Singapore REITs Review

SREIT Recommendation

KEPPEL DC REIT

AJBU.SI

FRASERS CENTREPOINT TRUST

J69U.SI

FRASERS LOGISTICS & IND TRUST

BUOU.SI

Singapore REITs Review

SREIT Recommendation

KEPPEL DC REIT

AJBU.SI

FRASERS CENTREPOINT TRUST

J69U.SI

FRASERS LOGISTICS & IND TRUST

BUOU.SI

Singapore REITs - Time to be selective, downgrade to NEUTRAL

- Three rate hikes the base case this year.

- Expect slower DPU growth for FY17F.

- KDCREIT, FCT and FLT our top picks.

FOMC dot plot diagram still signifies three hikes in 2017

- During the Mar FOMC meeting, Fed officials voted to raise the target range for the federal funds rate by 25 bps to 0.75%-1.00%, which was in-line with market expectations, as the fed funds futures rate had priced in a 100% probability of this happening prior to the meeting.

- This was underpinned by continued momentum in the labour market, expectations that inflation will stabilise around the Committee’s 2% longer run objective over the medium-term and moderate expansion in economic activity.

- Based on the Fed’s dot plot diagram, the Committee is expecting three rate hikes this year, with a projected median fed funds rate of 1.4% for 2017. This remains unchanged from the Dec 2016 FOMC meeting. However, we note that three FOMC participants had shifted their expectations from two rate hikes to three.

- Looking ahead, given more encouraging economic data points arising not only from the U.S. but also from other key economies such as China, coupled with the recent robust performance of the equity markets, we believe the likelihood of a faster-than-expected pace of rate increase remains a possibility at this juncture. This view could be reinforced if more details on the Trump administration’s fiscal policy plans are released in the future.

DPU growth expected to be positive, but relatively muted

- Operationally, the leasing environment remains challenging across the sub-sectors, given supply pressures and uncertain demand outlook.

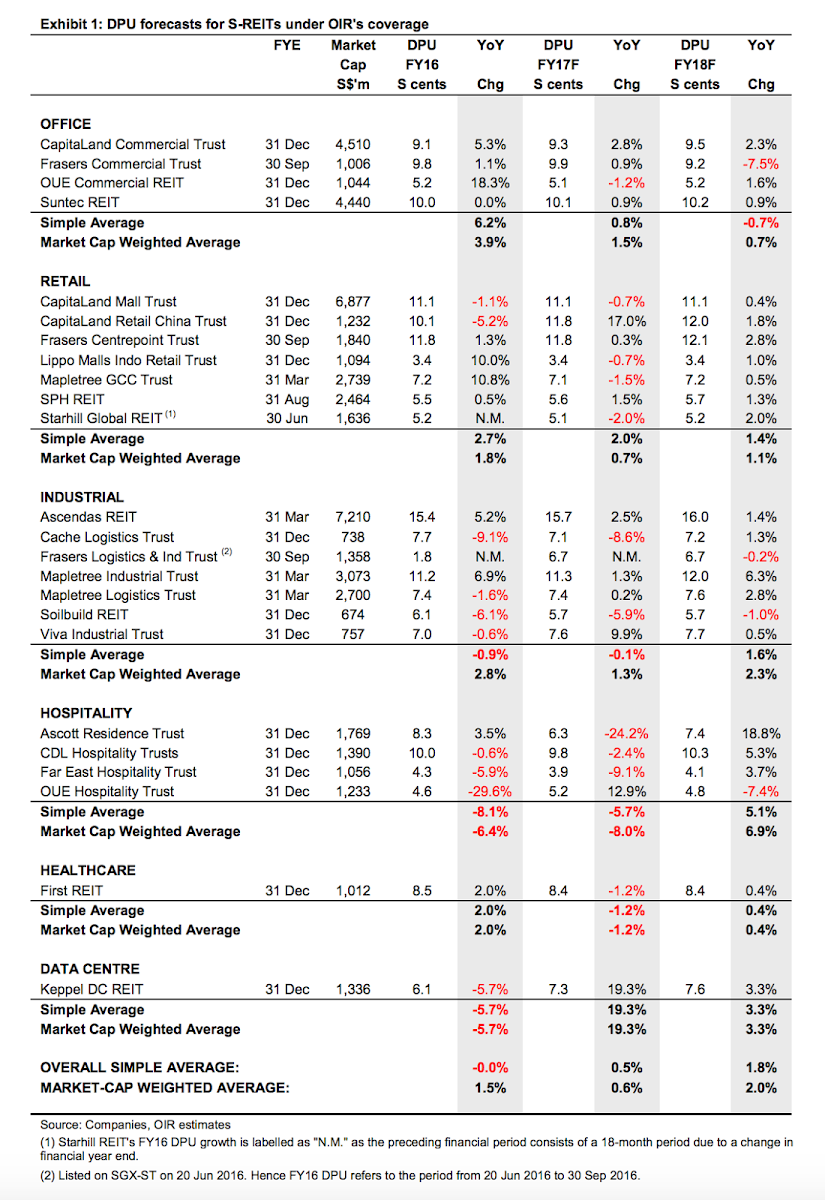

- For SREITs under OIR’s coverage, DPU growth came in at 1.5% on a market-cap weighted average basis in FY16.

- Looking ahead, we project DPU growth to remain in positive territory in FY17, but at a muted pace of 0.6% (market-cap weighted average), before picking up again in FY18 (+2.0%).

Valuations not expensive, but no longer compelling

- The FTSE ST REIT Index (FSTREI) is currently trading at a forward yield spread of 423 bps against the Singapore Government 10-year bond yield, which is approximately 0.2 standard deviation below the 5-year average (432 bps).

- While we believe S-REITs still warrant a strategic position in investors’ portfolio in light of uncertainties surrounding the geopolitical and macroeconomic environment, valuations are no longer compelling, in our view. As such, we downgrade the S-REITs sector from ‘Overweight’ to NEUTRAL.

- Notwithstanding our downgrade, S-REITs still offer an appealing yield relative to other major REIT markets.

- In terms of positioning, we recommend investors to be selective, and narrow down our preferred picks to three REITs. Based on current price levels, our top picks are Keppel DC REIT [BUY; FV: S$1.39], Frasers Centrepoint Trust [BUY; FV: S$2.28] and Frasers Logistics & Industrial Trust [BUY; FV: S$1.08]

Andy Wong Teck Ching CFA

OCBC Investment

|

http://www.ocbcresearch.com/

2017-03-23

OCBC Investment

SGX Stock

Analyst Report

1.390

Same

1.390

2.280

Same

2.280

1.080

Same

1.080