Singapore REITs

MAPLETREE LOGISTICS TRUST

M44U.SI

ASCOTT RESIDENCE TRUST

A68U.SI

CAPITALAND COMMERCIAL TRUST

C61U.SI

Singapore REITs

MAPLETREE LOGISTICS TRUST

M44U.SI

ASCOTT RESIDENCE TRUST

A68U.SI

CAPITALAND COMMERCIAL TRUST

C61U.SI

Property - Singapore REITs: Following The Overseas Trail

- Following the recent smorgasbord of overseas acquisitions by REITs, we have looked at the implied currency effects from geographic diversification. Extensive channel checks reveal current hedging policies which we have factored in to derive both current and forward trading yields.

- Though unrepresentative of all overseas REITs, geographically-diversified MLT, ART, CDREIT and FHT nevertheless display clear pick-ups in terms of their hedged forward yields vis-à-vis forward trading yields.

- Maintain OVERWEIGHT.

WHAT’S NEW

- We refine our earlier note on hedged yields analysis “Levelling the Playing Field: Hedging Their Bets Overseas” by factoring in the hedging policies for the REITs.

ACTION

Maintain OVERWEIGHT with MLT, ART and CCT as top picks.

- By factoring in the effects of forex movements on S-REITs, we have observed clear beneficiaries of diversification amid a depressed domestic outlook across sectors in the face of a looming supply glut.

- We continue to prefer deep value and diversified REITs, noting that ART and MLT offer more appealing hedged trading yields in their respective sectors by virtue of their extensive overseas footprint at 85% and 62% respectively.

ESSENTIALS

Factoring in hedging policies.

- Our discussions with management indicate that most REITs with overseas exposure typically carry out income hedges on a 3-12-month rolling basis when it comes to foreign sourced income. This is normally accomplished through the use of forward rate agreements on the income side.

- On the balance sheet side, most REITs with overseas exposure adopt natural hedging (via onshore borrowings) as much as possible with some using currency swaps as well.

Deriving hedged yields using forward currency swaps.

- We obtain the implied hedge cost by using 1-year and 2-year US dollar forward currency swaps of the respective countries in which the REITs hold assets relative to that of Singapore’s swap rate (base rate). We then obtain the weighted average hedge cost for the unhedged portion by geographic exposure across the REITs and subtract that from their respective trading yields, thus deriving our hedged trading yield figures.

Well-diversified counters MLT, ART, CDREIT and FHT benefit in terms of hedged forward trading yields vis-à-vis forward trading yields.

- ART will see a 57bp pick-up on a hedged forward yield basis while FHT and CDREIT see 21bp and 21bp pick-ups respectively. MLT will see a 16bp pick-up compared with flattish pick-ups among its peers.

- However, we note that these pick-ups are not representative of all REITs with overseas exposure, with Lippo Malls likely to see a high 203bp hedge cost for its forward yields despite its 100% Indonesian exposure.

Benefits of diversification.

- REITs with relatively higher exposure to Japan, Hong Kong and Europe see a pick-up in forward yields while those with exposure to Indonesia, Malaysia and China will see a drop.

- We like deep value and well-diversified REITs with a significant overseas footprint, namely ART, CCT and MLT. We believe these counters will see less exposure to the slowdown in Singapore that is affecting the domestic commercial, industrial, retail and hospitality space as a result of an unprecedented simultaneous supply glut across these segments.

TOP SECTOR PICKS

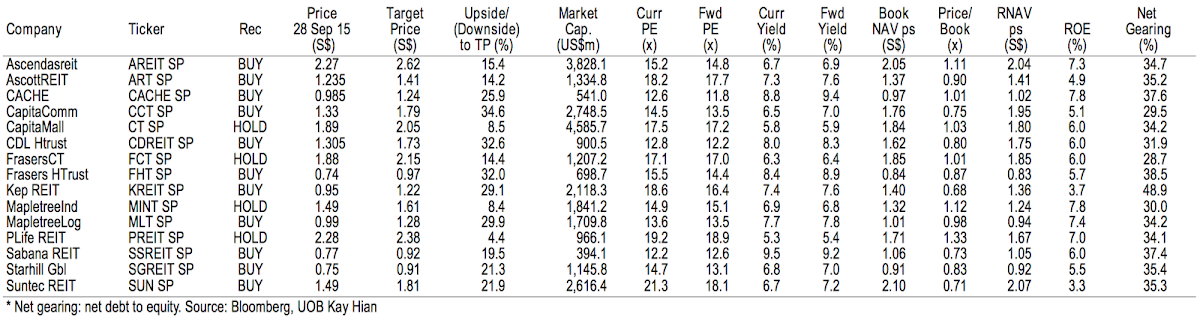

PEER COMPARISON

Vikrant Pandey

UOB Kay Hian

|

Derek Chang

UOB Kay Hian

|

http://research.uobkayhian.com/

2015-09-29

UOB Kay Hian

Analyst Report

1.28

Same

1.28

1.41

Same

1.41

1.79

Same

1.79