Singapore Strategy

SINGTEL

Z74.SI

CHINA AVIATION OIL(S) CORP LTD

G92.SI

CITY DEVELOPMENTS LIMITED

C09.SI

DBS GROUP HOLDINGS LTD

D05.SI

SINGAPORE TECH ENGINEERING LTD

S63.SI

Singapore Strategy

SINGTEL

Z74.SI

CHINA AVIATION OIL(S) CORP LTD

G92.SI

CITY DEVELOPMENTS LIMITED

C09.SI

DBS GROUP HOLDINGS LTD

D05.SI

SINGAPORE TECH ENGINEERING LTD

S63.SI

Singapore Strategy And Mid-Cap Marketing Feedback

- Our recent marketing trips to Taiwan and Malaysia suggest that investors should remain selective in Singapore given the lack of earnings clarity and an uncertain external outlook.

- The market could range trade and we would look to stock picking to outperform.

WHAT’S NEW

- Hitting the road on Singapore strategy and mid-cap picks. We had recently marketed our 2H16 Singapore strategy as well as our key mid-cap picks in Taiwan and Malaysia. This report highlights key feedback and stocks that garnered the most interest.

ACTION

No major pushback as Singapore lacks catalysts.

- Most investors we met had no major pushback to our cautious view. The key issue is that while valuations are not expensive, there is just no visibility in earnings and with macro risks looming, Singapore is expected to drift with external developments.

- We highlighted that in this scenario, price entry level is critical and that the current volatility may provide attractive buying opportunities.

Positioning ahead of a possible Brexit.

- All eyes are on the upcoming referendum in UK over its membership in EU. Based on various polls, including Bloomberg and non- partisan polls, it could go down to the wire and see a very close call.

- UOB Global Economics and Market Research (UOB GEMR) believes that ultimately UK will vote to stay in EU. However, given the uncertainties and lack of earnings visibility in Singapore, we remain relatively defensive and would only accumulate selectively on pull-backs.

- A stock to consider is ComfortDelGro (BUY; Target: S$3.16), which has underperformed on Brexit and Uber fears but we think most negatives have been priced in and we favour its strong financials and management track record (please refer to our RMN dated 21 June for more details on CD).

- Other stocks with meaningful exposure to the UK include City Developments, Ho Bee and Frasers Hospitality.

Keen interest in selected mid-caps.

- Investors were keen about hearing our top picks for mid-caps. China Aviation Oil (BUY; Target: S$1.56) garnered the most interest followed by Innovalues and Cityneon.

- CAO saw a lot of interest given its compelling business model with a monopoly in China’s jet fuel import market, which makes it an excellent proxy to the booming aviation sector in China. Equally impressive, was its strong corporate governance as well as risk management practices, which has been put in place by its strategic shareholder BP (which has a 20% stake).

- Innovalues and Cityneon enjoyed selective interest. M&As look active in Singapore and Innovalues could be a beneficiary as sector consolidation makes it an attractive candidate.

A binary situation for telecommunications.

- Investors were mixed on the telecommunications sector given the uncertainties over the potential entry of a fourth mobile operator.

- Other than potentially more competition, investors were concerned over potentially more price competition for data broadband as well as the proliferation of illegal set-top boxes that could affect demand for cable television.

- We have an underweight stance and a BUY on Singtel, with SELL ratings for M1 and StarHub.

Tactical trades for O&G stocks.

- While fundamentals for the shipyard sector are likely to be challenging, we highlighted that there are potential tactical trades, particularly for investors that take a view that oil prices could end closer to US$60.00/bbl by end-16. In view of the challenging fundamental outlook, we highlighted that risk seeking investors could trade in liquid stocks with strong balances.

- Based on a correlation analysis, stocks that could offer potential trading opportunities include Keppel Corp, SCI, SMM and Ezion. Please see the table below highlighting potential entry and target prices for these stocks.

S-REITs to consider and deep-value developers.

- As interest rates expectations are tapered in view of rising uncertainties, there were active discussions on the S-REITs and whether it’s time to relook at the S-REITs.

- Our view is for selective pickings and in terms of the segments, our top pick is hospitality (improving demand from recovering tourist arrivals) followed by the business park segment (limited supply growth).

- Our key picks include CD REIT and A-REIT. We also reiterated our preference for deep-value and diversified developers over S-REITs.

Reasonable valuations but awaiting better entry levels.

- The FSSTI is currently trading at 2016F PE of 14.00x and P/B of 1.18x. On a PE basis, the FSSTI is trading at a 8% discount to the long-term mean but we think a discount is warranted given the uncertain outlook ahead.

- We see the potential for more earnings downgrades and with the mixed external outlook, we would adopt a relatively defensive stance. In addition, the lack of positive catalysts could suggest a range bound market for the rest of 2016 and we would only buy on pull-backs.

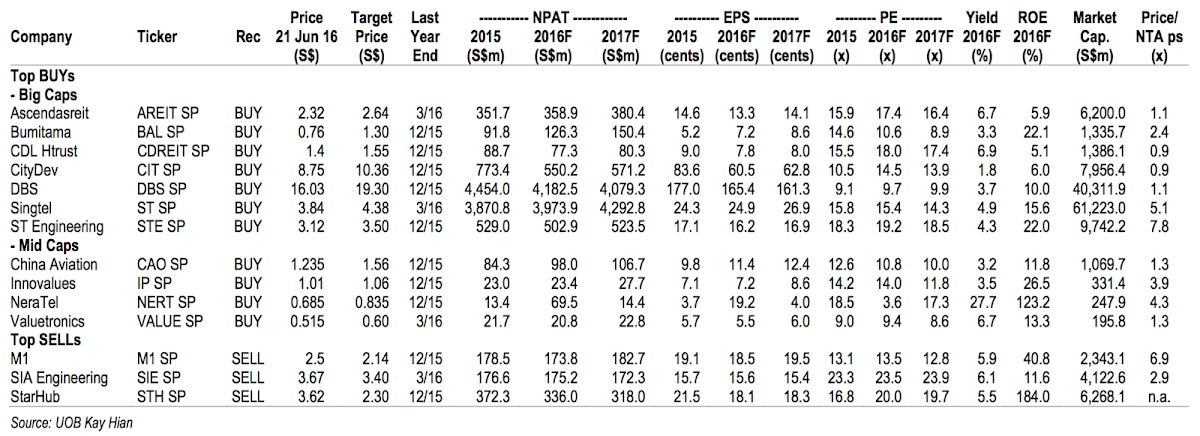

Stock selections for 2H16.

- Our key picks include Singtel, City Developments, DBS, STE, CD REIT, ART and Bumitama.

- Mid-cap gems include China Aviation Oil, Innovalues, Neratel and Valuetronics.

- On our SELL list are SIA Engineering, StarHub and M1.

KEY STOCK RECOMMENDATIONS

Andrew Chow CFA

UOB Kay Hian

|

Singapore Research Team

UOB Kay Hian

|

http://research.uobkayhian.com/

2016-06-22

UOB Kay Hian

SGX Stock

Analyst Report

19.30

Same

19.30

1.56

Same

1.56

10.36

Same

10.36

4.38

Same

4.38

3.50

Same

3.50

1.55

Same

1.55