: 6600

TERRATECH GROUP LIMITED

(40I.SI)

(40I.SI)

0.042

Vol: 725300

Value: 32086

TIONG SENG HOLDINGS LIMITED

(BFI.SI)

(BFI.SI)

0.235

Vol: 25000

Value: 5775

MATEX INTERNATIONAL LIMITED

(M15.SI)

(M15.SI)

0.040

Vol: 28900

Value: 1156

MAGNUS ENERGY GROUP LTD.

(41S.SI)

(41S.SI)

0.004

Vol: 8950100

Value: 44650

WE HOLDINGS LTD.

(5RJ.SI)

(5RJ.SI)

0.004

Vol: 4378300

Value: 17513

ASIAMEDIC LIMITED

(505.SI)

(505.SI)

0.061

Vol: 158300

Value: 10290

OCEAN SKY INTERNATIONAL LTD

(O05.SI)

(O05.SI)

0.077

Vol: 55700

Value: 4601

CFM HOLDINGS LIMITED

(5EB.SI)

(5EB.SI)

0.040

Vol: 59900

Value: 2396

LORENZO INTERNATIONAL LIMITED

(5IE.SI)

(5IE.SI)

0.047

Vol: 182000

Value: 8554

ATTILAN GROUP LIMITED

(5ET.SI)

(5ET.SI)

0.006

Vol: 1011000

Value: 7067

ISR CAPITAL LIMITED

(5EC.SI)

(5EC.SI)

0.006

Vol: 2230000

Value: 13380

MERCURIUS CAP INVESTMENT LTD

(5RF.SI)

(5RF.SI)

0.013

Vol: 200000

Value: 2600

POLARIS LTD.

(5BI.SI)

(5BI.SI)

0.007

Vol: 2000000

Value: 15500

ASIA-PACIFIC STRATEGIC INV LTD

(5RA.SI)

(5RA.SI)

0.008

Vol: 1920000

Value: 16910

HG METAL MANUFACTURING LTD

(526.SI)

(526.SI)

0.042

Vol: 1810700

Value: 75521

Data Source:

http://www.sgx.com/

http://sg.finance.yahoo.com/

Archive: